(Picture: Morris Birnbaum, MD, PhD, SVP of Pfizer Internal Medicine Unit)

Pfizer to Cut 300 Jobs as It Ends Alzheimer’s, Parkinson’s Quest – Biospace 1/8/2018

Pfizer announced Saturday, Jan. 6, that it was abandoning research and development into new neuroscience development, including Alzheimer’s and Parkinson’s disease. As a result, it will cut 300 jobs, primarily in Cambridge and Andover, Massachusetts and in Groton, Connecticut. About 200 of the job cuts will be in Massachusetts, the remaining in Connecticut.

The company indicated it will continue working on tanezumab, a late-stage drug for pain it is developing with Eli Lilly and Co., as well as Lyrica, for fibromyalgia. It also intends to continue working on developing neurological drugs for rare diseases.

In a statement, Pfizer said, “This was an exercise to re-allocate spend across our portfolio, to focus on those areas where our pipeline, and our scientific expertise, is strongest.”

Pfizer is one of the investors in a venture capital fund, the Dementia Discovery Fund, that was launched in 2015. Other drug companies that invest in the fund include GlaxoSmithKline and Lilly. Reuters notes, “However, some of Pfizer’s investments have resulted in disappointment. In 2012, Pfizer and partner Johnson & Johnson called off additional work on the drug bapineuzumab after it failed to help patients with mild to moderate Alzheimer’s in its second round of clinical trials.”

On Saturday, Pfizer indicated it plans to launch a new venture fund focused on neuroscience research.

The company also announced today that it was creating the Innovative Target Exploration Network (ITEN). This is a new, early-stage partnering model. It will allow collaborative relationships with specific academic institutions and principal investigators globally. The first three institutions to participate are The University of Cambridge and University of Oxford, both in the UK, and the University of Texas Southwestern (UTSW). Pfizer is planning to choose other academic institutions to be part of ITEN.

Each network is managed by an External Scientific Innovation Lead (ESIL) from Pfizer. That individual will liaise between researchers from Pfizer and the academic principal investigators from the involved institutions.

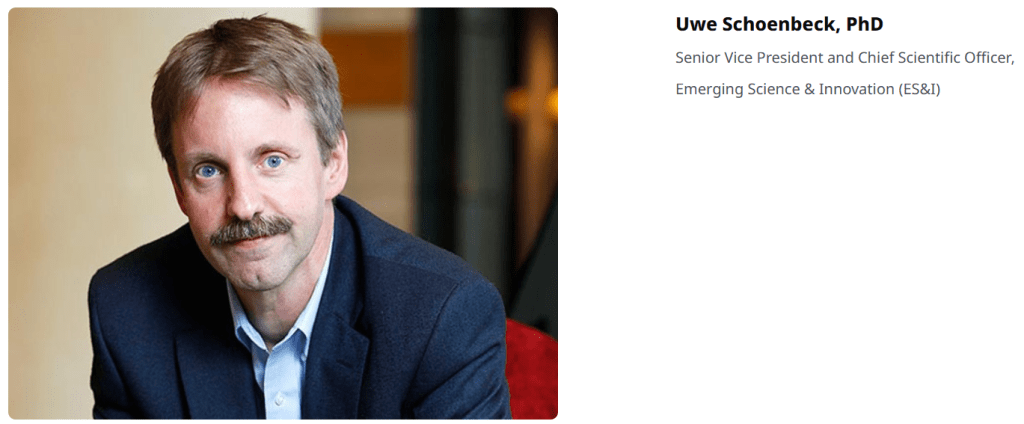

“The ITEN partnering model creates an environment of creative and agile scientific interaction,” said Uwe Schoenbeck, Pfizer’s senior vice president and chief scientific officer, External Science & Innovation, in a statement. “By establishing relationships with researchers early in the research and development process, we believe the ITEN model will better position us to identify potentially promising research projects—focused on seeking unique technology platforms and outstanding biology expertise—continually building on our mission to bring innovative new therapies to patients in need.”

