안녕하세요 보스턴 임박사입니다. Heptares Therapeutics는 Membrane-bound GPCRs 표적 신약개발을 위해 2007년에 설립되었습니다. StaR (Stabilized Receptor) platform을 바탕으로 2년후에 $30 Million Series A를 했습니다. Heptares는 영국 MRC의 Christopher Tate교수와 Richard Henderson 박사가 개발한 mini-G proteins라 불리는 small GPCR moeities를 이용한 StaR (Stabilized Receptor)를 통해 새로운 GPCR agonists를 얻는 플랫폼입니다. GPCR은 Kinase와 더불어 가장 큰 단백질 군이면서도 오랜동안 선택적으로 접근하기 어려운 표적으로 알려졌습니다. Heptares Therpaeutics의 시작과 함께 일본 제약회사인 Sosei가 어떻게 이 기술을 발전시키고 최근 그 자신감으로 Nxera Pharma로 사명을 변경하고 새로운 세대를 선도하게 될지에 대해 얘기해 보고자 합니다.

(참고: Structure and function of G protein-coupled receptors. MRC Laboratory of Molecular Biology)

Heptares raises $30M in Series A – Fierce Biotech 2/24.2009

Two-year-old Heptares Therapeutics raised $30.6 million in a Series A that will fund new research on drugs targeting G-protein-coupled receptors. Clarus Ventures led the syndicate for the UK biotech. MVM Life Science Partners and the Novartis Option Fund also joined in, with all three investors contributing equally.

Heptares is a platform company, looking to create a pipeline of experimental therapies using its own technology. The developer says it will advance its own drugs targeted against currently intractable GPCRs and expects to ink R&D pacts with other biopharma companies as well.

GPCRs are the site of action of 25 percent to 30 percent of current drugs, says Heptares. “However, these membrane proteins are notoriously difficult to isolate from cells in an intact and active form and this has severely restricted efforts to study GPCRs using modern drug discovery techniques. Heptares’ StaR (Stabilised Receptor) technology platform enables the company to overcome this technology hurdle by engineering and purifying GPCRs in stable and functional conformations that retain their drug-binding characteristics.”

CEO Malcolm Weir, a veteran scientist who spent 17 years at Glaxo, tells FierceBiotech that the venture money will finance operations for the next three to four years. The developer currently has a staff of 15 and plans to outsource much of its work.

“Over the next year or so we’ll roughly double in size,” he adds. “Our approach is to have a core technology team and also core pharmacology and medicinal chemistry teams as well and use them to supervise a lot of our outsourced work.”

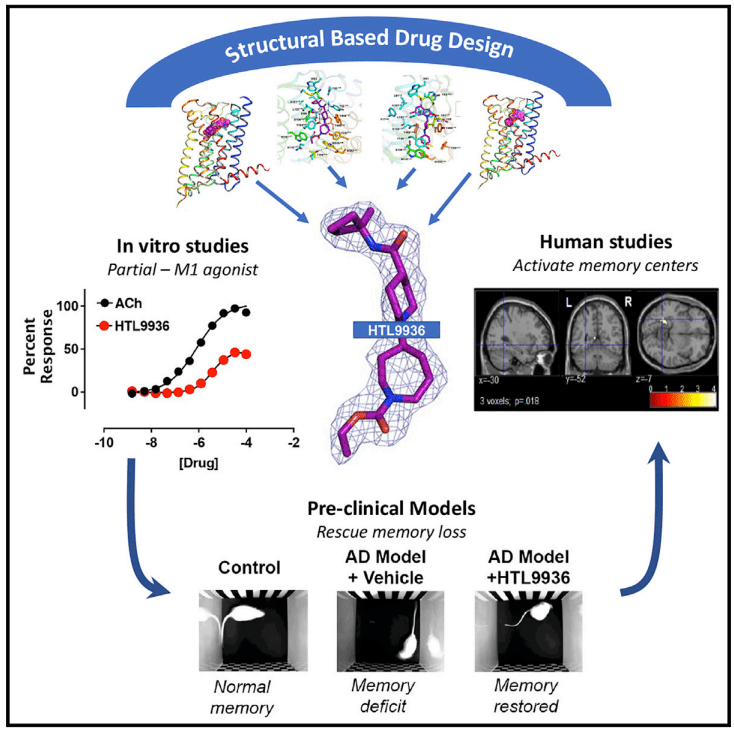

Series A를 하고 4년 후에 $21 Million Series B를 발표했는데, 첫번째 Drug candidate는 M1 muscarinic receptor agonist로 2013년말에 임상에 진입한다는 목표였습니다. 또한 Adenosine A2A, CGRP, Orexin 1, dual Orexin 1/2, mGlu5, 그리고 oral small molecule targeting GLP1/ GPR39 등 총 6개의 프로그램을 발표했습니다.

