안녕하세요 보스턴 임박사입니다.

오늘은 바이오텍 실패사례에 대해 좀 생각을 해보고자 합니다.

Susan Molineaux,는 Serial Entrepreneur입니다. Proteasome Inhibitor를 개발하는 Proteolix를 설립해서 2003년부터 2005년까지 CSO였다가 2005년부터 2009년까지 President & CEO였습니다. Susan Molineaux가 CEO로 있는 동안 Carfilzomib (Kryprolis, treatment of multiple myeloma)의 상용화를 이끌어내고 Onyx Pharmaceuticals에 Proteolix가 M&A 됩니다.

Proteolix, Inc. to be Acquired By Onyx Pharmaceuticals – Fierce Biotech 10/12/2009

Proteolix, Inc. today announced that it has signed a definitive agreement to be acquired by Onyx Pharmaceuticals, Inc. (Nasdaq: ONXX). Proteolix is a privately-held biopharmaceutical company focused on discovering and developing novel therapies that target the proteasome for the treatment of hematological malignancies and solid tumors. Proteolix’s lead compound, carfilzomib, is a proteasome inhibitor currently in multiple clinical trials, including an advanced Phase 2b clinical trial for patients with relapsed and refractory multiple myeloma.

“Proteolix has succeeded in pioneering a new class of potent proteasome inhibitors, as demonstrated by the promising data achieved in multiple studies of our lead candidate, carfilzomib. We believe Onyx truly shares our vision for carfilzomib as an important new therapy in oncology and recognizes Proteolix’s scientific leadership in proteasome inhibition,” said John A. Scarlett, M.D., President and Chief Executive Officer of Proteolix. “Onyx’s proven track record and commercial resources in oncology are impressive. We are excited to join forces and together we are poised to advance carfilzomib through regulatory approval and achieve our ultimate objective of helping patients.”

Under the terms of the transaction, Onyx will make a $276 million cash payment upon closing of the transaction. Additional payments include $40 million payable in 2010 based on the achievement of a development milestone and up to $535 million contingent upon the achievement of anticipated approvals for carfilzomib in the U.S. and Europe. Of the potential $535 million, a payment of $170 million is based upon the achievement of accelerated U.S. Food and Drug Administration approval. The transaction is expected to close in the fourth quarter of 2009, subject to the receipt of clearance under the Hart-Scott-Rodino Act and customary closing conditions.

Proteolix is a leader in developing therapeutics that inhibit the cellular proteasome, a validated and well-characterized approach to treating certain hematologic cancers. Carfilzomib is the first in a new class of selective and irreversible proteasome inhibitors. To date, carfilzomib has demonstrated strong response rates in multiple studies and a potentially more tolerable safety profile than currently approved agents. An ongoing accelerated approval Phase 2b trial in patients with relapsed and refractory multiple myeloma is expected to complete enrollment in 2009 with data anticipated in the second half of 2010. Carfilzomib is also being evaluated in a companion Phase 2 trial in relapsed multiple myeloma. A Phase 3 trial evaluating carfilzomib in combination with lenalidomide and dexamethasone as a potential treatment option for patients with multiple myeloma is expected to begin in 2010. Carfilzomib is also being evaluated in a Phase 1b/2 study for solid tumor cancers. In addition, Proteolix has discovered additional next-generation proteasome inhibitors to which it holds worldwide development and commercialization rights, including an oral proteasome inhibitor and a selective immunoproteasome inhibitor.

“Treatment options in multiple myeloma have historically been limited, and there is a tremendous need to expand the treatment paradigm with agents offering an improved efficacy and safety profile,” said Michael Kauffman, M.D., Ph.D., Chief Medical Officer at Proteolix. “Carfilzomib is in multiple ongoing clinical studies and has revealed clear single-agent activity in a heavily pre-treated multiple myeloma patient population, as well as being well tolerated alone, or in combination with Revlimid. Upcoming data for carfilzomib could support the potential near-term introduction of a novel therapy for this debilitating disease.”

