안녕하세요 보스턴 임박사입니다.

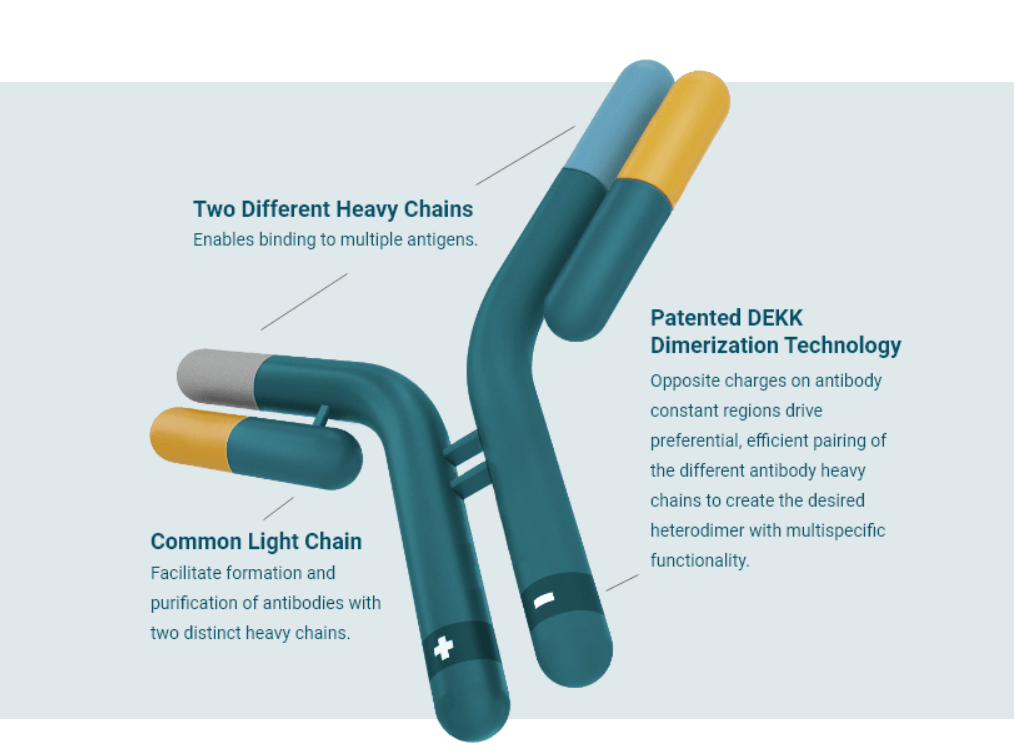

Merus NV는 Crucell 기술을 기반으로 2003년에 John de Kruif박사와 Ton Logtenberg 가 창업한 회사로서 이 회사의 기술은 Crucell의 PER.C6 cell line을 이용해서 Single Clonal Cell line으로 부터 Oligoclonics를 안정되게 대량으로 생산할 수 있습니다. PER.C6 cell line은 2004년에 Crucell과 DSM으로 부터 기술이전 계약을 받았고 DEKK IgG를 통해 Stable Bispecific Antibody를 만들 수 있는 기반기술을 확보하여 Full-length IgM format으로 Long half-life와 Low immunogenicity라는 중요한 장점을 확보할 수 있었습니다.

