안녕하세요 보스턴 임박사입니다.

Peptidream은 동경대학 (東京⼤学) Suga Hiroaki (菅裕明) 교수와 Kubota Kiichi(窪⽥規⼀)에 의해 2006년 7월에 설립되었습니다. Peptidream의 스토리는 2019년 Nature Index에 나온 적이 있습니다.

Peptidream은 일본 바이오텍의 대표적인 회사로 자리를 잡았습니다. 2020년에 Harvard Business Review에서도 Peptidream에 대해 기사를 쓴 바가 있습니다.

Medical researchers have leveraged technology to create major breakthroughs in the past few decades, accelerating the understanding of diseases, and their causes and treatment. Our accumulating knowledge also has accelerated the ability to translate science into practical therapies, but there are still many challenges: while researchers seek the right drug compounds that can target and deliver treatment for specific diseases, traditional drug innovation models can be slow and come with high costs.

Japan’s rising biotech company, PeptiDream, is tackling these issues, deploying a unique proprietary drug development technology and an innovative business model that will further research on and development and manufacture of peptides to deliver new medical therapies. “We really want to be a drug discovery engine,” says CEO Patrick Reid. Until recently, most advances in drug delivery have focused on small-molecule and large-molecule drugs, also known as antibodies. But now macrocyclic peptides are emerging as an important new avenue.

How are peptides different? Both small- and large- molecule drugs come with advantages – and limitations. The small molecule drugs are chemically synthesized in a lab and taken as a pill or capsule, so the active ingredient is easily absorbed into the bloodstream. Because they are small, molecules can penetrate cell membranes, making these drugs highly effective. But they can be unstable and they break down in the body, creating unwanted side effects. Formulating these drugs to take on specific new targets also can be slow and expensive.

Protein-based therapeutics (large-molecule drugs) are made by using living cells. They typically are not pills, but instead must be injected or infused. These large- molecule therapies, unlike the smaller-molecule drugs, cannot penetrate cells. But these drugs are easier to design for specific targets — typically a cell-surface receptor on the outside of the cell. However, these therapies cannot reach all required targets, and they can stay in the body too long causing side effects.

Enter peptides, compounds that consist of amino acids linked together and can be synthesized in the lab. Pioneering research by Suga Hiroaki, PeptiDream co-founder and professor at the University of Tokyo, established a way to ensure that a new kind of peptide compound can remain stable in the body and find a range of therapeutic targets with high specificity. They can also be broken down by and cleared from the body with greater specificity, making them an important new development in pharmaceuticals.

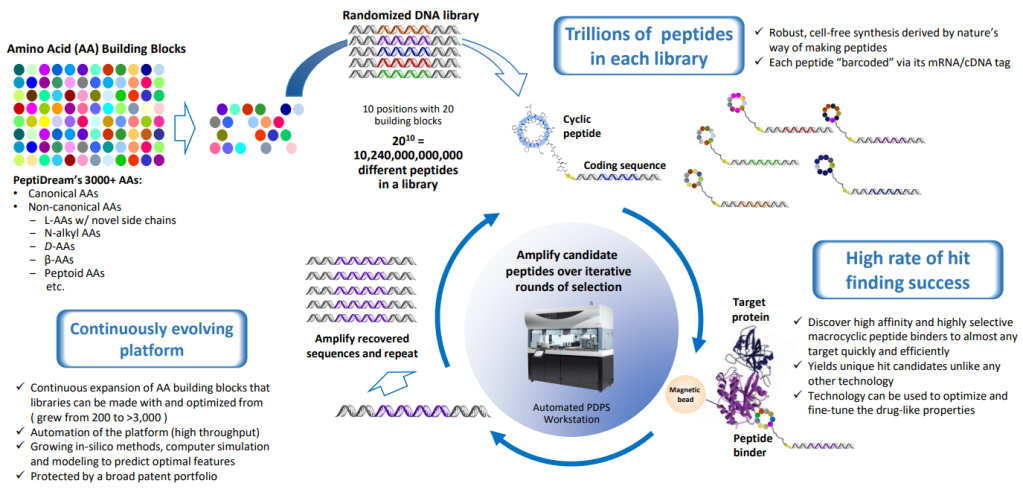

And these macrocyclic peptides can be combined, using a much larger set of amino acids than occur in nature – giving researchers the ability to experiment with many more combinations. PeptiDream’s Peptide Discovery Platform System (PDPS) is a proprietary technology that allows drug researchers to make trillions of peptide libraries. Reid describes PeptiDream as “platform company” that enables his researchers and others to make the process of discovering “hits” — the starting point for developing drugs — more efficient.