Heptares Therapeutics, the leading GPCR drug discovery and development company, today announced it has raised over US$21 million in a Series B financing to advance a clinical pipeline of novel drugs directed towards clinically validated targets for the treatment of neurological and psychiatric diseases. The financing round was co-led by the Stanley Family Foundation (SFF), one of the world’s leading neuroscience disease foundations, and current investor Clarus Ventures with Takeda Ventures also participating.

Heptares is preparing to initiate clinical development for its most advanced programme with a first-in-class selective M1 muscarinic receptor agonist later this year. Muscarinic agonism is clinically validated in the treatment of both Alzheimer’s dementia and cognitive impairment associated with schizophrenia, yet previous compounds lack the necessary selectivity and result in unwanted side effects. There is major unmet medical need in Alzheimer’s disease, where current agents typically offer only modest and transient effects, and currently no drug is approved for cognitive impairment associated with schizophrenia. Heptares has discovered multiple novel selective muscarinic agonists with a variety of pharmacological profiles, uniquely engineered using its StaR®-driven structure-based design approach, which represent first-in-class product candidates with significant commercial potential.

Heptares has also generated a broad pipeline of drug candidates, which are advancing towards the clinic for serious neurological diseases that target other historically undruggable or challenging GPCRs, including Adenosine A2A (multiple neuroscience indications), CGRP (severe migraine/headache disorders), Orexin 1 (addiction/compulsive disorders), dual Orexin 1/2 (chronic insomnia), and mGlu5 (autism, depression and dyskinesia). In addition, Heptares is pursuing novel oral small molecule projects that target GLP1 and GPR39 for the treatment of type 2 diabetes, as well as working with leading pharmaceutical partners on small molecule and antibody discovery and development programmes in multiple therapeutic areas.

Malcolm Weir, Chief Executive Officer at Heptares, commented: “Heptares is entering an exciting new phase of development as the lead compounds in our pipeline approach the clinic. All of these potential new medicines have been developed using our unique GPCR-focused structure-based drug design approach and technologies. Coupled with existing and future revenues from our strategic partnerships, funds from this new financing will enable us to accelerate our evolution into a clinical-stage drug development company.”

John Berriman, Chairman of Heptares’ Board of Directors, added: “We are delighted to conclude this significant financing. We are particularly pleased to welcome the Stanley Family Foundation as a new investor. SFF is a leading neuroscience disease foundation and brings extensive experience and networks that will be of great value as we advance the development of our pipeline in these areas. The involvement of SFF alongside existing investors Clarus and Takeda Ventures is clear recognition of the exceptional potential of Heptares to deliver new medicines to transform the treatment of neurological diseases.”

About Heptares Therapeutics

Heptares creates new medicines targeting clinically important, yet historically challenging, GPCRs (G protein-coupled receptors), a superfamily of drug receptors linked to a wide range of human diseases. Leveraging our advanced structure-based drug design technology platform, we have built an exciting discovery and development pipeline of novel drug candidates, which have the potential to transform the treatment of serious diseases, including Alzheimer’s disease, Parkinson’s disease, schizophrenia, migraine and diabetes. Our pharmaceutical partners include Shire, AstraZeneca, MedImmune, Morphosys, Takeda and Cubist, and we are backed by MVM Life Science Partners, Clarus Ventures, Novartis Venture Fund, Stanley Family Foundation and Takeda Ventures. To learn more about Heptares, please visit http://www.heptares.com

Series B를 마친 후 2년만에 일본 Sosei에 $180 Million upfront, $220 Million milestone 으로 자회사로 편입되게 됩니다. 당시 M1 muscarinic agonist가 임상에 진입한 상태였는데 동물실험 결과 Alzheimer의 원인으로 알려진 beta-amyloid에 작용한다는 결과가 있었습니다. 뿐만 아니라 AstraZeneca와 공동연구결과를 발표했는데 통증과 감염에 중요한 GPCR인 PAP2 inhibitor를 발표했습니다.

$400M buyout deal puts Heptares’ GPCR pipeline in Sosei’s hands – Fierce Biotech 2/22/2015

An expansive-minded Sosei has swooped in to buy Heptares Therapeutics, a U.K.-based biotech that’s been at work building a pipeline of G protein-coupled receptor-targeted drugs with a slate of some of the world’s biggest pharma partners. Sosei is paying $180 million in cash and offering up to $220 million in milestones. And rather than absorbing the tech, the Heptares group will now continue its efforts as a wholly owned subsidiary of the Japanese company.

Heptares picked up a Fierce 15 award back in 2007 as it was settling in to work on preclinical GPCR programs. Since then the biotech has inked pacts with AstraZeneca ($AZN) and MedImmune; Cubist, which was acquired by Merck ($MRK); Takeda Pharmaceutical; MorphoSys and Novartis ($NVS). Those partnerships provided some key financing for the company, which raised a $21 million B round back in 2013.

