(Picture: Bruce Booth, Ph.D., Partner at Atlas Ventures)

안녕하세요 보스턴 임박사입니다.

주식투자에서 Option Investing이라는 방식이 있습니다. 이 방식은 Structured Deal로서 Downside Risk를 줄이고 대신 Upside Gain도 어느 정도 포기함으로써 어려운 시장에서 살아남은 방법이라고 할 수 있는 Venture Investing Strategy 중에 하나입니다. 보스턴의 벤처캐피탈인 Atlas Ventures의 Bruce Booth 박사는 “Option-to-Buy M&A” Model을 가장 먼저 시작한 VC로 기억합니다. 2011년에 시작한 이래 아래와 같은 다양한 회사들이 이 모델에 의해 투자 회수가 되었습니다. 최근은 IPO시장이 2010년대에 비해서는 훨씬 좋은 상황이지만 언제든지 시장은 반대로 돌아설 수 있다는 생각으로 이 모델에 대해 다시 한번 생각을 해 보고자 합니다.

2007-2008년에 미국 서브프라임모기지 사태와 리먼-브라더스 사태로 시작된 글로벌 금융위기는 전세계 주식시장을 비롯한 금융시장에 오랜기간 충격을 주었는데 바이오텍의 충격은 당시 매우 심했습니다. IPO 시장은 수년간 적은 수의 기업만 가능했을 뿐만 아니라 IPO Valuation도 낮아서 당시 Venture Capital 에는 자금 회수를 할 방법이 상대적으로 어려운 실정이있습니다.

빅파마를 비롯한 바이오텍의 대량 해고가 매년 끊이지 않았던 어려운 시기였고 따라서 빅파마들의 파이프라인의 생산성도 크게 낮아지고 있었습니다. Original Drug Patent Expiry에 의한 Generic 압력은 그 어느 때보다 높았습니다. 반면 미국 대학이나 연구소에서 생산되는 기술혁신은 새로운 Drug Targets와 Platform이 태어날 기회가 되기도 했습니다.

2010년까지 미국 IPO 시장에 대한 Atlas Ventures의 블로그 글이 당시 상황을 잘 말해 줍니다. 2010년은 Nasdaq 시장지수를 반영한 바이오텍 IPO에서 전년에 비해 5% 정도 상승함으로써 그나마 선방한 해였습니다. 하지만 바이오 기업의 특성 상 나스닥 시장에서 가격이 중요한데 여전히 낮은 수준의 가격으로 벤처캐피탈의 입장이나 Crossover Investors 입장에서도 좋은 상황은 못되었던 것 같습니다.

Glimmer of hope: Biotech IPO Class of 2010 – Atlas Ventures Bruce Booth’s Blog 4/6/2011

Several recent stories from WSJ and VentureWire have highlighted the challenging performance of the IPO markets for biotech in 2011. It has indeed been tough: more shares offered at lower prices = more painful dilution. From a pricing perspective, the Class of 2010’s thirteen biotech IPOs faced similar challenges.

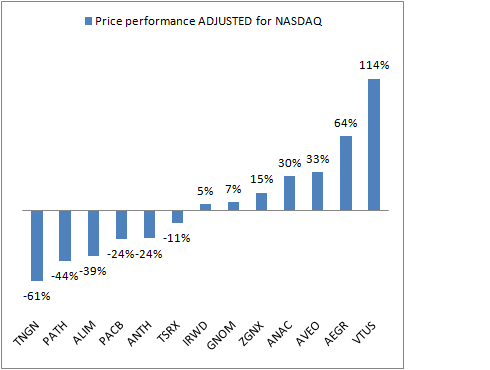

Surprisingly, however, the markets have been reasonably good to the 2010 class since their IPOs. Here is the price performance relative to their IPO price as of today:

The average and median performance of this “Class” is 18% and 14%, respectively – which is quite abit better than several of the recent prior classes performance. Ventrus, Aegerion, AVEO, Anacor have all appreciated by more than 30% since their IPO.

However, the NASDAQ itself has also been on a tear, up above 30% since mid-2010. To get a sense for individual company outperformance vs the market, I’ve adjusted the performance of the Class by the NASDAQ’s performance from the individual IPO dates:

The order shifts as one would expect in a bullish stock market with newer IPOs moving up in the ranking (less adjustment) and older IPOs moving down (more adjustment). Importantly, however, the class average stock performance was still up 5% after adjusting for NASDAQ market performance. That’s respectable.

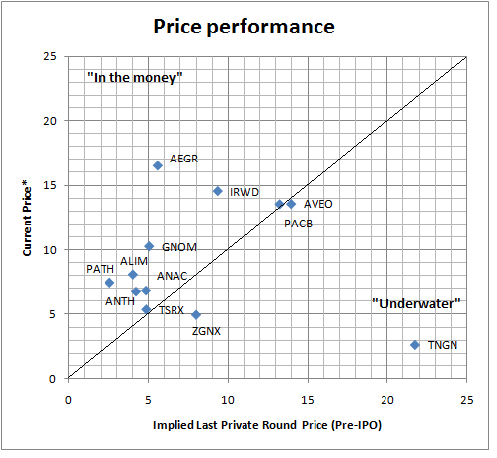

From a venture standpoint, since IPOs are financings not exits, understanding the price performance relative to their last private round is important. From what I can tell, it has actually been pretty strong. Here’s a snapshot of performance of 12 of these 13 where I could get the last private round pricing (courtesy of a friendly biotech investment banker). Unfortunately I don’t have data on Ventrus Biosciences. I’ve plotted the current stock price on the Y-axis and implied “last round” pre-IPO price on the X-axis. Any ticker above the line is at least “in the money” for the last private investor (maybe or maybe not for the early investors depending on the step-ups or cramdowns along the way); below the line are “underwater” positions for that last round. Good news is most are near or above the line – with considerable outperformance for Aegerion (nearly 3x) and Complete Genomics (2x). Tengion is sadly quite an underformer – roughly 10 cents on the dollar.

The takeaway message here is that despite the ‘doom & gloom’ around biotech IPOs, there’s some glimmer of hope in the post-market performance for the “Class of 2010”.