PeptiDream의 PDPS (Peptide Discovery Platform Systems)은 아래와 같습니다. 3천개 이상의 Amino acid로 다양한 Macrocyclic Peptides를 만들고 mRNA Display로 cDNAs를 만듭니다. 이 과정에서 1조개 이상의 Peptide library를 만들고 이 Library를 가지고 Target Protein과 가장 높은 Binding Affinity를 가지면서 높은 Selectivity를 갖는 Macrocyclic Peptides를 발굴합니다. 이 과정을 반복하면서 계속 Optimization한다는 개념입니다.

“We are not simply developing a single drug and trying to bring that all the way to approval; we are championing and developing an entirely new class of molecules,” Reid says. The platform has created an unusual set of collaborations for PeptiDream, whose drug discovery partnerships have included Merck, Bayer, Genentech and Novartis. This collaborative network has accelerated peptides development, Reid says, creating a large wave of compounds that should move into the clinic in the next few years.

“Our network of partners has allowed PeptiDream to function as company ten to twenty times its actual size,” he says. “With more than 100 discovery programs in parallel across a wide range of diseases, targets and administration routes, we are expanding the knowledge, understanding and appreciation of these molecules in therapeutics and diagnostics and more.”

It also was crucial that PeptiDream, as a startup, was able to focus on developing the platform for peptide drug discovery, something large pharmaceuticals had not done because of the cost and the long, uncertain time horizon. Japan embraced PeptiDream, initially as a largely bootstrapped company, and then when it went public in 2013, Reid says. “In the U.S. and Europe, we probably would have been pressured to borrow funds in order to grow faster,” he says. “Many companies in the U.S. with internal pipelines fail due to time and pressure constraints. They burn a lot of money very quickly.”

PeptiDream is now a $7 billion company and is also a founding investor in a contract manufacturing company, PeptiStar. Collaboration with other companies is crucial, says PeptiStar CEO Kameyama Yutaka, as new ecosystems for research, manufacturing and supply of peptide drugs are developed. In fact, PeptiDream, together with other co-founding investors Shionogi and Sekisui Chemical, has attracted additional ten investors as active R&D collaborators.

In order to accelerate the practical application and market creation of peptide therapeutics as next-generation drugs beyond biopharmaceuticals, the Japanese government also supports PeptiStar, providing 9 billion-yen (about $83 million) grant as part of the government’s program Cyclic Innovation for Clinical Empowerment, under the National Healthcare Policy. The money will allow PeptiStar, established in 2017, to become a leader in both scientific and business process innovation, says Kameyama.

“The current capacity of peptide manufacturing is limited, and it could be a big bottleneck of peptide medicine developments,” he says. “This quick fundraising will accelerate the development and commercialization of our ability to prepare the peptide compounds. And the support they have given us will also encourage many other partners in the important development of peptides.”

“Peptides have not been around very long, and as with any new technology, there is room for improvement, including costs,” Kameyama says. “We want to make production cheaper and higher quality, and collaboration is a competitive advantage. If a company established its own manufacturing facility, it would take time and money. But with a joint venture like ours, the cost and the sharing of technology and knowledge are very different.”

Both Reid and Kameyama credit the Japanese research and business ecosystem with their success. Professor Suga’s breakthrough work is just one spinoff of innovation coming from Japanese universities, where a pool of highly skilled research workers has developed. Japan’s challenge to create peptide drug market continues.

Peptidream이 2006년 7월에 UTEC과 설립한 이후에 2년간은 Stealth-mode로 회사의 PDPS (Peptide Discovery Platform Systems)을 만들고 IP를 확보하기 위해 노력을 했고 2008년에 펀딩을 받았고 2013년에 $52 Million로 동경 Mothers 상장을 했습니다.