Susan Molineaux,는 2010년에 UCSF의 기술을 임상에 적용하기 위해 Calithera Biosciences라는 Oncology 회사를 설립하게 됩니다.

Calithera Biosciences Closes $40 Million in Series A Financing – PR Newswire 7/8/2010

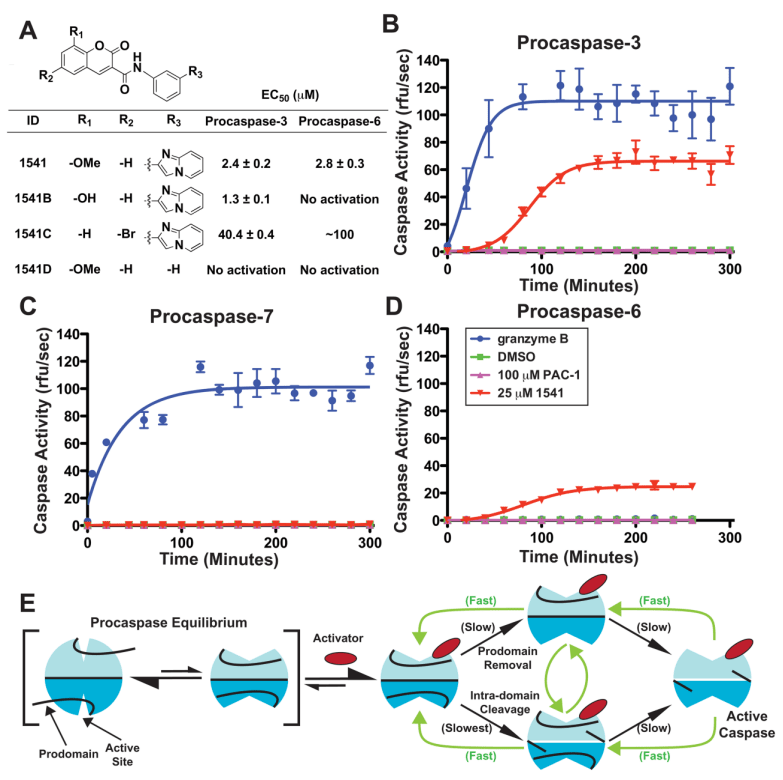

Calithera Biosciences, a company developing novel oncology therapeutics, today announced the completion of a Series A financing totaling $40 million. Morgenthaler Ventures led the financing with U.S. Venture Partners, Advanced Technology Ventures, Delphi Ventures and Mission Bay Capital also participating in the round. The capital will be used to support the company’s pioneering efforts to develop activators of caspases, the proteases that promote apoptotic cell death, for the treatment of cancer and other proliferative diseases.

“Promoting apoptosis in cancer cells is a validated approach to the treatment of cancer, as many oncology drugs on the market today are known to kill tumor cells by activating apoptotic pathways, albeit through indirect means,” said Susan Molineaux, Ph.D., co-founder and Chief Executive Officer of Calithera. “By targeting caspases directly, we hope to develop agents that have broad utility across many types of cancer, with greater specificity than current treatments and the potential to overcome chemoresistance.”

Calithera’s technology was developed by and licensed from the laboratory of co-founder James Wells, Ph.D., chair of the Department of Pharmaceutical Chemistry in the University of California, San Francisco School of Pharmacy. Dr. Wells’s laboratory has successfully identified several novel compounds that selectively activate procaspases and trigger apoptosis in cancer cells. Proceeds from the financing will be used to advance one or more caspase activators through preclinical development and into Phase 1 clinical trials in cancer patients. In parallel, the company will expand its technology for targeting allosteric activating sites to other enzymes with therapeutic potential in cancer.

“Most drug discovery efforts are focused on identifying drugs that inhibit enzyme function,” said Dr. Wells. “But, interestingly, many cellular enzymes remain dormant until activated. In the case of caspases, they can be activated on demand by mimicking the natural process with small molecules.”

