안녕하세요 보스턴 임박사입니다.

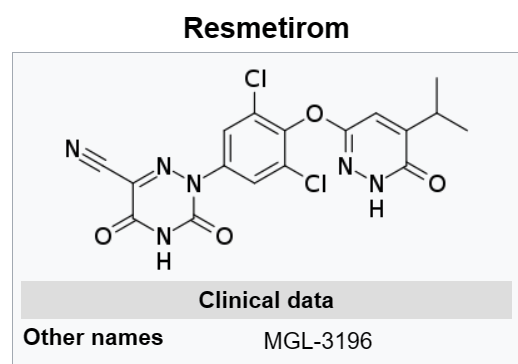

이런 날을 보려고 바이오텍 연구원으로 삽니다. 드디어 기다리고 기다리던 MASH (Metabolic dysfuction-associated steatohepatitis) 치료제가 FDA 승인 관문을 넘었습니다. 그 약물은 전에 임상3상 성공소식을 올렸던 Madrigal Pharmaceuticals의 Resmetirom입니다.

BIOTECH (10) – Madrigal Pharmaceuticals의 NASH 치료제 MGL-3196 (Resmetirom) 임상 3상 결과

약물의 Original Brand Name은 “Rezdiffra”입니다.

MASH는 질병 메카니즘이 아직 밝혀진 바가 없어서 수십년간 바이오텍과 제약회사들이 노력해도 계속 실패하고 있었습니다. 이제 드디어 최초의 MASH Drug이 승인된 만큼 다른 계열의 치료제도 임상3상을 통해 속속 FDA 승인 문턱에 다다를 것으로 보입니다.

현재로서는 FGF21 Inhibitors와 GLP-1 Agonist 등이 차기 MASH 치료제로서 가능성을 증명하기 위한 Pivotal Clinical Trials를 진행 중입니다.

Madrigal Pharmaceuticals’ NASH drug won an accelerated approval on Thursday, becoming the first treatment for a liver disease that for years has vexed scientists and investors.

The medication, resmetirom, was approved under the brand name Rezdiffra for patients with stage 2 and 3 fibrosis. It’s expected to be available in April, according to Madrigal. While the FDA described the disease as NASH in its label, it is now often referred to as metabolic dysfunction-associated steatohepatitis (MASH).

The company declined to comment on the price it will charge for Rezdiffra, its first approved drug. Earlier this year, CEO Bill Sibold touted resmetirom as a specialty drug that “provides tremendous value” in a high-need area and would be priced as such. ICER, a drug pricing watchdog, determined in May that the drug would be cost-effective if it was priced between $39,600 and $50,100 per year.

In an interview before the approval, Sibold told Endpoints News that Madrigal will initially focus on the roughly 315,000 MASH patients in the US who have stage 2 or 3 fibrosis and are being seen by hepatologists and gastroenterologists.

“They’ve been diagnosed. They’re with the right physicians who know the disease. They’ll understand the product and know how to follow these patients,” he said. “Let’s focus on those patients and give them something because they haven’t had anything.”

The approval is likely to be viewed as a crucial milestone in the treatment of nonalcoholic steatohepatitis (NASH), which is now referred to as metabolic dysfunction-associated steatohepatitis, or MASH. For years, companies have tried to bring treatments to market, only to be foiled by negative readouts or safety questions.

A ‘huge moment’ for MASH

“This is one of those diseases that industry has tried for years to find a solution,” Sibold said. “To be the first, it’s really a huge moment for patients, a huge moment for the medical community, a huge moment for industry, a huge moment for Madrigal.”

He’s optimistic about access and said Madrigal has had “extremely productive conversations” with health insurers.

“Payers also understand what the cost of NASH is as it progresses along,” he said, noting that some patients develop liver cancer or eventually need a transplant.

Madrigal’s drug follows the high-profile failure of a product that once led the field — and helped inspire it. In 2014, Intercept Pharmaceuticals’ early data readout for its experimental drug, obeticholic acid, helped put MASH on the map as a disease that offered a huge number of patients and no approved treatments. The readout triggered a surge of interest from investors and the medical community.

But it never made it across the finish line. The FXR agonist was rejected by the FDA for a second time last year after members of an advisory committee raised safety concerns. Shortly after the rejection, Intercept scuttled its MASH programs and sold itself to Alfasigma, with analysts highlighting the importance of a “pristine” safety profile.

Madrigal’s drug works a bit differently than Intercept’s. It’s designed to activate the thyroid hormone beta-receptor in the hopes of reducing a patient’s liver fat, inflammation and fibrosis, while also lowering their cholesterol.

It met both primary endpoints in a Phase III study, helping patients achieve MASH resolution with no worsening of fibrosis, and fibrosis reduction with no worsening of the nonalcoholic fatty liver disease (NAFLD) activity score, a widely-used metric that tracks changes in patients with nonalcoholic liver disease, including MASH.

About half of the patients treated with 100 mg of resmetirom and biopsied at 52 weeks showed MASH resolution or fibrosis improvement, Madrigal announced in February.

There was “no incidence of drug-induced liver injury,” the safety concern that worried FDA advisors about Intercept’s drug. The FDA did not require an adcomm for resmetirom.

The first, but not likely the last

Rezdiffra is now the only approved treatment for MASH patients. Previously, patients have been told to make lifestyle changes such as diet and exercise to avoid the need for a liver transplant.

“It’s just an awful thing to have them say, ‘Well, you have cirrhosis, and I’m sorry. We have no treatment,’” said Wayne Eskridge, a MASH patient and founder of the Fatty Liver Foundation, which has received contributions from MASH drug developers. “For patients coming on that will be diagnosed over the next few years, just not having to have that terrifically negative interaction is awesome.”

But he doesn’t think Madrigal’s medication will be the only option for long.

“With FDA, you never know,” Eskridge said. “But there’s been good progress and research. So we’re hoping that in the next two or three years, we see some other drugs as well to give broader treatment options for patients.”

He expects a class of drugs called FGF21s will pose the greatest competition to Rezdiffra, including a pair of late-stage therapies in development by Akero Therapeutics and 89bio. FGF21 is an endogenous metabolic hormone, and enhancing its activity has been shown to improve a list of symptoms, including hepatic fibrosis and inflammation. 89bio recently launched a Phase III trial for pegozafermin, while Akero’s efruxifermin is in an ongoing Phase III trial.

Akero recently unveiled additional data from its Phase IIb study suggesting that MASH patients treated with efruxifermin saw improvements in fibrosis without worsening of MASH through week 96. And Novo Nordisk and Eli Lilly are also testing their respective GLP-1 drugs, semaglutide and tirzepatide, in MASH.

In a trial readout in February, Eli Lilly reported that 74% of participants who took tirzepatide in a Phase II study showed an absence of MASH with no worsening of fibrosis at week 52, compared to about 13% of patients on placebo. The patients had stage 2 or 3 fibrosis.

Sibold previously suggested GLP-1s may perform best in early-stage MASH, before there is fibrosis or significant fibrosis, while later-stage patients “are in need of a liver-directed therapy quickly.”