The UK ITEN partnerships were established in 2017, and specific projects have already been reported. Both will focus on deubiquitinylation enzymes (DUBs), a gene family that has implications for cancer, and autoimmune, cardio-metabolic diseases and rare diseases.

The project with UTSW is a collaboration with Bruce Beutler, a Novel Prize-winning immunologist. It will focus on genetics approaches in oncology and metabolic disease.

The ITEN is expected to complement work at Pfizer’s Centers for Therapeutic Innovation (CTI), which was launched by Pfizer in 2010 to create academic-foundation-industry collaborations. CTI has 25 academic institutions and six foundations in its network, including the National Institute of Health (NIH).

“By focusing on research collaborations around early biology and therapeutic concepts, our ITEN collaborations will seek out innovative science and technology,” Schoenbeck said in a statement. “As research projects progress, we will work with the given institution to move them into the clinical phase using therapeutically aligned research units or through CTI.”

Backed by Bain, Pfizer loads prime CNS assets into new biotech – Fierce Biotech 10/23/2018

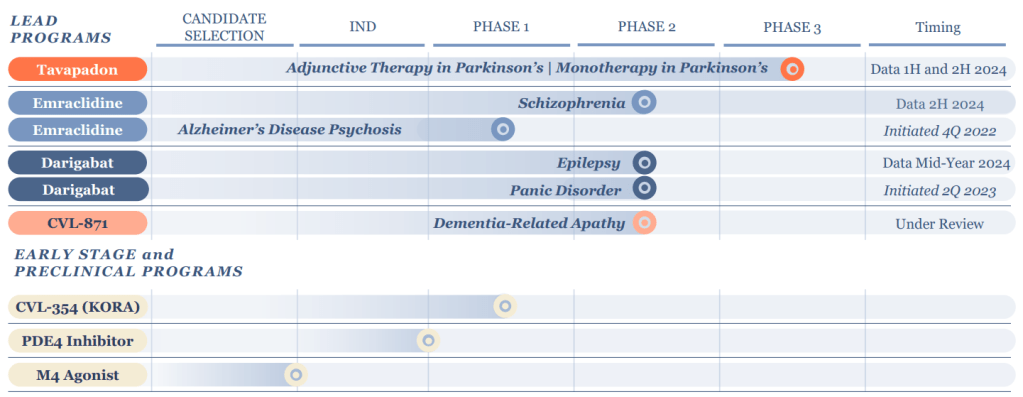

Pfizer has followed through on its pledge to divest a hunk of its neuroscience R&D, spinning several programs into a new company called Cerevel Therapeutics backed by $350 million in venture funding.

Pfizer is contributing a trio of clinical-stage drug candidates—including a Parkinson’s therapy due to start phase 3 testing next year—plus a clutch of earlier-stage programs, while Bain Capital and affiliates stumped up the initial funding.

It’s an approach the Big Pharma company also adopted last year when it hived off its rare disease assets into a company called SpringWorks, backed by Bain Capital and others including Double Impact, Orbimed and LifeArc.

The Cerevel spinoff “is similar [to SpringWorks], albeit on a larger scale in terms of number of assets, capital committed, and commercial potential,” explain Chris Gordon and Adam Koppel, M.D., Ph.D., managing directors at Bain Capital Private Equity and Bain Capital Life Sciences, respectively, who note there is also more cash in the offing if needed.

“It is a model that makes a lot of sense for pharma companies, if they can find the right partner,” they told FierceBiotech. This type of deal can push forward “assets that might not be optimally developed internally … while maintaining involvement and economic upside.”

Pfizer is retaining a 25% share in Cerevel, and two of its senior executives—Doug Giordano, senior VP of worldwide business development, and Morris Birnbaum, M.D., Ph.D., senior VP and chief scientific officer of internal medicine—will sit on the new company’s board alongside Gordon and Koppel. For now, there’s no word on who will fill the CEO role and other top positions.

Cerevel starts life with a pipeline headed by PF-06649751, a dopamine 1 partial agonist for Parkinson’s that is due to start a phase 3 study next year.

