Viking Therapeutics는 Amgen Scientist였다가 Analyst였던 Brian Lian 박사에 의해 2012년에 설립되었고 Ligand Pharmaceuticals의 5개의 약물 파이프라인을 $2.5 Million Bridge Loan으로 인수함으로써 단숨에 2개의 임상 파이프라인을 포함한 약물군을 확보했습니다.

SAN DIEGO–(BUSINESS WIRE)–Ligand Pharmaceuticals Incorporated (NASDAQ: LGND) announces the licensing of rights to five programs to Viking Therapeutics, Inc., a clinical-stage biopharmaceutical company focused on the development of novel, first-in-class or best-in-class therapies for metabolic and endocrine disorders.

The therapeutic programs covered in the license agreement include Ligand’s FBPase inhibitor program for type 2 diabetes, a Selective Androgen Receptor Modulator (SARM) program for muscle wasting, a Thyroid Hormone Receptor-ß (TRß) Agonist program for dyslipidemia, an Erythropoietin Receptor (EPOR) Agonist program for anemia, and an Enterocyte-Directed Diacylglycerol Acyltransferase-1 (DGAT-1) Inhibitor program for dyslipidemia. The FBPase Inhibitor program was the subject of an option originally granted to Viking in 2012.

Each licensed program includes a fee to be paid to Ligand in Viking equity at the time of a private or public financing, milestone payments and royalties on future net sales. Viking is responsible for all development activities under the license.

As part of this transaction, Ligand has agreed to extend a $2.5 million convertible loan facility to Viking that can be used to pay Viking’s operating and financing-related expenses.

“This is a creative licensing transaction that combines a bold portfolio of early- and mid-stage assets with a company that can advance these programs to major inflection points in the near-term. Viking’s programs have the potential to generate substantial news flow over the next 12 to 24 months and to be the basis for important new drugs in major therapeutic categories,” said John Higgins, President and CEO of Ligand Pharmaceuticals.

“R&D success has been the backbone of our prolific out-licensing activities over the past few years. Our objective is to establish proof-of-concept and solid initial data packages, and then to partner with companies that are well-positioned to manage advanced clinical and regulatory development. A relationship such as this one with Viking gives Ligand the opportunity to entrust valuable internal programs to a dedicated team with the operational resources to take them to the next level. Each of these licensed programs has the hallmark of quality that has defined Ligand’s successful research heritage over the years. We are pleased to have helped establish a platform to advance the programs and to make this investment in Viking to support further progress,” Higgins continued.

“Along with our partners at Ligand, we have created through this license an excellent vehicle to develop several promising new therapies for patients, while unlocking potential value for stakeholders,” said Brian Lian, President and CEO of Viking Therapeutics. “Each of the licensed programs has what we believe to be first-in-class or best-in-class characteristics and a differentiated therapeutic profile. Importantly, the portfolio fits well within Viking’s focus, as our team has an extensive history in diabetes and endocrine drug development, including two recent drug approvals. At all levels, from preclinical through pharmaceutical development, and including our chief medical officer, we have well-aligned development expertise to bring these programs forward.”

About Viking Therapeutics, Inc.

Viking Therapeutics is a clinical-stage biotherapeutics company focused on the development of novel, first-in-class or best-in-class therapies for metabolic and endocrine disorders. Viking’s research and development activities leverage its expertise in metabolism to develop innovative therapeutics that improve patients’ lives. Viking has a portfolio of five drug candidates in clinical trials or preclinical studies, which are based on small molecules licensed from Ligand and its affiliate. Viking’s lead clinical program is VK0612, a first-in-class, orally available drug candidate for type 2 diabetes (Phase 2b). Viking’s second clinical program is VK5211, an orally available, non-steroidal selective androgen receptor modulator, or SARM, for the treatment of cancer cachexia (Phase 2). Viking is also developing three novel preclinical programs targeting metabolic diseases and anemia.

For additional information about Viking and its programs, please visit http://www.vikingtherapeutics.com.

