<보스턴 임박사의 바이오텍 보고서 114호?

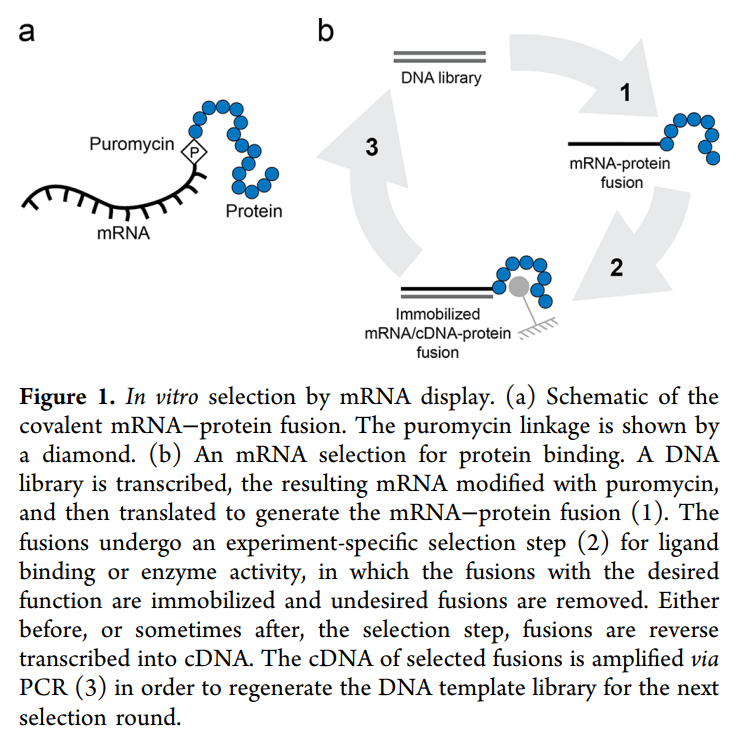

Ra Pharmaceuticals는 Nobel Laureate인 Jack W. Szostak교수 (Picture) 와 Burckhard Seelg교수가 2007년에 Nature에 보고한 mRNA Display 기술을 이용해서 Macrocyclic Peptide Drugs를 개발하기 위해 설립되었다.

mRNA Display 플랫폼 기술의 장점에 대해 Burckhard Seelig 교수가 2020년 ACS Synthetic Biology에 리뷰한 논문에 의하면 Phage Display 등과 비교해서 훨씬 다양한 peptide library를 만들 수 있는 장점이 있다.

Ra Pharmaceuticals는 Jack Szostak교수와 Doug Treco 박사등이 공동으로 2008년에 설립하고 2012년에 $27 Million Series A를 할 수 있었다.

