안녕하세요 보스턴 임박사입니다.

Opioid 약물이 FDA로 부터 승인을 받은 이후부터 사회적 반향이 많이 일어나고 있는데요 이 문제를 해결하기 위해 Non-Opioid Replacement Therapy를 개발하기 위한 Pharma/Biotech의 노력이 계속되고 있습니다.

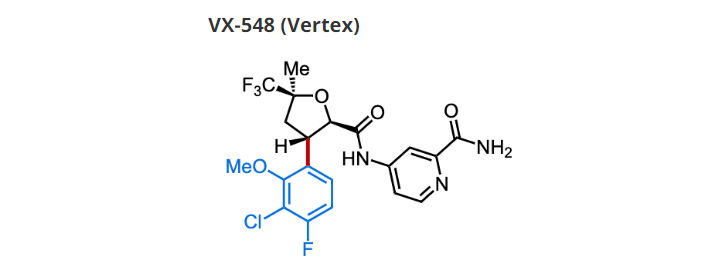

Vertex는 일찍부터 Sodium Channel Voltage 1.8 (NaV1.8) Inhibitors 개발을 위해 노력해 왔는데 지금까지 VX-150, VX-128, VX-961 및 VX-548과 같은 다양한 NaV1.8 Inhibitors를 임상시험을 통해 개발해 왔습니다.

가장 먼저 임상시험에 진입한 약물은 VX-150이었습니다.

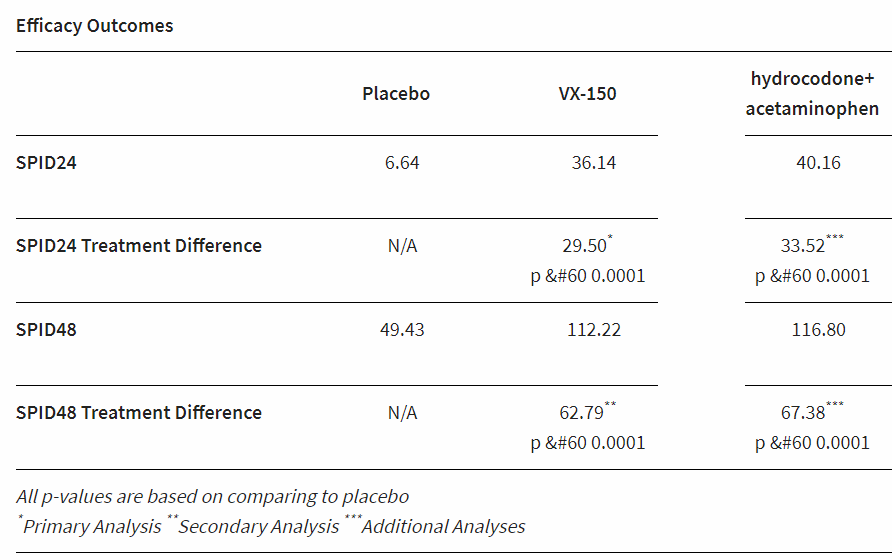

In its phase 2 trial in 243 patients undergoing bunionectomy surgery, Vertex’s orally active drug—a sodium ion channel blocker targeting the NaV1.8 channel—outperformed placebo in alleviating pain using the Sum of the Pain Intensity Difference measure at 24 and 48 hours. It also seemed to provide a similar benefit to an active control of hydrocodone plus acetaminophen, although the study wasn’t powered to make a direct comparison between the active arms.

Vertex has previously reported encouraging phase 2 data in the treatment of osteoarthritis pain, showing significant pain relief compared to placebo in the 14-day trial. The new study is the first to assess the drug’s effects on acute pain, and Vertex says it will now start a phase 1 trial later this year of an intravenous formulation of the drug for acute pain indications.

The biotech is also waiting on the results of a third phase 2 trial of the oral formulation, this time looking at the drug’s effects on hard-to-treat neuropathic pain in subjects with small fiber neuropathy, which are due in early 2019.

Having two positive trials is “de-risking the asset and making it more valuable—and perhaps attractive for a future partner,” says Jefferies, which puts Vertex ahead of rivals such as Biogen among companies with pain drugs targeting voltage-gated sodium channels. The analysts also note that the biotech has started a phase 1 trial in healthy subjects of a second NaV1.8 inhibitor, VX-128, which seems to be more potent than VX-150.

Vertex drops VX-961 to continue search for perfect pain drug – Fierce Biotech 1/31/2020

The NaV1.8 inhibitor (VX-961) failed to meet Vertex’s desired pharmacokinetic and tolerability profile, leading it to dump the drug and outline plans to move a follow-up candidate into the clinic.

