(Picture: Edward M. Kaye, MD, CEO of Stoke Therapeutics)

안녕하세요 보스턴 임박사입니다.

Stoke Therapeutics는 Biogen/Ionis Pharmaceuticals의 Spinraza 개발에 참여한 Adrian Krainer 박사와 Isabel Aznarez 박사에 의해 2014년에 설립되었습니다.

Stoke는 TANGO (Targeted Augmentation of Nuclear Gene Output) Platform에 기반을 둔 Antisense Oligonucleotide 회사입니다. TANGO에 대해서는 2020년 Nature Communications에 발표를 했습니다.

Lead Compound인 STK-001에 대해서는 2020년 Science Translational Medicine에서 Mouse Model을 이용한 PoC 결과를 발표하였습니다.

Using their proprietary TANGO (Targeted Augmentation of Nuclear Gene Output) approach, Stoke Therapeutics is developing antisense oligonucleotides (ASOs) to restore protein levels selectively.

For decades, Adrian Krainer, professor at Cold Spring Harbor Laboratory (CSHL), has studied the mechanisms of RNA splicing, how they go awry in cancer and genetic diseases, and how to correct faulty splicing. Krainer’s lab has found that it is possible to stimulate protein production by altering mRNA splicing through the introduction into cells of chemically modified pieces of RNA called antisense oligonucleotides (ASOs).

In late 2016, one such molecule, nusinersen (sold by Biogen under the brand name Spinraza), became the first FDA-approved drug to treat spinal muscular atrophy (SMA) by injection into the fluid surrounding the spinal cord. Nusinersen was conceived and tested over several years in SMA mouse models by Krainer and his CSHL colleagues, in a long-standing collaboration with drug developers led by Frank Bennett PhD at Ionis Pharmaceuticals.

Two years earlier, in 2014, Krainer co-founded Stoke Therapeutics (Nasdaq: STOK) with Isabel Aznarez, PhD, to use their groundbreaking science targeting pre-mRNA splicing to develop precision medicines that treat genetic diseases. Headquartered in Boston, Stoke Therapeutics is a biotechnology company focused on upregulating protein expression with RNA-based medicines. Using a proprietary TANGO (Targeted Augmentation of Nuclear Gene Output) approach, Stoke is developing ASOs to restore protein levels selectively.

Stoke’s initial focus includes haploinsufficiencies and diseases of the central nervous system and the eye, although proof of concept for its proprietary approach has been demonstrated in other organs, tissues, and systems. Stoke’s first compound, STK-001, is in clinical testing for the treatment of Dravet syndrome, a severe and progressive genetic epilepsy. Dravet syndrome is one of many diseases caused by haploinsufficiency (in which a loss of ~50% normal protein levels causes disease).