Hopefully the pricing struggles of Class of 2011 will be forgotten with some strong stock performance ahead.

이런 어려운 금융환경 속에서 Atlas Ventures는 Bill Gates와 함께 Nimbus Discovery LLC를 만드는 새로운 시도를 합니다. Nimbus Discovery LLC는 Option-to-buy M&A Model의 선구자적 기업이라고 볼 수 있습니다. 2009년 당시 아직 비상장기업이었던 Schrödinger라는 Computation drug discovery company가 있었는데 Bill Gates도 이 회사의 대주주 중 한명이었습니다. 당시 Schrödinger가 WaterMap이라는 In silico SAR Model을 개발했는데 이를 이용해서 Global Virtual Biotech을 만드는 실험을 한 것입니다.

Nimbus Discovery LLC는 Virtual Biotech Model을 Computational Drug Discovery에 연결한 방식이었습니다. 2009년부터 2010년까지 1년간 인더스트리의 백여개 표적을 조사하고 그 중에서 가장 경쟁력이 있다고 판단하는 십여개의 표적에 집중해서 Project 단위별 C-Corp를 만들고 IP를 각 회사에 집중시키는 방식이었습니다. Schrödinger의 60명의 박사들이 참여하고 해외 CRO들이 합성, Biology, DMPK 등을 하는 방식으로 해서 실제로 Nimbus의 인력은 필요 인력의 10-15분의 일에 지나지 않게 만든 것입니다.

Discovering Nimbus – Atlas Ventures Bruce Booth’s Blog 3/10/2011

Bill Gates has just backed one our new startups – Nimbus Discovery LLC – as part of an extension to the seed tranche. Here’s the press release.

It might come as a surprise to some, but Bill Gates has been a long-time biotech supporter: he was a founding investor in ICOS and was on that Board for 15 years, and importantly, he’s also one of the largest investors in Schrödinger, the world’s leading computation drug discovery company, and our founding partner with Nimbus.

So, with this financing, we’re launching Nimbus out of ‘stealth mode’. Here’s the story.

We founded Nimbus Discovery in 2009 with Schrödinger and have incubated the company here at Atlas for the past couple years. It’s fair to say Nimbus is a rather unconventional biotech, possessing three distinctive features.

- Unique Drug Discovery Partnership with Schrödinger provides access to an unparalleled technology suite without the financial burden of having to build it organically. Beyond the sheer breadth of Schrodinger’s software offerings, the crown jewel from our perspective is their new technology for evaluating the energetics of specific water molecules in binding sites called WaterMap™.

- Our bodies are 90+% water and yet most structure-based drug design models fail to integrate proper solvent (water) effects with regards to both entropy and enthalpy. WaterMap™ does this. We’ve already found it to be an incredibly powerful tool for identifying specific optimization strategies based on novel water-energy-driven Structure-Activity-Relationships. WaterMap™ is a incredibly well validated technology and has been applied (retrospectively) to about 45 different targets using ligands that have highly heterogenous structures. Not only does WaterMap™ accurately predict binding affinities, it explains SAR that would otherwise be inexplicable. In short, super cool science at the cutting edge of in silico drug discovery.

- Our partnership with Schrödinger provides us with far more than just this software package though – we get a large number of dedicated computational chemists, access to thousands of processors via their cloud computing network, new unreleased software algorithms, and exclusivity around specific targets. Continuous, advanced access to the most cutting edge technology applied in a personalized way to our targets allows Nimbus to maintain its first mover advantage.

- Moreover, Schrodinger continues to make a huge investment in its platform leveraging an army of ~60+ PhDs and the deep-pocketed support of Bill Gates and David Shaw. (As an aside, it’s probably the only biotech with two billionaires as its top two investors). It is no surprise that Schrodinger has led innovation in the field: the company currently has 50+ peer reviewed publications many of which are among the most heavily cited articles in the in silico modeling space.

- Ultra-lean “virtually integrated, globally distributed” R&D operating model to aim for exquisite capital efficiency. We’re really pushing the envelope on virtual drug discovery. We have 10-15x more FTEs working for the company externally as inside the company.

- The core team is two incredible individuals (Rosana Kapeller and Jonathan Montagu) who, in addition to being very smart seasoned biotech startup veterans, excel at integrating remote workstreams and collaborators. We’ve got several teams at offshore CRO partners doing biology, chemistry, crystallography, in vivo work, etc…. Not to mention a core set of KOL academic collaborators. We think we’ll be able to work on 3-4 programs with this setup.

- It’s paying dividends already: on less than $2M spent, we’ve generated a selective, potent IRAK4 inhibitor (cancer, inflamm) and a set of lead scaffolds against other targets.

- One of the key features of the operating model is the virtual integration of all these pieces, with in silico model refinement in the core of the ‘engine room’ so to speak. WaterMap and tools like it depend on constant structural model enhancement, which requires real time integration of project data into our models. Our remote virtual teams interact on almost a daily basis to integrate these new streams of information. This allows us to use these tools for more than just improving selectivity and potency – but also to more precisely know which part of molecules to optimize for PK/ADME concerns as well.

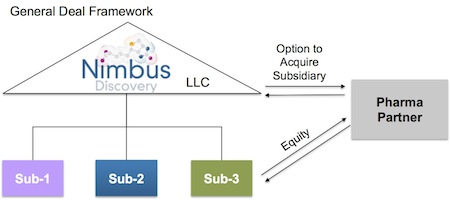

- Novel asset-centric corporate structure to promote liquidity and capital velocity. Back in 2009 we spent a lot of time figuring out how to leave the limitations of the traditional C-corp structure behind and adopt a more flexible LLC-holding company structure with target-specific subsidiaries as C-corps. A few companies have recently announced they are doing this as well, like Adimab and Ablexis. This structure does a couple very valuable things (beyond creating a job for accountants to track the project financing).

- First, it enables project-driven ‘clean’ transactions with Pharma, such that a Pharma can just acquire the target-specific subsidiary and own the IP/assets of a particular program if it so chooses.