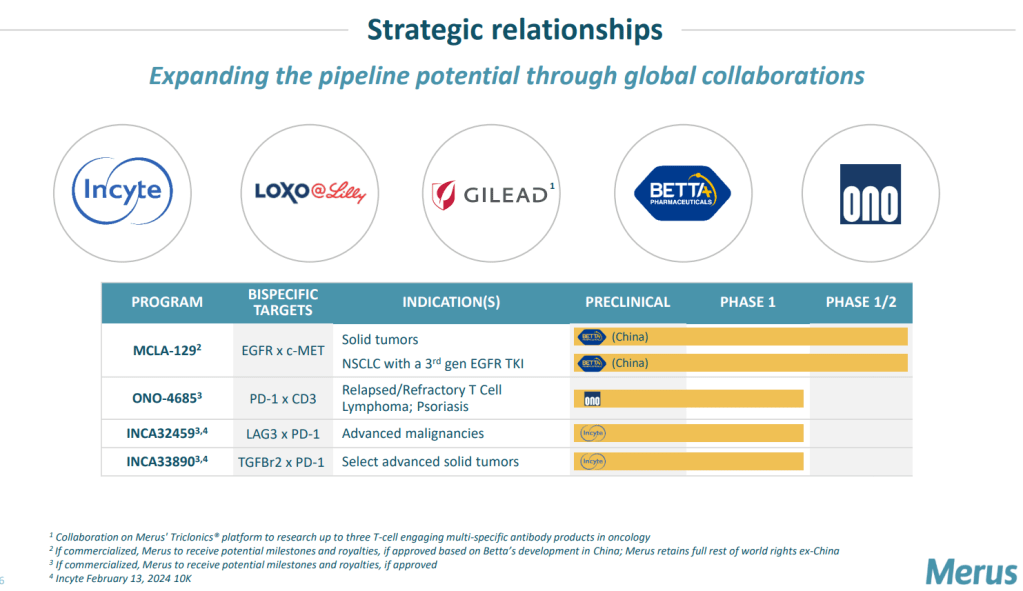

Bispecific T-cell engager 기술개발은 생산에 많은 자금이 소요되어 Merus는 매년 $50 Million 이상의 유상 증자나 계약을 통해 자금조달을 하고 있고 Novartis, Johnson & Johnson, Eli Lilly, Ono등의 제약사들이 지분투자나 공동계발에 참여하고 있습니다. 최근에는 Gilead와 $1.5 Billion 공동계약을 한 바 있는데 이를 통해 Merus는 Trispecific T-cell Engager에 영역을 확장하게 되었습니다.

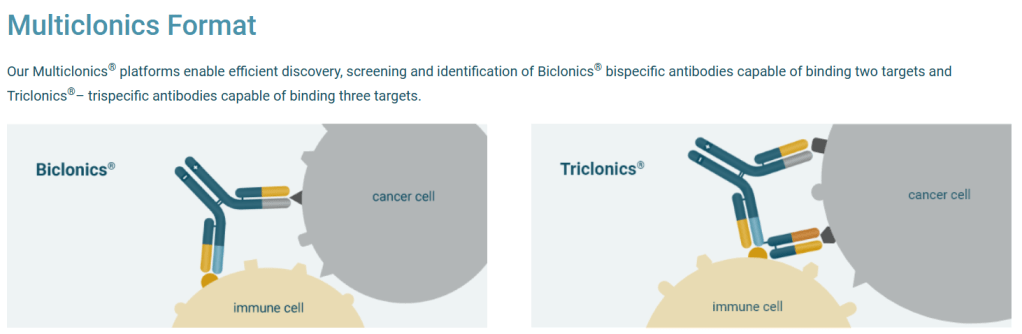

Merus의 Multiclonics Platform은 세가지 기술을 접목하는데 (1) Merus Mouse (MeMo)라는 기술로 다양한 cLC (common Light Chain) antibodies를 mouse 에서 얻고 이들의 타겟을 발굴하고 (2) Robotics를 이용해 cLC antibodies와 DEKK IgG를 결합한 수천개의 Multiclonics를 만들고 unbiased functional screening을 통해 (3) Best-in-class Biclonics나 Triclonics를 발굴하는 것입니다.