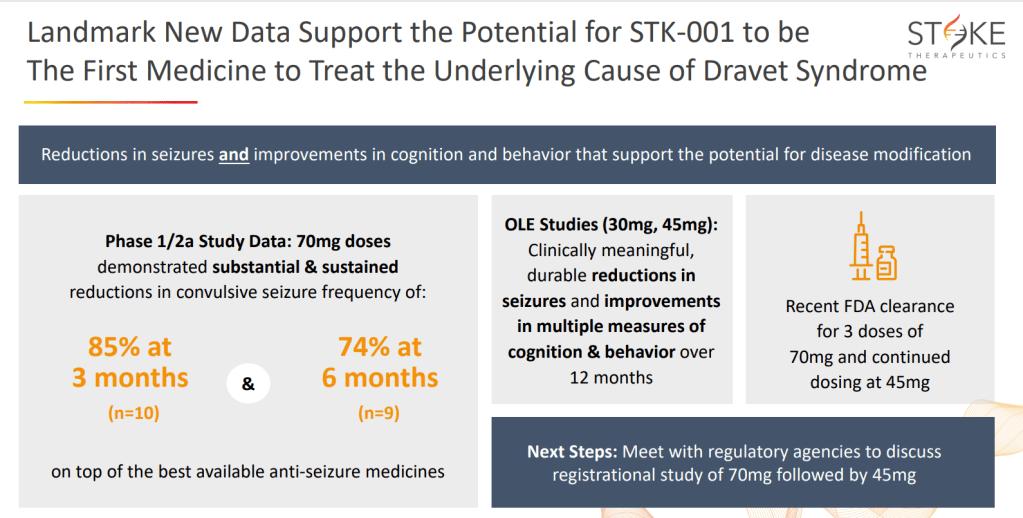

STK-001은 현재 임상1/2a상을 진행 중이고 가장 최근의 데이타는 몇일전에 발표되었습니다. 70mg을 받은 환자들은 3개월간 85%, 6개월간 74%의 높은 확률로 Seizure 빈도가 줄어들었고 30mg, 45mg을 받은 환자들의 경우 12개월간 인지 행동 측정결과 개선되고 Seizure 감소를 보였습니다. 이에 따라 FDA는 3 Dose (70mg, 2 x 45 mg)을 승인했습니다. 이 뉴스에 의해 오늘 주가가 거의 두배나 올랐습니다.

Stoke’s Early-Stage Data for Genetic Epilepsy Drug Sends Stock Skyrocketing – Biospace 3/26/2024

Stoke is also pursuing the development of STK-002 to treat autosomal dominant optic atrophy (ADOA), the most common inherited optic nerve disorder. In August 2022, Stoke enrolled the first ADOA patient in a two-year prospective clinical study.

STK-002에 대해서는 2022년 ASGCT 학회에서 발표한 바가 있습니다.

Stoke Therapeutics의 2024년 Corporate Presentation 자료를 올립니다. 현재 파이프라인은 아래와 같습니다. STK-001과 STK-002는 Stoke Therapeutics가 개발하고 Acadia와 공동개발하는 프로그램이 세개가 있습니다. Stoke Therapeutics가 개발하는 STK-001이 임상3상을 향해 가고 있습니다. 지난 10년간의 노력의 결실이 서서히 보이는 것 같습니다.

GEN Edge interviewed CEO and director Edward M. Kaye, MD, to learn how he was brought onto the leadership team at Stoke Therapeutics and the company’s latest progress treating rare genetic diseases with ASOs.

GEN Edge: Edward, what attracted you to be a part of Stoke Therapeutics?

Edward Kaye: I worked with Adrian on the Spinraza program when I was working with Genzyme. I got to know him as a scientist and respected his work. He called me and said we’ve got this new company interested in protein up-regulation using RNA splicing. I realized this is a fascinating approach to upregulating protein.

Most people have thought about upregulating proteins using messenger RNA (mRNA). There’s a lot of interest in mRNA because of vaccine development with Moderna. But one thing that is complicated with mRNA is that it breaks down immediately—all these endonucleases break it down. Getting it delivered into a cell to express a protein was challenging. It worked for things like vaccines because lymphocytes immediately took it up. However, other indications were a lot more challenging. Certainly, gene therapy is a way to upregulate a missing protein permanently. Still, the challenge is to deliver the exact amount of protein in the right cells using the current number of capsids and our gene therapy mechanisms.

This is a good approach to correct autosomal dominant diseases, where you’re missing 50% of the protein (haploinsufficiency). As a pediatric neurologist and biochemical geneticist, this was something that had stymied me. Most of the diseases we worked on were recessive diseases. At Genzyme, we avoided the dominant diseases! But now there’s an approach that we can titrate the exact amount of protein. We can take it from 50% to 100% and hopefully restore that protein and have a biological effect on the disease. It was an interesting opportunity to go after a set of previously difficult diseases.

I decided that this was too interesting of a scientific platform to miss out on, and I joined the company and came in as CEO in 2017. It’s been a fun experience going after new targets, especially since we are focused on rare diseases, most of which are pediatric. It was in my wheelhouse.

GEN Edge: Why go after pediatric CNS diseases?