PeptiDream raises $52.4M in Japanese IPO – Biocentury 6/3/2013

PeptiDream Inc. (Tokyo, Japan) raised Y5.3 billion ($52.4 million) through the sale of 2.1 million shares at Y2,500 in an IPO on the Tokyo Stock Exchange’s market of the high-growth and emerging stocks (Mothers). The share figure includes the sale of 405,000 shares in an overallotment. The company’s founders are selling an additional 1 million shares in the IPO. The Y2,500 price, which is the upper end of PeptiDream’s proposed Y1,920-Y2,500 range, values the company at Y33.1 billion ($329.7 million). Mizuho is lead underwriter. The shares are slated to start trading June 11. …

“People thought I was crazy, because it’s a very difficult thing to do,” Suga said. “I spent 10 years on this. I had many failures, but then I had two successes but they weren’t really useful, so that means failure for me. And then finally I came up with this flexizyme prototype, and I thought ‘this is it.’”

Enter Kiichi Kubota, the business brain and co-founder who runs PeptiDream today. Together, they nailed down patents on the technology and worked on ways to make the process of discovering “hits” – the starting point for developing drugs – more efficient. By reducing the number of steps, the company cut the average time needed to discover them from about three days to four hours, according to Patrick Reid, PeptiDream’s chief science officer. That also lowered the potential for human error, he said.

The Peptide Discovery Platform System has had strong interest from big pharma. Already, 16 of the most established names in the industry have signed agreements to work with PeptiDream to find hits for various diseases. The system can help discover drugs for pretty much anything, from cancer to neurological disease. Three firms, Bristol-Myers Squibb Co., Eli Lilly & Co. and Novartis AG, have gone a step further by licensing the technology to use in-house. PeptiDream’s revenue rose to 2.5 billion yen ($24 million) in the fiscal year ended June 2015.

“These guys are different,” said Brian Heywood, chief executive officer of Taiyo Pacific Partners LP, which holds a 5 percent stake in PeptiDream despite being generally suspicious of biotech shares. Heywood says that PeptiDream doesn’t burn funds like some of its peers and is cash-flow positive. “This is one of those weird things where someone has something special that nobody can imitate. And it’s patented.”

Not only that, PeptiDream kept part of its discovery for itself. Its system can create three types of drugs – peptide therapeutics, small-molecule medicines and what’s called peptide drug conjugates (PDCs). The first is mostly used for extracellular medicines, while the second, which are smaller, can permeate the cell. PeptiDream’s partnerships cover only those two.

The third, PDCs as they’re called, are envisaged as a kind of smart drug. The peptide part will be used, for example, to home in on a cancer cell, which the conjoined drug will then attack. This contrasts with conventional treatments such as chemotherapy that kill other cells as well as the cancerous ones, resulting in hair loss, nausea and other symptoms. Reid and his team are focusing on this area within the company.

“We carved that out,” Reid said. “The market is growing very rapidly. It’s one of the most rapidly growing areas of therapeutics.”

Analysts, who are predominantly bullish on the stock, say one risk for PeptiDream is if big pharma starts to lose interest. They point to Pfizer Inc. canceling an agreement in 2013, and how shares tumbled on the news.

“They have several partners, but we don’t know if the contracts will be extended indefinitely,” said Kiyokazu Yamazaki, an equity analyst at Ichiyoshi Research Institute Inc. who rates the shares a buy. “What people evaluate highly isn’t their creation of drugs in-house. It’s their contract revenue.”

Shares surged 175 percent from November to a peak at the start of this month, capped by a 14 percent jump on June 3 after PeptiDream raised its annual profit forecast by 84 percent and said it got a second licensing payment from Novartis. The stock has tumbled more recently but even after the decline, it trades at 166 times earnings and 37 times book value. PeptiDream posted profit of 1 billion yen in the 12 months ended June 2015.

The company moves to a new building near Tokyo Bay next year. Professor Suga remains an independent director and adviser, while his lab has moved on to other pursuits. His 8.6 percent stake is worth about $278 million, and he says he’s bought a house and filled it with guitars.

Kubota, the president, now spends half his time talking to investors, and says he hopes Suga will win a Nobel Prize for his discovery one day. Meanwhile, across the corridor, Reid’s at work testing the boundaries of the new world of peptide drug conjugates.