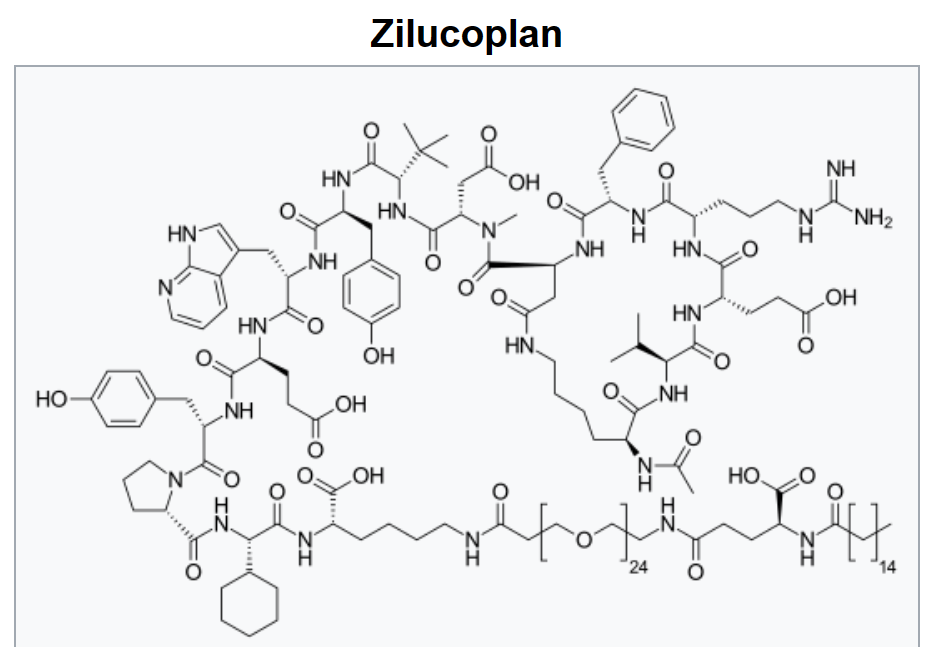

2015년에 첫번째 화합물인 Zilucopan (RA101495)가 2015년 12월에 임상1상에서 첫번째 환자에게 주사되었다. 2017년에는 Orphan Drug Designation을 받았고 2023년에 FDA로 부터 Zylbrisk라는 이름으로 승인되었고 EMA, MHRA 등에서도 승인됨으로써 mRNA Display 플랫폼 기술로 상용화된 최초의 약물이 되었다.

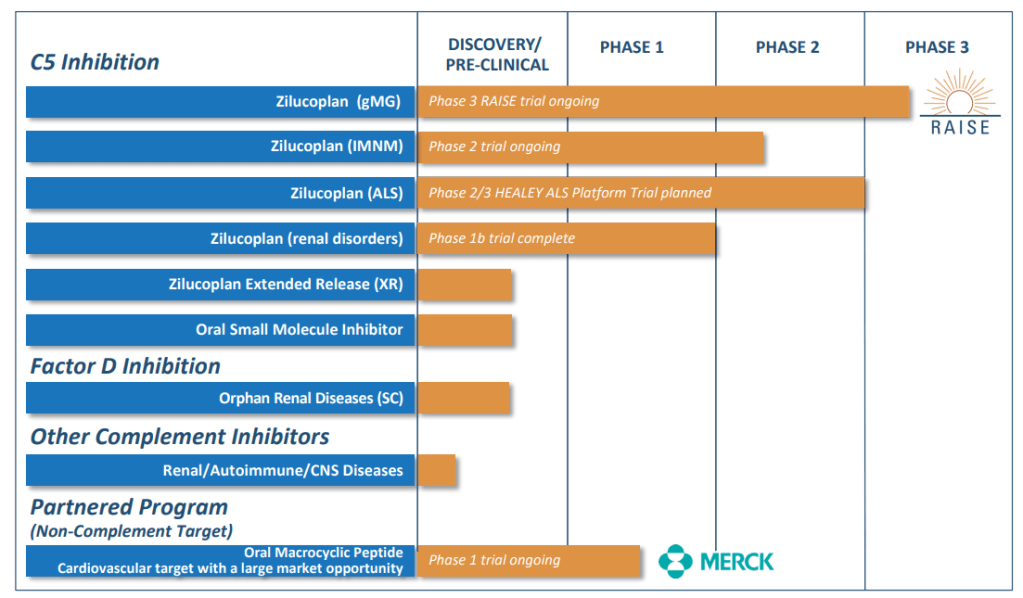

2013년에 시작한 Merck와 공동연구계약으로 Oral PCSK9 Inhibitor인 MK-0616이 개발되었다. 2019년에 임상 1상에서 첫번째 환자가 약물을 복용하였고 2023년에 임상3상에 진입해서 pivotal clinical trials가 진행 중이다.

Zilucopan의 가능성을 알아 본 UCB가 2021년에 Ra Pharmaceuticals를 100% 프리미엄 가격인 $2.5 Billion에 인수하였다.

mRNA Display 기술이 2007년에 Nature에 보고된 이후에 2023년에 Zilucopan이 상용화되기까지 16-17년간의 여정이었다. Zilucopan은 peak sales로 $1 Billion 이상을 보고 있는 Blockbuster Drug 가능성이 높은 약물이다. 또한 Oral PCSK9 약물인 MK-0616이 상용화된다면 Multi-billion dollar blockbuster가 탄생할 수 있을 것으로 기대한다. 과학기술의 발전이 환자들에게 유용하게 쓰인 좋은 예라고 생각한다.

2019년말에 발표한 Corporate Presentation에 나타난 Pipeline은 아래와 같다.

