(Picture: Athena Countouriotis, MD, Co-Founder & CEO of Avenzo Therapeutics and Mohammad Hirmand, MD, Co-Founder & CMO of Avenzo Therapeutics)

안녕하세요 보스턴 임박사입니다.

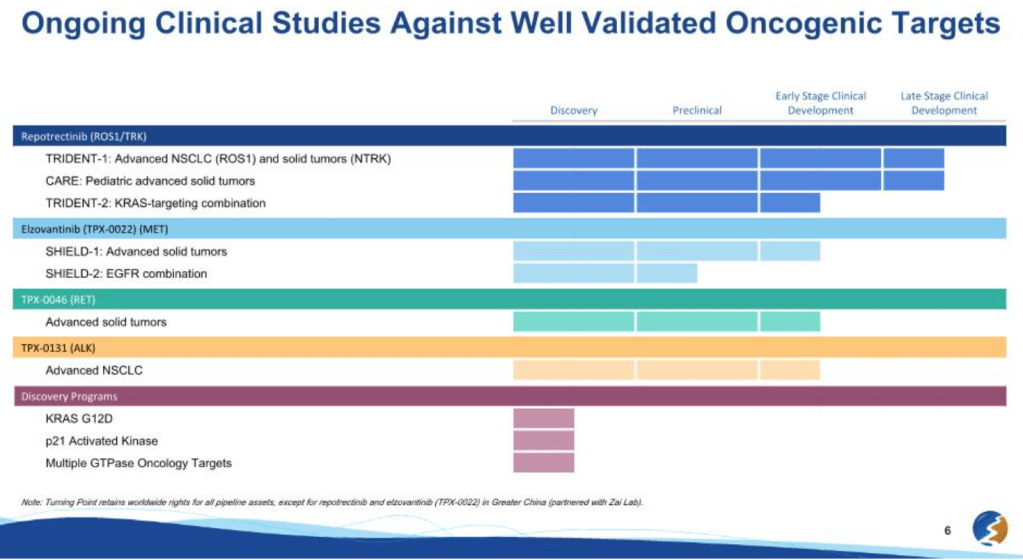

2022년에 Bristol Myers Squibb은 Turning Point Therapeutics를 122% 프리미엄인 $4.1 Billion에 인수했습니다. 당시 여러 파이프라인이 있었지만 Repotrectinib (ROS1/NTRK Inhibitor)가 M&A의 중심약물이었습니다.

Eyeing a rivalry with Roche and a new cancer asset slated to hit the markets next year, Bristol Myers Squibb is picking up Turning Point Therapeutics in a $4.1 billion acquisition.

BMS will gain access to repotrectinib, a midstage candidate in testing for first-line lung cancer as a potential competitor to Roche’s Rozlytrek. The Big Pharma landed Turning Point for $76 per share, with both companies’ boards approving the transaction that is slated to close in the third quarter.

The buy will bolster BMS’s medium- to long-term growth strategy, providing a pipeline of precision oncology medicines that target common mutations that cause the growth of cancer cells. The star is of course the lead asset repotrectinib, a next-generation tyrosine kinase inhibitor that targets the ROS1 and NTRK gene mutations—just like Rozlytrek.

The Roche med, which was approved in 2019, brought in 16 million Swiss francs ($16.6 million) for the Swiss pharma in the first quarter, a 78% increase over the same quarter a year before. The therapy is approved in a type of mutated non-small cell lung cancer (NSCLC), solid tumors and ROS1-positive, advanced non-small cell lung cancer.

Repotrectinib has earned three breakthrough-therapy tags and has demonstrated a longer duration of response compared to existing ROS1 agents in first-line NSCLC during a phase 1/2 trial. Other studies involving the med include late-stage adult and pediatric advanced solid tumor trials and an earlier stage KRAS-targeting combination study.

The therapy is expected to be approved in the U.S. in the second half of 2023, according to BMS. The Big Pharma will also “explore the potential” of Turning Point’s other candidates, which include the solid tumor therapies elzovantinib and TPX-0046.