VX-961 moved into early-phase development last year on the back of midphase data linking VX-150, another NaV1.8 inhibitor, to improved outcomes in people with acute, chronic and neuropathic pain. The midphase data led Vertex to conclude NaV1.8 inhibition can yield opioid-like efficacy without the side effects or abuse potential associated with that class of medicines.

Yet, Vertex opted to hold off on starting a late-phase trial of VX-150, choosing instead to gather data on the drug’s siblings before deciding which molecule to advance. The early phase study of VX-961 was part of Vertex’s effort to triage its NaV1.8 inhibitors.

Vertex’s willingness to drop VX-961 based on those variables reflects a belief that safety and efficacy are “table stakes” in pain. To succeed, Vertex is looking for “a molecule with the perfect PK” for the indication, Kewalramani said. That search is underpinned by an understanding of how pain drugs are used. Once or twice daily dosing is one essential requirement but is far from the only factor.

“We need to ensure that this medicine can be taken with food or without food. If you’re talking about acute pain, immediately post-surgery, being able to take it without food is going to be really important. We’re also thinking about [drug-drug interactions] and [cost of goods sold],” Kewalramani said.

Vertex’s criteria for the ideal molecule differ somewhat across acute, chronic and neuropathic pain, which Kewalramani sees as “three distinct groups.” The search for the chemistry that will meet the criteria goes on, but Vertex is sure NaV1.8 inhibition is the right approach.

“We’ve cracked the biology,” Kewalramani said.

Vertex will open a new stage of its search for the perfect NaV1.8 inhibitor when it moves another of VX-150’s siblings into phase 1 later in the first half of 2020. Data from that trial will inform Vertex’s decision about which pain drug to advance into later-stage development.

Vertex moves pain drug into mid-stage testing – Biopharmadive 4/26/2021

In pain, the company has been working to show that small molecule drugs can block the NaV1.8 channel and provide a non-opioid alternative for pain relief. Two of Vertex’s earlier candidates, known as VX-961 and VX-150, ran into challenges during clinical testing, and development of them has since stopped.

VX-548, meanwhile, is the most recent of Vertex’s channel-blocking agents to enter clinical testing. Having proved safe and tolerable in Phase 1 testing of healthy volunteers, the drug is now headed to Phase 2 “proof-of-concept” trials.

Carmen Bozic, Vertex’s chief medical officer, said in a Monday statement that the company is pushing VX-548 forward “with urgency, as these studies are the key next step toward our ultimate goal of developing transformative medicines for the treatment of pain.”

While Vertex and a few other large drug companies have their sights on developing better pain drugs, setbacks have been common. In one recent example, advisers to the Food and Drug Administration expressed concerns about the safety plans surrounding a closely watched experimental pain medicine from Pfizer and Eli Lilly.

Vertex reports positive trial results for acute pain candidate VX-548 – The Pharma Letter 1/4/2022

Vertex Pharmaceuticals (Nasdaq: VRTX) has been moving to diversify its product offerings, and today announced positive results from two Phase II proof-of-concept (POC) studies that investigated treatment with the selective NaV1.8 inhibitor VX-548 for acute pain following abdominoplasty surgery or bunionectomy surgery.

This is Vertex’ fourth attempt to develop a sodium channel Nav1.8

Vertex’s non-opioid drug reduces nerve pain in trial, shares hit record high – Reuters 12/13/2023

Vertex’s VX-548 hits primary endpoint in Phase II DPN trial – Clinical Trials Arena 12/13/2023

Vertex Pharmaceuticals’ (VRTX.O), opens new tab non-opioid painkiller significantly decreased pain in patients with diabetes suffering from chronic nerve pain in a mid-stage trial, fueling efforts to develop a treatment without the potential risk of addiction.

The trial studied the drug, VX-548, in patients with diabetic peripheral neuropathy, a type of nerve damage caused by high blood sugar.

Vertex is also testing the drug in keenly watched late-stage studies for acute pain, with data due in the first quarter of next year.

VX-548 has the potential to be a multi-billion dollar product for both conditions, executives said in a call.

Ahead of the data, analysts had estimated that the drug could generate peak sales of more than $5 billion.

Treatment with VX-548 resulted in a statistically significant reduction in weekly average of daily pain intensity, as measured on a scale at 12 weeks, Vertex said. On the scale, which ranges from 0 for no pain to 10 for worst pain imaginable, patients treated with the drug showed reductions of 2.26, 2.11 and 2.18 at the high, mid and low doses, respectively.