“We’ve developed a once-in-a-generation hit-finding platform,” Reid said. “It’s like sitting in a stack of gold every day.” Tom Redmond, Nao Sano, Bloomberg

Macau Daily Times라는 신문에서 PeptiDream의 스토리를 잘 소개한 것이 있어서 공유를 하는데 Suga Hiroaki (菅裕明) 교수는 본래 기타리스트를 꿈꿨지만 현실적인 이유로 신약개발을 하는 교수의 길을 가게 되었습니다. 미국에서 14년간 살다가 2003년에 동경대학 교수로 오게 되어서 Flexizyme을 발견한 후에 IP를 확보하고 동경대학에 있는 VC인 UTEC과 의논을 하면서 결국 PeptiDream을 창업하게 됩니다. PeptiDream은 일본 바이오텍의 몇개 안되는 유니콘 기업으로 $7 Billion Market Capitalization까지 올랐습니다.

Suga교수의 Flexizyme Project에 대해 사람들이 불가능하다고 얘기했지만 10여년의 기간 동안 수많은 실패를 딛고 결국 Flexizyme Prototype을 성공시키게 되었고 동경대학 교수가 되면서 Flexizyme을 완성하게 됩니다. 당시 동경대학 부교수였던 Patrick Reid교수가 CSO로 함께 참여를 했고 RaPID system을 3일 걸리던 것을 4시간만에 끝낼 수 있도록 발전시켰습니다. 16개의 글로벌 제약 바이오기업과 공동연구계약을 맺었고 BMS, Eli Lilly, Novartis는 연구계약을 넘어 기술을 라이센싱해서 자체적으로 할 수 있도록 시스템을 만들었습니다. 투자자들은 PeptiDream이 Cash-burn 없이 창업 2년차부터 수익을 얻는 비지니스 모델을 가진데 대해 특별한 투자기업이라고 얘기합니다. 공동창업자인 Kubota Kiichi(窪⽥規⼀)는 Suga Hiroaki (菅裕明)교수가 언젠가는 노벨상을 받을 것이라고 확신하고 있습니다. 저도 그렇게 생각합니다.

Failed Guitarist Seeking Life’s Roots Makes $3 Billion Drug Firm – Macau Daily Times 6/27/2016

When he realized he wasn’t going to make it as a guitarist, Hiroaki Suga set out to find the origin of life, and ended up creating a new way to develop medicines.

Many years spent fiddling with the building blocks of the universe – combining molecules to form compounds – led to Suga developing an enzyme that opened the door to a faster method of discovering drugs. PeptiDream Inc., the company he co-founded, has inked deals with many of the world’s biggest pharma firms, and shares have surged more than nine fold since listing in 2013.

“Everybody comes to PeptiDream,” Suga, 53, said in an interview from his office deep in the main campus of the University of Tokyo. An electric guitar hangs from his wall. “Everybody probably accepts now that the technology we developed is very, very smart, very efficient,” he said. “I might go back to looking for the origin of life after I retire.”

PeptiDream is part of a handful of Japanese biotech ventures that have grown into billion-dollar companies, which also includes Sosei Group Corp., the drug maker that now accounts for about 14 percent of the Mothers Index of smaller shares, and Euglena Co., which is trying to make jet fuel from algae. Like Euglena, it originated within Japan’s equivalent of Harvard, where Suga is a professor. In fact, PeptiDream is still based there today.

The path to becoming a USD3.2 billion company started when Suga’s lab developed an artificial ribozyme, which he named flexizyme for its “promiscuous” ability to help amino acids couple to form peptides. Libraries of peptides – proteins made from a small number of amino acids – had been used by health-care companies for years to facilitate drug discovery, but they hadn’t been effective because they were unstable.

Armed with flexizyme, the self-described research heretic Suga turned conventional wisdom on its head by making new libraries of a different type of peptides, often shaped more like a hula hoop than the spaghetti-type ones employed in the past. The steadier structure made them better at blocking the interactions between proteins that cause many diseases, according to Suga.