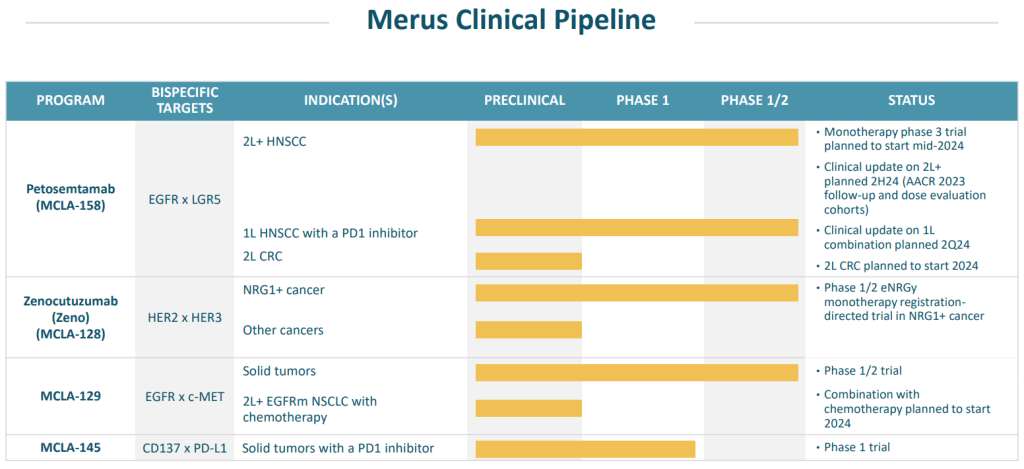

현재 자체 개발 중인 프로그램은 Petosemtamab (MCLA-158, EGFR x LGR5), Zenocutuzumab (MCLA-128, HER2 x HER3), MCLA-129 (EGFR x MET)가 임상 1/2에 있고 MCLA-145 (CD37 x PD-L1)이 임상 1상에 있습니다.

공동연구 중인 프로그램은현재 4가지가 있는데, BETTA와 진행 중인 MCLA-120 (EGFR x c-MET)이 임상 1/2상을 진행 중이고 ONO Pharma와 공동개발 중인 ONO-4685 (PD-1 x CD3)가 임상 1상에 Incyte와 개발 중인 INCA32459 (LAG3 x PD-1)과 INCA33890 (TGFBr2 x PD-1)이각각 임상 1상에 진입한 상태입니다.

금년 3월에 발표한 Corporate Presentation에 보다 자세한 설명이 있습니다. Merus NV의 Multiclonics Platform이 이제 Bispecific T-cell Engager 뿐만 아니라 Trispecific T-Cell Engager로 영역을 확장하고 있는데 아직까지는 임상이 초기단계이지만 곧 몇개의 프로그램은 pivotal clinical trials에 도달할 수 있을 것 같아 기대가 됩니다.

Dutch biotechnology company Crucell N.V. (Euronext:CRXL) (Nasdaq:CRXL) and allied contract manufacturer DSM Biologics announced today that Crucell and Merus B.V. have signed a PER.C6(R) research license agreement. This license agreement allows Merus to use the PER.C6(R) cell line for the further development of its Oligoclonics(TM) technology and related products.

“Oligoclonics(TM) are mixtures of human antibodies, produced by a single clonal cell line, that we expect to have improved clinical efficacy compared to current antibody therapeutics,” said Ton Logtenberg, CEO of Merus. “The PER.C6(R) cell line is instrumental in the stable and high yield production of Oligoclonics(TM).”

Under the terms of the agreement, Crucell and DSM will receive an upfront payment and annual maintenance fees. Further financial details were not disclosed.

About Merus

Merus is a Dutch biotechnology company founded in June 2003. The Company is focused on the discovery and development of a novel class of human antibodies, Oligoclonics(TM), that are expected to have improved clinical efficacy compared to current generations of human monoclonal antibodies. For more information, please visit http://www.merus-biopharm.com.

Merus receives EuroTransBio Grant – Press Release 12/15/2009

Merus BV, a biopharmaceutical company focused on the discovery and development of mixtures of human therapeutic antibodies, today announced that it has received a grant worth € 0.67 million for the development of an antibody combination therapy for chronic inflammatory diseases using its novel OligoclonicsTM and MeMoTM technologies. The grant was awarded by EuroTransBio.

Merus is applying the OligoclonicsTM and MeMoTM technologies to build a pipeline of innovative human therapeutic antibodies. With these technologies, Merus generates combinations of therapeutic antibodies produced from a single cell that boast superior biological activity when compared to single antibodies. The EuroTransBio grant will allow Merus to develop innovative antibody drugs for the treatment of chronic inflammatory diseases such as Rheumatoid Arthritis.

Ton Logtenberg, CEO of Merus, said: “We are pleased that EuroTransBio has recognized the potential of Merus’s innovative technologies to deliver next generation therapeutics offering substantial clinical benefit to patients with chronic diseases. This grant supports collaboration between European companies and academic institutions that combine their unique expertise to achieve this goal”.

