(Picture: R. Scott Struthers, Ph.D. – Founder and CEO of Crinetics Pharmaceuticals)

안녕하세요 보스턴 임박사입니다.

2008년은 미국 바이오텍의 최근 역사 중에 가장 힘들었던 시기입니다. 글로벌 금융위기와 함께 매년 구조조정이 있었습니다. 큰 도시인 보스턴이나 샌프란시스코도 이런데 샌디에이고와 같은 곳은 훨씬 충격이 컸고 2010년대 중후반까지도 샌디에이고에는 바이오텍 일자리가 없다는 말이 정설처럼 들리던 때입니다.

오늘 소개할 회사는 바로 San Diego에서 2008년에 설립한 Crinetics Pharmaceuticqls입니다.

Neurocrine Biosciences에서 1998년까지 2008년까지 10년간 Head of Endocrinology and Metabolism이었던 Scott Struthers는 2008년에 Neurocrine에서 함께 일했던 3명의 동료와 함께 자신의 집 주차장에서 Crinetics Pharmaceuticals를 설립합니다. NIH Grant를 열심히 써가며 월급도 없이 NIH SBIR grant로 회사의 프로그램을 조금씩 키워 나갔습니다. Crinetics의 스토리는 2019년에 San Diego Entrepreneurs Exchange에 비교적 상세히 실렸습니다.

Of the six San Diego life science initial public offerings (IPOs) in 2018, Crinetics Pharmaceuticals (CRNX) raised the most money at $117 million1. Started by four scientists in 2008 and now developing novel therapeutics for rare endocrine diseases, co-founder Scott Struthers was invited by Devang Thakkar and TiE South Coast to present how Crinetics went from garage to NASDAQ. Scott also co-founded San Diego Entrepreneurs Exchange (SDEE) so were happy to join him at JLABS San Diego for an update on his story.

Starting a Company During the Economic Recession

Crinetics was co-founded by Scott Struthers, PhD, Frank Zhu, PhD, Ana Kusnetzow, PhD, and Stephen F. Betz, PhD, in 2008. They had all worked at Neurocrine Biosciences, where they worked on a small molecule drug that acted on a GPCR peptide hormone receptor for the treatment of endometriosis. This incited ideas for doing drug discovery better. Although the economy was in the depths of the recession, starting a company had some advantages for Crinetics. Many companies were going out of business and selling their belongings. Colleagues in these labs told Crinetics they could have anything they didn’t sell. Not one to pass up a good deal, Scott drove his pickup around town and collected an assortment of lab supplies including chemistry glassware. Today Crinetics has seven chemists and they’ve never bought any glassware. “That was a big help back in the day because we had no money, we did not take a salary. We just filled our garages with this stuff until we got enough money to open a lab,” Scott said.

Private Funding for the First Lab

The first lab was modest and small. Steve would bring in his new puppy, Penny, instead of leaving her at home alone. “Because what is HR going to do?” Scott joked. “I would bring in my dog occasionally and it just became a thing, so you will still see puppies around the offices today.” Crinetics started working on areas where they could get funding. They had an approach for ovarian cancer that could selectively kill ovarian cells. This attracted the attention of a Santa Monica billionaire who wanted to reduce unnecessary euthanasia by spaying and neutering cats and dogs non-surgically. He gave them funding to apply their approach to an injectable method. “One lesson in entrepreneurship for me was to be willing to explore good ideas even if they are a bit outside of your comfort zone,” said Scott. It never panned out, but Scott says he’d like to resume the project when they have more time.

NIH Grant Funding Prompts Move to Second Lab

The NIH has three grant submission deadlines each year and Crinetics would submit two or three every cycle. “We were writing grants all the time to get our ideas funded. We had a 30% hit rate on ideas, and it helped us grow,” Scott said. When they got more money, they moved to their second lab. “There were still only four of us, but in a company at this stage you do everything yourself. We didn’t hire movers or even janitors. We moved ourselves, fixed broken fume hoods, and cleaned the restrooms,” Scott recalled.