UTEC에서 PeptiDream의 창업부터 IPO까지 함께 한 VC인 Katadae Maiko (片田江 舞子) 박사가 PeptiDream President & CEO인 Kubota Kiichi(窪⽥規⼀)를 인터뷰한 것이 있습니다. 동경대학 (東京⼤学) Suga Hiroaki (菅裕明) 교수가 Katadae Maiko (片田江 舞子) 박사와 얘기하면서 회사 창업 가능성을 생각하게 되었고 Katadae Maiko (片田江 舞子) 박사가 Kubota Kiichi(窪⽥規⼀)를 CEO로 천거했다고 합니다. Kubota는 IP Strategy를 잘 설계해서 Flexizyme에 대한 특허와 FIT system에 대한 특허를 획득한 후 향후 2년간 RaPID 특허기술을 완성하는데 전력하게 됩니다. 이렇게 특허를 확보한 후 PeptiDream이 세계적으로 다른 회사들이 갖지 못한 독보적인 기술 플랫폼을 확보했다는 확신했다고 합니다. Suga 교수의 논문을 읽은 제약회사들이 PeptiDream에 공동개발을 청해왔을 뿐 특별히 PeptiDream이 제약회사들을 접촉하려고 한 적이 없다는 점이 좀 특이하고 의아하게 생각했습니다. 기술의 수준과 독보적인 IP가 중요하다는 것을 다시 한번 깨달았습니다. 창업 당시 Business Plan에 의하면 창업 6-7년차부터 손익분기점을 맞겠다는 계획이었지만 실제로는 창업한지 2년차부터 손익분기점을 넘어섰고 빠르게 성장해서 놀랐다는 얘기를 서로 하며 웃었군요. VC인 Katadae가 창업 초기부터 다른 VC들 처럼 하지 않고 파트너로 함께 했다고 Kubota 사장은 얘기했습니다.

UTEC Interview with Peptidream co-founder, President & CEO Kiichi Kubota

In the natural world, there are creatures which are capable of producing substances unique to those species. In many instances in human history, such naturally occurring substances have been used as “miracle medicines” to save human lives. One class of such substances are “special peptides” produced by synthesizing “special amino acids” that do not occur naturally in the human body. PeptiDream was the first in the world to succeed in artificially synthesizing special peptides and linking it to drug discovery. PeptiDream has received a great deal of attention from the scientific and pharmaceutical industries and now, we are continuing our quest for medicines to cure incurable diseases around the world. The company was listed on the TSE Mothers in June 2013. How was PeptiDream able to commercialize a completely new drug discovery platform? We talk with the founder, President and CEO, Mr. Kiichi Kubota, and his companion from the founding period, UTEC partner, Dr. Maiko Katadae.

Kubota: There are 20 types of amino acids we possess in our body that have the l configuration. All proteins and peptides we synthesize in our bodies are made from these l-amino acids, its like we are playing LEGO.

On the other hand, in nature there are fungi, mosses, animals and plants which can produce special peptides from their own individual amino-acids. Often times the ‘miracle medicines’ that are discovered from rare species from the amazon or Tibet are these special peptides. The inception of our technology was an idea to make these special peptides available in test tubes rather than take a trip to the depths of the amazon forest or the Tibetan mountains.

Let’s review our science text books. Our bodies are made from several trillion cells. Each cell has 20 types of amino acids which it uses to synthesize its proteins and peptides. This synthesis occurs in the ribosome “the protein synthesis factory” from information obtained by copying the building instruction from the cell’s nucleus. If we can control the functioning of this ribosome, we can make proteins and peptides from selected amino acids and construct a practical drug discovery platform.

Kubota :The process through which the cell synthesizes its proteins or peptides have been long thought to be the “god’s work” or something that humans could not intervene with. However, if we use the “flexizyme technology” which our company’s co-founder Professor Suga invented, we can use the functioning of the ribosome to combine amino acids selectively. Even if the amino acid is specialized, we can handle the amino acids just like we would a normal one.

The flexizyme technology is a technology which “fools” the ribosome into combining amino acids and making proteins as we would intend it to. In addition, Peptidream has been able to not only synthesize specialized peptides but also to unlock the infinite opportunity of peptide drug discovery.

Kubota: Even if we are able to synthesize specialized peptides, the technology wouldn’t be so great if we could only create one or two. For drug discovery, we would need to be able to make various peptides at large volumes (a peptide library) and to screen for those peptides that would be appropriate to act as drugs. We were able to develop the ‘FIT system” which enables such library of specialized peptides, to the point where one test tube would contain a trillion peptides. Furthermore, we developed the ‘RAPID Display’ technology which allows for a fast and accurate screening of these billions and trillions of peptides. Combining these two technologies we established a drug discovery platform system ‘PDPS”. We now have alliances with global pharmaceutical companies and are at the forefront of drug discovery.

How will this special peptide platform make better our everyday lives? What will be made possible?Kubota: All diseases without cure are the addressable markets for the drugs discovered using our platform. Example of these include diseases which consistently rank high on the causes of deaths in developed countries such as cancer, diabetes mellitus, high blood pressure, other lifestyle diseases and their complications. Our dream is to stand up against these diseases through drug discovery. Fortunately, global pharmaceutical companies are also looking to cure diseases which have no cure. We are lucky that their needs and our intentions are aligned.