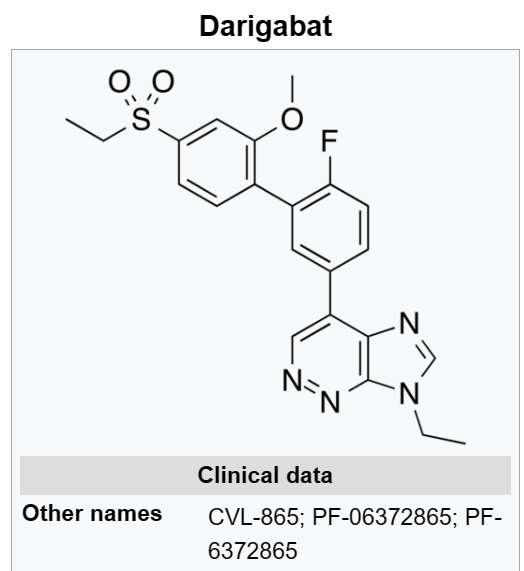

Following after are two phase 2-ready programs, including GABA 2/3 antagonist PF-06372865 for epilepsy and an M4 positive allosteric modulator that Cerevel will explore in “a psychosis-related indication,” according to Gordon and Koppel.

The remainder of Pfizer’s donated assets are all preclinical projects with “a diverse set of mechanisms [and] target indications currently in disease-modifying Parkinson’s, addiction/substance abuse disorder, psychosis, and neuroinflammation,” they noted.

Pfizer isn’t alone in deciding to downsize its direct involvement in central nervous system drug development, which tends to have a lower chance of success and higher costs than other therapeutic categories.

Other Big Pharma companies such as Sanofi, Johnson & Johnson, AstraZeneca and Merck have also cut back on CNS since its heyday in the late 20th century, when psychiatric drugs for diseases like schizophrenia and depression featured prominently among the top-selling medicines in the world, in favor of more lucrative areas such as cancer and diabetes

“When Pfizer made the decision to exit internal neuroscience research, we determined that the most effective way to maximize the potential value to patients of a promising clinical and preclinical portfolio would be to invest in external opportunities with high expertise and dedicated focus in CNS,” said Birnbaum.

“We are convinced that Cerevel represents such an opportunity and will continue to develop the Pfizer compounds, fulfilling our responsibility to patients and our goal to invest in biotech companies conducting promising neuroscience research in areas of urgent unmet need.”

Pfizer spinoff Cerevel to raise $445M in merger with blank-check company – Biopharmadive 7/30/2020

Biotech companies have found investors to be eager backers of their research ambitions this year, even amid the economic fallout of the coronavirus pandemic. Forty-one biotechs have launched initial public offerings in 2020, one-third more than had done so by the same point in 2019.

Seeking cash to fund its drug development plans, Cerevel took a more unusual approach, turning instead to a special purpose acquisition company, Arya Sciences Acquisition Corp II. As the name suggests, these so-called SPACs raise funds specifically with the aim to acquire or merge with another company, at which point the combined firm takes the place of the SPAC on a public stock exchange.

More than 50 SPACs have been created this year, raising a record $21 billion for private company takeouts, including deals involving electric truck-maker Nikola, sports-betting company DraftKings and the health services firm Multiplan.

Arya Sciences, which is sponsored by the hedge fund Perceptive Advisors, has already raised $150 million, and expects proceeds of some $320 million from a wide range of healthcare investors as a result of the Cerevel deal.

Investors include Fidelity, T. Rowe Price and RA Capital, as well as existing Cerevel shareholders Pfizer and Bain.

The merger, expected to close in the fourth quarter, will result in a combined company that’s expected to be worth around $1.3 billion. Cerevel’s management team, including CEO Coles, will continue to lead the new firm, which will trade on the Nasdaq stock exchange under the ticker CERE.

At a value of $445 million, the deal is among the largest go-public transactions for biotech in recent years, behind the IPOs of companies like Moderna, Genmab and Legend Biotech.

