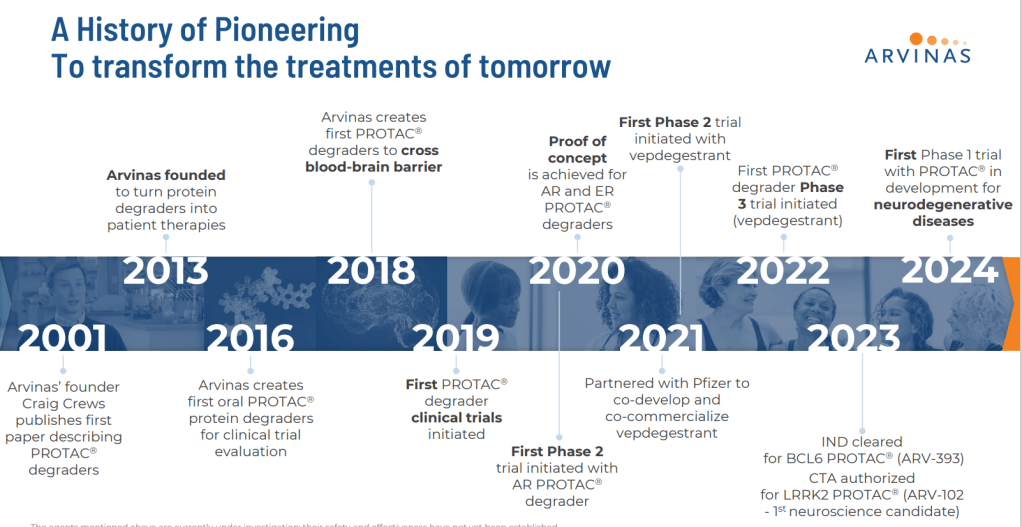

Arvinas는 Yale University Craig M. Crews 교수 연구실에서 개발한 PROTAC을 상용화 하기 위해 2013년에 New Haven, Connecticut에서 설립한 회사로 지금까지 10년간 Merck, Roche/Genentech, Pfizer, Bayer 등과 공동연구계약 및 VC/Crossover Funding을 통해서 성장한 회사이다.

PROTAC은 2001년에 PNAS 논문에 처음으로 보고한 이래 2024년 현재 Small molecule 분야 중에서 가장 핫한 분야 중 하나이고 Arvinas가 가장 앞선 회사로 평가한다.

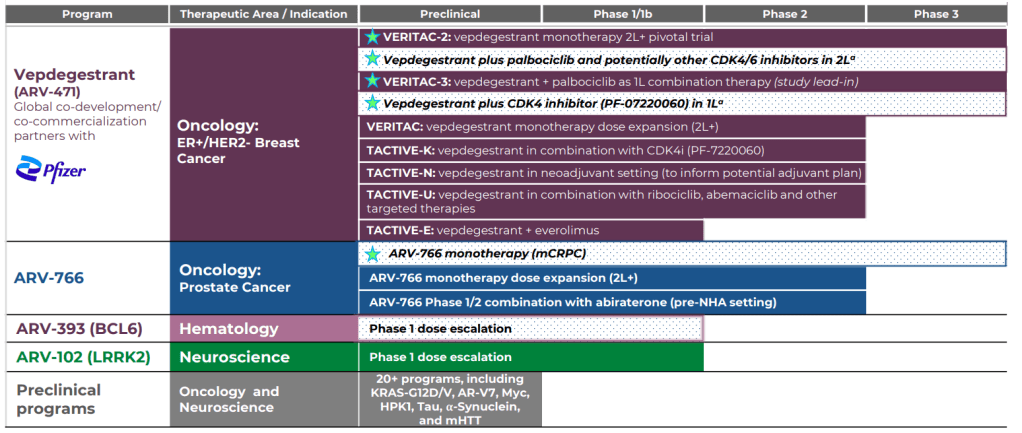

Pfizer와 공동개발 중인 Vepdegestrant (ARV-471)가 현재 ER+/HER2- Breast cancer 치료제로서 임상3상이 진행 중이다.

Arvinas는 2013년에 창업한 이래 PROTAC 분야의 역사를 쓰고 있는 중이다. Arvinas의 신약개발이 잘 순항해서 Oncology 분야 뿐 아니라 Neurology 분야 등에서도 환자들의 치료에 쓰일 수 있기를 기대한다.