UTEC’s Dr. Maiko Katadae has seen Peptidream from its birth to the drug discovery technology of dreams that it is today. Peptidream sprouted from the day Dr. Katadae met Professor Suga’s flexizyme technology. Through the advice from the Technology Licensing Office of Tokyo University that this technology may be suited for development by a venture, Dr. Katadae decided to support the incorporation of Peptidream and the commercialization of its technology.

Katadae: When I first saw Professor Suga’s invention I was astonished to say the least. At that point, there was no candidate drug being produced by the flexizyme technology yet but I had firm belief that this technology would enable drug discovery that had never been seen before and decided to pursue the incorporation of the company with professor Suga and the Tokyo University TLO. I met Mr.Kubota in the autumn of 2005 and felt his personality and his business philosophy was a great fit to the company and introduced him to Professor Suga as a CEO candidate for the new company.

And so Peptidream was incorporated in 2006 with Mr. Kubota as CEO. Peptidream’s strength of course lied in its flexizyme technology. Mr.Kubota came up with an impressive IP strategy fully utilizing the uniqueness of the flexizyme technology. Peptidream hence became a unique existence that no other company could imitate. Currently, Peptidream possesses library building technology, FIT system, RAPID display screening system but these were all created through Mr.Kubota’s IP strategy.

Kubota: At first our IP was only the flexizyme technology. After that, we were granted the patent for the FIT system. However for the screening technology to screen which peptides would be useful as a drug I realized we had to in-license external IP. If a company tries to make up for a technology deficit through the in-licensing of another companies technology, the value of the existing technology IP falls to below half its original value. It was a hard pill to swallow but we decided to focus on the development of our own display technology. It took two years to produce our unique RAPID display technology. Peptidream was now able to be established as a drug discovery platform through the combination of the three patented technologies. We made sure that no one else could do the same drug discovery without the combination of these three uniquely patented technologies. We created a situation that if anyone wanted to perform special peptide discovery, they would have to sign a contract with us. Till this day, there are no other company anywhere in the world which has a platform that can perform from drug discovery to drug screening.

Peptidream currently has contracts with domestic partners Daiichi Sankyo, Teijin Pharma and international pharmaceutical companies as an alliance partners. A venture that came from a “zero start” and growing through partnership with large corporations, is the ideal form of a biotech venture. We think this was only possible due to IP strategy and in-house technological development.

Kubota: The reason we were able to pursue joint development schemes and form alliances with domestic and international pharmaceutical companies from the very early days of our companies is because we had our unique technological development of course, but also because we solidified our patent strategy and established a “winning pattern” for ourselves.

We incorporated the company in 2006. Back then, the center of the pharmaceutical industry was antibody drugs. However, many international pharmaceutical companies had been looking for candidates for the next drug development as they foresaw high competition. With this background, pharmaceutical companies who saw our publication on specialized peptide drug discovery started reaching out to us. We only responded to these offers. We did not proactively approach the pharmaceutical companies. When signing contracts with them, we would submit our standard fee table for each joint development, our strategy was to always maintain a bullish attitude.

These strategies eventually turned to fruit and peptidream was able to be a profitable business from its second year onwards. We currently have contracts as alliance partners with 13 global pharmaceutical companies.

Kubota: The first impression I had of Dr. Katadae was that she was a technology enthusiast rather than someone at a venture capital firm.

Dr. Maiko Katadae, now a partner at UTEC had been with Peptidream since its very inception. The first task Dr. Katadae and Mr. Kubota did together was not to invest but to make an office at the University of Tokyo, cleaning it and bringing chairs and basic office supplies together. The investment into Peptidream happened in 2008.

Katadae: When I first saw the felxizyme technology I thought that “this technology will be a success or rather I want to make it a success!”. That’s why we invested in Peptidream but do you remember the business plan we first made together? We were planning about $10M USD sales in the company’s 6th or 7th year.

Kubota: hmm, the documents are still there but I don’t remember the numbers (laughs).