Acromegaly and the Genesis of Crinetics

Things started to come together when they began working on a disease called Acromegaly. Acromegaly is excessive growth—enlarged hands, feet, and facial features—caused by a benign tumor in the pituitary gland producing too much growth hormone. Richard Kiel, a famous actor in Jaws and Bond movies, had acromegaly. It causes metabolic changes, hypertension, cardiovascular disease, and diabetes and if left untreated can have a severe effect on mortality, morbidity, and quality of life. Neurosurgery to remove the tumor is tricky and often leaves residual tumor that continues to cause too much growth hormone.

Based on their Neurocrine experience with GPCRS and Scott’s graduate studies at The Salk Institute under Wiley Vale, they knew it was possible to inhibit growth hormone secretion by making analogs of a peptide hormone called somatostatin. They wrote another grant and were awarded a $2 million Phase II SBIR. “We celebrated by taking the whole company and spouses out to a fancy dinner. We have always tried to celebrate our successes,” Scott beamed. This funding allowed them to lease more lab space and add more people. “For the first time, we hired movers, got new furniture, albeit from Ikea, that we put together ourselves. By 2014 we had a respectable-sized team—and added more puppies,” Scott said.

Discovery of CRN808

By 2015, Crinetics had identified some promising small molecules and the beginnings of a drug pipeline. Scott explained how they used iterative medicinal chemistry for small molecule drug discovery—make a molecule and test it to inform of improvements for the next one. Using this approach, they homed in on the 808th molecule as the drug candidate for acromegaly, as 807 were not good enough, but kept going making nearly 5,000 molecules as backups. “This is actually super-efficient, as other companies have made nearly 10,000 in other projects before identifying the first drug,” Scott said. While they had raised $12 million in non-diluted funding from their own sweat equity and grants over the first 10 years, they did not have enough money to move CRN808 forward to clinical trials.

Series A Funding for Clinical Trials

They took a big risk and stopped seeking grant funding and spent a year focused on raising venture capital. The investors valued Crinetics at $12 million and were willing to put in $30 million with an option to draw $10 million later. Crinetics thought that valuation was too low and met to decide if they should walk away. “We decided that the $30 million would allow us create to more value and de-risk fundraising in the future,” Scott said. They didn’t know what the financing environment would be like in the next 6-12 months and decided not to wait. “It was one of the best decisions we ever made,” Scott said. They closed a $40 million Series A, of which they only used $30 million before moving on to their next round.

Company Valuation—Competitive Advantage and Market Potential

The Series A investors were willing to make this large investment because Crinetics was developing their somatostatin analogs as small molecule drugs taken orally once a day—a welcomed alternative to monthly injections. Acromegaly is treated with a 2-ml “goo” injected intramuscularly, once a month, with an 18-gauge needle. “This is not a simple insulin injection,” Scott said. While it is painful, Scott says patients complain more about taking time off work for monthly doctor’s office visits. Their once-a-day oral approach enabled consistent exposure and rapid dosing adjustments. Furthermore, the market for the injectable-based treatments for acromegaly and neuroendocrine tumors was about $3 billion. Their approach to treating acromegaly and the possibility of developing related treatments in the future justified the investment early on. “We celebrated with a dinner out, hired more folks, and bought new equipment,” Scott said.

Successful Phase 1 Clinical Trial

With money in the bank, Crinetics began Phase 1 testing on healthy volunteers. When given CRN808 orally, it blocked 90% of growth hormone, establishing clinical proof of concept and the suitability of a once-a-day oral approach, with a starting dose of 10 mg per day for future trials. The drug worked in cell cultures, rats, and now in healthy volunteers, doing what it was supposed to do. The results from healthy volunteers were consistent with approved injectables drugs, which were being used in patients. “This is probably the most important piece of data that we generated,” Scott said. “This was enough to convince the investment community that we might have a real drug on our hands.”

Series B to Fund Clinical Trials and New Programs

Crinetics started exploring other projects because the peptide hormone somatostatin acts on five different receptors. They wanted to optimize a molecule to inhibit insulin secretion for treating hyperinsulinism. When they showed in a hypoglycemic rat model that increasing doses of their drug candidate 02481 could restore normal glucose, they knew they had a potential drug candidate and a second program. “We went to raise additional money to support the CRN00808 clinical trials and develop new programs, closing a $63.5 million Series B in March 2018,” Scott said. With the momentum of positive trials results, new programs, and the ability to attract funding, they flipped instantly into working on the IPO.

