(Picture: Roger G. Ibbotson, PhD, Yale University)

안녕하세요 보스턴 임박사입니다.

생애주기 자산관리 (Lifetime Asset Management) 에 대해서 요즘 공부를 하고 있는 중입니다. 제가 언젠가 CFP가 되기 위한 것이기도 하지만 제 스스로가 현직에 있을 때 준비를 미리하는 것이 중요하다는 인식에서 비롯되기도 했습니다.

시니어 재정관리에 대한 여러가지 SNS에 돌아다니는 다양한 이야기나 정보들이 있지만 결국 원본을 찾아보면 미국 CFA Institute (재정전문가 연구소, Certified Financial Analyst Institute)의 자료들이 아닐까하고 생각합니다. Yale University의 Roger G. Ibbotson 교수는 Lifetime Asset Management에 대해 오랜기간 연구를 해 오신 분으로 Ibbotson Associates라는 회사를 만들어서 운영하시다가 2005년에 $80 Million에 인수되어 현재는 Morningstar의 사업부로 있습니다. 그는 Zebra Capital Management LLC이라는 Hedge Fund의 Founding Partner이기도 합니다.

Ibbotson Associates, an investment research and data firm that is now part of the financial data giant Morningstar, Inc. (NASDAQ: MORN; mid-2019 market cap $6 billion), was founded in 1977 by Roger Ibbotson, then a young University of Chicago professor. I was its first employee, in 1979. Ibbotson gave me some “office space” on his floor. He’s an early riser and I’m a night owl, so when he left in the early afternoon, I took over his desk. Eventually, we rented some office space in downtown Chicago.

Ibbotson, with his co-author Rex Sinquefield, had recently completed one of the oddest projects I had ever heard of: collecting data on capital market returns going back to 1926, so that the authors could compare the historical returns on stocks, bonds, “bills” (cash-like, short-term U.S. Treasury obligations), and inflation (that is, a hypothetical asset returning the rate of increase of the Consumer Price Index) – SBBI for short. The research had made the two authors famous at a young age, but it was not clear how to commercialize the information. Among other things, my job was to help Roger update, enhance, and promote the SBBI database and the ideas that accompanied it.

Why was this information useful? For one thing, while investors had been investing in these assets, or assets resembling them, for centuries, nobody knew what rate of return to expect from them. They didn’t even know what rate of return had been earned on them in the past! Ibbotson and Sinquefield’ Stocks, Bonds, Bills, and Inflation answered this latter question, at least over the roughly 50-year period for which we were able to collect data.

Turning historical information into forecasts

And, by inference (and a little simple math), Ibbotson and Sinquefield were able to transform the historical returns into forecasts by assuming that the relationships between the assets’ returns, what they called risk premiums, would be the same in the future – on average – than they were in the past. Only the base rate – the interest rate earned on U.S. Treasury bonds – needed to be adjusted for current market conditions.

At least, that was the hypothesis on which Ibbotson and Sinquefield relied at the time. More recent developments have suggested that risk premiums may be time-varying, for example low when the market is high (because you’re paying a high price for future earnings and dividends, causing future returns to be lower) and high when the market is low.

Bringing risk into the equation

This insight opened up an avenue for forecasting that had not existed before. Ibbotson and Sinquefield not only measured the average return on each asset class, and on the risk premiums – they also documented all of the monthly and annual returns. Doing so made it possible to measure the variability of returns, that is, the amount of risk for which investors were being rewarded, not just the size of the reward.

By “pricing” risk in this way, Ibbotson and Sinquefield not only estimated the mean or expected return on each asset class; they also forecast the whole distribution of potential future returns. They called these extrapolations probabilistic forecasts.

We were already used to probabilistic forecasts of the weather, but in investment finance this was something really new and different. Under Ibbotson and Sinquefield’s influence, probabilistic forecasts have become standard practice in financial planning. “You have an x% chance of earning at least y%,” a phrase that would have baffled most planners before Ibbotson and Sinquefield did their pioneering work, is now heard everywhere.

The emphasis on risk, on deviation from the expectation, is the most important benefit of this approach. And it is important to focus on downside risk – how much can you lose, and how does that compare to what you can afford to lose? – as well as how much you might gain from whatever amount of risk you’re taking.

Ibbotson Associates becomes a business

While the business was initially little more than a professor’s hobby, which made him a little money (and me a lot less), Ibbotson’s goal was to build a profitable going concern and perhaps even sell the business someday to a large financial data provider. We struggled at first to find a business focus; most of the revenue was from one-off, custom consulting jobs, the kind that professors often are asked to do.

But, one day, a young employee suggested printing the famous Ibbotson-Sinquefield historical return graph on a poster. (A sample poster is reproduced below.) The image later appeared on coffee cups, T-shirts, and in every high school economics classroom and every broker’s and financial planner’s office. More importantly, the underlying monthly return data were for sale on digital media, and the number of indexes (representing different asset classes and sub-classes around the world) grew from the original four to thousands. These are now available through Morningstar Direct, a service of Morningstar, Inc., the company that bought Ibbotson Associates in 2005 for about $80 million.

In addition, Ibbotson Associates provided 401(k) advice, one of the most marketable and valuable financial services. Such advice is used by employers to help their employees allocate among the various investment choices that are made available to them in their retirement savings plans. Ibbotson also developed optimizers (software for making portfolio choices); cost of capital estimators for appraisers, investment bankers, and regulated industries; and many other products that help professionals with investment decision-making. Ibbotson was “fintech” before fintech was a word!