The company got started with technology from Richard Henderson and Christopher Tate at the MRC Laboratory of Molecular Biology, building a structure-based drug design platform dubbed StaR. Just weeks ago the company touted a big advance in their collaboration with AstraZeneca, noting that researchers had used their knowledge of GPCRs to find molecules that could block PAR2, a GPCR which is activated by cleavage with a protease enzyme. It’s a target for pain and inflammation.

GPCRs represent a big target in drug development, accounting for dozens of top-selling drugs. Heptares has been using its tech to come up with improved and stabilized drugs for some of these targets.

Heptares has one clinical-stage asset in its pipeline, a muscarinic M1 receptor agonist. That’s been the subject of considerable preclinical work in the field, with some suggestions in animal studies that it has an impact on amyloid beta and other key culprits in the disease, positively influencing cognition and behavior.

“While core to our future, an independent subsidiary structure will ensure Heptares is able to maintain the culture and business model that has been the foundation of its success so far,” says Sosei CEO Shinichi Tamura. Heptares CEO Malcolm Weir will stay in charge of the unit.

MVM Life Science Partners got the company started and then continued to offer financing with a syndicate that includes Clarus Ventures, Novartis Venture Fund, Takeda Ventures and the Stanley Family Foundation.

Heptares Therapeutics의 플랫폼은 광범위해서 Sosei는 2개의 자회사 – Orexia & Inexia – 를 설립하고 Medicxi가 총 €40 Million 펀딩을 하게 됩니다. Orexin agonist platform의 OX1과 OX2 Agonists에 대해 Orexia는 Oral drug을 개발하고 Inexia는 Intranasal drug을 개발하는 것이 목표입니다.

Medicxi put €40m into two Sosei spin off companies – European Biotechnology 2/5/2019

Sosei Group Corporation has spun out two programmes of its neurology pipeline into two newly created companies funded by venture fund Medicxi.

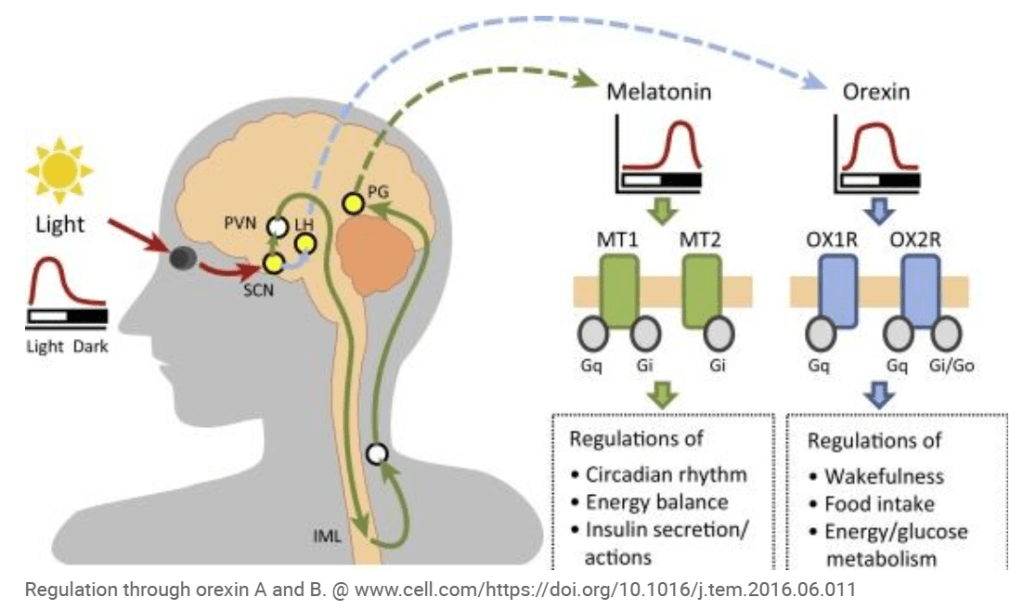

The newly created companies Orexia Ltd and Inexia Ltd aim to develop orally or intranasally administered drug candidates to treat the rare sleep disorder narcolepsy using Sosei Heptares’ orexin agonist platform, which targets the G protein-coupled receptors Orexin OX1 and OX2 (HCTR1 and HCTR2) in the hypthalamus. Medicxi agreed to invest up to €40m in both companies. Mario Alberto Accardi, who helped structure the deal on behalf of Medicxi, will become CEO of both companies.