IPO

As the company was busy moving again and generating data, Scott focused his efforts on preparing for the IPO process. He says first you bring in an auditing firm to make sure your financial house is in order. Then you select your banks and sit in a room with 25-30 people—bank lawyers and staff and your senior management team—to produce an S-1 document. You go out on the road for “test the waters” meetings to see who’s interested. When the S-1 becomes public, you go on the actual road show to see if they’ll order. “We ended up with well over $1 billion worth of orders for our $100 million financing, allowing us to pick and choose the investors,” Scott said. “We wanted quality investors who believed our story and would stick with us long term.”

The Crinetics IPO did very well, opening at $17 a share in July 2018, climbing to $42 in September, and settling back to the low 20’s for a market cap of around $500-600 million. “Far from the original pre-money evaluation the Series A investors gave us of $12 million,” Scott said. “I was absolutely right that we were undervalued early on, but it was the right thing for us to take the money and build the company.” Scott added that Crinetics owns all the patents—no licensing in or out—with the first patents expiring in 2037. “This is what builds those valuations because you are looking at billions of dollars of potential drug sales discounted by the time to cash flow and the amount of risk,” Scott said. “Our goal is to commercialize these drugs ourselves and reinvest in the next generation of drugs.”

With the move to the new building complete, Crinetics has started new projects, such as a treatment for Cushing’s disease, continuing the theme of small molecule drugs acting on peptide hormone receptors. With CRN808 now in global Phase II trials, they have four molecules and four projects in various stages of discovery and development. At 54 employees Crinetics is actively recruiting in several areas such as patient advocacy and medical affairs. Scott closed with a recruitment pitch, “It’s a fun place to work, and you don’t have to have a dog.”

- Reuter, Elise. “Seven San Diego Companies went Public in 2018.” San Diego Business Journal, 13 Dec. 2018. 28 Apr. 2019. https://www.sdbj.com/news/2018/dec/13/seven-san-diego-companies-went-public-2018/

본래 항암제를 개발하려다가 Benign tumor인 Acromegaly에 대해 연구를 시작하고 CRN0808을 발견하고 데이타를 확보한 후 임상에 들어가기 위해 $40 Million 시리즈 A를 합니다. 이 당시 회사의 Valuation으로 $12 Million을 받았다고 합니다. Acromegaly는 성장 호르몬 과다분비로 인해 몸의 손, 발, 얼굴 등이 커지는 병입니다. 당시에는 매주 한번씩 주사를 맞기 위해 병원에 방문해야 했는데 매일 복용할 수 있는 알약을 개발하는 것이 Crinetics의 목표였고 CRN0808이 바로 그런 약이었습니다.

Crinetics Pharmaceuticlas Completes $40 Million Series A Financing – Press Release 11/2/2015

Crinetics Pharmaceuticals, an innovative therapeutics company focused on specialty endocrine disorders, announced today the completion of a $40 million series A financing led by 5AM Ventures, Versant Ventures, and Vivo Capital. Crinetics plans to use the proceeds to advance development of its small molecule somatostatin agonist program to clinical proof-of-concept for the treatment of acromegaly, as well as to move additional programs into development.

Concurrent with the financing, Wendell Wierenga, Ph.D. has been appointed as chairman of Crinetics’ board of directors. In addition, Mason Freeman, M.D. representing 5AM Ventures, Steve Kaldor, Ph.D. representing Versant Ventures, and Mahendra Shah, Ph.D. representing Vivo Capital have joined Crinetics’ board of directors. Drs. Wierenga, Kaldor, and Shah are all highly successful serial entrepreneurs with extensive CEO and senior management experience in the biopharmaceutical industry. In addition to his role as Venture Partner at 5AM Ventures, Dr. Freeman is an endocrinologist and professor of medicine at Massachusetts General Hospital, Harvard Medical School.

“This financing is a major step forward in advancing our pipeline of novel, internally-discovered therapeutics into clinical development,” said Scott Struthers, Ph.D., founder and chief executive officer of Crinetics. “We are thrilled to have on our side top-tier institutional investors to provide the financial resources to continue building our company and pipeline, and new board members who are so experienced in guiding drugs through clinical development and regulatory approval to commercial success.”