Therapeutic monoclonal antibodies, a highly successful class of biological drugs, are conventionally manufactured in mammalian cell lines. A recent approach to increase the therapeutic effectiveness of monoclonal antibodies has been to combine two or more of them; however this increases the complexity of development and manufacture. To address this issue a method to efficiently express multiple monoclonal antibodies from a single cell has been developed and we describe here the generation of stable cell clones that express high levels of a human monoclonal antibody mixture. PER.C6® cells were transfected with a combination of plasmids containing genes encoding three different antibodies. Clones that express the three corresponding antibody specificities were identified, subcloned, and passaged in the absence of antibiotic selection pressure. At several time points, batch production runs were analyzed for stable growth and IgG production characteristics. The majority (11/12) of subclones analyzed expressed all three antibody specificities in constant ratios with total IgG productivity ranging between 15 and 20 pg/cell/day under suboptimal culture conditions after up to 67 population doublings. The growth and IgG production characteristics of the stable clones reported here resemble those of single monoclonal antibody cell lines from conventional clone generation programs. We conclude that the methodology described here is applicable to the generation of stable PER.C6® clones for industrial scale production of mixtures of antibodies.

Merus NV of Utrecht, the Netherlands, has closed a €21.7 million second financing round led by new investors the Novartis Option Fund, Pfizer Inc., Bay City Capital, and Life Sciences Partners. Merus’ seed investor Aglaia Oncology Fund followed on.

The money will be used to advance development of Merus’ antibody-based drugs for the treatment of cancer, inflammation and infectious diseases.

At the same time, the company granted the Novartis Option Fund the option to an exclusive license to one of Merus’ oncology programmes. The agreement includes upfront and potential milestones payments totalling over S200 million, plus royalties.

“We are very pleased by the high quality of the new investor syndicate,” said Ton Logtenberg, Merus CEO. “The mix of renowned financial and corporate US and European VCs is a validation of the perceived high value of Merus’ technologies.“

The proceeds will enable Merus to demonstrate its bispecific antibodies can target diseases that cannot be treated with single monoclonal antibodies. “The agreement with Novartis Option Fund further underscores that big pharma recognises the potential of our innovative antibody therapeutics,” Logtenberg said.

Lionel Carnot, an investment partner with Bay City Capital, said Merus’ technology, “Is a very ingenious solution to the key issues that have hindered the development of poly- and oligoclonal therapeutics.”

Merus Secures €31 Million in Series B Round Extension – Fierce Biotech 10/3/2013

Merus B.V., a biopharmaceutical company focusing on innovative human antibody therapeutics, today announced a €31 million (US$42 million) extension to its Series B financing round, bringing the total round to €47.6 million (US$65 million).

Johnson & Johnson Development Corporation (JJDC) joined as a new investor along with existing investors Novartis Venture Fund, Pfizer Venture Investments, Bay City Capital, LSP (Life Sciences Partners), and Aglaia Oncology Fund. A representative of JJDC will join Merus’ Board of Directors. Merus will use the new funds to broaden its portfolio of pre-clinical programs for the treatment of cancer patients and to bring its lead programs into phase I clinical testing.

“We view the continuing support of our investors as a strong endorsement of our technology, our team and our strategy,” said Ton Logtenberg, Chief Executive Officer of Merus. “We are particularly proud to welcome Johnson & Johnson Development Corporation to our investment consortium as our third big pharma corporate venture investor. As a next milestone, we are looking forward to moving our lead candidate into clinical development next year.”

The investment of JJDC in Merus B.V. was announced at the launch of the Johnson & Johnson Innovation Centre in London today.

Earlier this year, Merus presented encouraging research and preclinical data of MCLA-117, a product candidate to treat acute myeloid leukemia, a disease with very poor long-term prognosis. MCLA-117 is based on Merus’ proprietary Biclonics™ ENGAGE platform and is currently in development.