Turning Point President and CEO Athena Countouriotis, M.D., said with BMS’ commercial capabilities and manufacturing footprint, the biotech can accelerate efforts to bring its medicines to patients. BMS CEO Giovanni Caforio, M.D., meanwhile, said the acquisition continues the company’s “strong track record of strategic business development to further enhance our growth profile.”

SVB Securities analysts said the deal represents a 122% premium from Turning Point’s previous close of $34.16. But the shares skyrocketed upward Friday afternoon on the news of the deal to $74 apiece—a 116% increase and a gain of nearly $40. This reflects SVB Securities’ expectation of “little resistance from investors” given the tough biotech markets and the fact that many companies are trading at or below cash.

The firm predicts the market potential for repotrectinib to be $1.14 billion in the first-line setting and $455 million in the second line at peak. But this may take a few quarters after launch, into 2024, to realize. Turning Point is expected to meet with the FDA soon to discuss the filing, which could occur by the end of the year.

During that meeting, Turning Point is expected to get clarity on whether an accelerated approval might be an option for repotrectinib and whether the therapy could be submitted for a “line agnostic” ROS-1 indication, meaning it could be used at whatever stage of treatment for patients with the matching gene mutation. The company will also learn whether any confirmatory or post-approval studies will be needed, which is the case when an accelerated approval is granted.

“While we are not privy to the specifics of the deal or [Bristol’s] expectations for this meeting, we think it is unlikely to derail the deal given that the drug has three breakthrough therapy designations, suggesting that the agency views the compound as significantly differentiated,” SVB Securities wrote.

BMS has several therapies approved or in development for NSCLC, including Opdivo, Yervoy, Opdualag and CC-90011; however, SVB Securities does not believe this will raise any antitrust red flags given none of those target ROS1.

Repotrectinib (ROS1/NTRK Inhibitor)는 2023년말에 FDA 승인을 받아서 Augtyro라는 브랜드명으로 판매되고 있습니다. 이로써 Turning Point Therapeutics 팀의 실력이 입증된 셈입니다.

FDA approves repotrectinib for ROS1-positive non-small cell lung cancer – FDA Release 11/16/2023

On November 15, 2023, the Food and Drug Administration approved repotrectinib (Augtyro, Bristol-Myers Squibb Company) for locally advanced or metastatic ROS1-positive non-small cell lung cancer (NSCLC).

This is the first FDA approval that includes patients with ROS1-positive NSCLC who have previously received a ROS1 tyrosine kinase inhibitor (TKI), in addition to patients who are TKI naïve.

The full prescribing information for Augtyro will be posted here.

Approval was based on TRIDENT-1, a global, multicenter, single-arm, open-label, multi-cohort clinical trial (NCT03093116) which included patients with ROS1-positive locally advanced or metastatic NSCLC. Efficacy was evaluated in 71 ROS1 TKI-naïve patients who received up to 1 prior line of platinum-based chemotherapy and/or immunotherapy and 56 patients who received 1 prior ROS1 TKI with no prior platinum-based chemotherapy or immunotherapy.

The major efficacy outcome measures were overall response rate (ORR) and duration of response (DOR) according to RECIST v1.1 as assessed by blinded independent central review. Confirmed ORR in the ROS1 TKI naïve group was 79% (95% CI: 68, 88) and 38% (95% CI: 25, 52) in those patients receiving prior treatment with a ROS1 inhibitor. Median DOR was 34.1 months (95% CI: 25.6, not evaluable) and 14.8 months (95% CI: 7.6, not evaluable) in the two respective groups. Responses were observed in intracranial lesions in patients with measurable CNS metastases, and in patients with resistance mutations following TKI therapy.

The most common (>20%) adverse reactions were dizziness, dysgeusia, peripheral neuropathy, constipation, dyspnea, ataxia, fatigue, cognitive disorders, and muscular weakness.