Acromegaly, a hormonal disorder caused by over-secretion of growth hormone, affects at least 20,000 individuals in the U.S. Current injectable peptide-based treatments generated over $2 billion in worldwide sales in 2014 for the treatment of acromegaly and other neuroendocrine tumors. “Acromegaly patients need much better options than those they have now,” said Dr. Freeman. “If Crinetics’ lead program is successful, it will represent an important improvement in therapy for these patients because it will be a major advancement in how the drug is administered and improve overall efficacy,” said Dr. Freeman.

“This is a group of highly-accomplished drug hunters that I have known for many years,” said Dr. Wierenga. “I look forward to working with the team to develop drugs that help improve patients’ lives across a range of specialty endocrine disorders.” Dr. Wierenga has a long and distinguished career in the biopharmaceutical industry where he has had a leading role in the discovery and development of 16 FDA approved drugs.

“We invested in Crinetics because we believe in Scott and his team’s ability to build an important new company in the area of specialty endocrinology,” said Tom Woiwode, Ph.D., Managing Director at Versant Ventures. “This investment is very much a continuation of our strategy of investing in proven drug discovery and development teams, such as our prior backing of the Quanticel team, as well as the Inception family of companies, all of which are also in San Diego.”

2918년 3월초에 CRN0808 (Paltusotine)의 임상1상 결과는 성공적이었고 $63Million Series B를 할 수 있었습니다. 시리즈B에서는 RA Capital, Orbimed 같은 큰 자본이 들어왔습니다. Paltusotine (CRN0808)의 개발에 대한 스토리는 ACS Medicinal Chemistry Letters 2023년호에 발표했습니다.

Crinetics Pharmaceuticals Snags $63.5 Million in Series B Funding – Biospace 3/14/2018

Five months after its lead drug began Phase I testing San Diego-based Crinetics Pharmaceuticals Inc has secured $63.5 million in Series B financing.

Crinetics said it will use the funds to continue development of its lead product CRN00808, which is in early-stage trial for acromegaly, a hormonal disorder. CRN00808 is a nonpeptide somatostatin agonist designed to be taken orally to free patients from painful injected therapies and the scheduling of frequent clinic visits to receive them, according to company information. Crinetics initiated a Phase I study in October 2017. The double-blind, placebo-controlled study will evaluate the safety, pharmacokinetics, and pharmacodynamics of CRN00808 in 83 healthy volunteers. Additionally, the trial will test CRN00808’s ability to suppress serum IGF-1 and GHRH-stimulated GH levels. CRN00808 is the first candidate Crinetics has moved into the clinical stage.

In addition to the development of CRN00808, Crinetics said it will use some of the funding “to develop additional new targeted therapeutics for endocrine disorders and endocrine-related cancers, and for general corporate purposes.”

The latest investment round was led by Perceptive Advisors and includes new investors RA Capital and OrbiMed. Existing investors 5AM Ventures, Versant Ventures and Vivo Capital participated in the financing as well, the company said.

Scott Struthers, the founder and chief executive officer of Crinetics, said he was delighted to have “some of the world’s most prominent healthcare investors” support the company as it moves into its next phase of growth.

“This fundraising puts us on a strong financial footing that allows us to further the development of CRN00808 and advance our pipeline of additional internally-discovered drug programs. We believe Crinetics is poised to make a meaningful contribution to the treatment of rare endocrine disorders and today’s successful fundraising validates that promise and our strategy to date,” Struthers said in a statement.

Joseph Edelman, founder and CEO of Series B backer Perceptive Advisors, touted the potential of Crinetics’ internally developed programs. Edelman said those assets have the potential not only to treat conditions such as acromegaly but also neuroendocrine tumors, hyperinsulinism and Cushing’s disease.

“There is considerable unmet need in rare endocrine disorders, and we are excited to be a part of this effort to bring new options to patients and their physicians,” Edelman said in a statement.

As part of the financing, two members of the Perceptive Advisors team have been appointed to the Crinetics Board of Directors. Weston Nichols, an analyst, and Matthew K. Furst, who has served as Senior Advisor for Perceptive, have taken the board positions. Another board change includes the departure of Vivo Capital’s Mahendra G. Shah. He will be replaced by Jack B. Nielsen, a managing director at Vivo.