- Second, and importantly, it solves the classic drug discovery illiquidity problem (where it takes 7-10 years to get liquid via M&A or IPO); this LLC structure enables us as shareholders to cycle capital back to our investors in a tax-efficient manner on a per project basis. Furthermore, it creates this type of ‘deal optionality’ without foregoing any of the traditional benefits of C-corps.

At the end of the day these three elements are great value enablers, but ultimately it’s about the medicines we discover. To pick the targets we sought to generate drugs against, we took an orthogonal approach to traditional “biology” driven target selection. History has shown that generally in silico technologies in drug discovery are helpful tools for the vast majority of targets, but not game-changing. With Nimbus, we wanted to let the technology identify targets where its new insight into SAR was potentially transformational rather than incremental – essentially, to find the rare 10% of targets where these technologies offered a compelling path to new, differentiated chemical matter against hot targets. To accomplish this, we spent the first 12 months of the company screening several hundred ‘hot targets’ in the industry’ pipeline before picking the 10% or so to focus on with Schrödinger.

Our two lead programs today:

- IRAK4. One of the most interesting immune-kinase targets in both B-cell cancers (like the IRAK4-dependent MyD88-driven Activated Diffuse B-cell lymphoma and inflammation. It’s traditionally been very challenging to get selectivity and cellular potency; we’ve managed to generate a series that addresses both of those and aim for a development candidate by end of 2011.

- ACC or Acetyl-CoA Carboxylase. A critical enzyme in the metabolism of lipids and a top target for obesity as well as cancer metabolism. It’s been very hard to drug effectively. We’ve managed to get very interesting leads against a unique allosteric domain that should enable a differentiated profile.

Saving the best for last, it’s fair to say our team is exceptional. Rosana Kapeller is our CSO and was founder of Aileron Therapeutics after nearly a decade at Millenium. Jonathan Montagu is our CBO and was with Concert, J&J, Chiron and BCG. The broader team of folks at Schrodinger, like Ramy Farid (President of Schrodinger and founding Board Director of Nimbus), and our chemistry leadership (Ron Wester, Gerry Harriman, Donna Romero, John McCall) are also incredible.

With that rundown, we’re officially out of stealth mode and aiming to close on a Series A soon. Exciting times.

Nimbus의 Series A를 한지 2년 후 (창업 후 4년 후) 이 모델에 대한 블로그 포스팅이 있었는데 당시는 ACC 프로그램이 DC selection을 한 상태였습니다. Investor 입장에서 Platform Company인 Nimbus Discovery LLC는 영원히 운영되고 자회사들만이 독자적으로 생존하며 매각되는 조건의 구조였습니다.

The Nimbus Experiment: Structure-Based Drug Deals – Atlas Ventures Bruce Booth’s Blog 6/27/2013

A couple years ago we unveiled a new startup called Nimbus Discovery LLC which was experimenting with a new model that combined three key elements: Schrodinger’s cutting edge in silico drug screening and design platform, a truly virtual and globally distributed operating model for drug discovery, and an asset-centric LLC-based corporate structure (discussed here).

Although it’s too early to tell what eventual value will be created from this experiment, the company’s early biomarkers are strongly positive. Nimbus has cracked two very tough-to-drug targets of high interest to Pharma (immunokinase IRAK4 and lipid-pathway regulator ACC), and is entering IND-enabling development this year. The technology and virtual operating model have worked well together in efficiently delivering high quality drug candidates.

Importantly, the market validation of the model has also been positive: today Nimbus announced a deal with Monsanto, and last month announced a similar deal with Shire – both involve collaborative drug discovery with a pre-defined path to liquidity around those projects. Given the unique nature of the deals, I thought it would be worth sharing more details and a few general reflections on the model.

Both deals are structured to take advantage of the Nimbus asset-centric approach: they involve equity or equity-like investments in individual R&D programs housed in standalone subsidiaries, alongside an option to acquire those subsidiaries at a specific milestone with pre-negotiated deal economics. These are very enabling for Nimbus: project-based resourcing to support the prosecution of a pipeline with clear value creation points defined at the outset without the need for dilutive funding at the parent LLC level.

These collaborative deals were born out of close relationships Atlas has with both Monsanto and Shire. Over the past few years, both companies have been able to watch Nimbus deliver against its existing programs, in particular for ACC, IRAK4, Tyk2. Here’s the short promotional on their programs’ progress On ACC, it took Nimbus only 16 months from standing start with a virtual screen to get to a fully characterized Development Candidate (DC) with a first-in-class allosteric regulator of the target; for IRAK4, the team has discovered truly selective inhibitors with potent in vivo activity and DC-like profiles; and lastly, they have cracked the Tyk2 selectivity challenge vs closely homologous JAK2 and other JAK family members. The progress of these case studies and the familiarity they had with our team definitely facilitated both transactions. More evidence for why tighter collaborative Pharma/Venture relationships are value-creating.

The bigger picture: why these deal structures make sense

- For the biotech, these deals help build a portfolio comprising multiple program-focused entities under an LLC umbrella. In some respects, the pipeline becomes a collection of call options on individual paths of potential liquidity.

- For Pharma, these structures can be tailored to the requirements and sensitivities of each partner, in many cases enabling what could be described as a P&L-sparing, “balance sheet supported” portfolio of innovative projects. This may not always be the interest of a partner, but accessing the otherwise inaccessible cash on the balance sheets of Big Pharma is a definite positive for these deal structures.

- For shareholders, including investors and team members, this model secures potential routes to liquidity that accrue as programs are progressed and monetized through development – importantly without having to sell the entire company. In essence this model creates the evergreen drug discovery stage biotech – a real unicorn in the history of biotech (because most drug discovery biotechs have to either sell or become later stage development players to achieve liquidity).

- Lastly, the structure has enormous financing flexibility: any individual subsidiary/program can be financed separately if desired – creating options for going longer on specific programs without diluting the parent platform company (or for a new investor, without having to fund drug discovery if that’s not their interest).