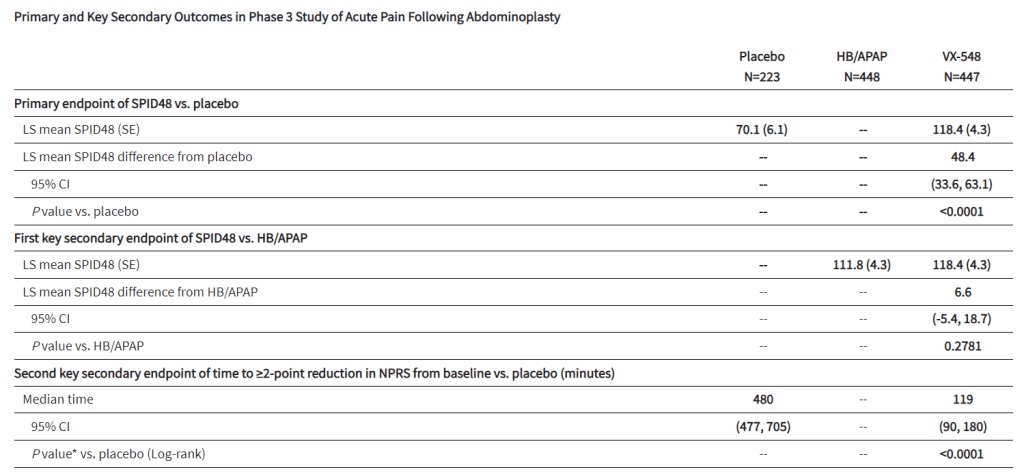

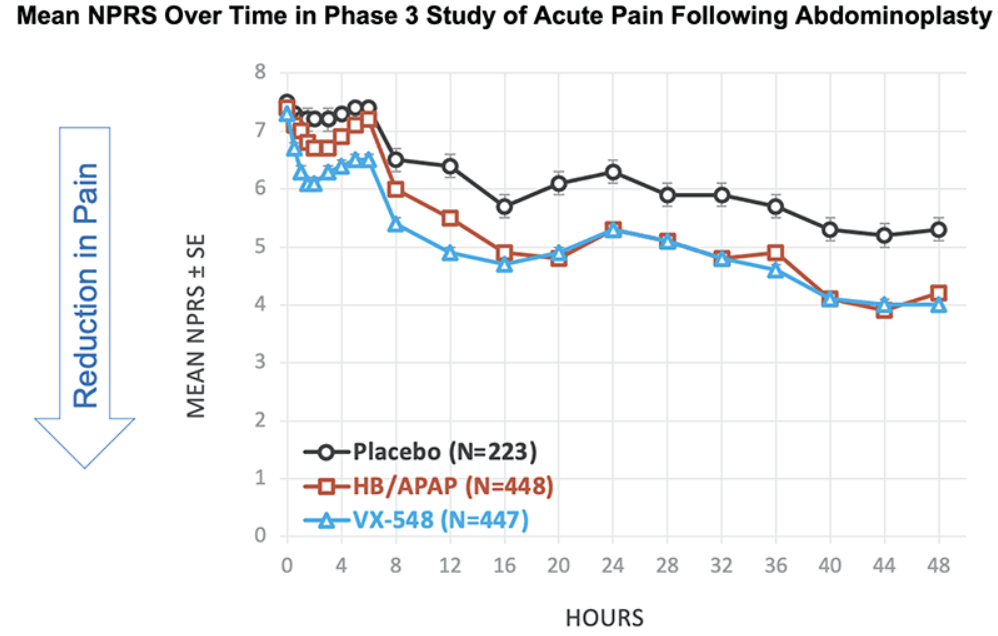

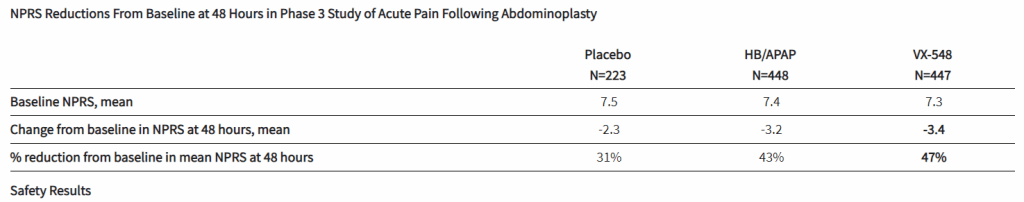

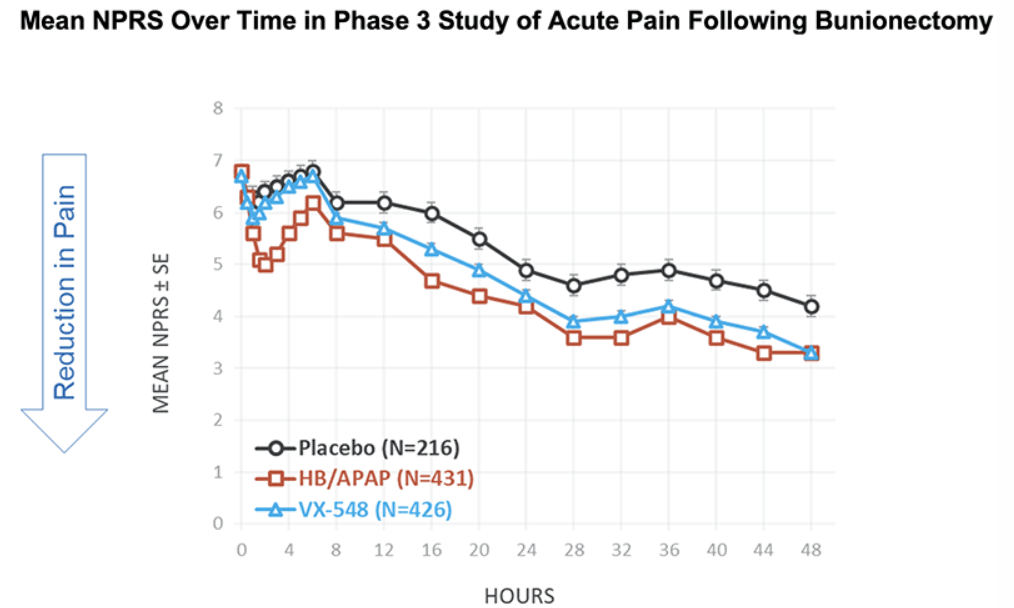

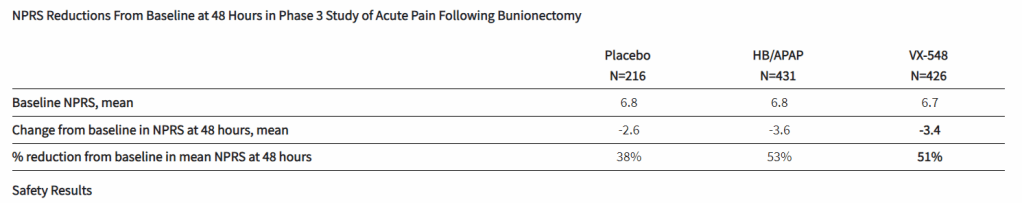

After the biotech discarded a pair of NaV1.8 inhibitors based on early clinical data, a third drug candidate, VX-548, aimed at the sodium channel has beaten placebo in two late-phase clinical trials. The significant improvements in pain intensity in the 48 hours after patients underwent tummy tucks and bunionectomies caused the studies to meet their primary endpoints.

While the primary endpoints compared VX-548 to placebo, Vertex randomized some participants in both trials to take the common pain combination of hydrocodone bitartrate and acetaminophen (HB/APAP). The drug, which is sold as Vicodin, contains the opioid hydrocodone and is frequently abused.

VX-548 had a numerical advantage over HB/APAP in the tummy tuck trial but the difference fell short of statistical significance. In the bunionectomy trial, HB/APAP performed significantly better than VX-548, resulting in a p value of 0.0016. The finding that HB/APAP provides more pain relief than Vertex’s drug candidate in bunion surgery patients complicates the case for VX-548.

Vertex’s pain program has focused on achieving opioid-like efficacy without the abuse potential of that class of effective but problematic medicines. Talking at the J.P. Morgan Healthcare Conference earlier this month, Vertex CEO Reshma Kewalramani discussed the need to fill the “gaping hole in the treatment landscape between acetaminophen and NSAIDs and opioids.”