Merus B.V., a clinical-stage immuno-oncology company developing innovative bispecific antibody therapeutics, today announced that it has entered into an agreement with investors for the sale of up to € 72.8 million ($80.5 million) of Series C preferred shares and consummated the first tranche under the agreement. New investors include Sofinnova Ventures and Novo A/S as the co-leads, along with RA Capital Healthcare Fund, Rock Springs Capital, Tekla Capital Management and an unnamed U.S.-based life sciences-focused investor. The company’s existing investors, including Novartis Venture Fund, Johnson & Johnson Innovation – JJDC, Inc., Pfizer Venture Investments, Bay City Capital, LSP Life Sciences Partners and Aglaia Oncology Fund, also participated in the financing.

“The proceeds from this financing provide us with funding to advance our key clinical and preclinical programs and to broaden our pipeline of innovative therapeutics that recruit cells of the immune system to kill cancer cells,” said Ton Logtenberg, Ph.D., Chief Executive Officer of Merus. “This financing follows the progression of Merus into a clinical stage company. Our first lead bispecific antibody, MCLA-128, has commenced phase 1/2 clinical trials as a potential targeted therapy for solid tumors and our second lead bispecific antibody, MCLA-117 for the treatment of acute myeloid leukemia, is planned to commence clinical trials in the first quarter of 2016.“

As part of the transaction, Anand Mehra of Sofinnova Ventures and Jack Nielsen of Novo A/S have joined the Merus board of directors.

“Cancer remains a disease of significant unmet medical need where targeted therapies that activate the immune system to kill tumor cells hold the promise of providing novel and effective treatment options for patients,” said Anand Mehra. “Merus’ proprietary technology platform has enabled the company to build a significant pipeline of promising immuno-oncology drug candidates.”

About Merus B.V.

Merus is a clinical-stage immuno-oncology company developing innovative bispecific antibody therapeutics, referred to as Biclonics. Biclonics are based on the full-length IgG format, are manufactured using industry standard processes and have been observed in preclinical studies to have several of the same features of conventional IgG-based antibodies, such as long half-life and low immunogenicity. Merus’s lead Biclonics product candidate, MCLA-128 is being evaluated in a Phase 1/2 clinical trial in Europe as a potential treatment for HER2-expressing solid tumors. Merus’s second Biclonics product candidate, MCLA-117, is being developed as a potential treatment for acute myeloid leukemia, and Merus expects to initiate clinical trials of this candidate in the first quarter of 2016. The company also has a robust pipeline of proprietary product candidates in pre-clinical development, including Biclonics designed to bind to various combinations of immunomodulatory molecules, including PD-1 and PD-L1. For further information, please visit www.merus.nl.

Big Pharma-backed Merus edges toward $65M Nasdaq IPO – Fierce Biotech 5/11/2016

Merus is edging toward its long-gestating $65 million (€57 million) Nasdaq IPO. The cancer specialist, which lists Novartis ($NVS), Johnson & Johnson ($JNJ) and Pfizer ($PFE) among its largest investors, plans to build the IPO on the support of its existing backers, which are expected to buy half of the offered shares.

Utrecht, the Netherlands-based Merus first talked up the prospect of a Nasdaq IPO during the go-go month of April 2015. At that time, the $100 million it was aiming for was on the low side of the sums being proposed and raised by fellow oncology biotechs such as Adaptimmune Therapeutics ($ADAP), Aduro Biotech ($ADRO) and Blueprint Medicines ($BPMC). Yet by the time Merus formalized its plan to go public in October, the tide had turned, leaving a clutch of biotechs on the outside looking in through the then-closed IPO window.

Having raised €72.8 million in a private round in August, Merus was better equipped than some to ride out the downturn in sentiment toward biotech IPOs. And the immuno-oncology player has gone back to its current investors to get its IPO out the door. Merus has commitments from as-yet-unnamed existing institutional investors to buy $32.5 million of the IPO shares. Bay City Capital, Aglaia Oncology Fund, Sofinnova Venture Partners, Novo A/S and LSP sit alongside the aforementioned Big Pharma trio on the list of Merus’ main investors. Each organization owns more than 5% of the company.