Ra Pharma Closes $8.6 Million Second Tranche of $27 Million Series A – Biospace 5/16/2012

“Ra Pharmaceuticals is developing Cyclomimetics to address diseases with significant unmet medical need, such as HAE,” said Doug Treco, Ph.D., Co-Founder, President and CEO, Ra Pharmaceuticals. “The only FDA-approved treatment for the prevention of HAE attacks is delivered intravenously every 3 to 4 days and produced from human blood. Our synthetic Cyclomimetics are easily produced, and could offer a stable, highly potent option for patients suffering from HAE. In addition, Cyclomimetics have the potential to be orally-available, which would significantly increase the quality of life for patients with HAE.”

Treco continued, “We will continue to build out our pipeline using our high-diversity drug discovery platform capable of generating optimized lead candidates in a matter of weeks, but also hope to secure discovery and development partnerships as we gain momentum with our internal programs. The Company is on sturdy ground with the recent 2nd tranche closing of our $27M series A financing and a strong IP portfolio covering our lead candidates, display technologies and the ability to generate peptidomimetic libraries with multiple non-natural amino acids.” Dr. Treco will present “Direct selection of cyclic peptidomimetics from in vitro display libraries” at TIDES, the Oligonucleotide and Peptide Research, Technology and Product Development Conference on Wednesday, May 23, 2012, at 10:00 am PT at the Mandalay Bay Resort & Casino in Las Vegas, NV.

About Cyclomimetics™

Cyclomimetics are peptide-like molecules characterized by their cyclic structure and backbone and side-chain modifications that provide unique, beneficial properties not found in natural peptides. The result is a highly specific and stable molecule with improved cell permeability and the potential for greatly increased bioavailability.

Cyclomimetics result from the Company’s proprietary Extreme Diversity™ platform. The platform is unique in that it combines in vitro display technology, a completely defined translation system and a wide variety of non-natural amino acids. Unlike certain other display technologies, in vitro display does not require the use of a bacterial or yeast host, and it can produce libraries of 10 to 100 trillion members. Further, the technology has the potential to address protein-protein interactions and other previously undruggable targets.

Ra Pharmaceuticals today announced it has entered into a collaboration with Merck, known as MSD outside the United States and Canada, focused on the development of Cyclomimetics™, a new class of compounds that have the diversity and specificity of antibodies while retaining the attributes of small molecules. Under the agreement, Ra Pharmaceuticals will use its proprietary Extreme Diversity™ platform to develop Cyclomimetic candidates for protein targets in multiple therapeutic areas.

“Cyclomimetics have novel properties that enable the targeting of protein-protein interactions, a property sought after for a wide range of disease indications,” said Doug Treco, Ph.D., Co-Founder, President and CEO, Ra Pharmaceuticals. “The collaboration with Merck highlights the broad potential of our Extreme Diversity platform and provides us with the resources to strengthen and advance our core technology.”

Under the terms of the agreement, Ra Pharmaceuticals is eligible to receive up to $200 million in payments, including up-front and research funding, as well as upon the achievement of discovery, development, regulatory and commercialization milestones for multiple targets.™

Cyclomimetics™ are peptide-like molecules characterized by their cyclic structure and backbone and side-chain modifications that provide unique, beneficial properties not found in natural peptides. The result is a highly specific and stable molecule with improved cell permeability and the potential for greatly increased bioavailability.

Ra Pharma was incorporated in 2008 and secured a $27M Series A in February of 2010 led by New Enterprise Associates with Morgenthaler Ventures, Novartis Venture Funds and Amgen Ventures participating.

2015년에 $58.5 Million Series B를 할 수 있었다.

Ra Pharmaceuticals Announces $58.5M Series B Financing – Business Wire 7/23/2015

Ra Pharmaceuticals today announced it has completed a $58.5 million Series B financing co-led by RA Capital Management, Novo Ventures, and Lightstone Ventures, and joined by new investors Rock Springs Capital and Limulus Venture Partners. All of the Company’s existing investors, which include New Enterprise Associates (NEA), Novartis Venture Fund, Morgenthaler Ventures, and Amgen Ventures, also participated in the significantly oversubscribed round. The proceeds of the financing will be used to generate human proof of concept data for its lead molecule, RA101495, in multiple indications. RA101495 is a next generation complement C5 inhibitor and is expected to enter Phase 1 clinical studies for the treatment of paroxysmal nocturnal hemoglobinuria (PNH) in late 2015. This financing will also allow the Company to advance multiple product candidates derived from Ra Pharma’s proprietary Extreme Diversity™ platform, including the development of a broader pipeline of products targeting additional diseases of the complement system.