시리즈 B를 하자마자 IPO를 준비합니다. 다행히 오랜 어려운 시기를 지나고 IPO 시장이 좋을 때였습니다. CEO의 판단이 돋보이는 부분입니다. 위의 San Diego Entrepreneur Exchange에 보면 수요예측에서 거의 $1 Billion 정도의 구매의사를 확인할 수 있어서 좋은 투자자를 선별할 수 있었다고 합니다.

Crinetics Pharmaceuticals Announces Pricing of Initial Public Offering – Globe News Wire 7/17/2018

Crinetics Pharmaceuticals, Inc. (Nasdaq:CRNX), a clinical stage pharmaceutical company focused on the discovery, development and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors, today announced the pricing of its initial public offering of 6,000,000 shares of common stock at a public offering price of $17.00 per share. All of the shares are being offered by Crinetics. The shares are expected to begin trading on the Nasdaq Global Select Market on July 18, 2018 under the ticker symbol “CRNX.” The gross proceeds from the offering, before deducting underwriting discounts and commissions and other offering expenses payable by Crinetics, are expected to be $102.0 million. The offering is expected to close on July 20, 2018, subject to the satisfaction of customary closing conditions. In addition, Crinetics has granted the underwriters a 30-day option to purchase up to an additional 900,000 shares of common stock at the initial public offering price, less underwriting discounts and commissions.

J.P. Morgan Securities LLC, Leerink Partners LLC and Piper Jaffray & Co. are acting as joint book-running managers for the offering.

About Crinetics Pharmaceuticals

Crinetics Pharmaceuticals is a clinical stage pharmaceutical company focused on the discovery, development and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors. In March 2018, the Company reported initial results from a Phase 1 trial with its lead product candidate, CRN00808, an oral somatostatin agonist for the treatment of acromegaly, an orphan disease affecting more than 25,000 people in the United States. The Company is also developing other oral somatostatin agonists for hyperinsulinism and neuroendocrine tumors, as well as an oral nonpeptide ACTH antagonist for the treatment of Cushing’s disease. Crinetics was founded by a team of scientists with a track record of endocrine drug discovery and development.

2023년 9월에 임상 3상의 Pathfinder-1 결과가 나왔습니다. 큰 부작용은 없었고 원하는 약효를 얻을 수 있었습니다.

A daily oral investigational drug has shown a significant ability to help patients with acromegaly maintain their insulin-like growth factor (IGF-1) levels. Paltusotine, developed by Crinetics Pharmaceuticals, demonstrated statistically significant improvements in primary and secondary efficacy measures during the phase 3 PATHFNDR-1 trial. This 36-week assessment, including an open-label extension, compared paltusotine to a placebo in patients with the rare condition of excessive growth hormone (GH) production.

These findings suggest a promising path for paltusotine to become a groundbreaking treatment for acromegaly, a severe and potentially life-threatening disease that significantly affects daily life and well-being. It offers a less invasive alternative for patients.

According to a statement from Crinetics, the randomized, double-blind, placebo-controlled PATHFNDR-1 trial produced significant positive outcomes with paltusotine. In this study, which is one of two ongoing phase 3 evaluations of the daily oral drug in acromegaly patients transitioning from standard-care injection therapy, the drug was assessed in patients previously controlled with octreotide or lanreotide depot monotherapy. Of the 58 adult patients enrolled, the primary endpoint was the proportion of patients maintaining their IGF-1 levels after switching to paltusotine following 36 weeks of treatment.

Crinetics reported that 25 (83%) patients receiving paltusotine achieved the primary endpoint of maintaining IGF-1 levels below 1.0 times the upper limit of normal (ULN) after 36 weeks, compared to only 1 (4%) of patients receiving the placebo (P <.0001).

Patients were randomized to either treatment (n = 30) or placebo (n = 28) during the treatment period and were given the option to participate in an open-label extension assessment of paltusotine if they were switching from somatostatin analogs.