“I am excited about the novel chemical approach that Calithera is taking,” said Chris Christoffersen, Ph.D., of Morgenthaler Ventures and Chairman of the Calithera Board. “The technology to discover small molecules that target binding sites to activate, rather than inhibit, enzymes has the potential to be a powerful and broadly applicable approach to developing innovative therapies across many targets.”

Expert Leadership Team in Place

The management team of Calithera brings to the company both deep scientific expertise and extensive experience in drug development.

Susan Molineaux, Ph.D., was most recently a founder and Chief Executive Officer of Proteolix, a company that developed proteasome inhibitors. Proteolix was in late-stage clinical trials with carfilzomib in multiple myeloma when Onyx Pharmaceuticals acquired the company in 2009 for $851 million. Prior to forming Proteolix, Dr. Molineaux held leadership positions at Rigel Pharmaceuticals and Praecis Pharmaceuticals. Dr. Molineaux began her career as a scientist in the Immunology group at Merck.

Mark Bennett, Ph.D., Senior Vice President of Research at Calithera, was Vice President of Research at Proteolix. Previously, he was Director of Cell Biology at Rigel Pharmaceuticals. Prior to that, Dr. Bennett served as an Assistant Professor in the Department of Molecular and Cell Biology at University of California, Berkeley.

Eric Sjogren, Ph.D., Senior Vice President of Drug Discovery at Calithera, was most recently the Vice President and Head of Medicinal Chemistry at Roche, Palo Alto. He held a series of positions during his 15-year tenure at Roche. Prior to that, Dr. Sjogren was at Syntex for eight years.

Calithera’s Board of Directors includes Susan Molineaux, Ph.D., Chris Christoffersen, Ph.D., Larry Lasky, Ph.D., from U.S. Venture Partners, Jean George from Advanced Technology Ventures, Deepa Pakianathan, Ph.D., from Delphi Ventures, and James Wells, Ph.D.

UCSF Spinoff Calithera Shows Promise of Translational Research – UCSF Blog 7/19/2010