“RA101495 has the potential to be transformative for patients with PNH and other complement system disorders as a self-administered, subcutaneous product,” said Doug Treco, PhD, Founder and CEO of Ra Pharma. “The molecule potently inhibits C5 activation through a unique mechanism of action, and preclinical data demonstrate a near complete inhibition of hemolysis, the hallmark of PNH, in non-human primates.”

“We’ve been impressed by the quality of the C5 inhibitor data, the team, and the potential for future breakthroughs using the Company’s core discovery platform,” noted Rajeev Shah, Managing Director at RA Capital Management. “We are very excited to be a part of this program and look forward to contributing to a shift to improved therapies for the treatment of PNH and other complement system disorders.” Upon closing the financing, Mr. Shah and Peter Tuxen Bisgaard, Partner at Novo Ventures (US) Inc., have joined Ra Pharma’s Board of Directors.

Ra Pharma also announced today that its multi-target collaboration that was established in April 2013 with a subsidiary of Merck & Co., Inc., known as MSD outside the United States and Canada, has been extended. “We are pleased to have the opportunity to continue to work closely with Merck scientists,” stated Dr. Treco. “The collaboration has allowed us to apply our technology to some particularly difficult targets, and Merck’s continued commitment is a testament to the power of the Extreme Diversity Platform to deliver highly differentiated peptides and the success we have had to date in the collaboration.”

Ra Pharmaceuticals announced today that it has launched a Phase 1 study of its synthetic peptide C5 inhibitor, RA101495. The Phase 1 trial is a randomized, double-blind study designed to test the safety of single, escalating doses of RA101495 and to establish the pharmacokinetics and pharmacodynamics after subcutaneous administration in healthy volunteers.

IPOs: Ra Pharma raises $92M, as Pfizer to gain rights to Myovant – Fierce Biotech 10/26/2016

Rare disease play Ra priced its offering right at the midpoint of its anticipated range at $13. In an optimistic gesture, it bumped up the number of shares sold to 7 million from an anticipated 5.8 million. That enabled it to raise a whopping $92 million, up from the previously expected $75 million.

As for Ra, its newly raised cash will go to back its lead candidate, RA101495, in Phase II testing. It plans to start a Phase II trial of the subcutaneous injectable to treat paroxysmal nocturnal hemoglobinuria (PNH) during the first quarter of next year with data due during the second quarter. It’s also got a Phase II trial slated for RA101495 to treat refractory generalized myasthenia gravis (rMG) lined up for the second half of 2017.

RA101495 is a synthetic macrocyclic peptide, a ring-shaped chain of amino acids, which is an inhibitor of complement component 5 (C5). This plays a key role in the rupture and destruction of red blood cells that is associated with PNH. The only approved drug for PNH is Alexion’s ($ALXN) blockbuster Soliris (eculizumab), a biweekly intravenous drug that’s a C5 inhibitor.

Ra expects that RA101495 will be a daily subcutaneous injection that, unlike Soliris, will be self-administered, thereby offering more convenience and flexibility.

Ra Pharmaceuticals, Inc. (NASDAQ:RARX) today announced that the U.S. Food and Drug Administration (FDA) has granted Orphan Drug Designation to RA101495 for the treatment of paroxysmal nocturnal hemoglobinuria (PNH). Ra Pharma is a clinical stage biopharmaceutical company focusing on the development of next-generation therapeutics for the treatment of complement-mediated diseases. RA101495, the Company’s lead clinical candidate, is a synthetic macrocyclic peptide inhibitor of complement component 5 (C5). The molecule is currently in Phase 2 clinical development as a self-administered subcutaneous (SC) injection for the treatment of PNH, a rare, chronic, life-threatening blood disorder where red blood cells are attacked and destroyed by the complement system.