Under the terms of the agreement, Orexia and Inexia will gain a portfolio of related patents from Heptares Therapeutics Ltd and have the right to exploit a series of Orexin OX1 and OX2 positive modulators and products derived therefrom, including dual OX1/OX2 agonists of Heptares, as well as access to proprietary know-how and development capabilities. While Orexia will focus on the development of oral therapies able to cross the blood-brain barrier (BBB), Inexia will focus on the development of candidates for intranasal delivery using the Optinose Exhalation Delivery System (EDS). Heptares Therapeutics will retain an equity holding in both companies and will receive R&D payments as well as milestone payments.

Orexia and Inexia will use the proceeds from Medicxi for lead optimisation, formulation and clinical development towards Phase IIb POC. According to SoseiHeptares narcolepsy is the primary target indication. Narcolepsy is a socially debilitating disorder characterised by an inability to properly maintain wakefulness, and a pathological intrusion of signs of REM sleep into wakefulness. Narcolepsy is a non-progressive, life-long condition. A vast majority (>90%) of human narcoleptics lacks detectable levels of the orexin peptides in the cerebrospinal fluid due to a highly specific degeneration of orexin neurons, indicating that human narcolepsy is an “orexin deficiency syndrome.” Most patients with narcolepsy have diminished levels of orexin A concentrations in cerebral spinal fluid, which binds to both OX1 and OX2 in the hypothalamus.

Thus it is probable that the drug cancidates in question represent orexin A mimetics. OX agonists enhance wakefulness, reduce jet leg or anestesia recovery time. Furthermore OX2 agonist can help reduce fat accumulation. According to estimates, narcolepsy affects about 236,000 patients in the US and the EU, is heavily underdiagnosed – durgs to treat the disorder are forcasted to achieve a market value of €2.5bn by 2022.

Orexia and Inexia will run out-sourced drug development programmes, leveraging an experienced team of drug developers within Sosei Heptares and additional contributions from a group of leading experts in the orexin space. Both companies follow Medicxi’s asset-centric virtual model utilising minimal infrastructure and thus increasing capital efficiency.

Currently, there are some interesting therapy options of narcolepsy that could replace amphetamine (“speed”)-based treatment:

Pitolisant is an EU approved (2016) histamine H3 receptor inverse agonist that activates histamine neurons, under development in the US to treat excessive daytime sleepiness and cataplexy in people with narcolepsy.

Solriamfetol (JZP-110) is a wake-promoting agent, a dopamine and nonrepinephrine reuptake inhibitor to treat excessive daytime sleepiness in people with narcolepsy and obstructive sleep apnea. Jazz Pharmaceuticals filed for and NDA at the FDA last year.

Sodium oxybate is currently tested in Phase III clinical trails for the treatment of excessive daytime sleepiness (EDS) and cataplexy

Furthermore, two OX2 agonists, YNT-185 and TAK-925 have been shown to reduce daytime sleepiness in mice models for narcolepsy.

2년 후 Medicxi가 $250 Million 펀딩으로 새로 설립한 Centessa Pharmaceuticals에 Orexin Ltd와 Inexin Ltd의 병합회사인 Orexin Therapeutics가 다시 합병되어 OX1 & OX2 Agonist 개발은 Centessa에게 옮겨지게 됩니다.

Sosei Group Corporation (“the Company”) (TSE: 4565) notes the announcement today from Centessa Pharmaceuticals (“Centessa”) about its launch as a novel asset-centric pharmaceutical company designed and built to advance a portfolio of highly validated programs. In conjunction with its launch, Centessa has completed the merger of 10 private biotech companies (“Centessa Subsidiaries”) that will each continue to develop its assets with oversight from the Centessa management team.

Centessa was founded by specialist life science venture capital firm Medicxi and raised $250 million in an oversubscribed Series A financing from a group of blue-chip investors.

Centessa’s asset-centric R&D model applied at scale has assembled best-in-class or first-in-class assets, each of which is led by specialized teams committed to accelerate development and reshape the traditional drug development process. With its unique operational framework, Centessa aims to reduce some of the key R&D inefficiencies that classical pharmaceutical companies face because of structural constraints.

Each Centessa Subsidiary team is asset-focused, in that it prosecutes a single program or biological pathway, with leadership provided by subject matter experts who are given a high degree of autonomy to advance each program. With a singular focus on advancing exceptional science, combined with proprietary capabilities, including structure-based drug discovery and design, the subsidiary teams enable Centessa to potentially develop and deliver impactful medicines to patients.

Orexia Therapeutics (“Orexia”), a new entity comprising Orexia Limited and Inexia Limited, which were created in February 2019 by Sosei Heptares and Medicxi, has been merged into Centessa. Orexia is developing oral and intranasal orexin receptor agonists using structure-based drug design approaches. These agonists target the treatment of narcolepsy type 1, where they have the potential to directly address the underlying pathology of orexin neuron loss, as well as other neurological disorders characterized by excessive daytime sleepiness.