Nimbus certainly anticipates doing more of these types of structured transactions, both for its lead programs (IRAK4, ACC, Tyk2) and de novo collaborations around jointly-identified targets. Several of our other platform-based drug discovery companies, like RaNA Therapeutics, are structured in this way and will likely be pursuing deals of this type. Other drug discovery platform biotechs, like Forma and Viamet, have also been experimenting with versions of this LLC-holding company model. Several subsidiary-level deals have been done across the industry (like Forma-Genentech, among others). To my knowledge, none of these have yet to hit their acquisition-triggering milestones. It will be exciting to see what happens when this crop of deals matures to their pre-defined endpoints.

Creatively thinking about new approaches, new business models is part of innovating around the venture model – some experiments will work, some won’t. But the Nimbus experiment feels pretty good right now.

그로부터 10년이 흐른 후 Atlas Ventures의 Jeb Keiper가 14년간의 Nimbus Discovery LLC Model에 대한 이야기를 잘 정리해 주었습니다. 3개의 Chapter로 구성이 된 “The Book of Nimbus”라는 책입니다.

The Book of Nimbus – Atlas Ventures Jeb Keiper’s Blog 4/27/2023

Forward

Nimbus Therapeutics began 14 years ago. The premise at the time was that putting computational chemistry in the primary position for new molecule ideation would upend the drug discovery paradigm. It did just that. Three best-in-class molecules in the clinic, over $400 million invested and over $4 billion returned to equity holders, all while focused on our mission to design breakthrough medicines for patients.

Fourteen years on, this corporate experiment has gone far beyond the initial idea, and has established an R&D engine more effective than most big pharma R&D groups at producing best-in-class small molecules against targets that matter in human disease biology. Throughout that time Nimbus has not just built functional capabilities and continued adopting technological innovation, but importantly has worked tirelessly to establish strong cross-functional and interdisciplinary ties that bind discovery and development into a more cohesive, more effective R&D engine. Much of our success springs from being nimble and pragmatic on the journey: by optimizing areas we know work well and adapting to ever-changing landscapes in the capital markets, therapeutics spaces, and laws and regulations (e.g., IRA).

The Book of Nimbus is still being written, but its arc over the years already shows the shape of what I believe to be Nimbus’ mark on our industry: as an R&D powerhouse with the potential to repeatedly create breakthrough medicines for patients.

1장은 2009년부터 2016년까지 7년간의 이야기입니다. Atlas Ventures의 Bruce Booth와 Schrödinger Ramy Farid 사이의 대화로 시작된 말도 안되는 아이디어 – “2년간 $10 Million을 투자해서 5개의 프로그램을 DC 단계까지 만든다”는 터무니없는 아이디어로 시작합니다. 이 아이디어는 5년에 하나의 DC로 수정되었고 투자금액은 $50 Million으로 올라갔습니다.

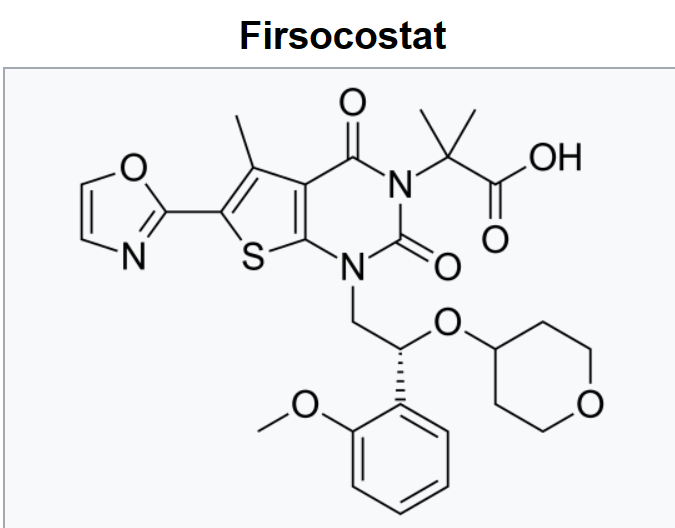

ACC Inhibitor인 Firsocostat이 Gilead에 팔렸고 MASH 치료제로 개발 중입니다.

Chapter 1 – An Unreasonable Idea

The year was 2009. Barack Obama had just been sworn in as the 44th president. The automotive industry just received an $81 billion bailout from the federal government, and unemployment sat at 10% (the highest in 25 years). Michael Jackson died, Slumdog Millionaire won the Oscar for Best Picture, and meanwhile Bruce Booth of Atlas Venture and Ramy Farid, CEO of Schrödinger, began work on a very unreasonable idea. It was the beginnings of Project Troubled Water, Inc.: set up a “virtual project team,” leverage Schrödinger scientists to lead computational chemistry, and do all the wet work at CROs. Invest $10 million to get 5 development candidates in 2 years. Unreasonable indeed.

The five development candidates in two years became one development candidate in five years. The cost went from $10 million to $50 million, inclusive of investments in the platform and broader pipeline. In those respects, one might look at Nimbus’ first chapter as a failure, but they’d be wrong. Because the other thing that happened was the creation of an incredible discovery engine that entirely changed the small molecule drug discovery paradigm. Those years of hard work forged the unique project style that coupled computational chemistry leadership with battle-tested medicinal chemists, biologists who are subject matter experts on the target, and CROs and academic collaborators that fueled an unprecedented “DMTA” engine: Design a molecule on a computer, Make the molecule at a CRO, Test the molecule in a proprietary bespoke biological screening cascade for the target, and Analyze the resulting data, which would then feed the design phase of the next iteration. Blood, sweat, and tears poured into the establishment and optimization of this framework. High science led the vanguard of the work, yet behind the scenes a novel business structure was developed simultaneously, the LLC structure. The LLC structure at Nimbus is more than just a holding company framework; it is an intricate, well-planned set of agreements, accounting methods, and governance operations procedures that allowed the Nimbus discovery engine to flourish. Long-time Nimbi extraordinaire Holly Whittemore perfected this approach alongside the amazing counsel at Goodwin, notably Bill Collins, Mitch Bloom, Dan Karelitz, and many others.