Arvinas Inc., a biotechnology company creating a new class of drugs based on protein degradation, today announced it has raised $15 million in Series A funds and $4.25 million in financial support, $1 million of which is in the form of equity, from the Connecticut Department of Economic and Community Development and Connecticut Innovations. Investors in the Series A round include co-leads Canaan Partners and 5AMVentures along with Connecticut Innovations and Elm Street Ventures. The funds will support the development of the company’s technology which has primary application in multiple oncology indications and potential in inflammatory, autoimmune and rare diseases.

Arvinas is built on the research of Craig Crews, PhD, Lewis B. Cullman Professor of Molecular, Cellular and Developmental Biology and professor of Chemistry and Pharmacology at Yale University. The new drugs being developed by Arvinas would induce a cell’s own protein-degradation capabilities to bind to a particular protein and “label” it for degradation, thus removing a protein from the system entirely. This contrasts to a more traditional drug development approach that inhibits proteins. However, only 25 percent of the body’s 20,000 proteins can be inhibited. Proteins that cannot be inhibited can potentially be degraded using Arvinas’ approach, radically expanding the number of disease-causing proteins that can become the targets of new drugs.

“Degrading proteins as opposed to inhibiting them has potential to open up areas of drug development that were previously closed because of the technical limitations of protein inhibition,” said Tim Shannon, MD, CEO of Arvinas and Venture Partner at Canaan Partners. “The Arvinas technology platform represents an entirely new class of drugs bringing an innovative approach to treating disease.“

“In addition to the fact that a very large portion of proteins cannot be blocked, inhibition is not permanent, so a disease-causing protein can eventually become active again after treatment with a drug,” said Dr. Crews. “To effectively stop cancer, a drug-binding site must be inhibited 95 percent of the time, which is currently difficult to achieve. If a protein is removed entirely, that should overcome this problem.”

Arvinas also announced the formation of a Scientific Advisory Board (SAB), which will help guide the development of its novel approach. Members of the SAB include Daniel D. Von Hoff, MD, Chief, distinguished professor and director of clinical translational research division at the Translational Genomics Research Institute and Chief Scientific Officer for US Oncology; Mark Murcko, PhD, former Chief Technology Officer at Vertex Pharmaceuticals; Thomas J. Lynch, Jr., MD, Director of the Yale Cancer Center and Physician-in-chief at Smilow Cancer Hospital at Yale-New Haven; Richard Ulevitch, Venture Partner 5AM and Professor and Chairman Emeritus of the Department of Immunology at The Scripps Research Institute, La Jolla, California; and Peter Farina, PhD, executive in residence at Canaan Partners and former Senior Vice-President of Development at Boehringer Ingelheim.

Arvinas worked with the Yale Office of Cooperative Research (OCR) to secure intellectual property protection for the technology.

“The Arvinas team has lined up an impressive slate of supporters of the unique technology that comes out of Yale University,” noted John Soderstrom, PhD, Managing Director of the Office of Cooperative Research at Yale and a member of Arvinas’ Board of Directors. “Degrading proteins that are driving disease has the potential to bring about drastic changes in drug development, and we anticipate significant interest from pharmaceutical companies.”

Joining Dr. Shannon and Dr. Soderstrom on the Arvinas Board of Directors will be Kush Parmar, MD PhD and a Principal at 5AM Ventures and Brad Margus, the CEO of Genome Bridge and former CEO of Envoy Therapeutics.

Merck wagers $434M on Arvinas and its protein-disposal system – Fierce Biotech 4/7/2015

Under the deal, Merck will hand the New Haven, CT, biotech an up-front payment and research funding, promising more cash tied to development milestones and setting Arvinas’ maximum haul at $434 million if everything works out over the multiyear agreement. In exchange, Merck will get a chance to use the company’s proteolysis-targeting chimera, or PROTAC, technology, which creates small-molecule treatments that mark proteins for degradation.

Based on work out of Craig Crews’ Yale University labs, PROTAC treatments are designed to get rid of unwanted proteins by triggering a cell’s natural clean-up system, marking targets for removal and letting the body’s degradation mechanisms do the rest. Arvinas, launched in 2013, has largely focused its internal efforts on oncology, but the Merck deal spans multiple disease targets in an undisclosed array of therapeutic areas, the company said.

