(Picture: Juan Jaen and Terry Rosen, source from Chem & Eng News)

안녕하세요 보스턴 임박사입니다.

Arcus Biosciences는 Flexus Biosciences가 2015년에 BMS에 매각된 후에 나머지 Asset을 가지고 Spin off한 회사입니다.

BIOTECH (111) Flexus Biosciences: Treg Small Molecule Inhibitors

Arcus Biosciences는 $120 Million Series A로 시작합니다. Flexus 때와는 펀딩 규모가 크게 달라집니다. 회사 초기부터 Terry Rosen은 Stand-Alone Biotech을 만들어 나가는 것을 목표로 합니다.

Bay Area Startup Arcus Biosciences Emerges With $120 Million. – Biospace 8/30/2016

New immuno-oncology startup Arcus Biosciences has scored an impressive $120 million funding in two financing rounds all while in stealth mode.

FierceBiotech reported that Arcus will use its funding to push two of its immuno-oncology treatments into early clinical testing over the next year. The company, which has remained in stealth mode, is initially developing drug therapies for small molecules along the ATP-adenosine pathway; CD73, CD39 and the A2A receptor, FierceBiotech reported. Its lead candidate is expected to be from the CD73 program, with the A2A program slated to be the second candidate in the clinic.

Rosen told FierceBiotech that he is building Arcus as a long-term company and not something that will generate interest only to be snapped up by a larger company. “This is the last field in which I will probably ever work,” he said, according to FierceBiotech.

Investors supporting the company include Novartis , Celgene, The Column Group and Foresite Capital, according to the company’s website. Since its founding, Arcus has been on a bit of a hiring spree. The company initially planned to have 38 employees on staff by year’s end, but that has since been scaled up to about 60 employees, FierceBiotech reported.

Arcus’ cancer portfolio attracts $35M option deal from Japan’s Taiho. – Fierce Biotech 9/20/2017

Taiho is paying $35 million over three years for access to Arcus’ portfolio of cancer immunotherapy candidates, which the company said is poised to deliver four clinical projects before the end of 2018. Another $275 million is on offer for each drug program that Taiho chooses to license over the five years of the option agreement, which covers Japan and some other Asian markets but excludes China.

Taiho is a major seller of cancer drugs with chemotherapy products like Abraxane, Yondelis and Zolinza, and is already an investor in Arcus via its venture capital unit, which took part in the Californian biotech’s $70 million series B round last year.

Arcus Biosciences gains meaty $107M with help from Google Ventures. – Fierce Biotech 11/13/2017

Immuno-oncology startup Arcus Bioscience has got off another impressive round of funding, just over a year after emerging from stealth with $120 million. This latest round, worth a major $107 million, was led by Google’s venture arm, with a host of new backers getting into the action, including Wellington Management Company LLP, EcoR1 Capital, BVF Partners L.P., Decheng Capital, Hillhouse, Aisling Capital and entities affiliated with Leerink Partners, as well as existing investors The Column Group, Foresite Capital, Invus Opportunities, DROIA, Celgene and Taiho Ventures.

They’re all buying into Arcus’ science in small molecule and antibody immuno-oncology approaches, with the aim of building its own internal combinations, rather than using the “throw and see what sticks” approach that many marketed I-O drugs are doing with nearly every cancer drug in the pipeline available.

This cash boost, bringing its total since its founding in 2015 to nearly a quarter of a billion, will help toward a series of clinical programs for AB928, a first-in-class dual adenosine receptor antagonist, and AB122, a PD-1 antibody.

Earlier this month, Arcus says it kick-started a phase 1 of AB928, with a midstage test, in combo with AB122 in cancer patients, slated for the first half of next year; it also started an early-stage trial of AB122 in cancer patients in Australia, with data set to be posted in 2018. The biotech added that it “plans to evaluate AB122 in combination with its other product candidates, in addition to AB928, in the future.”

The $107 million also allows it to push on with “at least two” additional experimental meds into clinical development, including AB680, a first-in-class small molecule CD73 inhibitor, as well as AB154, a TIGIT antibody. This also comes a few months after Arcus bulked up its cancer immunotherapy pipeline with a $816 million deal—including $18.5 million upfront—to license an anti-PD-1 antibody developed at China’s Gloria Pharma and WuXi Biologics.