By the time Chapter 1 was nearing its end, Project Troubled Water, then Nimbus Discovery, became Nimbus Therapeutics as we took a further step to forward integrate into clinical development. Having partnered our lead IRAK4 asset with Genentech (which ultimately failed to progress), Nimbus entered the clinic with our allosteric inhibitor of acetyl-CoA carboxylase (ACC) in healthy volunteers, with plans to begin a Phase 2 in NASH. Our ACC inhibitor, now named firsocostat, remains first-in-class, and is in a Phase 2b study in severe NASH patients run by Gilead, who acquired the program in 2016.

For further reading about Nimbus’ first chapter, many an excellent blog has been written about those formative days. Check out:

- Discovering Nimbus, March 2011, Bruce Booth

- The Nimbus Experiment, June 2013, Bruce Booth

- The Race to Treat NASH, May 2015, Rosana Kapeller

- Is Biotech Ready for an Über Disruption, March 2016, Rosana Kapeller

- Nimbus Delivers its Apollo Mission, April 2016, Bruce Booth

- A Decade of Discovery, May 2019, Jeb Keiper

2장은 2016년부터 2022년까지 6년간의 이야기입니다. Fircocostat을 Gilead에 매각한 후 회사의 미래에 대한 논의가 있었고 BD를 통해 2017년 Celgene과 Tyk2와 STING program에 대한 Option deal을 합니다. 그런데 2019년초에 BMS가 Celgene을 합병하면서 Tyk2 프로그램에 위기가 옵니다. BMS는 Nimbus의 Tyk2 program을 back-up으로 가져갔고 BMS가 가진 Tyk2 Inhibitor인 Sotyktu Deucravacitinib) 이 승인이 나면서 Nimbus의 Allosteric Tyk2 product는 Psoriasis 치료제로 선회하게 됩니다.

Phase-3 data package를 가지고 빅파마 들과 딜을 한 결과 Takeda에 매각됩니다.

Chapter 2 – Building an Integrated Approach

It was 2016, we had sold our lead asset to Gilead, and we had no idea what exactly was going to happen next. The transaction in 2016 was also the first true biotech “exit” of a holding company/single asset that would return capital to investors and employees – like a true M&A – but preserve the rest of the portfolio and the Nimbus business model. Miraculously, everyone came back to work the next day, week, month, and it truly felt like a new adventure as we knew we were charting a course not many previously had. The transition had its challenges though: we had begun working in clinical development, hired staff, and now were reset to an early-stage preclinical company. All our resources in chapter 1 had begun funneling to the lead program, and with only $67 million raised over 7 years, Nimbus was not exactly “robust” at an enterprise-level. We had just 22 people by the end of that year, 15% of the company having departed following the Gilead deal.

At that time the Nimbus Board discussed the next chapter of our company. The first thought was to never raise money again; become a perpetual motion machine. We kept 5% of the Gilead deal proceeds in 2016 in the hopes we could span our way to a next BD deal in our pipeline – and we did! In 2017 we formed a classic Celgene option deal with our two most advanced programs, TYK2 and STING. Nimbus retained full ownership and control of the programs in exchange for funding and pre-programmed exits of $400 million each for Phase 1b data in a few years.

That created a conundrum. With the two lead programs effectively pre-sold, what would the rest of Nimbus do? Would we wind down and exit, or chart some different path? That critical strategic discussion led to some fundamental changes in Nimbus, changes that ultimately laid the groundwork for amazing success in chapter 2.

The year was 2018, and the Board at Nimbus had agreed with our plan to re-invest in discovery and build out our internal pipeline. The successful computational powerhouse DMTA cycle we had built could broaden applications across more targets. And in that new pipeline, our goal was to identify “The One” (I personally cannot help but think of Keanu Reeves’ character Neo, from the Matrix movies). “The One” was a molecule that we would forward-integrate further around, which would be the nucleus to crystallize our clinical development organization. The strategic shift spawned our mission statement at Nimbus: We design breakthrough medicines. It also led to a $65 million equity financing to kickstart pipeline creation. Little did we know that “The One” would be a molecule we already had in our hands, our allosteric TYK2 inhibitor….

This direction and change in strategy fomented uncertainty, which led to inevitable turnover. Nine years in at that point, we saw 25% of the Nimbi depart that year, including our first CEO, Don Nicholson, and I am humbled the Board asked me to step in as Nimbus’ next CEO. Having said farewell earlier to our founding CSO, Rosana Kapeller, my first step was to rebuild the fundamental high science foundation of the company. I turned to my good friend and former colleague, Peter Tummino, then VP, Global Head of Lead Discovery at Janssen, to be our next CSO. Over the next four years, the science at Nimbus flourished, and with it, the reputation for excellence grew. We became the magnet for top talent that Nimbus is now known for, attracting such amazing scientists as Christine Loh, Scott Edmondson, Mark Cartwright, and so many more, too many to name, but all of whom deserve my most humble thanks for joining on this mission to design breakthrough medicines for patients.

In the middle of chapter 2, the most dramatic wrinkle then occurred. It was January 3rd, 2019, and BMS just announced that they were acquiring Celgene. I remember learning of this from Holly Whittemore, as I cheerfully greeted her with “Happy New Year” on my first day back to the office. She replied, “Hey, did you see this?” and swiveled her monitor to show me the news. After I picked my lower jaw up off the floor, I said 30 seconds later “We are going to keep our TYK2 program.” Celgene had signed up for the option deal with Nimbus in 2017 to access our (hoped-for at the time) best-in-class allosteric TYK2 inhibitor to compete with their rival BMS’ TYK2 inhibitor (which today is known as Sotyktu). BMS had just begun Phase 3 trials of their agent, which was likely to be successful — as we now know it was.

The initial interactions with BMS were pragmatic and sensible. Following the close of the BMS deal, the Nimbus TYK2 option was allowed to persist as a backup option, should the BMS TYK2 drug fail in Phase 3. During the year-of-Covid, 2020, we slowly started our Phase 1 program with our TYK2 candidate while BMS slogged through Phase 3. Then came 2021, the most consequential, and tumultuous, year in the Book of Nimbus thus far. It was a period of dramatic activity, much of it well-documented in the public domain, but thankfully all resolved by January of 2022. In the end, after a rollercoaster of legal ups and downs, we settled out of court, leaving Nimbus sole ownership of its TYK2 program.