If Merus can find buyers for the remaining 2.2 million shares at the $15-a-pop midpoint of its target range, it will exit the offering with net proceeds of $56.7 million, a sum it plans to split fairly evenly between three of its pipeline prospects. Lead candidate MCLA-128 will swallow up $17 million of the IPO haul. Merus anticipates this funding will take it through to the end of a Phase I/II clinical trial in patients with HER2-expressing solid tumors. Merus expects top-line data in the second half of 2017, but that target that has yo-yoed over the past 6 months.

As recently as January, Merus told investors to expect data by the end of the year. While the public is now set to have to wait longer to get a full look at the data, Merus is continuing to release snapshots of the progress of the study. In the dose-escalation stage, 12 of the 27 patients who took MCLA-128 experienced “an objective positive response.” Of those 12, 11 had stable disease after two cycles of treatment. Three people were stable after four rounds of therapy. Merus thinks MCLA-128 kills cancer cells by blocking growth pathways and eliciting the support of immune effector cells.

Merus is moving another two candidates down the pipeline closely behind MCLA-128. The more advanced of the pair, MCLA-117, began a Phase I/II study in patients with acute myeloid leukemia this month. If Merus hits its IPO fundraising target, it will commit $14 million to the study, a sum it thinks will see it through to the delivery of top-line data in the first half of 2018. A further $10 million is earmarked for MCLA-158, which is expected to enter the clinic as a treatment for colorectal cancer before the end of 2017. Each of the candidates is a bispecific antibody.

The willingness–or not–of Nasdaq investors to bankroll the advance of the programs could go some way to indicating whether the freeze on listings by European biotechs is coming to an end. Over the past 6 months, Basilea Pharmaceutica (SWX:BSLN) and Bavarian Nordic (CPH:BAVA) have both canned planned listings, while perennial IPO bridesmaid Mapi Pharma has continued to try unsuccessfully to go public.

Incyte Corporation (NASDAQ:INCY) and Merus N.V. (NASDAQ:MRUS) announced today that they have entered into a global, strategic collaboration agreement focused on the research, discovery and development of bispecific antibodies utilizing Merus’ proprietary Biclonics® technology platform. The Collaboration and License Agreement grants Incyte the exclusive rights for up to eleven bispecific antibody research programs, including two of Merus’ current preclinical immuno-oncology discovery programs.

Biclonics® retain the IgG format of antibodies that are produced naturally by the immune system and, by binding to two targets, enable multiple modes of action that cannot otherwise be obtained with conventional monoclonal antibodies.

“By virtue of a unique ability to simultaneously engage multiple protein targets, we believe bispecific antibodies have the potential to play an important role in the future of biotherapeutics,” said Reid Huber, Ph.D., Incyte’s Chief Scientific Officer. “This collaboration with Merus expands our large molecule discovery capabilities into an innovation-rich area of research, creating additional opportunities for us to deliver on our commitment to improving and extending the lives of patients with cancer and other serious diseases.”

“This transformative, global collaboration further underscores the potential of Merus’ Biclonics® technology platform and establishes a strong relationship with Incyte, a leader in innovative drug development,” said Ton Logtenberg, Ph.D., Chief Executive Officer of Merus. “We look forward to expanding our pipeline under this agreement, as we efficiently exploit our preclinical discovery engine and progress our most advanced, proprietary assets in the clinic.”

Terms of the Collaboration

Under the terms of the collaboration, Incyte has agreed to pay Merus an upfront payment of $120 million. In addition, Incyte has agreed to purchase 3.2 million shares of Merus stock at $25 per share, for a total equity investment of $80 million.

The parties have agreed to collaborate on the development and commercialization of up to 11 bispecific antibody programs. For one current preclinical program, Merus will retain all rights to develop and commercialize approved products in the United States, and Incyte will develop and commercialize approved products arising from the program outside the United States. Following any regulatory approval of a product candidate for this particular pre-clinical program, each company has agreed to pay the other tiered royalties ranging from 6 to 10 percent on net sales of products in their respective territories.

Merus also has the option to co-fund development of product candidates arising from two other programs. For any program for which Merus exercises its co-development option, Merus would be responsible for 35 percent of global development costs in exchange for a 50 percent share of U.S. profits and losses and tiered royalties ranging from 6 to 10 percent on ex-U.S. sales by Incyte for these programs. Merus also has the right to elect to provide up to 50 percent of detailing activities for product candidates arising from one of these programs in the United States.