Kaye: I had taken care of patients with Dravet syndrome and realized this was a challenging disease. I experienced firsthand that it’s more than just a seizure disorder. Dravet syndrome is considered one of the more common genetic seizure disorders. But when you take care of these patients, there’s more than simply seizures. There are other aspects of the disease, such as behavioral problems: sleep, gait, and speech problems. These children reach a period of stagnation in their development; for the first couple of years of life, they seem to be developing quite typically, and then they stop progressing.

That was as upsetting to families as the seizures. The treatments are anti-epileptic, which is fine, and they treat seizures. But they need to address the other aspects. Treating genetic epilepsy by going after the primary genetic cause seemed to be a very reasonable approach. In other words, if you’re missing the sodium channel and could upregulate that sodium channel to get it back up to a hundred percent, it should significantly improve these patients. That was the hypothesis that we had developed. We’re in the clinic now, and we can demonstrate that that is the case.

GEN Edge: How does delivery go into the choice of drug modality for pediatric CNS diseases?

Kaye: One of the reasons why we decided to go after the CNS is that antisense oligonucleotides (ASOs) are indeed quite good, but they don’t get into every organ or every cell type. Adrian had shown with Spinraza that if you deliver ASOs by intrathecal delivery, you get nice biodistribution throughout the brain. So, that was already precedent with the use of Spinraza. We knew we could get into very diffuse parts of the brain by giving an intrathecal administration. It does not work with this particular ASO if you give it systemically because it doesn’t cross the blood-brain barrier. You could get nice delivery into the eye with an intravitreal injection. One of the reasons why we focused on the CNS and the eye was a delivery issue.

That doesn’t mean we wouldn’t go after other organs and diseases. But we would have to have a delivery mechanism that went into those organs and tissues. Stoke has a whole program where we look at different ASO-backbone chemistries for delivery. We’ve looked at conjugation with fatty acids or antibodies. We are exploring and looking at other tissues that have already been demonstrated. One is the kidney. The other tissue is the lung. Others have demonstrated that if you give ASOs by an aerosol delivery, it gets into many parts of the lung. We’ve thought about muscle and heart, but we have to have a different delivery system. Several companies we’ve talked to have systems that might be amenable to us.

We also look at the TANGO signature. Only some genes have the TANGO signature. Specific genes are easy to regulate where you have a lot of RNA messages that are non-productive that you can turn into productive. Each gene and each disease is different. We go through a rigorous process before we decide on a new therapeutic area or target we want to go after.

GEN Edge: How does Stoke Therapeutic manufacture ASOs?

Kaye: We use a couple of contract manufacturers and go through a fairly rigorous process to audit other companies. One nice feature about using ASOs is that there’s been a lot of work done on manufacturing. There are a lot of contract manufacturers that can make these, so we don’t have to manufacture them ourselves. It’s not that complex. It’s not like gene therapy, which is very complicated.

You have to deal with the percentage of empty versus full capsids. Many companies have said this is important, and we have to do it ourselves. But that’s a massive investment. I remember looking at gene therapy when I was at Genzyme. We figured out this’s a half-billion-dollar investment to invest in a manufacturing facility to do it right.

If you can contract out and have quality manufacturers know how to do it, why reinvent the wheel if you don’t have to while spending money. So, that’s a fortunate thing for us that we can use contract manufacturers to make our product. The cost of goods is certainly much less than what you’d have to spend on things like gene therapy, which are costly and difficult to make.

GEN Edge: What milestones does Stoke Therapeutics have in its sights?

Kaye: Dravet syndrome is a major focus right now. We hope to get data from our Phase II that will inform us of the trial design for Phase III. We want to demonstrate proof of concept in humans with Phase II and then go on to Phase III, a placebo control study for registration and commercialization. That’s step number one.

We also plan to be in the clinic with our next program next year. That would be for dominant optic atrophy, the leading genetic cause of optic atrophy. This is similar to Dravet in that it’s a nonsense mediate decay (NMD) exon. You’re missing 50% of the OPA1 protein —an essential protein for mitochondrial function and structure.