Cerevel’s lead drug is an experimental treatment for early- and late-stage Parkinson’s disease. This January, Cerevel launched a Phase 3 development program for the drug, which will include three trials and is expected to yield results by 2023.

Nearer term are two earlier-stage drugs for schizophrenia and epilepsy, for which Cerevel anticipates data next year and in 2022.

While development of those three compounds will account for much of the money Cerevel is raising, the biotech is also advancing drugs for substance use disorder and apathy related to Alzheimer’s disease.

Cerevel Therapeutics’ schizophrenia prospect has impressed in a phase 1b clinical trial, triggering a 136% surge in the stock price.

Shares rose to $29.69 in pre-market trading Wednesday. The Pfizer spinout is now preparing to move into phase 2 and looking into additional indications including dementia-related psychosis.

Having come through the multiple-ascending dose part of the study, Cerevel randomized 81 patients to receive placebo or one of two doses of CVL-231. The drug is designed to selectively target the M4 muscarinic receptor to provide antipsychotic activity without causing the side effects that contribute to limited patient compliance and high relapse rates associated with current treatment options.

Participants who received 30 mg of CVL-231 once a day experienced a 19.5-point reduction in severity of schizophrenia symptoms as assessed by the Positive and Negative Syndrome Scale (PANSS). Cerevel said the improvement is clinically meaningful and, when compared to the 6.8-point reduction in the placebo arm, statistically significant.

A cohort of patients who received 20 mg of CVL-231 twice a day performed slightly worse, notably, on the PANSS Positive Score, but the combined treatment data set still beat placebo on the total and subscores.

Analysts at Jefferies said “PANSS improvement came in above expectations on both an absolute and placebo-adjusted basis and looked similar to, if not better than, competitor [Karuna Therapeutics].”

Cerevel’s data “look impressive,” according to Mizuho’s Vamil Divan, but he urged the company’s investors to hold their horses a bit given the small size of the study. Divan wants to see clearer data from both Karuna and Cerevel’s products before reaching a conclusion on which one is best.

Karuna’s M1-M4 muscarinic agonist spurred 17.4- and 11.5-point improvements in schizophrenia symptoms on an absolute and placebo-adjusted basis. The trial benefited from a smaller reduction in the placebo group, however.

Divan believes the competing results from Karuna and Cerevel are similar. But Boston-based Karuna has the advantage of being ahead, as the company’s results—released 20 months ago—were for a phase 2 trial, whereas Cerevel is just now planning a phase 2. The schizophrenia market is also large and drugs for the condition can often move into adjacent indications, such as dementia-related psychosis.

Shares in Karuna, which is trying to resurrect an old Eli Lilly drug, fell 9% in the wake of Cerevel’s data.

Safety scuttled muscarinic receptor agonists in the 1990s and were an area of concern going into the phase 1b readout on CVL-231. Cerevel came through the early test, finding the dropout rates in the treatment and control groups were similar and the adverse event results were free from red flags. Notably, while one patient on CVL-231 suffered increased heart rate, the feared cardiovascular side effects otherwise didn’t materialize.

“CVL-231 looks pretty clean on [cardiovascular] tox … and likely attributed to its selectivity for M4 and ability to avoid peripheral activation of M1,” the Jefferies analysts wrote in a note to investors. The study found no link between CVL-231 and extrapyramidal side effects or weight gain and only infrequent cases of gastrointestinal adverse events.

Divan said both Karuna and Cerevel’s data helps bolster the idea that muscarinic receptor agonists can be used for schizophrenia.

Investors sent shares in Cerevel soaring after seeing the data. The surge reflects increased confidence that Cerevel can deliver on its vision of establishing CVL-231 as the new standard of care in the blockbuster schizophrenia market.

Cerevel still has a long way to go to deliver that vision, starting with a planned phase 2 study.