For each of the other eight programs, Incyte has agreed to independently fund all development and commercialization activities. For these programs, Merus will be eligible to receive potential development, regulatory and sales milestone payments of up to $350 million per program, which could result in an aggregate milestone opportunity of approximately $2.8 billion if all development, regulatory and sales milestones are achieved across all such eight other programs in all territories. Merus will also be eligible to receive tiered royalties ranging from 6 to 10 percent on global sales of any approved products under these eight programs.

Merus will retain rights to both of its clinical candidates and MCLA-158, as well as its technology platform and future programs emerging from Merus’ platform that are outside the scope of this agreement.

The transaction is expected to close in the first quarter of 2017, subject to the early termination or expiration of any applicable waiting periods under the Hart-Scott Rodino Act and customary closing conditions.

Merus Announces $55.8 Million Private Placement Offering of Common Stock – Press Release 2/14/2018

Merus Announces Pricing of Public Offering of Common Shares – Press Release 11/5/2019

Merus N.V. (Nasdaq: MRUS), a clinical-stage bispecific antibody company developing Biclonics®, today announced the pricing of an underwritten public offering of 4,750,000 common shares, at a public offering price of $14.50 per share, before underwriting discounts and commissions. Merus also granted the underwriters a 30-day option to purchase up to an additional 712,500 common shares. The gross proceeds from the offering, before deducting underwriting discounts and commissions and estimated offering expenses, are expected to be approximately $68.9 million, excluding any exercise of the underwriters’ option to purchase additional common shares. All of the shares in the offering are to be sold by Merus.

Eli Lilly, via its Loxo Oncology biotech unit, is signing up to a three-therapy deal with Merus focused on T-cell redirecting bispecific antibody work.

Netherlands-based Merus gets $40 million upfront and a $20 million equity investment from the Big Pharma as well as $1.6 billion in total for three drugs.

These will come out of Merus’ so-called Biclonics platform, which develops CD3-engaging, T-cell redirecting bispecific antibody therapies.

“CD3-engaging bispecific antibodies are rapidly becoming one of the most transformative immune-modulating modalities used to treat cancer,” said Jacob Van Naarden, M.D., chief operating officer of Loxo Oncology.

“We expect these therapies will become an important component of the Loxo Oncology at Lilly biologics strategy. Merus has built a differentiated platform and one that we believe can enable us to create bispecific antibody therapies with wider therapeutic indexes than those available today. We look forward to working closely with Merus to develop new potential medicines for patients with cancer.”

Merus attracted some buzz a few years back with its impressive list of big-name backers including Novartis, Johnson & Johnson and Pfizer.

It had to dial down its plan to raise $100 million in an initial public offering but still managed to pull in $55 million in May 2016. Later that year, it inked a $200 million deal with Incyte to develop bispecific antibodies. Lilly becomes the latest to team up with its platform.

Merus is working on its own internal pipeline focused on zenocutuzumab (also called MCLA-128), targeting fusions involving the gene NRG1, which can drive the growth of many different types of cancers.

“The collaboration with Loxo Oncology at Lilly and their world class research capabilities opens up exciting possibilities for Merus’ Biclonics platform,” added Bill Lundberg, M.D., president and CEO of Merus.

“Our CD3 T-cell engager platform includes over 175 novel and diverse anti-CD3 common light chain antibodies across a wide range of affinities and attributes and enables functional screening of large libraries for optimal performance. We look forward to working together with Loxo Oncology at Lilly to define a new generation of medicines to treat cancer.”

Merus Announces Pricing of Public Offering of Common Shares – Press Release 1/21/2021

Merus N.V. (Nasdaq: MRUS) (“Merus”, “we” and “our”), a clinical-stage oncology company developing innovative, full-length multispecific antibodies (Biclonics® and Triclonics™), today announced the pricing of an underwritten public offering of 4,848,485 common shares at a public offering price of $24.75 per share. The gross proceeds from the offering, before deducting underwriting discounts and commissions and estimated offering expenses, are expected to be approximately $120 million. In addition, Merus granted the underwriters a 30-day option to purchase up to an additional 727,272 common shares at the public offering price, less the underwriting discounts and commissions. All of the shares in the offering are to be sold by Merus.