Katadae: We were at a stage where we did not even know if the business model would work. “We probably said one project should bring about this much revenue, and thought how many of those we needed to achieve our goal”. When we looked back, those numbers were so far off. Peptidream’s business model is one which presumes that pharmaceutical companies would be willing to reveal information about their drug targets. In simpler terms, it is assumed that pharmaceutical companies would reveal information usually kept very secret. We received a lot of comments in the line of “there is no way that is possible”. I remember being very frustrated at this but now I think of it as “We were able to prove a business model which people thought impossible” which I find very meaningful.

Kubota: Dr. Katadae has always been with us, from when we were setting up our first office until our IPO. The perspective to see a venture capitalist as not someone who would just offer money but as someone who chases dreams with you is a very important perspective in making a successful business.

Katadae: At the start, venture capitalists and entrepreneurs sit at opposite sides of the table. However, in the process of investing, I place an emphasis on how close we can sit with the entrepreneurs on the same side of the table. Venture capitalists until they invest are simply looking to buy shares at a cheap rate and then sell at a high price, hence our incentives are the opposite of an entrepreneurs’. The important thig is that trust and closeness are built in the process of having many discussions with the entrepreneurs that when we realize, we have ended up on the same side.

Kubota: Well, in our case you were literally sitting next to me from the very start.

Peptidream went public on the Tokyo Mothers Exchange in June of 2013. Peptidream’s share was valued at 7900 yen, 2500 yen over the public price. It’s market capitalization has surpassed ~$6 billion USD. Mr. Kubota dreams of having the first drug go commercial with the initials “PD”

Kubota: I do have a wish to make a drug that has the “PD” initials. However, at the base of this wish is my motivation to work that alleviates the suffering of patients.

Provide novel drugs for patient without cures, that is always our mission.

Suga Hiroaki 교수는 Flexizyme이라는 새로운 효소를 개발하였습니다. 이에 대한 리뷰는 2011년에 Accounts of Chemical Research에 실린 바 있습니다. Flexizyme은 In Vitro Selection으로 Artificial Amino Acids를 tRNA에 결합시키는 Artificial Ribozyme을 의미합니다.

FIT (Flexible In Vitro Translation) System은 Flexizyme이라는 Novel Ribozyme을 이용해서 tRNA에 Unnatural amino acids를 결합시킨 후 In-Vitro Translation을 통해서 “Reprogrammed Translation을 통해서 “Thioether-closed Macrocyclic Peptides (tcMPs)를 만들고 이것을 mRNA Display로 만드는 것입니다.

RaPID (Random nonstandard Peptides Integrated Discovery)는 결국 FIT와 mRNA Display를 결합시킨 시스템을 말하는 것입니다.

2023년 12월에 PeptiDream이 발표한 Corporate Presentation과 R&D Day Presentation을 아래에 링크합니다.

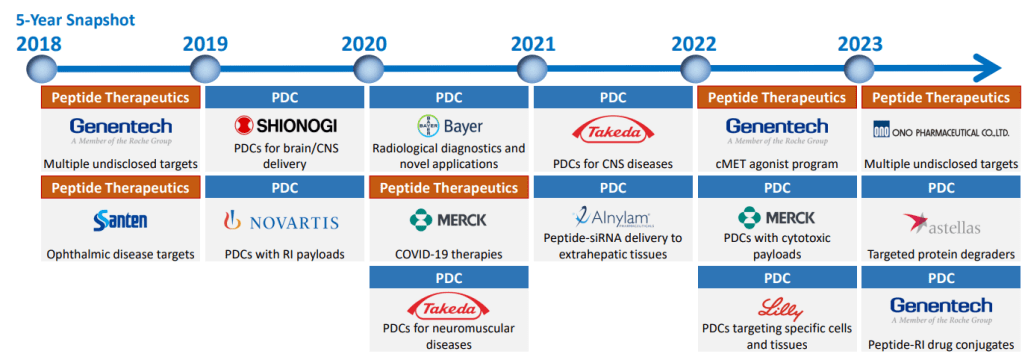

최근 5년간의 공동연구계약 상황을 보면 Macrocyclic Peptides와 Peptide-Drug Conjugate (PDC) 분야로 나뉘어져서 비교적 골고루 공동연구계약이 이루어지고 있는 것을 볼 수 있습니다. Genentech의 경우에는 Macrocyclic Peptides와 PDC 분야 모두에 공동계약을 하고 있습니다.