These children are born with normal vision. Then, somewhere at the end of the first decade of life, typically in school when they have a vision test, they find out that their vision is affected and can’t be corrected by glasses. It’s a non-refractive error. Then you get sent to an ophthalmologist or a neuro-ophthalmologist, and somebody picks up that there’s optic atrophy, which is just a whiteness or a power of the optic nerve. Because these retinal ganglion cells are very energy dependent, they slowly die. But it’s a very slowly progressive process that takes decades.

If somebody finds out they have optic atrophy and are unsure why, they can undergo standard testing. People are currently being tested and explicitly diagnosed with autosomal dominant optic atrophy. But again, we’ve demonstrated recently that you can get the ASOs into those retinal ganglion cells. More importantly, we’ve shown that we can regulate protein very nicely—and even more importantly, we can improve oxidative phosphorylation in these cells. It is a good demonstration that we can get the ASO where we want it to be, and it has an effect. We like that one and expect to be in the clinic next year with that program and move that along.

We also have a collaboration with Acadia. That’s a program where we have three targets that we’ve identified, two of which we’ve announced publicly. One is Rett syndrome—a fairly common progressive disease that includes not only epilepsy but also autistic spectrum and a neurodevelopment problem. The other is genetic epilepsy. But more importantly, it has a big neurodevelopmental component to it. With both or at least one of these programs, we’d like to address some of these progressive diseases’ neurologic problems.

Rett syndrome is very similar. There are affected girls, and there could also be more severely affected boys that appear normal. In the first few years of life, they start to have these atypical movements in this progressive autistic spectrum disorder. There’s certainly evidence in mouse models that you probably can arrest this progression again if you can replace that protein, MECP2, which is a critical protein for brain function. That would lead to [therapeutic programs for] not only epilepsy but nerve developmental disorders.

There’s a host of haploinsufficient diseases that affect cognition, so that could be a fascinating area for us too. Nobody has cracked that. No one has gone after these developmental disorders. Based on animal work, we now know that it’s not all prenatally determined that this disorder continues to progress. Especially something like Rett syndrome, where these girls are quite normal at birth and then seem quite normal for four to six years, and then suddenly have this deterioration. So if you can identify these early, I think we could also affect some of these symptoms.

This has been a challenging time for small- and mid-cap companies, but we saw this coming two years ago, I thought it would happen a year earlier, but we went public, did financing, and used our at-the-market (ATM) offering. Part of it was to develop a war chest to survive the downturn. We have enough cash to get us into 2025, which is a nice position. We’re not worrying about running out of money. We’re just focused on trying to ensure we do the best science.

Antisense player Stoke Therapeutics picks up $40M series A – Fierce Biotech 1/4/2018

Stoke Therapeutics completed a series A round to support the development of its antisense approach to boost gene expression and treat disease caused by genetic insufficiency.

Apple Tree Partners ponied up the $40 million, which will drive Stoke’s antisense oligonucleotide preclinical development programs. The company’s focus is upregulating RNA splicing to ramp up production of messenger RNA that can be translated into protein.

“Stoke Therapeutics represents a bold step forward in opening up a vast new area of drug development focused on upregulation of gene expression,” new CEO Ed Kaye, who takes the helm in the briefest of periods after leaving his former DMD biotech Sarepta, said in a release. “By restoring gene dosage using target-specific antisense approaches, we have the opportunity to create a new way of treating diseases that are not amenable to enzyme replacement, gene therapy or other existing modalities.”

Stoke licensed its tech, dubbed Targeted Augmentation of Nuclear Gene Output (TANGO), from scientific founder Adrian Krainer of Cold Spring Harbor Laboratory.

“Our plan for 2018 is to identify at least three preclinical programs that we can bring for IND studies in 2019,” Kaye said.

“Right now, we are focusing on the central nervous system,” he said. “We are looking at some of the genetic epilepsies and also some of the autosomal dominant forms of blindness. … We are looking at other organs, but those [programs] are not as well-developed at this time.”