Sosei Heptares continues to provide research services to Orexia and its equity holding in Orexia has been converted into a proportional shareholding in Centessa. The full announcement from Centessa can be found at www.centessa.com

Miles Congreve, Chief Scientific Officer of Sosei Heptares, commented: “This is a very exciting development for Orexia and we are delighted that it has been selected to be part of Centessa. We look forward to seeing this novel scaled asset-centric operating model in action and believe it will overcome existing pharma R&D inefficiencies to drive the rapid development of new medicines for patients.”

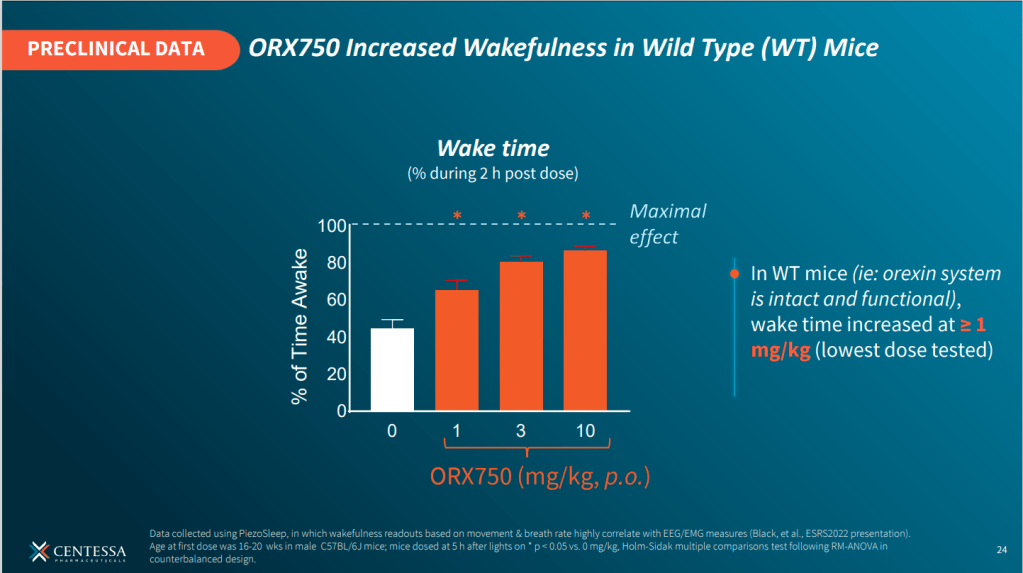

2024년 3월에 발표한 Centessa Pharmaceuticals의 Corporate Presentation에 의하면 OX2 Agonist인 ORX750이 2023년에 Drug candidate nomination되어 2024년에 임상에 진입하여 Human PoC data를 얻을 계획이라고 밝혔습니다. 전임상 결과를 몇가지 나누면 ORX750은 hOX1R과 비교해서 hOX2R에 0.11 nM 로서 거의 1만배의 선택성을 보인다고 합니다.

또한 Sosei는 2019년에 Roche/Genentch과 $26 Million upfront를 포함한 총 $1 Billion 규모의 GPCR 공동연구를 발표했습니다.

Sosei Heptares pens $1B biobucks GPCR pact with Genentech – Fierce Biotech 7/16/2019

After spinning out two companies at the start of the year, Sosei Heptares has now inked a new deal with Roche biologics unit Genentech. The headline $1 billion biobucks is, as ever, heavily backloaded, with the upfront a mere $26 million. Under the deal, the pair will seek to work on new meds that modulate G protein-coupled receptor (GPCR) targets “across a range of diseases.”

For its part, Sosei Heptares will wed its GPCR-focused structure-based drug design work to Genentech’s expertise as they look for GPCR targets of interest to the Big Biotech.

Genentech said in a statement that it will be responsible for developing and selling any new therapies coming out of the deal and “will have exclusive global rights to these agents.”

GPCRs are a broad class of membrane receptors the members of which bind to a variety of signaling molecules and are involved in a wide range of functions in the human body.

Researchers estimate that between one-third and one-half of all marketed drugs act by binding to GPCRs, according to Nature, and that has made them a big target for drug developers although many GPCRs are “orphan,” meaning their precise roles and ligands in the body are unknown.

This isn’t Roche’s first foray into the area, as back in 2017 it entered into a neurological and developmental disorder drug discovery pact with Confo Therapeutics, giving the Swiss major a potential source of small-molecule agonists of an undisclosed GPCR.

Sosei Heptares, too, has a long list of biopharma partners, including the likes of Allergan, AstraZeneca and Daiichi Sankyo. It did have a pact with Israeli generics giant Teva Pharmaceutical, but this was scrapped last spring.