This Pfizer Spinout Is Leaving Nothing to Chance – The Street 8/24/2022

You don’t become one of the largest and most successful drug developers on the planet by chance. Pfizer (PFE) has carefully curated its portfolio of drug products and managed pipelines across numerous therapeutic areas. More than once, the pharma titan has created spinoffs for strategic or competitive reasons.

That’s exactly how Cerevel Therapeutics (CERE) got its start. The drug developer was created in 2018 when Pfizer deprioritized its neuroscience pipeline and Bain Capital provided an initial cash infusion of $350 million. The business went public through a SPAC in late 2020 and bagged another $440 million in funding.

The assets provided by Pfizer proved to be quite valuable. Shares of Cerevel Therapeutics more than doubled in summer 2021 on phase 1 results for an experimental schizophrenia drug called emraclidine. The results were impressive, but the asset is behind a late-stage asset from Karuna Therapeutics (KRTX) that just crushed a phase 3 clinical trial.

Results from the competitive landscape forced the hand of Cerevel Therapeutics. It more than doubled its cash balance in a series of transactions to support the continued development of its pipeline — leaving nothing to chance as financial conditions tighten.

Juicing the Cash Balance

Cerevel Therapeutics, now valued at over $5 billion, is one of the premier precommercial drug developers. It wields a pipeline spanning eight unique neuroscience assets being investigated as potential treatments for schizophrenia, Parkinson’s disease, dementia, substance abuse, and other ailments.

A large, maturing neuroscience pipeline will be expensive to develop. Unlike rare diseases, the company’s therapeutic area of choice requires pivotal studies with hundreds of enrolled patients. The business reported R&D expenses of $127.5 million in the first half of 2022, an increase of 73% compared to the prior year.

Although Cerevel Therapeutics exited June 2022 with $531 million in cash, it decided to raise an additional $554 million from debt and stock offerings in mid-August. The competitive landscape shows why action was needed.

Keeping Pace with a Key Competitor

The funding creates a no-doubter funding pathway to develop the pipeline into the second half of this decade. Not many precommercial drug developers can boast that.

The fundraising was announced just two days after Karuna Therapeutics revealed a no-doubter of its own. The company’s lead drug candidate, KarXT, delivered a best-case scenario in a pivotal phase 3 clinical trial in schizophrenia. The drug candidate met the primary endpoint and key secondary endpoints, all measured against placebo for a period of five weeks.

Karuna Therapeutics expects to submit a new drug application (NDA) to the U.S. Food and Drug Administration (FDA) in mid-2023, which suggests the drug could earn approval in the first half of 2024 and launch by mid-2024. By comparison, Cerevel Therapeutics doesn’t expect to deliver phase 2 results for emraclidine until the first half of 2024.

The competition isn’t settled just yet. Investors need to focus on characteristics that could differentiate KarXT and emraclidine.

- Selectivity: Both KarXT and emraclidine hit the same molecular target, the M4 muscarinic receptor. However, KarXT also whacks M1, M2, and M3 muscarinic receptors, whereas the emraclidine is selective for M4. That could provide a potential advantage if a more selective drug compound provides safer or more durable treatment over longer treatment periods. For instance, KarXT treatment was associated with elevated heart rates.

- Dosing: KarXT was administered with a flexible dose given twice daily, with the dose level increasing over time. That could complicate the durability of treatment observed beyond five weeks. By contrast, emraclidine is administered as a fixed dose given once daily. That will be easier to track and model for longer treatment periods.

The late-stage data for KarXT appears to position the asset for eventual FDA approval and commercial success. While emraclidine is relatively far behind, it could provide a better and more convenient treatment option for individuals thanks to its selectivity.

In other words, KarXT may race to a commercial lead in this head-to-head matchup, but it may just be paving the way for its competitor to gobble up the opportunity.

Investors aren’t out of the woods yet. There are multiple development, regulatory, and commercial derisking events on the horizon for both Karuna Therapeutics and Cerevel Therapeutics. Just don’t make the mistake of sleeping on this Pfizer spinout.