Throughout this period of interacting with BMS, litigation attorneys, and the FTC, Nimbus was fortunate to find investors who believed in our team, our science, and our conviction that we had a sound strategy that did not rely on a binary outcome of whether we won or lost litigation. We were fortunate to raise $225 million to power TYK2, as well as the rest of our pipeline, including the clinical start of our HPK1 inhibitor program in cancer patients. That funding enabled the two Phase 2b trials of our TYK2 program, one in psoriasis and one in psoriatic arthritis.

In 2022, with sole ownership of our lead asset, Nimbus began seriously considering an initial public offering after 13 years of private operation. Our CFO, Ian Sanderson, had joined to lead us through that transition, and instead his experience and expertise led us through finding private funding at the start of a very turbulent period in the public capital markets. By mid-summer 2022, the market sentiment was downright sour, and Nimbus was running low on the cash needed to power up our programs. In true Nimbus fashion, we did continue to keep all our options on the table, and the BD team at Nimbus had been in constant communication since 2019 with all key pharma partners that would entertain talks about our TYK2 program. Our Phase 2b study was wrapping up and we expected data in Q4; meanwhile, on every investor’s mind was the expected approval of BMS’ TYK2 inhibitor in September. Nearly 90% of investors and physicians had predicted that BMS would get a black box warning on Sotyktu, since TYK2 was a JAK family member, even though Sotyktu was super selective against the other JAKs. When the approval finally arrived at 11pm on the PDUFA date with no black box, suddenly, allosteric TYK2s were a new class of medicines for psoriasis with potential in many autoimmune diseases.

Shortly after the Sotyktu approval, our 260 patient Phase 2b study read out. The data, ultimately unveiled at AAD in March 2023, were stunning: biological efficacy rivaling IL-17 and IL-23 with an oral small molecule, and possessing a safety profile at least as benign as BMS’ Sotyktu. Our long-time clinical development lead, Bhaskar Srivastava, an M.D. Ph.D. dermatologist, could not contain his excitement. He delivered one of the most well designed and executed studies in the field and deserves enormous credit for developing a medicine with such profound potential for so many patients.

In the frenetic weeks that followed the unblinding of the study, our Chief Business Officer, Abbas Kazimi, was on center stage, building a team including the excellent advice of Phil Ross at J.P. Morgan and wise counsel of Sarah Solomon at Goodwin. The pharma relationships Nimbus had established allowed diligence teams to engage efficiently and move past the first point of an interaction – trust. Our small team was able to support multiple major pharmaceutical companies plowing through diligence, not just withstanding the onslaught but in fact delivering a data package of Phase 3-ready quality. The bidding was fast and furious, and ultimately the incredible team at Takeda, led by CEO Christoph Weber and R&D Head Andy Plump, became the most compelling group dedicated to taking our program forward to patients, which we announced on December 13, 2022. We could not be more thrilled with their leadership and commitment, and we closed the deal by February of 2023.

For further reading about Nimbus’ second chapter, many excellent blogs were written about this period. Check out:

- Talent in the Biotech Gig Economy, January 2017, Jeb Keiper

- Nimbus Deal with Celgene, October 2017, Bruce Booth

- IPO a No-Go, September 2018, Jeb Keiper

- Core Values Workout, March 2020, Jeb Keiper

- Selective TYK2 Inhibitors, March 2021, Jeb Keiper

- Takeda Acquires TYK2, December 2022, Bruce Booth

2023년 이후 Nimbus는 3장을 쓰기 시작했습니다. 새로운 Breakthrough Medicine을 개발한다는 계획입니다. 구조조정이 있었고 Oncology와 Immunology Programs를 개발하고 있습니다.

Chapter 3 – Establishing a Legacy R&D Institution

This blog is being written as we turn the page to chapter 3, however the groundwork began with long-range planning almost a year ago. We had scenarios for every eventuality for the TYK2 data, partnering interest, and the financing environment. With that said, we knew if we were successful in psoriasis, the implications would require a large multinational company to create the value of global registrations in multiple indications. Given the value of established infrastructure in pharma, it was clear that an M&A acquisition of our TYK2 subsidiary was likely.

We therefore have had some time in which to contemplate what this next act for Nimbus holds. Although we are just now at the beginning stages of the great journey to come over the coming years, many of the formative pieces are now in place — just as our TYK2 program was at the time of Nimbus’ last inflection point. Our clinical-stage HPK1 inhibitor is now progressing into expansion trials in solid tumors, while a crafted pipeline of opportunities, including what we would consider a disruptive medicine in the autoimmune field, heads toward the clinic next year. While our expertise in immunology and oncology is strong, we also have depth in metabolic disorders, and have a fabulous collaboration with Eli Lilly on AMPK activators, along with earlier programs in discovery.

And excitingly, we are better positioned than at any point in our history to navigate what comes next. Our investments throughout chapter 2 have built an organization with an even wider skillset, from discovery through to clinical execution, and deeper disease area expertise than ever before. Key to Nimbus’ third chapter will be Chief Medical Officer Nathalie Franchimont, who joined us from Biogen late last year to lead our Development organization, building upon our foundations of quality, operations, and execution. Nathalie, Peter Tummino and Bhaskar Srivastava are building out our early clinical and translational biology expertise, while at the same time we are investing in our computational capabilities, tackling tough targets like transmembrane GPCRs in our discovery pipeline. As the winds of change in our industry keep blowing strong, the flexibility and optionality of the Nimbus structure remain a key competitive advantage that has contributed to this enterprise’s longevity.