The majority of protein-targeting therapeutics in the market or in development work by either inhibiting or boosting their targets, whether via antibodies or small-molecule chemicals. But only about a quarter of the body’s roughly 20,000 proteins can be effectively drugged that way, Arvinas CEO Manny Litchman said. By attacking proteins from within their home cells, however, Arvinas’ technology can potentially open up new avenues of therapeutic development, he said, exposing some long-untouchable targets to guided degradation.

That potential was a major selling point for Merck, Litchman said, and now it’s on Arvinas to demonstrate that its technology can come through in the proof-of-concept stage, rolling into what the CEO expects to be “a true collaboration.” Merck has the option to expand the deal to include more disease targets, triggering an undisclosed payment, and Litchman believes the agreement could create a model for Arvinas’ future partnerships.

The company has held onto a host of internal programs also based on PROTAC, including a lead oncology asset Arvinas expects to get into the clinic in the middle of next year. The biotech will likely look to ink one or two more deals along the way, Litchman said, at once cautious not to spread itself too thin and optimistic that Merck’s big co-sign will help it bring would-be partners to the table.

“I think when a company like Merck has done deep due diligence, surveyed the competitive landscape and selected Arvinas as the best platform out there for protein degradation, that’s a signal for others we’ve talked to that perhaps a deeper dive may be warranted,” Litchman said.

Arvinas got rolling with a $15 million A round from Canaan Partners and 5AM Ventures, licensing Crews’ technology and assembling a team of investigators to push it forward. The biotech quickly moved to establish preclinical proof of concept for PROTAC, recruiting Litchman, an 18-year Novartis ($NVS) veteran, in time to start showing off the platform at January’s JP Morgan Healthcare conference.

Genentech embraces Arvinas with $300M tie-up on protein degradation – Fierce Biotech 10/1/2015

Fresh on the heels of its inclusion in this year’s Fierce 15, New Haven, CT-based Arvinas has pulled the wraps off a new partnership with Genentech that comes with a $300 million package of milestones.

Genentech, a marquee player in the cancer drug R&D arena, is turning to Arvinas for protein degradation platform tech that was originally developed by Yale’s Craig Crews. Arvinas was launched in 2013 and later signed a development pact with Merck.

The biotech has been focused on moving beyond protein inhibition–a big field in biotech–and into protein degradation, targeting particular proteins for destruction in search of a more permanent solution to a wide array of disease triggers.

“There’s huge interest in this area,” company Chairman Tim Shannon told FierceBiotech earlier in the week. “We’ve had a lot of outreach and we expect more.”

There’s no news on exactly what Genentech is targeting initially, but the biotech arm of Roche has rights to expand the collaboration to include more targets. The upfront in the deal was not disclosed.

“Genentech is very interested in protein degradation as a therapeutic approach to address difficult disease targets,” noted Genentech’s chief deal maker, James Sabry. “Arvinas’s PROTAC technology offers an exciting opportunity to harness the body’s own system to degrade pathogenic proteins.“

The company has been funded by Canaan Partners, 5AM Ventures, Connecticut Innovations and Elm Street Ventures.

Arvinas Secures $41.6M Series B Financing – Appoints New Board Members – PR Newswire 10/21/2015

Arvinas LLC (“Arvinas”), a private biotechnology company creating a new class of drugs based on targeted protein degradation, today announced that it has closed a Series B financing round of $41.6 million.

All of the initial Series A investors, including the two lead Series A investors, Canaan Partners and 5AM Ventures, participated in this new round. Three additional leading private venture investment firms joined the round: RA Capital Management, OrbiMed, and New Leaf Venture Partners.

“We were impressed by the scientific accomplishments of Arvinas in their first two years and enthusiastic about the robust pipeline entering clinical trials in 2016,” said Andrew Levin, M.D., Ph.D., of RA Capital Management, which led the Series B financing. “Arvinas has a truly unique platform degrading targets of interest, within and outside of oncology, and they are using this powerful platform to rapidly build a portfolio of bifunctional small molecules. We are pleased to join them in this endeavor.”

Arvinas is harnessing the body’s own natural degradation and removal system to target and degrade pathogenic proteins by using bifunctional small molecules, Proteolysis-Targeting Chimeras (PROTACs). PROTACs recruit an E3 ubiquitin ligase to a specific targeted protein, labeling that protein for elimination by the ubiquitin/proteasome system.