The company will initially zero in on diseases caused by a single malfunctioning gene, but TANGO could potentially be used to modulate a nonmutated gene in order to halt or reverse disease progression, the company said.

“We’re focusing on smaller indications and on organs we think we can handle as a small company, but I think the potential for this platform could be much larger,” Kaye said.

“We are tremendously impressed by the broad potential of this approach to address so many debilitating diseases and have assembled the team, platform and funding to thoroughly exploit this opportunity,” said Seth L. Harrison, M.D., founder and managing partner of Apple Tree Partners and chairman of the Stoke board of directors.

Stoke joins Atlantic Healthcare and Ionis Pharma in the antisense field. The former kicked off a rolling FDA submission for its inflammatory bowel disease candidate in May, while the latter recently licensed a second gastrointestinal antisense drug to J&J’s Janssen.

Stoke Therapeutics nabs $90M series B for oligonucleotide work – Fierce Biotech 10/23/2018

Stoke has completed a meaty $90 million second funding round as the startup eyes getting its leading candidate into the clinic by 2020.

The Bedford, Massachusetts-based biotech said it will also push on with work across its pipeline of antisense oligonucleotide medicines in other severe genetic diseases.

The financing round was led by RTW Investments with help from founding investor Apple Tree Partners. New investors include RA Capital Management and Cormorant Asset Management, as well as a host of others.

This builds on the $40 million series A it grabbed back at the start of the year. Stoke licensed its tech, dubbed Targeted Augmentation of Nuclear Gene Output (a.k.a. TANGO), from scientific founder Adrian Krainer of Cold Spring Harbor Laboratory.

Stoke said it has “identified thousands of genes that could be addressed” by its TANGO tech, which targets nonproductive RNA splicing to increase gene expression, aimed at getting to the heart of monogenic diseases caused by loss or reduction of gene function.

The company said it is “rapidly advancing” its lead program in Dravet Syndrome, a rare, lifelong form of epilepsy that begins in the first year of life with frequent and/or prolonged seizures. Current treatment options are limited, and patients with Dravet face a 15-20% mortality rate, according to the Dravet Syndrome Foundation.

Its early-stage pipeline also includes drugs targeting other diseases of the central nervous system, as well as diseases of the eye, ear, liver and kidney.

“Our technology is designed to address, for the first time, the genetic cause of diseases like Dravet Syndrome so we can do more than alleviate symptoms—we can potentially prevent the long-term disabling consequences of these diseases,” said Ed Kaye, M.D., CEO of Stoke, and former Sarepta chief. “We are delighted to have the support of such an outstanding group of crossover investors to speed our progress toward the clinic.”

Stoke joins Atlantic Healthcare and Ionis Pharma /Akcea in the antisense field, with the latter getting approvals earlier this year for its effort in Tegsedi (inotersen injection), an antisense oligonucleotide for certain patients with the rare disease hereditary transthyretin amyloidosis (hATTR), as well as Biogen’s SMA drug Spinraza.

Stoke Therapeutics raises $163.3M in Nasdaq IPO – S&P Global 6/21/2019

Stoke Therapeutics Inc. closed its planned IPO on the Nasdaq Global Select Market, raising gross proceeds of about $163.3 million.

The company sold 9,074,776 shares at $18 apiece, including 1,183,666 shares that were sold upon full exercise of the underwriters’ option.

The Bedford, Mass.-based company started trading on the Nasdaq under the ticker STOK on June 19.

Stoke Therapeutics has said earlier that it would use the proceeds for a phase 3 clinical development of its lead product candidate STK-001 to treat Dravet syndrome, a type of epilepsy with seizures often triggered by high body temperatures or fever. The funds would also go toward conducting preclinical studies for other product candidates.

J.P. Morgan Securities LLC, Cowen and Co. LLC and Credit Suisse Securities (USA) LLC acted as joint book-running managers, while Canaccord Genuity LLC acted as lead manager for the offering.