This comes six months after the company spread out its GPCR workload: When Sosei bought out U.K. biotech Heptares for $400 million in 2015, it inherited a big pipeline of GPCR-targeted programs—too many to take forward on its own.

Back in January, it spun some of those out into two new U.K.-based biotechs that will be bankrolled in part by Anglo-Swiss venture fund Medicxi to the tune of €40 million (around $46 million).

The two new companies—dubbed Orexia and Inexia—have been created to advance various projects targeting the GPCR protein orexin that have grown out of Sosei Heptares’ R&D operations in Cambridge, and specifically agonists of orexin OX1 and OX2 for neurological diseases including narcolepsy.

Dr. Malcolm Weir, executive vice president and chief R&D officer of Sosei Heptares, said: “Sosei Heptares has strived to collaborate with leaders in the industry who appreciate the potential of combining their extensive drug development and commercialization expertise with our world-leading GPCR structure-based drug design approach to generate and advance new therapeutics across multiple disease areas.

“We are therefore delighted to enter this new partnership with Genentech, one of the most innovative companies in the biopharmaceutical industry, and excited to see what the combination of our respective capabilities can deliver.”

James Sabry, M.D., Ph.D., global head of pharma partnering at Roche, added: “We believe GPCRs are an important target class that play a role in many serious diseases. Sosei Heptares brings truly unique capabilities to enable and accelerate GPCR drug discovery. We look forward to collaborating with the Sosei Heptares team to hopefully bring novel GPCR-targeted medicines to patients as quickly as possible.”

Neurocrine Biosciences and Sosei Heptares, no strangers to major research pacts, are joining forces for a range of early- to midstage neuro assets.

This area has proven to be a high-risk R&D target for the industry, but Neurocrine is willing to put down $100 million—and up to $2.6 billion—in a heavily backloaded biobucks deal to get its hands on Sosei Heptares’ muscarinic receptor agonists for schizophrenia, dementia and other neuropsychiatric disorders.

Neurocrine is already plotting a phase 2 with selective M4 agonist HTL-0016878 in schizophrenia next year, while also in the cards are phase 1 tests for a dual M1/M4 and a selective M1 agonist in the year after.

Under the pact, Sosei Heptares retains the rights to develop M1 agonists in Japan, while Neurocrine nabs co-development and profit share options. Muscarinic receptors are crucial to brain function and researched in drug targets in psychosis and cognitive disorders.

Sosei Heptares says in early, mainly preclinical work, this platform has shown the potential to deliver therapeutic effects while avoiding both the harmful side effects caused by nonselective agonists and the efficacy issues experienced in some older patients.

This came out of its G protein-coupled receptor (GPCR) stabilized receptor platform (StaR), technology also being used by the likes of Roche’s Genentech, which signed up with the biotech in a $1 billion biobucks pacts two years ago.

Neurocrine, too, has form when it comes to relatively small upfronts but heavily backloaded biobucks pacts, having penned a deal with gene therapy player Voyager Therapeutics in 2019 worth $1.8 billion. It will, however, hope to have better luck with Sosei, given that earlier this year it exited that Voyager pact after an FDA clinical hold seemingly scared it away from the deal.

Neurocrine also has its own work across similar areas as its new deal with Sosei, including more recently picking up an exclusive license to seven assets from Takeda’s early- to midstage psychiatry pipeline, including clinical-stage programs in schizophrenia, treatment-resistant depression and anhedonia, or the inability to feel pleasure.

The Takeda pact hasn’t, however, seen much luck in schizophrenia, with the pair’s asset luvadaxistat failing a phase 2 earlier this year. The companies said they would continue work on the drug, though Neurocrine now has a backup in hand.

“Our partnership collaboration with Sosei Heptares to advance their selective muscarinic agonist portfolio leverages the strengths of both our organizations with one goal in mind, to bring important medicines to patients who need better treatment options,” said Kevin Gorman, Ph.D., CEO at Neurocrine Biosciences.

“We continue to add potential best-in-class compounds to our growing pipeline, which further positions Neurocrine Biosciences as a leading neuroscience-focused biopharmaceutical company.”

금년 2월에 발표한 회사의 전체적인 2023년 결과를 보면 GPCR program을 통한 선도기업으로서의 지위를 공고히 하고 있다는 느낌을 받습니다.

- HTL0048149; 임상 1상 진입 – 첫번째 환자 dosed

- NBI-1117569 (Muscarinic M4 agonist); 임상1상 시작

- NBI-1117567 (Muscarinic M1 agonist); 2024년 중 임상시험 계획

- PF-06954522 (oral GLP-1 R agonist): 임상1상 시작

Tokyo, Japan and Cambridge, UK, 13 February 2024 – Sosei Group Corporation (“Sosei Heptares” or “the Company”; TSE: 4565) provides an update on operational activities and reports its consolidated results for the 12 months ended 31 December 2023. The full report can be found by clicking here.