The recommended repotrectinib dose is 160 mg orally once daily with or without food for 14 days, then increased to 160 mg twice daily, until disease progression or unacceptable toxicity.

This review used the Assessment Aid, a voluntary submission from the applicant to facilitate the FDA’s assessment.

This application was granted priority review, breakthrough designation, and fast track designation. FDA expedited programs are described in the Guidance for Industry: Expedited Programs for Serious Conditions-Drugs and Biologics.

Repotrectinib (ROS1/NTRK Inhibitor)의 FDA 승인이 있기 전에 Turning Point의 CEO와 CMO였던 Athena Countouriotis 박사와 Mohammad Hirmand 박사는 Avenzo Therapeutics를 설립하고 Orbimed, SR One, Lilly Asia Ventures 등 굵직한 VC의 펀딩으로 $200 Million Seed & Series A round를 마칩니다. Avenzo의 비즈니스 모델은 초기 oncology small molecules, ADCs 등을 확보하는 것이고 중국 바이오텍으로 부터 중국 이외의 권리를 인수해서 속히 나스닥에 상장하고 약물을 성공시킨다는 전략입니다.

The crew at Turning Point Therapeutics is back together for a new biotech that wants to acquire early-stage oncology small molecules, including antibody drug conjugates, and potentially form partnerships with China-based drug developers for ex-China rights as it eyes a speedy leap onto the Nasdaq around this time next year, CEO Athena Countouriotis told Endpoints News.

After selling Turning Point to Bristol Myers Squibb, announced at the onset of last year’s ASCO confab, she and colleague Mohammad Hirmand founded Avenzo Therapeutics. The CEO and CMO already have approximately $200 million in seed and Series A financing from five big-name investors to evaluate which drugs to bring into its pipeline. That includes SR One, OrbiMed, Foresite Capital, Citadel’s Surveyor Capital and Lilly Asia Ventures. Bidding wars for assets have led Avenzo to miss out on some deals in recent months, but the biotech has three active term sheets and hopes to bring in its first asset in the third quarter, Countouriotis said in a Friday morning interview.

Following that deal, Avenzo will likely look to raise a Series B of similar size before going onto the Nasdaq, for which the startup already has a ticker symbol in mind, the CEO said. She has invested in the company herself and named it after her two children, Ava and Enzo.

Conversations are already underway with companies that no longer have clinical plans for certain therapeutic candidates or are cash-constrained, Countouriotis told Nasdaq in a recent interview. With the help of Lilly Asia Ventures, Avenzo will also scour ADC opportunities in China, where recent deals have come together for Duality Biologics with BioNTech and MediLink Therapeutics with Zai Lab. The one area Avenzo is shying away from is cell and gene therapy, the CEO said, noting the manufacturing spending required.

Avenzo’s story seems rare today, but has the hallmarks of 2020-2021 biotech ambitions: quick financing, blue-chip VC firms coming together to back executives with IPO and M&A chops, assets that haven’t been through much clinical testing and a speedy flip onto the public markets.

Avenzo’s path also sounds familiar to Acelyrin’s: raise massive private rounds to bankroll the licensing of other companies’ drugs and then take them through the clinic. Earlier this month, Acelyrin, led by former Horizon Therapeutics executives, went public in one of biopharma’s largest IPOs in years.

Speaking with Nasdaq, Countouriotis said San Diego-based Avenzo is still in “stealth mode,” a term used endlessly in biotech circles. With eight employees in Avenzo’s infancy, the CEO hopes to grow the company like she did at Turning Point, which went public in 2019 and then sold for $4.1 billion last summer, growing from less than 20 employees to 300-plus during her tenure.