2018년초에 $128 Million IPO를 해서 Nasdaq에 상장을 했습니다.

Arcus Biosciences eyes $100M IPO. – Fierce Biotech 2/21/2018

Under the terms of agreement, Gilead is paying Arcus $375 million on closing, with $175 of it upfront and $200 million in equity. Arcus is eligible for up to $1.225 billion in opt-in and milestone payments based on its current clinical product candidates. In addition, Gilead gets access to the company’s current and future investigational immuno-oncology products. That includes rights to zimberelimab and the right to opt-in to all other current Arcus clinical candidates, including AB154, AB928 and AB680. The opt-in fees range from $200 million to $275 million per program.

If Gilead chooses to opt-in to the AB154 program, Arcus is eligible for up to $500 million in possible future U.S. regulatory approval milestones. The $200 million equity investment comes to $33.54 per share. Gilead will gain the option to acquire additional shares of Arcus up to a maximum of 35% of outstanding voting stock over the course of the next five years, at a 20% premium at the time of the option, or, if greater, at the initial purchase price per share.

The deal with Arcus would greatly expand the company’s presence in oncology and immuno-oncology. Arcus recently began Phase II clinical trials of AB154 in non-small cell lung cancer, with the idea that the anti-TIGIT therapy would improve the efficacy of anti-PD-1 checkpoint inhibitors, in this case, Arcus’s zimberelimab. TIGIT is another immune checkpoint.

Arcus has a clinical-stage pipeline of four immuno-oncology programs. Its oncology discovery pipeline has six preclinical compounds. The company currently is running 10 clinical trials, including the Phase III NSCLC trial.

In addition to the upfront, equity and milestone payments, Arcus is eligible for tiered royalties ranging from high-teens to low twenties on any eventual commercial products. Gilead picked up exclusive rights to commercialize any optioned programs outside of the U.S., although they will be subject to rights of any of Arcus’s existing partners. Gilead is also providing up to $400 million in ongoing research and development support over the length of the collaboration. In addition, Gilead has the right to appoint two people to Arcus’s board of directors. Before rumors of the deal in April, Arcus had a market cap of $716 million. As news leaked, shares climbed as much as 54%.

One of the key aspects of that deal was magrolimab, a monoclonal antibody in clinical development for several cancers, including myelodysplastic syndrome (MDS), acute myeloid leukemia (AML) and diffuse large B-cell lymphoma (DLBCL).

Terry Rosen, chief executive officer of Arcus, stated, “We believe Gilead is an ideal partner for Arcus with its focus on thoughtful and purposeful science, vision to provide transformational therapies in the oncology setting and deeply experienced scientific leadership. At the same time, this partnership structure facilitates Arcus’s path to becoming an independent, fully integrated biopharmaceutical company.”

Gilead deal에 의한 $200 Million 지분투자를 포함해서 총 $302.5 Million 유상증자를 했습니다.

Gilead는 $220 Million을 투자해서 Arcus Biosciences의 지분을 13%에서 19.5%로 늘립니다.

Gilead Sciences to Increase Its Ownership In Arcus Biosciences. – Press Release 2/1/2021

Arcus Biosciences, Inc. (NYSE:RCUS), an oncology-focused biopharmaceutical company working to create best-in-class cancer therapies, today announced that Gilead Sciences is increasing its ownership in Arcus to 19.5%, from approximately 13%, by purchasing 5,650,000 additional shares of Arcus’s common stock at a per share purchase price of $39.00. Proceeds of $220 million to support and accelerate Arcus’s comprehensive clinical development plans.

Gilead-Arcus 공동연구는 2020년에 시작한 이래 매우 성공적으로 진행되어 오고 있습니다. 이에 따라 Gilead는 $320 Million 추가 투자를 통해서 지분을 33%로 늘렸습니다. 이사회에 들어가는 Gilead member도 2명에서 3명으로 늘려서 Arcus Biosciences에 대한 경영권을 늘려 나가고 있습니다.