Chris Cargill, President & CEO of Sosei Heptares, commented: “2023 has been a transformational year for Sosei Group and the progress made by our teams across all areas of the business has been exceptional. This progress is enabling the Group to accelerate its development in 2024 as an integrated, technology powered, commercial-stage biopharmaceutical company focused on cutting-edge science and delivering life-changing medicines for patients in Japan and globally.

“We continue to accelerate business integration following the acquisition of Idorsia Pharmaceuticals Japan Ltd (“IPJ”) and Idorsia Pharmaceuticals Korea Co., Ltd (“IPK”), which has brought an exciting new dimension to our Group including the potential for many strategic development and commercial opportunities. We embark on this next phase of our journey as a well-financed organization and with a clear vision to create value for all our stakeholders and I want to thank all our employees for their efforts in making this a reality.”

Operational Highlights for Q4 2023

- Landmark investment of ~JPY8 billion (~USD54m) into Sosei Group from new OPF1 fund operated by JIC Venture Growth Investments Co., Ltd., an affiliate of Japan Investment Corporation – in conjunction with a share offering and convertible bond restructuring to finance the Group’s strategic growth initiatives; to extend the maturity profile of its debt; and further strengthen its financial base.

- Marketing approval for PIVLAZ® in South Korea – for the prevention of cerebral vasospasm and related conditions after aneurysmal subarachnoid hemorrhage (“aSAH”) securing.

- New Drug Application submitted in Japan for the approval of daridorexant, a novel dual orexin receptor antagonist, for the treatment of adult patients with insomnia – in relation to the submission, the Group received JPY 1.5 billion, which has been recognized as revenue in Q4 2023.

- Partner Neurocrine confirmed its plans to evaluate two new muscarinic agonist candidates in Phase 1 studies – both NBI-1117569 (a muscarinic M4-preferring agonist) and NBI-1117567 (a muscarinic M1-preferring agonist) are oral compounds that may have the potential to treat neurological and neuropsychiatric conditions. A Phase 1 study of NBI-1117569 has begun and a Phase 1 study of NBI-1117567 is expected to begin in 2024.

- Partner Pfizer entered a new oral small molecule GLP-1 receptor agonist into a Phase 1 clinical trial targeting metabolic diseases – PF-06954522 was discovered by Pfizer scientists during a multi-target research collaboration in which Pfizer had access to Sosei Heptares’ StaR® technology.

- Discussions underway with GSK to regain full ownership of GSK43814061, a clinic-ready, first-in-class, oral GPR35 agonist targeting Inflammatory Bowel Diseases (“IBD”) – upon regaining ownership, the Group expects to proceed with a planned UK Phase 1 trial of GSK43814061 while determining the optimal strategy for the further clinical development and/or re-partnering of the program.

- US$3.75 million milestone payment received from partner Genentech – the discovery-based payment is related to progression of a potential first-in-class project targeting an undisclosed GPCR. Genentech will now be responsible for further development and commercialization of this potential new medicine.

- Strong progress in collaborations with leading technology companies

- Kallyope – identification, validation and nomination of a first GPCR target to enter a therapeutic discovery program for gastrointestinal diseases,

- Verily – launching a new discovery program based on the successful validation and nomination of a GPCR target for immune-mediated diseases with an initial indication focus of IBD, and

- PharmEnable Therapeutics – expansion of a collaboration to drive discovery of novel small molecule drug candidates against a second neurological disease target.

Operational Highlights for Full Year 2023

- Transformational acquisition of Idorsia’s pharmaceutical business in Japan and APAC – achieves key strategic milestone to become a fully integrated biopharmaceutical company:

- Adds complementary late-stage clinical development capability with profitable and fast-growing commercial operations in Japan.

- Brings highly experienced team, with proven clinical development and commercial launch track record.

- Lean, go-to-market commercial model, well positioned to scale rapidly to generate significant value from Japan and APAC geographic expansion.

- Includes Japan and APAC (ex-China) rights to two medicines with significant growth potential (PIVLAZ®) and daridorexant, as well as exclusive options and selected rights to up to seven other products from Idorsia’s clinical development pipeline.

- Purchase price of JPY65 billion is fully funded from existing cash (JPY25 billion) and new JPY40 billion long-term, low-rate corporate loan.

- First subject dosed with wholly owned HTL0048149 in Phase 1 trial – HTL’149 is a first-in-class GPR52 agonist designed by the Company as a once-daily oral treatment to address positive and negative symptoms and cognitive impairment in schizophrenia patients without the adverse effects typically associated with existing antipsychotic drugs.

- First patient dosed with cancer immunotherapy candidate HTL0039732in Phase 1/2a trial – HTL’732 is an orally available small molecule EP4 antagonist for advanced solid tumors being evaluated under an agreement with Cancer Research UK.