(By Dan Fost) With innovation as the watchword, a biotech spinoff from the UCSF School of Pharmacy announced a $40 million Series A round of investment last week – hailed by an investor as “one of the largest first rounds of financing in some time.” Calithera Biosciences, which launched this year out of the lab of Jim Wells, PhD, at Mission Bay, brings a novel approach to killing cancer cells that several major biotech investors see as having the potential to help speed recovery from the disease. Calithera provides the latest example of cutting-edge research and technology that have originated at UCSF and spun out into companies or industry partnerships, with the intent of having a direct, positive impact on patients’ lives. Since UCSF spawned the biotech industry in the 1970s with the launch of Genentech and the discovery of recombinant insulin as the first biotech drug, the University has issued 1,757 biomedical patents and has spun off more than 66 companies from its research. Those UCSF patents have led the UC system in generating license and royalty fees during these cash-tight times. The UCSF discovery that led to the current hepatitis B vaccine generates the largest royalties of the entire UC system, and the discovery of human growth hormone, which was developed and brought to market by Genentech, is among the top five. Although it’s not the largest UC campus, UCSF has consistently ranked first in the 10-campus system, as measured by total utility licenses issued, total utility patents and total license income. Over the last 10 years alone, the biomedical campus has issued 602 UCSF patents, averaging $64 million per year in licensing, litigation and royalty income. “We are certainly very prolific in winning US patents, and overall, we’ve been very successful in licensing,” said Joel Kirschbaum, PhD, director of the UCSF Office of Technology Management. While Kirschbaum said the licensing revenue helps support programs as well as the University’s educational mission, he noted, “Our fundamental mission is to transfer the fruits of publicly funded research to benefit the public.” The real win in cases like Calithera, he said, will come if the therapy the company develops achieves its goal of significantly helping cancer patients. Calithera’s announcement comes one month after the release of an economic impact report that UCSF commissioned, which showed that the University – through its vast research and medical enterprise – has a $6.2 billion annual economic impact on the Bay Area. The Calithera deal also stands in the vanguard of a new model that could generate faster translation of scientific research into patient care, while also increasing funding to the UC system. Among its venture backers is Mission Bay Capital (MBC), an independent venture fund that is managed by the California Institute for Quantitative Biosciences (QB3), based at UCSF’s Mission Bay campus. “In the long term, universities need to be more innovative about finding revenue streams to survive,” said Douglas Crawford, PhD, QB3’s associate director and a pro bono managing partner of Mission Bay Capital, noting that California will never return to its 1960s-level of investment in the University system. “We’ve got to be nimble about finding resources.” MBC benefits from advisers that include renowned investors Brook Byers, Chris Christoffersen, PhD, and John Wadsworth Jr. as it helps connect savvy investors with the world-class research taking place in University labs. In the past few years, UCSF has put a renewed emphasis on working with industry in an effort to expedite translational medicine, a trend that has accelerated under Chancellor Susan Desmond-Hellmann, MD, MPH, a former Genentech executive. Like Desmond-Hellmann, Wells is a veteran UCSF scientist who left the University for a long stint in industry. A member of the prestigious National Academy of Sciences, Wells spent 16 years at Genentech, and then started his own firm, Sunesis Pharmaceuticals, now a publicly traded company. He returned to UCSF in 2005 and now chairs the Department of Pharmaceutical Chemistry in the School of Pharmacy, with a joint appointment in the School of Medicine’s Department of Cellular and Molecular Pharmacology. His lab is focused on understanding and modulating signals in human cells, working with small molecules. For the past five to seven years, the lab has taken an unconventional approach to studying caspases – enzymes that kill cells – which cancer cells have been able to avoid. Most drugs work to inhibit enzyme function, but Wells’ lab has studied what would happen if the enzymes were activated instead. “Cells have within them the ability to commit suicide,” Wells said. “When they are heavily virally infected or have accrued mutations on the pathway to developing cancer, they have inborn mechanisms by which can they commit suicide for the benefit of the organism. But most cancers find a way to avoid this inborn mechanism. They create mutations that don’t allow it to happen.” Many cancer drugs try to stimulate that process of programmed cell death, known as apoptosis. Those drugs start at a point that, Wells said, is upstream from the cancer. They launch what he called a “bucket brigade” designed to cause cell death farther downstream. The problem, he said, is that “cancers figure out ways to lesion it, and avoid the bucket brigade. We thought it might be an interesting approach as an anticancer drug if we could activate caspases directly” at the downstream junction. Three years ago, a postdoctoral fellow in the lab, Dennis Wolan, PhD, used a high-throughput screen in Wells’ Small Molecule Discovery Center at QB3 to discover a compound that would activate the caspases in a cancer cell and kill it. “For reasons we don’t fully understand, but are beginning to understand, it will kill cancer cells much more rapidly than other cells,” Wells said. The lab published a paper in Science last fall, which attracted interest from venture capitalists. Teaming up with biotech industry veteran Susan Molineaux, PhD, who is co-founder and chief executive officer of Calithera, led to the formation of the company, which is based in South San Francisco. In last week’s announcement, Calithera announced the hiring of Molineaux and the rest of the management team and board of directors, which includes Wells. The $40 million funding round was led by Morgenthaler Ventures and included, in addition to Mission Bay Capital, US Venture Partners, Advanced Technology Ventures and Delphi Ventures.

Glutaminase Inhibitor인 Telaglenastat (CB-839)의 임상1상을 진행시키기 위해 $35 Million Series D를 했습니다.