In addition to financial resources, this round of investment brings impressive experience and intellectual resources to Arvinas in the form of three new members of the Board of Directors:

- Andrew Levin, M.D., Ph.D., Managing Director, RA Capital Management

- Stephen Squinto, Ph.D., Venture Partner, OrbiMed

- Liam Ratcliffe, M.D., Ph.D., Managing Director, New Leaf Venture Partners

Manuel Litchman, M.D., President and Chief Executive Officer of Arvinas commented: “We are gratified by the continued support of our Series A investors and thrilled with our new investment partners. Andrew, Steve, and Liam bring remarkable track records of accomplishment and knowledge to our Board; they, along with the resources of their firms, will help us succeed as we move forward. The Series B gives us the capital we need to advance an aggressive pipeline of targeted degraders into the clinic and to continue to strengthen our unique platform.”

“This has been a great month for Arvinas, announcing a collaboration with Genentech, being named a ‘Fierce 15’ biotech, and now completing an investment round with several marquee firms,” said Tim Shannon, M.D., Chairman of the Board of Arvinas and General Partner, Canaan Partners.

Pfizer, Arvinas Forge $830M Protein Degradation R&D Deal – Biospace 1/4/2018

Two months after expanding a licensing deal with Genentech, privately-held Arvinas LLC struck another lucrative deal with a major pharmaceutical company. Connecticut-based Arvinas inked a deal with Pfizer worth up to $830 million to develop small molecules that can degrade proteins.

Pfizer will use Arvinas’ proprietary PROTAC (PROteolysis TArgeting Chimeras) Platform to create small molecule therapeutics aimed at degrading disease-causing cellular proteins. The two companies provided some brief outlines of the deal but much of the meat was left undisclosed. For example, the companies did not disclose what targets the therapy would take aim at, nor did they disclose how many targets are included in the deal. What is known is that Arvinas will drive discovery efforts and Pfizer will be accountable for the therapy when it reaches the clinical stage and any potential commercialization.

John Ludwig, head of medicinal sciences at Pfizer, said the company has “considerable interest” in protein degradation. He did say the global pharma company would determine the applicability of Arvinas’ PROTAC Platform across multiple therapeutic areas, but did not name them.

Unlike inhibitors, Arvinas’ PROTAC Platform is designed to remove target proteins. The company believes this offers several advantages over traditional small cell inhibitors. By removing target proteins directly rather than simply inhibiting them, PROTACs can provide multiple advantages over small molecule inhibitors which can require high systemic exposure to achieve sufficient inhibition, often resulting in toxic side effects and eventual drug resistance, according to Arvinas data. With multiple protein targets, Arvinas’ PROTAC platform has demonstrated that a transient binding event at a range of binding sites and affinities can translate into very potent degradation of the target protein, the company said. The platform was developed in the Yale University laboratory of Craig Crews, who is the company’s founder and chief scientific advisor.

“As a global industry leader, Pfizer is uniquely positioned to partner with us as we exploit the potential of PROTACs in multiple disease areas,” Arvinas Chief Executive Officer John Houston said in a statement.

Under terms of the deal, Arvinas could receive up to $830 million when all payments, including upfront monies and milestones are factored into the equation. However how those payments will be broken down were not disclosed. If any of the therapies make it to commercialization, Arvinas may be entitled to receive tiered royalties based off any sales.

“This marks another key milestone as we continue to expand the use of our targeted protein degradation platform and advance Arvinas’ first candidates into the clinic.”

Like Pfizer, Genentech has also been tight-lipped about its collaboration with Arvinas. The Bay Area company has not disclosed disease targets it is working on with Arvinas.

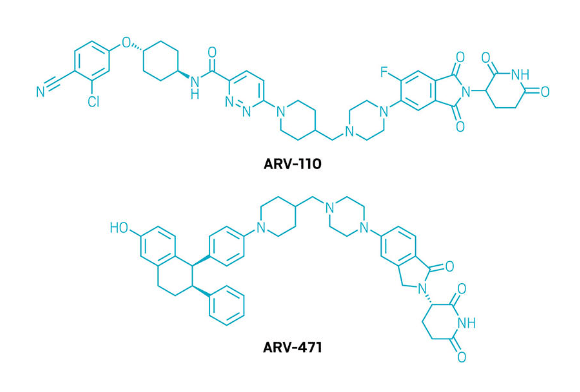

In its own pipeline development, Arvinas is focused on targeting both prostate and breast cancer with a focus on androgen and estrogen receptor degradation. In November, the company named its first clinical candidate ARV-110, designed to target and induce degradation of the androgen receptor protein. In December, the company announced its second candidate for clinical development, ARV-378. The candidate is an orally bioavailable small molecule PROTAC designed to target and induce the degradation of the estrogen receptor (ER) protein, which plays a prominent role in the development of ER positive breast cancer.