- Partner Neurocrine Biosciences initiated Phase 1 clinical study with NBI-1117570 – an investigational, oral, muscarinic M1/M4 selective dual agonist that may have the potential to treat neurological and neuropsychiatric conditions.

- Partner Tempero Bio received FDA clearance to advance clinical development of TMP-301 for alcohol and substance use disorders – TMP-301 (formerly HTL0014242) is a selective, orally available mGluR5 negative allosteric modulator (NAM) candidate discovered by Sosei Heptares and out-licensed to Tempero Bio.

- Sosei Group’s share listing elevated to the Tokyo Stock Exchange Prime Market – shortly after, Sosei Group shares were included in the Tokyo Stock Price Index (TOPIX).

- Changes to Board and Executive Management team – Ms. Eiko Tomita, a highly experienced pharmaceutical executive, was elected as an Independent External Director. Ms. Candelle Chong was promoted to Executive Vice President and Chief of Staff.

그리고 회사명을 최근 Nxera Pharma로 변경하였습니다.

Sosei ushers in new era with Nxera Pharma name change – Fierce Biotech 2/16/2024

The Sosei Group is making a major change to its corporate business as it renames and changes up its head office location.

This comes amid two major buyouts for the group in the form of Heptares Therapeutics in 2015 (which had become Sosei Heptares) and its deal to snap up Idorsia Pharmaceuticals’ Japan business last year.

Now, the group has decided to formally merger Idorsia Pharmaceuticals Japan (aka IPJ) into Sosei “with the strategic goal to expand the company’s operations in Japan,” the company said in a statement.

This has, however, left a lot of legacy names and subsidiaries that now won’t technically exist, so, for the sake of simplicity, Sosei has decided to bring all these names under one corporate umbrella from April 1 into Nxera Pharma.

Simplicity also exists within the rebrand: “The name ‘Nxera’ derives from the words ‘Next’ and ‘Era’ to express the company’s determination to be a leader in the next era of science and healthcare,” the company said in its press release.

Its mission statement is to be a “technology enabled pharma company that will challenge the status quo in its pursuit of better treatments for patients in need across multiple therapeutic areas.”

While the umbrella exists for Nxera, there are country names wedded to each new-look company. This sees Sosei Group Corporation become Nxera Pharma, while IPJ becomes Nxera Pharma Japan and its Korea biz becomes Nxera Pharma Korea.

Heptares Therapeutics, meanwhile, becomes Nxera Pharma UK.

This also sees the moving of its head offices to the same location as the head office of what was IPJ, which is in Minato City in Tokyo. This is to “accelerate business integration and enhance operating efficiencies,” the company said.

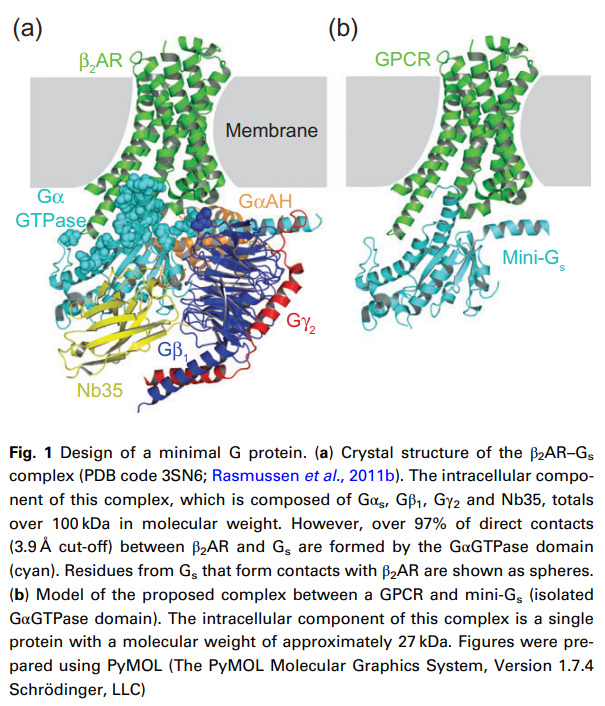

Byron Carpenter와 Christopher G. Tate 교수는 2016년에 mini-G proteins에 대한 논문을 Protein Engineering, Design & Selection에 발표를 하였습니다.

Christopher Tate 등은 mini-G proteins라는 GPCR의 저분자형 단백질을 이용해서 Agonists를 찾을 수 있다는 결과를 PLOS 2017년에 발표했습니다.

M1 muscarinic receptor agonist 개발에 대한 결과는 2021년 Cell에 발표를 했습니다.

2023년 11월에 Sosei에서 발표한 Corporate Presentation을 보면 조금 더 알 수 있습니다.