Ra Pharmaceuticals Announces Pricing of Public Offering of Common Stock – Biospace 2/14/2018

Ra Pharma (NASDAQ: RARX) (“Ra Pharma”) today announced the pricing of an underwritten public offering of 8,400,000 shares of its common stock at a public offering price of $6.00 per share, before underwriting discounts. Ra Pharma also granted the underwriters a 30-day option to purchase up to an additional 1,260,000 shares of common stock. The gross proceeds from the offering, before deducting underwriting discounts and estimated offering expenses, are expected to be $50.4 million, excluding any exercise of the underwriters’ option to purchase additional shares. All of the shares in the offering are to be sold by Ra Pharma.

Ra Pharmaceuticals, Inc. (NASDAQ:RARX) today announced that it has received a development milestone payment under its collaboration agreement with Merck, known as MSD outside the US and Canada. The milestone payment is associated with the companies’ collaboration for a non-complement cardiovascular target with a large market opportunity. Initiated in 2013, this collaboration leverages Ra Pharma’s Extreme Diversity™ platform aimed at producing macrocyclic peptides that have the diversity and specificity of antibodies, while retaining the pharmacologic attributes of small molecules.

“Our Extreme Diversity platform allows us to create drug-like peptides with high bioavailability, stability, cell permeability, and potency, potentially filling unmet needs associated with monoclonal antibody, biologic, and peptide therapies,” said Doug Treco, PhD, President and Chief Executive Officer of Ra Pharma. “As our collaboration with Merck has demonstrated, this chemistry, and the large libraries of drug-like molecules it enables, allow us to rapidly identify orally-available lead peptides, and we are pleased to have delivered these peptides to Merck.”

“The advancement of our collaboration with Merck, in parallel with the clinical progress of zilucoplan, our lead internal pipeline candidate in development for generalized myasthenia gravis, paroxysmal nocturnal hemoglobinuria, and other complement-mediated diseases, underscores the power and productivity of our platform for drug discovery,” Dr. Treco added.

Under the terms of the agreement, Ra Pharmaceuticals is eligible to earn up to $59 million in additional milestone payments from Merck based upon the achievement of development, regulatory, and commercialization milestones. Ra Pharma is also eligible to receive low-to-mid single digit percentage royalties on any future sales of compounds resulting from the collaboration.

Ra Pharmaceuticals, Inc. (Nasdaq: RARX) (“Ra Pharma”) today announced the pricing of an underwritten public offering of 8,387,097 shares of its common stock, at a public offering price of $15.50 per share, before underwriting discounts and commissions. Ra Pharma also granted the underwriters a 30-day option to purchase up to an additional 1,258,064 shares of its common stock. The gross proceeds from the offering, before deducting underwriting discounts and commissions and estimated offering expenses, are expected to be approximately $130.0 million, excluding any exercise of the underwriters’ option to purchase additional shares. All of the shares in the offering are to be sold by Ra Pharma.

Ra Pharmaceuticals, Inc. (Nasdaq: RARX) (“Ra Pharma”) today announced the pricing of an underwritten public offering of 4,000,000 shares of its common stock, at a public offering price of $32.50 per share. Ra Pharma also granted the underwriters a 30-day option to purchase up to an additional 600,000 shares of its common stock. The gross proceeds from the offering, before deducting underwriting discounts and commissions and estimated offering expenses, are expected to be approximately $130 million, excluding any exercise of the underwriters’ option to purchase additional shares. All of the shares in the offering are to be sold by Ra Pharma.

Ra Pharmaceuticals, Inc. (Nasdaq:RARX) today announced that it has earned a clinical development milestone under its collaboration agreement with Merck, known as MSD outside the U.S. and Canada. The milestone is associated with the dosing of the first patient in a Phase 1 clinical trial evaluating an investigational orally-available macrocyclic peptide for a non-complement cardiovascular target with a large market opportunity from the companies’ collaboration.

“I’m extremely excited to have reached this significant milestone, which notably marks the second compound from Ra’s Extreme Diversity™ platform to enter human clinical testing,” said Doug Treco, Ph.D., President and Chief Executive Officer of Ra Pharma. “The continued progress of our collaboration with Merck, in parallel with the advancement of our internal pipeline, including zilucoplan, our lead clinical candidate in development for the treatment of multiple tissue-based complement-mediated disorders, underscores the robust and broad potential of our platform technology across a range of therapeutic areas.”