Merus Announces Pricing of Public Offering of Common Shares – Press Release 11/4/2021

Merus N.V. (Nasdaq: MRUS) (“Merus”, the “Company,” “we” and “our”), a clinical-stage oncology company developing innovative, full-length multispecific antibodies (Biclonics® and Triclonics™), today announced the pricing of an underwritten public offering of 3,859,650 common shares, at a public offering price of $28.50 per share (the “Offer Shares”). Merus also granted the underwriters a 30-day option to purchase up to an additional 578,947 common shares (the “Option Shares” and together with the Offer Shares, the “Shares”). The gross proceeds from the offering, before deducting underwriting discounts and commissions and estimated offering expenses and excluding the underwriters’ option to purchase the Option Shares, are approximately $110.0 million. All of the shares in the offering are to be sold by Merus.

Merus Announces Pricing of Public Offering of Common Shares – Press Release 8/9/2023

Merus N.V. (Nasdaq: MRUS) (“Merus”, the “Company,” “we” and “our”), a clinical-stage oncology company developing innovative, full-length multispecific antibodies (Biclonics® and Triclonics®), today announced the pricing of an underwritten public offering of 6,818,182 common shares, at a public offering price of $22.00 per share (the “Offer Shares”). Merus also granted the underwriters a 30-day option to purchase up to an additional 1,022,727 common shares (the “Option Shares” and together with the Offer Shares, the “Shares”). The gross proceeds from the offering, before deducting underwriting discounts and commissions and estimated offering expenses and excluding the underwriters’ option to purchase the Option Shares, are expected to be approximately $150.0 million. All of the shares in the offering are to be sold by Merus.

Gilead, Merus Ink Potential $1.5B Deal for T-Cell Engagers – Biospace 3/7/2024

Gilead Sciences is partnering with Netherlands-based clinical-stage oncology biotech Merus to find new dual tumor-associated antigens targeting tri-specific antibodies, the companies announced Wednesday.

Under the deal, Merus will receive an upfront payment of $56 million for initial targets as well as an equity investment from Gilead of $25 million in Merus common shares. Merus has the potential to receive up to $1.5 billion in additional payments based on potential development and commercialization milestones.

The research collaboration, option, and licensing agreement will leverage Merus’s proprietary platform. According to the company, the platform can design antibodies capable of binding to three targets simultaneously.

“We have seen the successful application of bispecific antibodies as an immune-modulating modality used to treat cancer. We are now looking ahead to developing additional multispecific antibodies capable of driving robust anti-tumor immune responses with an improved efficacy and safety profile,” Flavius Martin, executive vice president of Research at Gilead, said in a statement. “We are excited to explore the potential of Merus’ differentiated Triclonics platform to discover and advance transformative new cancer therapies as we deepen our portfolio across oncology indications.”

The move comes as Gilead has been on a dealmaking path in 2024. In February, the Bay Area-based biotech announced a $4.3 billion acquisition of CymaBay Therapeutics, snapping up its lead candidate seladelpar which designed to treat the autoimmune disease primary biliary cholangitis.

“We are looking forward to working with Gilead to develop novel T-cell engager antibodies using our Triclonics technology,” Merus Chief Business Officer Hui Liu said in a statement. “We are grateful for our collaborations which represent opportunities for Merus to leverage our research capabilities to pursue innovative biology and to address significant unmet medical needs. Importantly, this collaboration represents the first for our proprietary Triclonics platform.”

The collaboration will see some competition as it looks to target the T-cell engager space. Amgen announced in October 2023 that its bispecific T-cell engager showed positive Phase II results. The tarlatamab drug was investigated in patients with small cell lung cancer with advanced disease and, had an objective response rate of 40% and hit the primary endpoint. Median progression-free survival was under five months while the median overall survival was 14.3 months.

In related news, Crossbow Therapeutics announced Tuesday that it has nominated its first development candidate, a T-cell engager.