Calithera Biosciences Secures $35 Million in Series D Financing – PR Newswire 10/29/2013

Calithera Biosciences, a biotechnology company focused on the development of novel cancer therapeutics, today announced the successful completion of a $35 million Series D financing led by Adage Capital Partners, LP. Joining Adage as new investors in this financing are the Longwood Fund and two other institutional investor groups. Existing investors Morgenthaler Ventures, Advanced Technology Ventures and Delphi Ventures, who have funded the company through earlier rounds of financing, also participated in the transaction. In conjunction with this financing, Christoph Westphal, MD, PhD, Partner and Co-Founder of the Longwood Fund, will join Calithera’s Board of Directors as an observer.

Calithera will use the proceeds from the financing to accelerate the development of the company’s lead clinical-stage candidate CB-839 through Phase 1 clinical trials in patients with advanced solid and hematological tumors. CB-839 is a potent and selective orally bioavailable glutaminase inhibitor that blocks the growth and survival of many different types of cancer cells by interfering with their metabolism of glutamine. Calithera will also continue to develop its pipeline of novel therapeutics, including an inhibitor of MCL-1, an anti-apoptotic BCL-2 homolog over-expressed in many cancers.

“With this strong support from new and current investors, we will advance CB-839 through an early set of clinical trials aimed at identifying specific populations of cancer patients with glutamine-dependent tumors that would benefit from treatment with CB-839,” said Susan Molineaux, PhD, President and Chief Executive Officer of Calithera Biosciences. “CB-839 has demonstrated promising anti-tumor activity in a broad range of tumor types that depend on glutaminase for cell growth and survival. We look forward to initiating clinical studies for CB-839.”

“The Calithera team possesses an impressive track record in discovering and developing successful oncology drugs,” said Christoph Westphal. “Calithera’s drug, CB-839, is an important new therapeutic candidate that has the pharmacological characteristics necessary to compete as a successful commercial oncology product. We look forward to CB-839 and additional innovative pipeline candidates entering clinical trials and making significant contributions to the advancement of cancer therapy.”

Calithera Biosciences, Inc. (Nasdaq: CALA), a clinical stage biotechnology company focused on discovering and developing novel small molecule drugs for the treatment of cancer and other life-threatening diseases, today announced the closing of its previously announced public offering of 5,750,000 shares of common stock, including 750,000 shares sold pursuant to the underwriter’s exercise in full of its option to purchase additional shares. Gross proceeds from the offering at a public offering price of $6.25 per share, before underwriting discounts and commissions and offering expenses, were approximately $36 million. Citigroup acted as the sole book-running manager for the offering.

그러나 Glutaminase Inhibitor인 Telaglenastat (CB-839)의 임상2상 중 하나였던 CANTATA 임상이 primary end point를 맞추는 데 실패함에 따라 35%의 인력 구조조정을 하게 됩니다. 여기서부터 회사가 위태로워지기 시작합니다. 그래도 이 때까지는 $115 Million이나 현금이 있는 상태여서 개발에 힘을 실을 시간은 있었던 것이 아닌가 싶습니다. 하지만 이후 경영진은 Caspase Hypothesis를 포기하고 Takeda의 두신약에 매달리게 됩니다. 그리고 엎친데 덮친 격으로 코로나 팬데믹으로 인해 임상 진행도 쉽지 않았던 것 같습니다.

Calithera flunks phase 2 cancer trial, axes 35% of staff – Fierce Biotech 1/4/2021

A phase 2 clinical trial of Calithera Biosciences’ telaglenastat in renal cell carcinoma has missed its primary endpoint. The failure of the glutaminase inhibitor to improve progression-free survival (PFS) prompted Calithera to lay off 35% of its staff to stretch its cash reserves beyond future readouts.

Telaglenastat is designed to stop cancer cells from consuming the glutamine they need to survive and grow. Calithera tested the hypothesis by randomizing 444 metastatic renal cell carcinoma patients to receive telaglenastat or placebo orally twice a day, in addition to Exelixis’ Cabometyx, and assessing the effect of the experimental drug on PFS.