Initiated in 2013, the Merck collaboration leverages Ra Pharma’s Extreme Diversity platform aimed at producing macrocyclic peptides that are designed to have the diversity and specificity of antibodies, while retaining the pharmacologic attributes of small molecules, with the potential to allow for the rapid identification, design, and development of drug-like peptides with high stability, bioavailability, cell permeability, and potency.

Under the terms of the agreement, Ra Pharma is eligible to earn up to $56 million in additional milestone payments from Merck based upon the achievement of development, regulatory, and commercialization milestones. Ra Pharma is also eligible to receive low-to-mid single digit percentage royalties on any future sales of compounds resulting from the collaboration.

UCB strikes $2.5B deal to buy Ra for rival to Alexion’s Soliris – Fierce Biotech 10/10/2019

UCB Pharma has struck a $2.5 billion (€2.2 billion) deal to acquire Ra Pharmaceuticals. The takeover will give UCB control of a phase 3 rival to Alexion’s Soliris that some analysts have tipped to rack up blockbuster sales.

Ra is focused on a once-daily, self-administered, subcutaneous C5 inhibitor called zilucoplan. The peptide moved into phase 3 in myasthenia gravis earlier this month on the strength of midphase data suggesting it may pose a threat to Alexion’s claim on the indication and its broader stranglehold on the market for complement-mediated disease therapies.

UCB, which has its own phase 3 myasthenia gravis asset, sees zilucoplan as a good fit for the growth plan it set out at the start of the year. To acquire the drug, UCB has put together a deal worth $48 a share, a more than 100% premium over Ra’s closing price yesterday.

That premium, which results in a deal worth $2.5 billion, or $2.1 billion net of Ra’s cash, reflects the belief that zilucoplan can generate blockbuster sales. Jefferies analysts think U.S. sales of zilucoplan in myasthenia gravis will top out at around $630 million, powering the therapy to worldwide peak sales in excess of $1 billion and leading them to back UCB’s decision to strike the deal.

“[Myasthenia gravis] is a space UCB knows well, and with zilucoplan’s potential the proposed deal makes strategic sense,” the analysts wrote.

UCB’s knowledge of the myasthenia gravis space stems from its development of rozanolixizumab, an anti-FcRn antibody that is in phase 3 development in the indication. The overlap between UCB and Ra’s pipelines could create antitrust issues given the difficulties Bristol-Myers Squibb and Roche have faced in their acquisitions of Celgene and Spark Therapeutics, respectively.

However, UCB expects the deal to close without incident by the end of the first quarter of 2020. The Jefferies analysts said UCB’s confidence is based on differences between the mechanisms of action of zilucoplan and rozanolixizumab, which the pharma company thinks makes the drugs complementary rather than competitive.

If the deal closes, UCB will take zilucoplan to key readouts. Data from the phase 3 myasthenia gravis trial are due early in 2021. By then, UCB should have data from a phase 2 trial of zilucoplan in immune-mediated necrotizing myopathy that is due to start soon. Ra is also developing an extended release formulation of zilucoplan and an oral C5 inhibitor that are due to enter the clinic next year.

Zilucoplan (Zilbrysq; UCB, Inc.) has been granted FDA approval for the treatment of generalized myasthenia gravis (gMG) in adult patients who are anti-acetylcholine receptor (AChR) antibody-positive.

gMG is a rare, chronic, heterogeneous, unpredictable autoimmune disease. It is characterized by dysfunction and damage at the neuromuscular junction and drivers of the disease pathology include the complement cascade, immune cells, and pathogenic immunoglobulin G autoantibodies.

“For people with gMG, the unpredictable nature of the severity and frequency of symptoms can be debilitating and can have a substantial impact on many aspects of their day-to-day lives,” said James F. Howard, MD, Distinguished Professor of Neuromuscular Disease and professor of neurology, medicine, and allied health at the university of North Carolina at Chapel Hill School of Medicine and lead investigator in the RAISE trial, in a press release. “In addition to muscle weakness, people living with gMG experience fatigue, affecting their overall quality of life.”

In anti-AChR antibody-positive gMG, pathogenic AChR autoantibodies (IgG1 and IgG3) initiate the classical complement pathway, leading to the cleavage of C5 and the membrane attack complex formation, damage to the NMJ, loss of AChRs, and subsequent impaired synaptic transmission. Preventing MAC formation reduces damage to the post-synaptic membrane, reduces disruption of ionic channel conductance, and helps preserve neuromuscular transmission.