VX-548’s mechanism “does not hold addictive potential,” Kewalramani said, and the CEO restated her belief that the molecule can fill the gap in the treatment landscape after seeing the phase 3 data. Even so, the failure to beat, and in one trial even to match, the opioid leaves Vertex open to skepticism as it works to persuade payers that VX-548 is a better option than established, relatively cheap alternatives.

That all awaits Vertex down the line. First, the big biotech needs to get VX-548 to market. Vertex plans to file for FDA approval by the middle of the year and is seeking a broad label in moderate-to-severe acute pain. The opportunity is huge, with Vertex estimating acute pain affects more than 80 million people a year in the U.S., a market currently largely served by generic medicines.

Vertex’s push to get VX-548 over the line in acute pain is part of a broader program. The drug candidate came through a phase 2 test in painful diabetic peripheral neuropathy last month, emboldening Vertex to start planning a pivotal program, and the biotech has other NaV1.8 and NaV1.7 inhibitors in clinical and preclinical development with a view to developing monotherapies and combinations.

A New Pain Mechanism Works. Pretty Much. – Derek Lowe’s In the Pipeline 2/2/2024

One thought on “BIOTECH (92) – Vertex Non-Opioid Replacement NaV1.8 Inhibitor Suzetrigine (VX-548) Phase 3”