The drug flunked the test. Median PFS in the telaglenastat arm was 9.2 months, compared to 9.3 months in the control cohort. Almost two-thirds of patients had previously been treated with PD(L)-1 therapies. Calithera said the arms were well balanced.

Calithera responded to the setback in the CANTATA clinical trial by outlining plans to lay off 35% of its employees. With Calithera having 90 full-time employees at the last publicly disclosed count, the proposal suggests around 30 positions are at risk. The cuts are intended to stretch the $115 million Calithera had in the bank at the end of 2020 past data drops from two clinical trials.

One of the studies, KEAPSAKE, is assessing telaglenastat in KEAP1/NRF2 mutant non-small cell lung cancer (NSCLC) patients. Calithera is continuing the NSCLC trial despite the clear failure of CANTATA in the belief that there is a strong, distinct rationale for targeting the patient population.

The KEAP1/NRF2 pathway’s regulation of reactive oxygen species is implicated in the development of some cases of NSCLC. As the process results in cells that depend on glutaminase activity, Calithera sees reasons to think telaglenastat can succeed in a genetic subset of NSCLC patients despite failing in renal cell carcinoma.

Laying off the staff is intended to enable Calithera to keep going into 2022, by which time it will have delivered interim results from the NSCLC clinical trial. The extended cash runway also takes Calithera past the completion of a phase 1 clinical trial of arginase inhibitor CB-280 in cystic fibrosis patients.

The readouts could revitalize Calithera, but, for now, the company is at a low point. Shares in the West Coast biotech fell more than 50% in premarket trading, sinking to their lowest point since its 2014 IPO.

Calithera Biosciences, Inc. (Nasdaq: CALA), a clinical-stage, precision oncology biopharmaceutical company, today announced an agreement with Takeda Pharmaceutical Company Limited (“Takeda”) to acquire two clinical-stage compounds, both of which have demonstrated single-agent clinical activity with the greatest potential in biomarker-defined cancer-patient populations. The compounds, sapanisertib (CB-228, formerly TAK-228) and mivavotinib (CB-659, formerly TAK-659), further strengthen Calithera’s pipeline of clinical-stage targeted therapies.

“We believe that these clinical-stage compounds are an excellent complement to our internally-developed pipeline programs, and fit well with our current strategic focus on biomarker-driven therapeutic approaches. We are encouraged by the promising single-agent clinical data that suggest these investigational therapies could help transform treatment for multiple cancer patient populations with high unmet need,” said Susan Molineaux, PhD, president and chief executive officer of Calithera. “Specifically, sapanisertib has the potential to be the first targeted treatment for patients with NRF2-mutated squamous non-small cell lung cancer. We have learned a great deal about the unmet medical need of patients with KEAP1/NRF2 mutations, as well as how to identify and recruit these patients, during the conduct of our KEAPSAKE trial evaluating telaglenastat. This complementary approach in KEAP1/NRF2-mutant squamous NSCLC demonstrates our commitment to these patients and the pathway.

“Additionally, mivavotinib has the potential to be a best-in-class SYK inhibitor in non-Hodgkin’s lymphoma, as well as a first-to-market approach for patients with diffuse large B-cell lymphoma whose tumors harbor MyD88 and/or CD79 mutations.

“We plan to start a clinical trial in squamous NSCLC with sapanisertib and a clinical trial in DLBCL with mivavotinib, both in biomarker specific populations, and generate data in the next 12 to 18 months that will define the clinical development and potential regulatory approval paths for both of these compounds.”

The terms of the transaction include a total upfront cash payment to Takeda of $10 million and $35 million issued to Takeda in Calithera Series A preferred stock. Additionally, Takeda will be eligible to receive from Calithera clinical development, regulatory and sales milestone payments across both programs. Calithera will pay tiered royalties of high single-digits to low teens on future net sales should these candidates achieve regulatory approvals and subsequent commercial availability.