Zilucoplan is the first once-daily subcutaneous, targeted peptide inhibitor of complement component 5 (C5 inhibitor) and is the only once-daily gMG target therapy for self-administration by adults with anti-AChR antibody-positive gMG. Benefits of self-administration compared to intravenous (IV) administration include reduced travel time, decreased interference with work and family obligations, and increased independence. As a peptide, zilucoplan can be used concomitantly with IV immunoglobulin and plasma exchange, without supplemental dosing.

The approval is supported by safety and efficacy data from the RAISE study (NCT04115293), published in May 2023. Patients were randomized 1:1 to receive daily subcutaneous injections of 0.3 mg/kg zilucoplan or placebo for 12 weeks.

The primary endpoint was change from baseline to week 12 in the Myasthenia Gravis-Activities of Daily Living (MG-ADL) score, which assesses activities such as breathing, talking, swallowing, and being able to rise from a chair. Efficacy was also measured as a secondary endpoint using the Quantitative Myasthenia Gravis (QMG) total score, which assesses muscle weakness.

According to the findings, zilucoplan delivered rapid, consistent, and statistically significant benefits among different patient- and clinician-reported outcomes at week 12 in a broad population of adults with mild-to-severe anti-AChR-antibody positive gMG. At week 12, treatment with zilucoplan demonstrated a statistically significant improvement from baseline for MG-ADL total score and QMG total score.

The most common adverse reactions were injection site reactions, upper respiratory tract infection, and diarrhea.

“Until now, people living with gMG have only had access to C5 therapy intravenously, which can be inconvenient and time consuming,” said Iris Loew-Friedrich, executive vice president and chief medical officer at UCB, in the press release. “Now, with the option of Zilbrysq, a self-administered once-daily, subcutaneous targeted complement C5 inhibitor, we hope a broad population of mild-to-severe adult patients with AChR-antibody-positive gMG will be able to have greater independence.”

Merck & Co. is betting big on its oral PCSK9 inhibitor. Buoyed by midphase results, the Big Pharma has kicked off a clutch of late-stage studies including a cardiovascular outcomes trial that will follow patients for around six years.

The New Jersey-based drugmaker has identified the candidate, MK-0616, as a way to bring the powerful cholesterol-lowering effects of PCSK9 inhibition to more patients. Like Amgen’s Repatha and Sanofi and Regeneron’s Praluent, MK-0616 binds to the PCSK9 enzyme to lower LDL-C and thereby reduce the risk of cardiovascular events. But while Repatha and Praluent are injectable antibodies that struggled to live up to sales expectations, Merck’s candidate is an oral peptide that may be more attractive to patients.

Merck is running three phase 3 clinical trials of MK-0616. First up are two similar studies that will assess the effect of the oral peptide on LDL-C levels after 24 weeks. Merck is targeting a primary completion of September 2025 for both studies.

The third clinical trial is a cardiovascular outcomes study. In that trial, Merck will track 14,500 patients for up to six years to test whether MK-0616 reduces major adverse cardiovascular events in people at high risk. The length of the trial, which has a primary completion date in late 2029, sets it apart from earlier efforts to assess the impact of PCSK9 inhibition on cardiovascular outcomes.

When Amgen, Regeneron and Sanofi developed their injectable PCSK9 drugs, they assessed the effect of the treatments on cardiovascular outcomes over a median of 2.2 to 2.8 years. Later, long-term follow-up trials found the effect of the drugs on cardiovascular outcomes increases over time, suggesting that the developers could have shown more profound changes if their main studies had kept going for longer.

Dean Li, M.D., Ph.D., president of Merck Research Labs, discussed the lessons of the earlier programs on a conference call with investors earlier this year, describing the need to strike a balance. If the trial is too short, Merck risks missing out on “the full maximum impact that you can have on the label,” Li said, but that “needs to be balanced with whatever the IRA looks like” years from now.

The threat of the Inflation Reduction Act is so severe that Merck has fielded questions about whether it would choose to delay the launch of the oral PCSK9 drug until it has outcomes data. Merck CEO Robert Davis didn’t dismiss the idea, only saying that “it’s too early to make that kind of decision.” Davis needs to make the most of MK-0616 to help offset the loss of exclusivity on megablockbuster Keytruda.