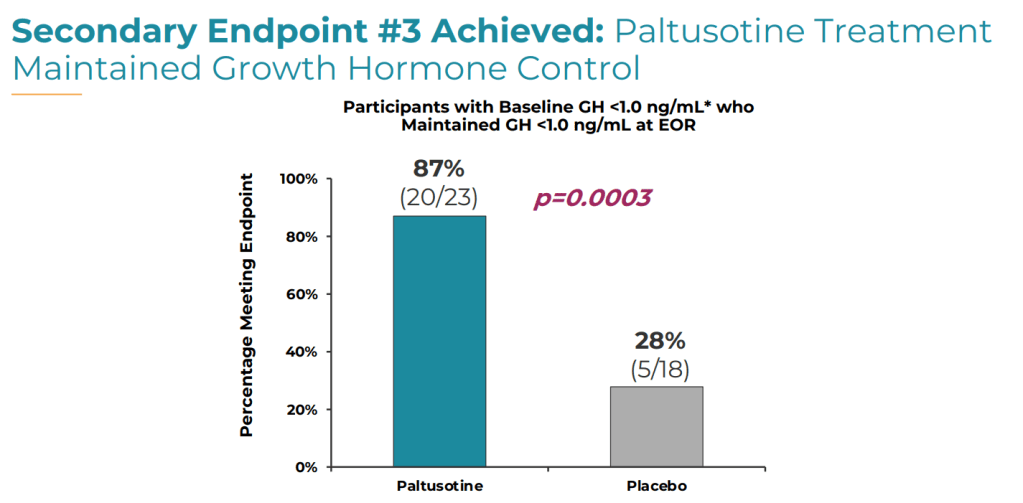

Additionally, investigators observed significant improvements in three key secondary endpoints:

1. Mean change from baseline IGF-1 level (0.04x ULN vs. 0.83x ULN; P <.0001)

2. Mean change from baseline in Acromegaly Symptoms Diary Score (-0.6 vs. 4.6; P = .02)

3. Proportion of patients who maintained GH levels below 1.0 ng/mL (20 [87%] vs. 5 [18%]; P = .0003).

Data from PATHFNDR-1 also indicated that paltusotine was well-tolerated, with no reports of serious or severe adverse events among participants treated with the drug. The most commonly reported treatment-related side effects included arthralgia, headache, diarrhea, abdominal pain, and nausea, each reported in fewer than 30% of treated patients.

While awaiting a comprehensive, peer-reviewed analysis of PATHFNDR-1, to be presented at upcoming scientific conferences, Crinetics executives and investigators expressed their enthusiasm for these significant outcomes. They believe that paltusotine, if approved, could provide a much-needed, simple, oral, once-daily therapy for acromegaly patients, reducing the burden of injections. The company intends to seek regulatory approval as quickly as possible, pending the completion of the PATHFNDR-2 study early next year.

Reference:

Sherwood, A. (2023, September 10). Crinetics’ once-daily oral paltusotine achieved the primary and all secondary endpoints in the Phase 3. Crinetics Pharmaceuticals – Developing Therapies for Rare Endocrine Diseases.

The initial findings of a Phase 2 study have shown that the investigational drug paltusotine may significantly reduce both the frequency and intensity of bowel movements and flushing symptoms experienced by those living with carcinoid syndrome.

In addition to reducing two of the key symptoms of the syndrome, the results of the study showed that paltusotine was well-tolerated by trial participants, according to Crinetics Pharmaceuticals, Inc., which developed and is testing the investigational compound.

Paltusotine is an oral, once-daily investigational compound being developed to treat carcinoid syndrome as well as the hormonal disorder called acromegaly.

The paltusotine trial consists of a randomized treatment phase followed by a long-term extension phase. During the open-label treatment phase of the study, 36 participants were randomized to receive either 40 mg or 80 mg of paltusotine daily.

The initial trial findings indicate that:

- Paltusotine resulted in a 65% reduction in bowel movement frequency and 65% reduction in flushing episodes, a finding consistent with prior clinical studies

- Paltusotine was generally well-tolerated, with a safety profile consistent with prior clinical studies

- There were no treatment-related severe or serious adverse events

- The majority of treatment-related adverse events were mild-to-moderate

- The most frequently reported adverse events included diarrhea, headache, and abdominal pain.

Crinetics Pharmaceuticals, Inc., focuses on the discovery, development and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors. The company expects to complete the treatment phase of the study in the first quarter of 2024 before moving into phase 3 trial.

Crinetics Pharmaceuticals’ oral med paltusotine regulated levels of a hormone associated with the pituitary gland disorder acromegaly in a phase 3 test, setting up a regulatory submission for the second half.

Paltusotine met the primary endpoint of the PATHFNDR-2 trial with 56% of the 111 participants achieving an insulin-like growth factor 1 (IGF-1) level less than or equal to 1 time the upper limit of normal compared to those on placebo, where just 5% of patients met the mark, according to a Tuesday press release.