“Collaboration is an important aspect of our R&D strategy and at the center of our efforts to deliver new treatment options to patients. We are confident that Calithera, with their highly capable and experienced team, is the ideal partner to resume the development of sapanisertib and mivavotinib, and to maximize their potential to address underserved patient populations,” said Christopher Arendt, Ph.D., head of Oncology Cell Therapy and Therapeutic Area Unit of Takeda. “We look forward to seeing how these programs advance under Calithera’s leadership.”

Sapanisertib is a dual TORC 1/2 inhibitor that targets a key survival mechanism in KEAP1/NRF2-mutated tumor cells. These mutations are found in a considerable sub-population of patients across multiple solid tumor types. Sapanisertib has demonstrated promising single-agent activity in patients with relapsed/refractory NRF2-mutated squamous non-small cell lung cancer (NSCLC) and exhibits differential anti-tumor activity compared to rapalog inhibitors of TORC1 in NRF2-mutant squamous NSCLC in vivo models. A Phase 2 study planned to begin in the first quarter of 2022 will further evaluate sapanisertib as a monotherapy in patients with squamous NSCLC harboring a NRF2 mutation.

Mivavotinib is a SYK inhibitor that targets the constitutively active BCR pathway in many non-Hodgkin’s lymphoma (NHL) cases as well as the constitutively active inflammatory signaling pathway in MyD88-mutated NHL. In early phase studies, mivavotinib showed promising single-agent responses in relapsed/refractory diffuse large B-cell lymphoma (DLBCL). In addition, recent preclinical studies have shown enhanced SYK activity and sensitivity to SYK inhibition in DLBCL and other NHLs harboring mutations in MyD88 and/or CD79, which comprise a distinct genetic subset of DLBCL known to have poor outcomes with standard-of-care therapy. Accordingly, Calithera plans to initiate a Phase 2 study of mivavotinib in 2022 for the treatment of patients with DLBCL with and without mutations in MyD88 and CD79. Beyond DLBCL, both preclinical and clinical data support expansion across additional NHL subtypes and other hematologic malignancies as part of long-term plans.

Calithera Biosciences has reported that it will suspend the Phase II KEAPSAKE clinical trial of telaglenastat in stage IV non-squamous non-small cell lung cancer (NSCLC) due to a lack of clinical benefit.

This placebo-controlled, randomised, double-blind trial analysed the safety and anti-tumour activity of telaglenastat in combination with standard-of-care chemoimmunotherapy as front-line treatment for stage IV NSCLC patients. These subjects had tumours with Kelch Like ECH Associated Protein 1 (KEAP1) or Nuclear factor-erythroid factor 2-related factor 2 (NRF2) mutations. The trial had randomised a total of 40 subjects when it was unblinded on 27 October 2021. The efficacy results, which included investigator-evaluated progression-free survival, did not show any clinical benefit. Interim analysis findings of the trial also showed a reduced likelihood of an eventual positive outcome.

그리고 2년 후에 회사는 완전히 문을 닫게 답니다. 안타깝습니다.

Calithera Biosciences has kept its head down since a phase 2 fail in 2021 caused layoffs for a third of its workforce. But in the wake of enrollment delays for two lead cancer therapies, the cash-strapped biotech has given up the fight and announced it’s liquidating the business.

“The board of directors and management devoted substantial time and effort in identifying and pursuing various opportunities, but we were unable to complete a transaction that would allow us to continue the development of our clinical programs and enhance shareholder value,” CEO Susan Molineaux, Ph.D., said in a release Monday.

As a result, all clinical programs will be shut down, with “most” of the company’s employees terminated by the end of this quarter.

“Importantly, I would like to sincerely thank our employees and others who have supported Calithera over the years,” Molineaux added in her statement yesterday. “We appreciate your partnership and participation, and we truly wish the outcome was different today.”