Bain scores over tenfold return with $8.7 billion Cerevel sale – Reuters 12/7/2023

Private equity firm Bain Capital stands to make more than 10 times the $250 million it invested in Cerevel Therapeutics Holdings Inc (CERE.O), opens new tab following the neurology-focused drug developer’s $8.7 billion sale to AbbVie Inc (ABBV.N), opens new tab, according to regulatory filings.

Boston-based Bain committed $350 million in 2018 to carve Cambridge, Massachusetts-based Cerevel out of Pfizer Inc (PFE.N), opens new tab, but only $250 million of that was drawn, the filings show. The deal with AbbVie, announced on Tuesday, now values Bain’s 36.5% stake in Cerevel at about $2.7 billion.

This more than tenfold return is significantly higher than the private equity industry’s average return on invested capital in the healthcare sector of 2.9 times, according to investment advisor Cambridge Associates.

A Bain spokesperson declined to comment.

Bain’s success reflects the high stakes of its bet on Cerevel’s drug portfolio. It is developing medicines for Alzheimer’s, Parkinson’s, psychosis, epilepsy and panic disorder. Its experimental drug emraclidine is in mid-stage trials as a treatment for schizophrenia that will yield data the company hopes can be used to seek regulatory approval.

Bain and Pfizer, which retained a 15% stake in Cerevel, took the company public in 2020 through the merger with a special purpose acquisition vehicle. It was one of the few such deals to have proved successful, as most companies that went public through that route in the past three years now trade at a fraction of their deal value.

Bain, which has about $180 billion in assets under management, is one of the private equity industry’s most prolific investors in the healthcare sector, completing more than 940 deals in the space since 1984.

AbbVie’s $45-per-share, $8.7 billion acquisition of the neuroscience drug developer Cerevel Therapeutics was $10 per share higher than its initial bid, according to details in an SEC filing, as the big pharma upped its price despite a lack of formal offers from other suitors.

The filing details several months of negotiations between Cerevel and other companies when it first explored a regional partnership in Japan for its lead schizophrenia and Alzheimer’s disease psychosis drug. Those talks eventually fell apart but would be reborn as full-fledged takeover discussions that led to the deal announced late last year.

AbbVie, which had originally been involved in the Japan partnership talks, returned to the table in October with an offer of $35 a share for the whole company. The investment bank Centerview, which has been involved in most of the major biopharma transactions this year, brought in other potential bidders.

The potentially interested parties included Pfizer, which had created Cerevel when it spun out its neuroscience work in a partnership with Bain Capital in 2018. Pfizer still owns about 15% of the biotech and had nominated two of the board’s directors, Deborah Baron and Suneet Varma, who were recused from the discussions.

Cerevel is in Phase II clinical trials with its lead schizophrenia asset, emraclidine. The drug works similarly to Karuna Therapeutics’ lead drug, KarXT, which is scheduled to get an FDA approval decision by Sept. 26. Karuna last month struck a deal to sell itself to Bristol Myers Squibb for $14 billion.

On Nov. 2, Pfizer told Cerevel it wasn’t interested in a deal before Cerevel’s clinical trial results read out in 2024 and said it wouldn’t make a competing offer. And while other companies were looking at Cerevel, they hadn’t made bids. Meanwhile, AbbVie continued to raise its offer to $40, then $41.50, while Cerevel told AbbVie that would be insufficient.

On the last day of November, as the Cerevel talks were ongoing, AbbVie said it would buy cancer drugmaker ImmunoGen for $10.1 billion — after bidding far more than its nearing rival. Cerevel inquired if that would affect any deal talks, and AbbVie said it was still interested.

On Dec. 4, an undisclosed Party C also said it would be willing to pay $40 per share, but Cerevel said it would not meet the bar.

Two days later, AbbVie said it would pay $45 per share in cash, and the deal was done. The companies expect the transaction to close in the middle of this year.

Despite FTC scrutiny picking up on the pharmaceutical sector, Gonzalez told analysts on the day of the announcement that he doesn’t expect any issues that will stop the deal.