Transitions are not easy times, though, and as was the case in our move to chapter 2, we’ve needed to navigate turnover and figure out a way to realign and reorganize the Nimbi while preserving our diversity and special sauce, a task that has been led with care and grace by our Chief People Officer, Erin Cowhig. Reorganizations are never a pleasant task, and it has led to some tough choices, where we have needed to bid farewell to some excellent Nimbi simply because their roles were not going to be essential to this next chapter. We thank them for their service and are committed to their safe landings, as they join the ranks of amazingly successful alumni from Nimbus. We’re proud of the small but growing Nimbus diaspora, a testament to how special a place Nimbus has become. Elsewhere in the industry we see biotechs who emulate our corporate structure, our computational engine, or our approach to deal-making (or all 3!). Awesome. We must be doing something right. If Nimbus is able to help shape the industry approach, give a better shot to making therapeutics that help patients, then we have multiplied our impact many times beyond our four walls.

Nimbus is committed to the notion that “small is beautiful” in drug R&D: breakthrough small molecules designed by a small expert team. We have built hard-earned capabilities in both discovery and development, and will continue to build on those in chapter 3. Our mission remains the same: We design breakthrough medicines. Our objective in dollars and cents terms is to again shoot for the moon, to become again a multi-billion-dollar biotech. But our ambition is far greater than that. Nimbus has an opportunity to build a legacy R&D institution. A paradigm of excellence in small molecule drug discovery and development. Chapter 3 will take some time to evolve as the pages are just being written, but we are blessed with an ideal combination of functional skills, established quality processes, and enough hungry, “unreasonable” individuals who drive us to become more than we ever thought we could be.

Nimbus의 14-15년간의 실험의 경험을 가지고 IFM Therapeutics가 2017년에 Series A를 통해 Stealth-mode로 부터 알려진 이후에 지금까지 IFM Uno라는 자회사를 BMS에 매각하면서 STING Agonist와 NLRP3 Agonist를 넘겼고 2021년에는 Novartis에 IFM TRE를 통해서 NLRP3 Antagonist program을 팔았습니다. 그리고 오늘 다시 IFM Due를 통해서 Novartis는 STING Antagonist program을 매입했습니다.

Atlas의 Option-to-buy M&A를 위한 스타트업 설립은 최근 뜸해졌지만 오랜 기간의 경험이 축적된 만큼 현재 바이오텍 스타트업계에서 이런 구조를 가장 잘 활용하고 운용하는 벤처캐피탈이 아닐까 생각합니다.

IFM’s Hat Trick and Reflections On Option-To-Buy M&A – Atlas Ventures Bruce Booth’s Blog 3/13/2024

Today IFM Therapeutics announced the acquisition of IFM Due, one of its subsidiaries, by Novartis. Back in Sept 2019, IFM granted Novartis the right to acquire IFM Due as part of an “option to buy” collaboration around cGAS-STING antagonists for autoimmune disease.

This secures for IFM what is a rarity for a single biotech company: a liquidity hat trick, as this milestone represents the third successful exit of an IFM Therapeutics subsidiary since its inception in 2015.

Back in 2017, BMS purchased IFM’s NLRP3 and STING agonists for cancer. In early 2019, Novartis acquired IFM Tre for NLRP3 antagonists for autoimmune disease, which are now being studied in multiple Phase 2 studies. Then, later in 2019, Novartis secured the right to acquire IFM Due after their lead program entered clinical development. Since inception, across the three exits, IFM has secured over $700M in upfront cash payments and north of $3B in biobucks.

Kudos to the team, led by CEO Martin Seidel since 2019, for their impressive and continued R&D and BD success.

Option-to-Acquire Deals

These days option-based M&A deals aren’t in vogue: in large part because capital generally remains abundant despite the contraction, and there’s still a focus on “going big” for most startup companies. That said, lean capital efficiency around asset-centric product development with a partner can still drive great returns. In different settings or stages of the market cycle, different deal configurations can make sense.

During the pandemic boom, when the world was awash in capital chasing deals, “going long” as independent company was an easy choice for most teams. But in tighter markets, taking painful levels of equity dilution may be less compelling than securing a lucrative option-based M&A deal.

For historical context, these option-based M&A deals were largely borne out of necessity in far more challenging capital markets (2010-2012) on the venture front, when both the paucity of private financing and the tepid exit environment for early stage deals posed real risks to biotech investment theses. Pharma was willing to engage on early clinical or even preclinical assets with these risk-sharing structures as a way to secure optionality for their emerging pipelines.

As a comparison, in 2012, total venture capital funding into biotech was less than quarter of what it is now, even post bubble contraction, and back then we had witnessed only a couple dozen IPOs in the prior 3 years combined. And most of those IPOs were later stage assets in 2010-2012. Times were tough for biotech venture capital. Option-based deals and capital efficient business models were part of ecosystem’s need for experimentation and external R&D innovation.

Many flavors of these option-based deals continued to get done for the rest of the decade, and indeed some are still getting done, albeit at a much less frequent cadence. Today, the availability of capital on the supply side, and the reduced appetite for preclinical or early stage acquisitions on the demand side, have limited the role of these option to buy transactions in the current ecosystem.

But if the circumstances are right, these deals can still make some sense: a constructive combination of corporate strategy, funding needs, risk mitigation, and collaborative expertise must come together. In fact, Arkuda Therapeutics, one of our neuroscience companies, just announced a new option deal with Janssen.

Stepping back, it’ s worth asking what has been the industry’s success rate with these “option to buy” deals.

Positive anecdotes of acquisition options being exercised over the past few years are easy to find. We’ve seen Takeda exercise its right to acquire Maverick for T-cell engagers and GammaDelta for its cellular immunotherapy, among other deals. AbbVie recently did the same with Mitokinin for a Parkinson’s drug. On the negative side, in a high profile story last month, Gilead bailed on purchasing Tizona after securing that expensive $300M option a few years ago.

But these are indeed just a few anecdotes; what about data since these deal structures emerged circa 2010? Unfortunately, as these are mostly private deals with undisclosed terms, often small enough to be less material to the large Pharma buyer, there’s really no great source of comprehensive data on the subject. But a reasonable guess is that the proportion of these deals where the acquisition right is exercised is likely 30%.