Acromegaly is a rare hormone disorder caused by a benign tumor in the pituitary gland that secretes growth hormone, causing excess secretion of IGF-1 from the liver. This can lead to bone, joint, cardiovascular, metabolic, cerebrovascular or respiratory diseases. Symptoms include abnormal growth of hands and feet, enlargement of heart, fatigue, sleep apnea, severe swelling and other complications.

Surgical removal of the tumors is the standard initial treatment for most patients, but therapies are needed for patients without this option or when surgery is unsuccessful. This accounts for about 50% of patients, Crinetics said. Patients are traditionally offered injectable depot somatostatin analogues, but Crinetics wants to offer an easier treatment option with a daily oral med.

Paltusotine also met the key secondary endpoints of the late-stage test, including change from baseline in IGF-1 levels, change in acromegaly symptoms and regulation of growth hormone, among others.

“This study demonstrates that paltusotine can provide both symptom control as well as biochemical control in patients who are not currently on pharmacologic treatment. If approved, the prospect that paltusotine can offer an innovative, once-daily oral alternative represents a significant step forward in improving the treatment experience for patients,” said principal study investigator Monica Gadelha, M.D., Ph.D., professor of endocrinology at the Medical School of the Universidade Federal do Rio de Janeiro.

The therapy was well tolerated, and no serious adverse events were reported in patients who received paltusotine, Crinetics said. Treatment-emergent adverse events were comparable across the treatment and placebo arms, with the most common events reported being diarrhea, headache, joint pain and abdominal pain.

Crinetics plans to submit an approval request for paltusotine in acromegaly in the second half of the year, with a potential launch to follow in 2025.

The PATHFNDR program includes two phase 3 studies. PATHFNDR-1 previously showed that paltusotine maintained IGF-1 levels in patients who switched from monthly injectable medications, backing up earlier phase 2 studies.

This is the second time this month Crinetics has announced a clinical trial win, after the same drug met the main goal of a phase 2 trial for carcinoid syndrome. Paltusotine led to “rapid and sustained reductions in flushing episodes and bowel movement” in patients with the neuroendocrine tumor.

Crinetics’ shares were trading up 13% premarket Tuesday to $42.86 compared to $37.93 at close Monday.

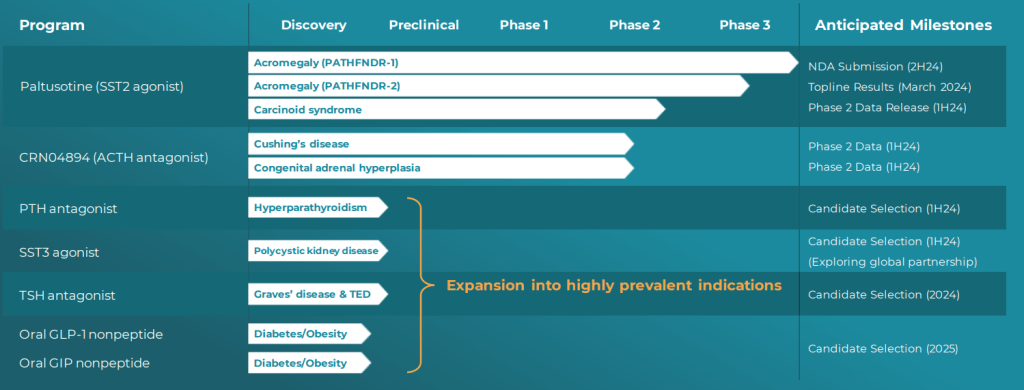

현재 Crinetics Pharmaceuticals의 파이프라인은 아래와 같습니다.

자세한 내용은 2024년 2월에 발표한 Corporate Presentation에서 확인할 수 있습니다. 금년 하반기에 Paltusotine의 NDA Filing을 하고 2025년에 FDA 승인을 받아서 상용화를 하겠다는 계획입니다. 2008년 그 어려운 어둠의 시기를 잘 견디고 이제 Benign tumor 환자들에게 매주 주사를 맞으러 병원에 가지 않고 매일 한번씩 복용하는 알약을 선사할 날이 가까이 온 것 같습니다.