Gilead Expands Arcus Collaboration with $320M Equity Investment. Biospace 1/30/2024

Gilead Sciences and Arcus Biosciences have amended their collaboration agreement, the companies announced Monday, with Gilead making an additional equity investment of $320 million and raising its ownership stake in Arcus to 33%.

Gilead’s separate equity investment of $320 million will be in Arcus common stock at $21 per share. The deal will also see Gilead Chief Commercial Officer Johanna Mercier join Arcus’ board, marking a third Gilead member. According to Monday’s announcement, the amendment to the companies’ partnership will include “governance enhancements” to help make “streamlined decision-making” as well.

Under the agreement, Gilead and Arcus have reprioritized their joint domvanalimab development program, an anti-TIGIT antibody. They will focus on advancing and possibly accelerating Phase III studies of STAR-121, which investigates lung cancer treatment, and STAR-221 for gastrointestinal cancer.

Gilead and Arcus expect these programs to be fully enrolled by the end of 2024. Their prioritization focuses on domvanalimab-contaning regimen research, where they contend it may have a “significant impact” in combination with chemo treatment and where there is a high unmet need. The companies also plan to start the STAR-131 trial, a Phase III lung cancer study that combines domvanalimab and Arcus’ zimberelimab.

However, the updates include halting the Phase III ARC-10 study investigating domvanalimab and zimberelimab compared to a Keytruda monotherapy in PD-L1-high non-small cell lung cancer. The reason for the stop is to prioritize STAR-121 and STAR-221.

Arcus CEO Terry Rosen said the Gilead investment will give the biotech enough cash to last into 2027 and enable it to fund the Phase III study of the CD73 inhibitor quemliclustat in pancreatic cancer and the asset AB521 in kidney cancer. The quemliclustat trial will be run by Arcus independently as part of the new arrangement.

“Since the inception of our partnership with Gilead in 2020, the companies have moved increasingly closer in all aspects of our research and development efforts. This investment and prioritization enable both companies to leverage their respective strengths and focus on efficiently advancing novel combinations that can potentially change the landscape of cancer treatment,” Rosen said in a statement.

In November 2023, Arcus and Gilead reported positive results for the combination of domvanalimab, zimberelimab, and chemotherapy in treating upper gastrointestinal cancers, showing an overall response rate of 80% in patients with PD-L1-high tumors.

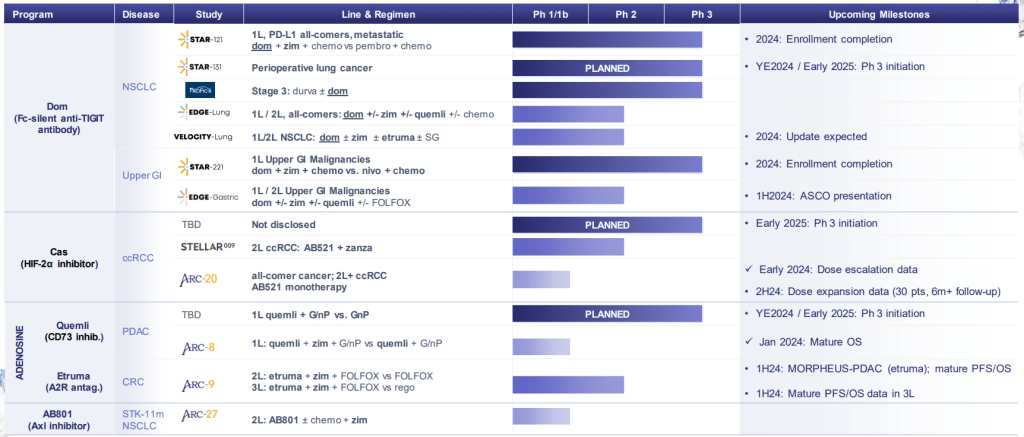

현재 Pipleline은 아래와 같습니다. 2024년 2월에 발표한 Corporate Presentation도 첨부합니다. Arcus Biosciences가 Clinical-Stage에서 Commercial-Stage Company로 성장하는 것은 시간 문제이지 않을까 싶습니다. 역시 경험많은 Terry Rosen과 Juan Jaen의 수십년간의 우정과 파트너쉽이 아름다운 결실로 맺어지길 바랍니다.