Arvinas gains $55M C round as it eyes cancer trials, pipeline work – Fierce Biotech 4/4/2018

Former Fierce 15 winner Arvinas, which has caught the attention of Pfizer and Roche over the last year, has got off a strong $55 million series C as it looks to bring its cancer candidates into the clinic.

The New Haven, Conn.-based biotech is, like a number of startups, working on protein degradation, with early-stage efforts focused on oral programs in castration-resistant prostate cancer and the estrogen receptor for ER-positive positive breast cancer.

Both are preclinical, but with this cash boost the biotech is plotting clinical studies in the fourth quarter.

The $55 million round was led by new investor Nextech Invest, with help from Deerfield Management, Hillhouse Capital and Sirona Capital, as well as original investors Canaan Partners, 5AM Ventures, RA Capital Management, OrbiMed and New Leaf Venture Partners.

The cash will also be used to “advance the company’s early-stage oncology pipeline, CNS pipeline and efforts on undruggable targets,” according to a statement.

This comes after a good 12 months for the biotech: In January, ahead of the J.P. Morgan biotech event, Arvinas penned a deal potentially worth $830 million, and more besides, with Big Pharma Pfizer in a pact that centers on the discovery and development of PROTACs (proteolysis targeting chimeras) across multiple disease areas.

And a few months before, in November last year, it inked a deal with Genentech, which saw Roche’s biologics arm double the size of its original alliance with Arvinas, moving the potential value of the pact up above $650 million.

The expansion of the deal allows Genentech to use Arvinas’ protein degradation technology against additional disease targets, also using PROTACs.

This comes as protein degradation is becoming a bigger deal among several smaller biotechs. Fellow Fierce 15 company C4 Therapeutics is tackling protein degradation using small-molecule binders, dubbed degronimids, that can target, destroy and clear proteins through the ubiquitin/proteasome system.

“This past year has been exciting for us with two clinical candidate nominations, the expansion of our collaboration with Genentech and the announcement of a new collaboration with Pfizer,” said John Houston, Ph.D., president and CEO of Arvinas, in the announcement.

“With this additional financial support from existing and new investors who believe in our innovative protein degradation platform, we will continue executing on our strategy of progressing our lead programs to the clinic, expanding the use of the platform outside of oncology, and tackling undruggable targets,” Houston said.

Arvinas lines up for $100M IPO – Fierce Biotech 8/30/2018

Arvinas has been on a roll this year, starting with a Pfizer R&D deal worth potentially $830 million and bagging a $55 million series C in April to push its cancer drugs into the clinic. Now, the Yale spinout has filed to raise up to $100 million in its IPO, which will get its lead assets through the IND stage and into phase 1.

The New Haven, Connecticut-based biotech is working on an androgen receptor program, ARV-110, in castration-resistant prostate cancer, and an estrogen receptor program, ARV-471, in metastatic ER-positive breast cancer. The bulk of the IPO funds is earmarked to carry these assets into the clinic; what’s left will go toward expanding its protein degradation platform and conducting preclinical work for its earlier-stage programs, Arvinas said in its S-1, filed Thursday.

Arvinas drew its series C round from the likes of Deerfield, Sirona Capital, Canaan Partners and OrbiMed, saying at the time that it aimed to start clinical studies in the fourth quarter.

Arvinas’ drugs are based on its PROTACs (proteolysis targeting chimeras) platform, which grew out of the work of Craig Crews’ lab at Yale University. PROTACs work by activating the body’s protein disposal system. They recruit an enzyme to tag target proteins for ubiquitination and degradation.

Ubiquitination is a process whereby a damaged or unneeded protein is tagged with the protein ubiquitin and then sent to a protein complex called a proteasome, where it is degraded. The hope is that by degrading proteins instead of just blocking them, Arvinas’ drugs will surmount challenges that come with small-molecule protein inhibitors.