Money had been tight at the biotech for a while. Calithera had cash and equivalents of $34.1 million at the end of September, which was only expected to last into the second quarter of this year. In November, the company revealed it was “evaluating all options for its programs, including strategic collaboration or licensing agreements and actively considering the sale of certain programs, in order to extend its cash runway.”

It can’t have helped that things weren’t quite going to plan for its lead programs, either. Calithera also used its November financial report to reveal that “site activation delays” meant that enrollment for trials of sapanisertib and mivavotinib had been “slower than anticipated.” Still, the company said at the time that initial data from these studies were expected in mid-2023, with sapanisertib having secured an FDA fast-track tag for non-small cell lung cancer in October.

The biotech licensed both drugs from Takeda in 2021 after the failure of its own drug telaglenastat in a midstage kidney cancer test prompted Calithera to wield the ax on 35% of staff.

Calithera’s announcement is just the latest in a string of recent closures for struggling biotechs, with Otonomy winding down in December, followed by Nabriva Therapeutics last week.

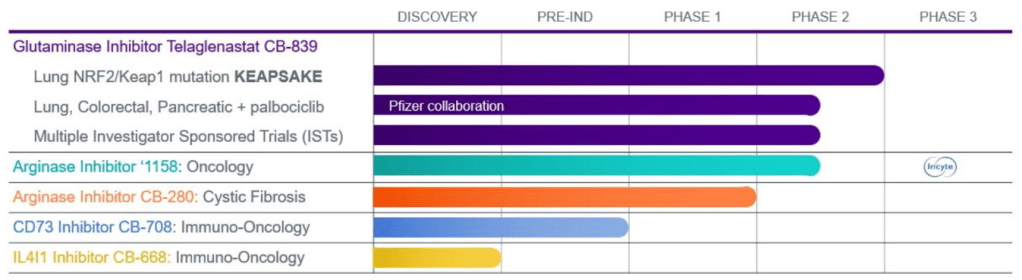

10-K에 보고한 2020년초 파이프라인은 아래와 같습니다.

2021년 3월의 파이프라인도 2020년과 다르지 않습니다. 다만 CANTATA Clinical Trials만 제외되었습니다.

2022년 3월의 파이프라인은 2021년과 완전히 달라져 버렸습니다. 저는 2021년부터 2022년 사이의 결정이 잘못된 것이 아닌가하고 생각합니다. 이해하기 힘든 것은 왜 CD73 Inhibitor인 CB-708의 임상을 시도하지 않았는가 하는 것입니다. 전임상 데이타로 봤을 때는 Best-in-class 약물이었습니다. 2019년 STIC에서 발표한 포스터입니다.

CD73 (ecto-5′-nucleotidase) has emerged as an attractive target for cancer immunotherapy of many cancers. CD73 catalyzes the hydrolysis of adenosine monophosphate (AMP) into highly immunosuppressive adenosine that plays a critical role in tumor progression. Herein, we report our efforts in developing orally bioavailable and highly potent small-molecule CD73 inhibitors from the reported hit molecule 2 to lead molecule 20 and then finally to compound 49. Compound 49 was able to reverse AMP-mediated suppression of CD8+ T cells and completely inhibited CD73 activity in serum samples from various cancer patients. In preclinical in vivo studies, orally administered 49 showed a robust dose-dependent pharmacokinetic/pharmacodynamic (PK/PD) relationship that correlated with efficacy. Compound 49 also demonstrated the expected immune-mediated antitumor mechanism of action and was efficacious upon oral administration not only as a single agent but also in combination with either chemotherapeutics or checkpoint inhibitor in the mouse tumor model.

2023년 5월에 Susan Molineaux는 Para Therapeutics를 새로 창업했습니다. Proteolix의 성공과 Calithera의 실패로 부터 배운 Susan Molineaux의 새로운 도전에 또 새로운 기대를 해 봅니다.

The CEO scored big with the multiple myeloma drug Kyprolis, then fizzled with Calithera. Her new company is taking another approach to cancer.