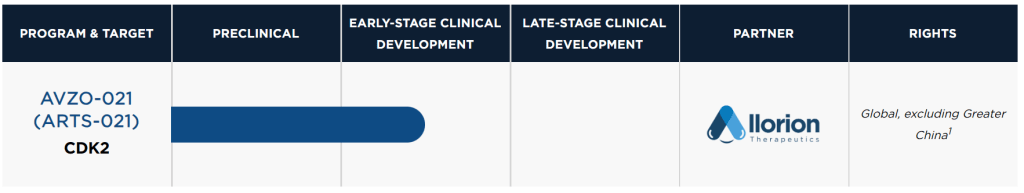

전략대로 중국의 Allorion Therapeutics로 부터 임상1상에 있는 CDK2 blocker AVZO-021을 $40 Million upfront & $1 Billion total 가격으로 인수합니다.

Avenzo Therapeutics, Merck KGaA and AbbVie each inked new deals to top up their cancer pipelines, with the former two companies handing over a combined $85 million in upfront cash.

Avenzo disclosed Thursday that it has locked arms with Allorion Therapeutics, snapping up ex-Greater China rights to the early-stage CDK2 blocker AVZO-021. The enzyme has been shown to hamper the impact of CDK4 or CDK6-targeting therapies in patients with HR-positive/HER2-negative breast cancer and can drive tumor development in other kinds of cancers, according to Avenzo. The med is currently in a phase 1 trial in patients with breast cancer and other patients with solid tumors. Avenzo can also tack on a preclinical asset from Allorion slated for IND submission in early 2025.

In exchange, Avenzo is paying Allurion $40 million upfront with more than $1 billion in biobucks attached to milestones for both AVZO-021 and the preclinical program. The money comes from nearly $200 million in funds raised in the middle of 2023, thanks to the likes of Lilly Asia Ventures and SR One.

Avenzo is the latest venture from ex-Turning Point CEO Athena Countouriotis, M.D., who helped lead a $4.1 billion buyout from Bristol Myers Squibb in June 2022.

Avenzo wasn’t the only biotech to hit the dealmaking trail, with Merck KGaA tacking on ex-US licensing rights to Inspirna’s phase 2 colorectal cancer med, ompenaclid. Inspirna has aimed the med specifically at patients with RAS-mutated, advanced forms of the cancer, showing at last year’s European Society for Medical Oncology annual meeting that the drug produced a 37% objective response rate in 30 evaluable patients. The median progression-free survival was 10.2 months in a slightly larger sample size of 41 patients.

The German pharma is paying $45 million upfront with an undisclosed amount of biobucks on the table. Merck also has the option to co-develop and co-commercialize the med in the U.S. alongside Inspirna.

Last but certainly not least, AbbVie, fresh off its end-of-the-year shopping spree, is heading back to the deal well, this time for Umoja’s cell therapies. The top prize is licensing rights to Umoja’s lead in-situ candidate UB-VV111, currently in IND-enabling studies. The asset is the first test of Umoja’s in-vivo CAR-T, aiming to break some of the limitations associated with current autologous manufacturing processes. Umoja plans to ask regulators to enter a phase 1 trial in the first half of this year.

The second part of the deal is a larger discovery pact for up to four additional in-situ candidates, aimed at targets selected by AbbVie. All told, Umoja received both an undisclosed upfront payment and equity investment, with $1.4 billion in milestone payments available.

AVZO-021을 인수하고 2달이 지나서 $150 Million Series A-1을 받았습니다. 이번에는 Sofinnova가 들어왔습니다. AVZO-021은 기존 CDK4/6 inhibitor에 저항성을 가진 환자들을 대상으로 한다는 전략입니다.

Avenzo Closes $150M Oversubscribed Series A-1 to Advance Cancer Therapies – Biospace 3/27/2024

San Diego-based Avenzo Therapeutics on Tuesday announced that it has closed a $150 million oversubscribed Series A-1 funding round, which the biotech will use to develop novel oncology therapeutics.

Tuesday’s haul brings Avenzo’s total capital raised to $347 million since it was founded in August 2022, according to the company. The Series A-1 was led by New Enterprise Associates, Deep Track Capital, Sofinnova Investments and Sands Capital. New backers include Quan Capita, Delos Capital and TF Capital.