The company’s pipeline focuses on cancer, but its multiyear deal with Pfizer centers on developing PROTACs for multiple disease areas. The pair didn’t disclose which indications they would be chasing, but protein degradation could have applications in central nervous system disorders and rare diseases.

Arvinas isn’t alone in the growing protein degradation field. Its Fierce 15 peer, C4 Therapeutics, is using small-molecule binders called degronimids that can target, destroy and clear proteins through the ubiquitin/proteasome system. And Cedilla Therapeutics, which launched in April, is studying protein stability in search of points in the protein degradation process it can intervene.

“Where we are looking is in pivotal events upstream of this machinery that govern the transition [of proteins] between an operational state to a susceptible state,” said Cedilla’s Chief Scientific Officer Brian Jones at the company’s launch.

Bayer and Arvinas, Inc. (Nasdaq: ARVN), a biopharmaceutical company creating a new class of therapies to degrade disease-causing proteins, today announced an agreement to leverage Arvinas’ novel PROTAC® protein degrader technology to develop new human therapeutics for patients with cardiovascular, oncological, and gynecological diseases. In addition, Bayer and Arvinas will jointly launch a new company to leverage Arvinas’ PROTAC® technology for agricultural applications. The overall series of arrangements includes over $110 million in upfront cash and committed funding for the human disease collaboration, the agricultural joint venture, and a direct equity investment by Bayer in Arvinas.

The multi-faceted deal will extend the application of targeted protein degradation to new therapeutic areas and outside human biology. It leverages Arvinas’ expertise in targeted protein degradation, a field the company has led since its founding in 2013, and Bayer’s decades of experience in developing both human therapies and innovative, sustainable agricultural technologies.

“As the first company founded around targeted protein degradation, we’ve been excited about the potential to improve the lives of patients since our inception,” said John Houston, Ph.D., President and Chief Executive Officer of Arvinas. “However, we’ve known that the potential of this technology could be broader than drug development. Through these transactions, not only do we plan to expand our reach into new therapeutic areas, but we and Bayer expect to be the first to apply this approach to agriculture, working to safely and efficiently feed the world’s growing population. It’s a natural next step in our commitment to improving human health.”

“With our unique position as a leading company in both Crop Science and Pharmaceuticals, we see a great opportunity to partner with the pioneer of the PROTAC® technology, to advance this technology as quickly as possible to deliver future solutions for sustainable agriculture and innovative medicines for patients,” said Kemal Malik, Bayer Board member for Innovation.

Pharmaceutical Collaboration and Equity Investment

Bayer and Arvinas will collaborate to seek to develop a series of novel product candidates for diseases with serious unmet need. Arvinas will receive an upfront payment and committed R&D funding, as well as a direct equity investment in Arvinas. Combined, these committed funds exceed $60 million. Bayer will own the rights to novel lead structures generated in the collaboration. As programs progress through research, development, and commercialization, Arvinas is also eligible to receive development milestones of over $685 million and commercial royalties ranging from the mid-single digits to the low double-digits.

Agricultural Joint Venture

In launching a joint venture (JV), Bayer and Arvinas are investing in one of the greatest challenges facing the world: feeding the growing global population. PROTAC® targeted protein degraders have the potential to address resistance mechanisms in plants to existing agricultural solutions, with solutions to control weeds, insects, and disease by leveraging the selectivity and other features of PROTAC® protein degraders. The JV will be committed to leveraging Arvinas’ PROTAC® protein degrader technology to create innovative, safe, and sustainable agricultural products. The JV will be supported by intellectual property and over $55 million in committed funding from Bayer, and by technology and intellectual property from Arvinas. Bayer and Arvinas will equally share governance and equity ownership of the JV.

Arvinas, Inc. Announces Pricing of Public Offering of Common Stock – Press Release 11/6/2019

Arvinas, Inc. (Nasdaq: ARVN), a biotechnology company creating a new class of drugs based on targeted protein degradation, today announced the pricing of an underwritten public offering of 4,545,455 shares of its common stock at a price of $22.00 per share, before underwriting discounts and commissions. In addition, Arvinas has granted the underwriters an option for a period of 30 days to purchase up to an additional 681,818 shares of common stock at the public offering price, less the underwriting discounts and commissions. All of the shares are being offered by Arvinas.

Arvinas Announces Oversubscribed $350 Million Private Placement – Press Release 11/27/2023