Ibbotson Associates today

Roger Ibbotson, the founder, is now 76 years old, a professor in the practice of finance at the Yale School of Management, and the founding partner of a hedge fund called Zebra Capital. He is also on the board of Morningstar, where his “baby” is a strategic business unit with its own corporate identity. Ibbotson Associates has come a long way from my office on his floor.

Roger Ibbotson 교수님의 강의자료를 올립니다.

함께 나눌 연구자료는 책으로도 출간이 된 것인데 제목은 “Lifetime Financial Advice: Humqn Capital, Asset Allocation and Insurance” (2007)입니다.

먼저 이 책에서 얘기하는 중요한 내용을 정리하고자 합니다.

2장: 인적자본 (Human Capital) 과 금융자본 (Financial Capital)의 합이 총자본 (Total Wealth)가 되는데 25세를 시작점으로 (미국에서는 25세에 첫직장에 취직하기 때문) 25세에는 인적자본이 가장 최고치이고 금융자본은 가장 최저치에서 시작합니다. 나이가 들어감에 따라 인적자본은 점점 줄어들어서 (즉, 연봉의 시장성) 65세경이 되면 거의 최저가 되고 반대로 금융자본은 최고가 됩니다. 그리고 전체적으로는 총자본은 계속 상승한다는 원리입니다. 그러니까 젊을 때에는 인적자본을 극대화해서 돈을 열심히 벌고 일부를 저축 (투자) 해서 계속 금융자본을 축적하고 인적자본이 최저점에 이르렀을 때부터 금융자본으로 살 수 있도록 해야 한다는 것입니다.

3장: 인적자본을 활용해야 하는 젊은 나이에 가장 큰 리스크는 일찍 죽을 수 있다는 리스크가 있습니다. 이것을 Term Life Insurance (생명보험) 으로 헤징할 수 있다는 것을 얘기합니다. 생명보험의 가치는 사실상 40세를 넘어서면서 급격히 낮아집니다. 왜냐하면 인적자본의 가치가 상당히 줄어들기 때문입니다. (즉, 일할 수 있는 나이가 얼마 남지 않았다는 뜻).

4장: 인적자본이 소멸된 65세부터는 금융자본을 인출하면서 살아가기 때문에 금융자본이 점차 줄어들게 되고 50만불의 금융자본을 가지고 있다고 가정하고 매년 $5만불씩 인출을 한다고 하면 95세가 넘은 시점에서 거의 바닥이 나게 됩니다.

그런데 금융자본을 은퇴로 인해 인출할 때 세가지 리스크에 노출될 수밖에 없게 됩니다.

- 첫째, 금융시장 리스크 (Financial Market Risk): 은퇴시 금융시장이 크게 떨어지면 어떻게 하나?

- 둘째, 장수 리스크 (Longevity Risk): 내가 만약 너무 오래 살게 되어 말년에 돈이 부족하면 어떻게 하나?

- 셋째, 소비 불확실성 리스크 (Risk of Spending Uncertainty): 내가 과연 충분한 은퇴자금을 모았는지 어떻게 확신할 수 있는가?

이 세가지 리스크를 관리해야 하는데 아래와 같이 관리할 수 있습니다.

- 첫째, 금융시장 리스크: 서로 상관관계가 적은 자산군으로 포트폴리오를 만들어 금융시장 리스크를 헤징합니다.

- 둘째, 장수리스크: 소셜연금과 장수연금으로 헤징할 수 있습니다.

- 셋째, 소비 불확실성 리스크:

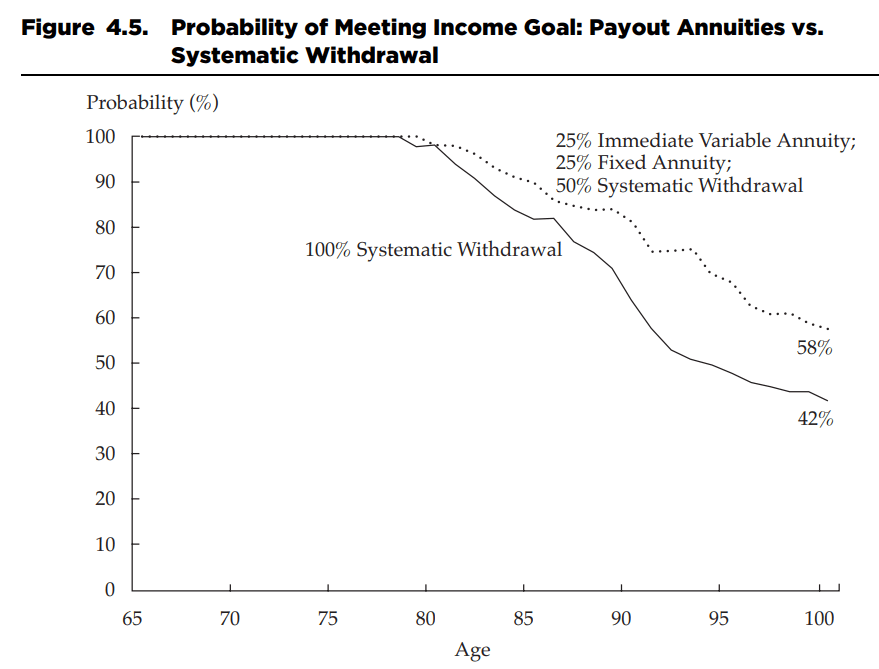

- 100%를 스스로 관리하며 인출하는 것보다 즉시연금, 고정비 연금과 스스로 인출하는 것을 적절히 병용함으로써 소비 불확실성 리스크를 헤징할 수 있습니다.

여기까지가 4장까지 요약입니다. 다음에는 5장부터 마지막장인 7장까지에 대해 정리하겠습니다.