Avenzo CEO Athena Countouriotis in a statement said that the company has “made great progress” in its aim to “advance the next generation of oncology therapies for patients,” including its lead program AVZ-021, a potentially best-in-class CDK2 selective inhibitor.

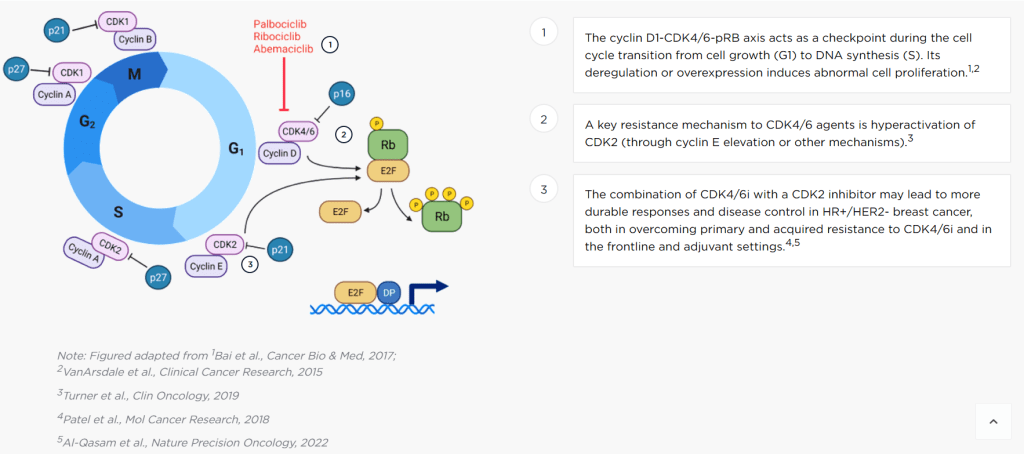

According to Avenzo’s website, most FDA-approved inhibitors target the CDK4/6 axis, which in turn helps prevent the abnormal cell proliferation central to cancers. However, most patients develop resistance to CDK4/6 inhibitors through the hyperactivation of the CDK2 pathway. AVZ-021 works by blocking this cascade, which when used with CDK4/6 inhibitors could overcome such resistances and induce durable treatment responses.

AVZ-021 was originally developed by the Boston- and China-based Allorion Therapeutics, which demonstrated in pre-clinical studies that the candidate selectively targeted CDK2 over CDK1, which is otherwise a driver of treatment toxicity. In January 2024, Avenzo paid $40 million upfront in an exclusive licensing deal with Allorion, which also includes an option for an additional preclinical program.

Avenzo also pledged more than $1 billion in development, regulatory and commercial milestones, plus tiered royalties, for both programs.

In collaboration with Allorion, Avenzo is running a Phase I/II study to evaluate AVZ-021 in patients with HR+/HER2- metastatic breast cancer and other advanced solid tumors.

The first part of the study is a dose-escalation phase to evaluate the safety and tolerability of the candidate, as well as determine a recommended Phase II dose. The partners will then test AVZ-021 in a Phase II dose-expansion study to evaluate the antitumor activity of the candidate. The trial is currently recruiting in the U.S.

“We are in a strong position to advance our potentially best-in-class CDK2 inhibitor, AVZO-021, expand our pipeline with additional assets, and continue to grow our team,” Countouriotis said.

With its oversubscribed Series-A1, Avenzo follows in the footsteps of other San Diego biotechs that have recently reported sizable funding hauls. Last week, Capstan Therapeutics announced that it had closed a $175 million Series B funding round to develop its in vivo CAR-T cell therapy candidate. Mirador Therapeutics also launched last week, securing $400 million in funds to advance inflammatory and fibrotic disease programs.

설립한지 이제 1년이 채 되지 않았기 때문에 파이프라인은 한개입니다. 계속 초기 약물을 사서 파이프라인을 붙여나갈 것으로 기대합니다.