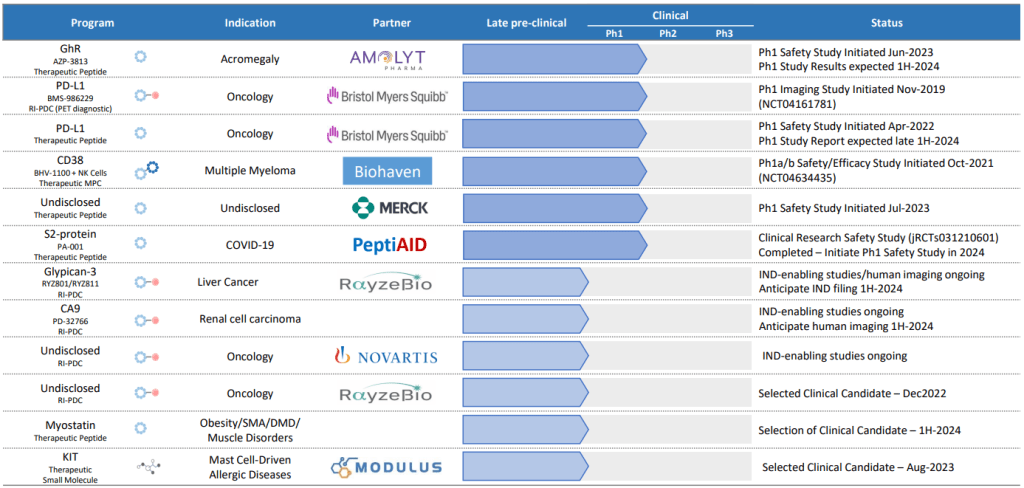

2023년 11월 현재 Peptidream의 Pipeline은 아래와 같습니다. 아직까지는 임상1상이 가장 앞선 단계인 Early-stage입니다. Hit Identification까지는 비교적 빠르게 진행할 수 있지만 역시 Drug Candidates를 얻는데까지 Lead Optimization은 시간이 상당히 걸리는 것 같습니다. 창업한지 18년차가 되었습니다. 지속적인 성장을 통해 언젠가 PeptiDream도 자체적인 개발 프로그램을 갖게 되기를 기대합니다.

2025년 11월 17일 (월요일)

펩티드림에 대해서 글을 쓴 지 1년여가 지났군요. 작년에 글을 쓸 때에는 긍정적인 부분을 많이 쓰고자 노력을 했는데 이번에는 수가 히로아키 교수가 펩티드림에 대한 소회를 인터뷰한 것이 있어서 좀 남기려고 합니다.

The Case of the Missing Startups. Why biotechs find it hard to get going in Japan – ACCJ Sep 2019

University and government venture funds play a much larger role in Japan than they do in Western countries. Yet we see fewer biotechnology startups here compared with, say, the United States, which is home to eight of the top 10 highest-funded ventures. Why?

“If you have $10 million, you will just burn through it,” Suga said, adding that less capital will keep you focused and get results that can lead to bigger things...With limited funds, “You need to really develop technology that will allow you to collaborate with big pharmaceutical companies,” Suga explained.

This unusual approach has worked well for PeptiDream, so why don’t we see more biotech startups succeeding this way in Japan?

Suga said there are several reasons.

“The first is that venture capitalists are not investing in risky companies, and biopharmaceutical companies are high risk,” he explained. “If you are developing business software, after six months, you know if it isn’t working.

“The second reason is that Japanese society prefers to go with what’s known,” he continued. In this case, it means that talent heads for the largest pharmaceutical companies, which are seen as stronger and a safe harbor. “For example, all my students go to big pharma. They don’t go to PeptiDream.”…Large Japanese companies tend to have little interest in helping smaller ones.

The third obstacle that Suga cited is the fact that many startups in Japan are research units that have been spun off from large companies that chose to leave Japan. “They had a very good team here, so they decided to spin off. They already have a background from big pharma and continue doing [what they were doing],” he explained. “That means that they aren’t hugely different from the big companies.”

Suga 교수님은 일본의 문화적 습성에 때문에 대학으로 부터 스타트업이 생길 수 없다고 말씀하십니다. 즉,

- VC가 biotech에 투자하는 것을 꺼리고

- 일본 사회가 큰 회사를 선호하는 경향이 있으며

- 일본의 스타트업 대부분은 일본 대기업에서 분사한 회사로서 일본을 떠나려는 회사들이기 때문이다.