This estimate comes from triangulating from a few sources. A quick and dirty dataset from DealForma, courtesy of Tim Opler at Stifel, suggests 30% or so for deals 2010-2020. Talking to lawyers from Goodwin and Cooley, they also suggest ballpark of 30-50% in their experience. The shareholder representatives at SRS Acquiom (who manage post-M&A milestones and escrows) also shared with me that about 33%+ of the option deals they tracked had converted positively to an acquisition. As you might expect, this number is not that different than milestone payouts after an outright acquisition, or future payments in licensing deals. R&D failure rates and aggregate PoS will frequently dictate that within a few years, only a third of programs will remain alive and well.

Atlas’ experience with Option-based M&A deals

Looking back, we’ve done nearly a dozen of these option-to-buy deals since 2010. These took many flavors, from strategic venture co-creation where the option was granted at inception (e.g., built-to-buy deals like Arteaus and Annovation) to other deals where the option was sold as part of BD transaction for a maturing company (e.g., Lysosomal Therapeutics for GBA-PD).

Our hit rate with the initial option holder has been about 40%; these are cases where the initial Pharma that bought the option moves ahead and exercises that right to purchase the company. Most of these initial deals were done around pre- or peri-clinical stage assets. But equally interesting, if not more so, is that in situations where the option expired without being exercised, but the asset continued forward into development, all of these were subsequently acquired by other Pharma buyers – and all eight of these investments generated positive returns for Atlas funds. For example, Rodin and Ataxion had option deals with Biogen that weren’t exercised, and went on to be acquired by Alkermes and Novartis. And Nimbus Lakshmi for TYK2 was originally an option deal with Celgene, and went on to be purchased by Takeda.

For the two that weren’t acquired via the option or later, science was the driving factor. Spero was originally an LLC holding company model, and Roche had a right to purchase a subsidiary with a quorum-sensing antibacterial program (MvfR). And Quartet had a non-opioid pain program where Merck had acquired an option. Both of these latter programs were terminated for failing to advance in R&D.

Option deals are often criticized for “capping the upside” or creating “captive companies” – and there’s certainly some truth to that. These deals are structured, typically with pre-specified return curves, so there is a dollar value that one is locked into and the presence of the option right typically precludes a frothy IPO scenario. But in aggregate across milestones and royalties, these deals can still secure significant “Top 1%” venture upside though if negotiated properly and when the asset reaches the market: for example, based only on public disclosures, Arteaus generated north of $300M in payments across the upfront, milestones, and royalties, after spending less than $18M in equity capital. The key is to make sure the right-side of the return tail are included in the deal configuration – so if the drug progresses to the market, everyone wins.

Importantly, once in place, these deals largely protect both the founders and early stage investors from further equity dilution. While management teams that are getting reloaded with new stock with every financing may be indifferent to dilution, existing shareholders (founders and investors alike) often aren’t – so they may find these deals, when negotiated favorably, to be attractive relative to the alternative of being washed out of the cap table. This is obviously less of a risk in a world where the cost of capital is low and funding widely available.

These deal structures also have some other meaningful benefits worth considering though: they reduce financing risk in challenging equity capital markets, as the buyer often funds the entity with an option payment through the M&A trigger event, and they reduce exit risk, as they have a pre-specified path to realizing liquidity. Further, the idea that the assets are “tainted” if the buyer walks hasn’t been borne out in our experience, where all of the entities with active assets after the original option deal expired were subsequently acquired by other players, as noted above.

In addition, an outright sale often puts our prized programs in the hands of large and plodding bureaucracies before they’ve been brought to patients or later points in development. This can obviously frustrate development progress. For many capable teams, keeping the asset in their stewardship even while being “captive”, so they can move it quickly down the R&D path themselves, is an appealing alternative to an outright sale – especially if there’s greater appreciation of value with that option point.

Option-based M&A deals aren’t right for every company or every situation, and in recent years have been used only sparingly across the sector. They obviously only work in practice for private companies, often as alternative to larger dilutive financings on the road to an IPO. But for asset-centric stories with clear development paths and known capital requirements, they can still be a useful tool in the BD toolbox – and can generate attractive venture-like returns for shareholders.

Like others in the biotech ecosystem, Atlas hasn’t done many of these deals in recent funds. And it’s unlikely these deals will come back in vogue with what appears to be 2024’s more constructive fundraising environment (one that’s willing to fund early stage stories), but if things get tighter or Pharma re-engages earlier in the asset continuum, these could return to being important BD tools. It will be interesting to see what role they may play in the broader external R&D landscape over the next few years.

Most importantly, circling back to point of the blog, kudos to the team at IFM and our partners at Novartis!

IFM Therapeutics, a biopharmaceutical company developing a portfolio of first-in-class small molecules targeting the innate immune system, today announced the closing of a $27 million Series A financing led by Atlas Venture and Abingworth, with participation from Novartis. In conjunction with the funding Jean-François Formela and Vincent Miles, Partners at Atlas and Abingworth respectively, have joined IFM’s CEO, Gary D. Glick, on the board of directors, with Dr. Formela serving as chair of the board.

IFM Therapeutics, incubated as a part of the Atlas Venture seed program, is developing modulators of novel targets that either enhance innate immune responses for treating cancer, or dampen certain immune responses that drive many inflammatory diseases. The company will use the proceeds of the financing to advance and expand its early-stage portfolio and begin clinical development of its most advanced product candidate, a selective activator of a novel target, for treating solid tumors.

“While proteins in the innate immune system represent an attractive landscape of therapeutic targets, they have been notoriously difficult to drug,” said Dr. Formela from Atlas. “During the brief period since its founding, IFM has made excellent progress on several of these targets, reflecting its exceptional team of experienced scientists and executives, possessing expertise in medicinal chemistry, a deep understanding of the relevant biology, and relationships with academic thought leaders in the areas of immunology and immune oncology.”

“IFM’s programs have the potential to make a major difference in the lives of patients with serious, and sometimes fatal, diseases,” said Abingworth’s Dr. Miles. “We look forward to helping the team build on their strong start to advance these programs into clinical development.”

“This financing is an important validation of the IFM team and technology,” said Dr. Glick, IFM’s Co-founder and CEO. “The company is fortunate to be working with a talented and experienced group of investors. Their expertise in building world-class biopharmaceutical companies will be invaluable as we grow the company.”