About Ligand Pharmaceuticals

Ligand is a biopharmaceutical company with a business model that is based upon the concept of developing or acquiring royalty revenue generating assets and coupling them to a lean corporate cost structure. Ligand’s goal is to produce a bottom line that supports a sustainably profitable business. By diversifying our portfolio of assets across numerous technology types, therapeutic areas, drug targets and industry partners, we offer investors an opportunity to invest in the increasingly complicated and unpredictable pharmaceutical industry. In comparison to its peers, we believe Ligand has assembled one of the largest and most diversified asset portfolios in the industry with the potential to generate revenue in the future. These therapies address the unmet medical needs of patients for a broad spectrum of diseases including diabetes, hepatitis, muscle wasting, Alzheimer’s disease, dyslipidemia, anemia, asthma and osteoporosis. Ligand’s Captisol platform technology is a patent protected, chemically modified cyclodextrin with a structure designed to optimize the solubility and stability of drugs. Ligand has established multiple alliances with the world’s leading pharmaceutical companies including GlaxoSmithKline, Onyx Pharmaceuticals (a subsidiary of Amgen Inc.), Merck, Pfizer, Baxter International, Eli Lilly & Co. and Spectrum Pharmaceuticals. Please visit http://www.captisol.com for more information on Captisol. For more information on Ligand, please visit http://www.ligand.com.

Ligand Licenses Five Programs to Viking Therapeutics – Contract Pharma 5/23/2014

Ligand Pharmaceuticals has licensed the rights to five programs to Viking Therapeutics, a clinical-stage biopharma company focused on the development of therapies for metabolic and endocrine disorders. As part of this transaction, Ligand will extend a $2.5 million convertible loan to Viking that can be used to pay Viking’s operating and finance expenses. Ligand will receive a fee for each program, milestone payments and royalties on future sales. Viking is responsible for all development activities under the license.

The therapeutic programs include Ligand’s FBPase inhibitor for type 2 diabetes, a Selective Androgen Receptor Modulator (SARM) program for muscle wasting, a Thyroid Hormone Receptor-β (TRβ) Agonist for dyslipidemia, an Erythropoietin Receptor (EPOR) Agonist for anemia, and an Enterocyte-Directed Diacylglycerol Acyltransferase-1 (DGAT-1) Inhibitor program for dyslipidemia.

“This is a creative licensing transaction that combines a bold portfolio of early- and mid-stage assets with a company that can advance these programs to major inflection points in the near-term. Viking’s programs have the potential to generate substantial news flow over the next 12 to 24 months and to be the basis for important new drugs in major therapeutic categories,” said John Higgins, president and chief executive officer of Ligand Pharmaceuticals.

“Along with our partners at Ligand, we have created through this license an excellent vehicle to develop several promising new therapies for patients, while unlocking potential value for stakeholders,” said Brian Lian, president and chief executive officer of Viking. “Each of the licensed programs has what we believe to be first-in-class or best-in-class characteristics and a differentiated therapeutic profile. Importantly, the portfolio fits well within Viking’s focus.”

2015년에 $24 Million IPO를 했습니다. Micro-cap Biotech IPO였지요.

SAN DIEGO–Ligand Pharmaceuticals Incorporated (NASDAQ: LGND) partner Viking Therapeutics, Inc. (NASDAQ: VKTX) announced that it has priced its initial public offering of 3,000,000 shares of its common stock at an initial offering price to the public of $8.00 per share. Viking has granted the underwriters a 30-day option to purchase up to an additional 450,000 shares of common stock at the same price to cover over-allotments, if any. Viking expects the shares to begin trading on the Nasdaq Capital Market on April 29, 2015 under the ticker symbol “VKTX”. Viking expects the offering to close on May 4, 2015, subject to the satisfaction of customary closing conditions.

Laidlaw & Company (UK) Ltd. is acting as the sole book-running manager for the offering. Feltl and Company, Inc. is serving as co-manager for the offering.

Ligand invested $9 million in the offering. Ligand will issue an additional press release once the transaction has closed.

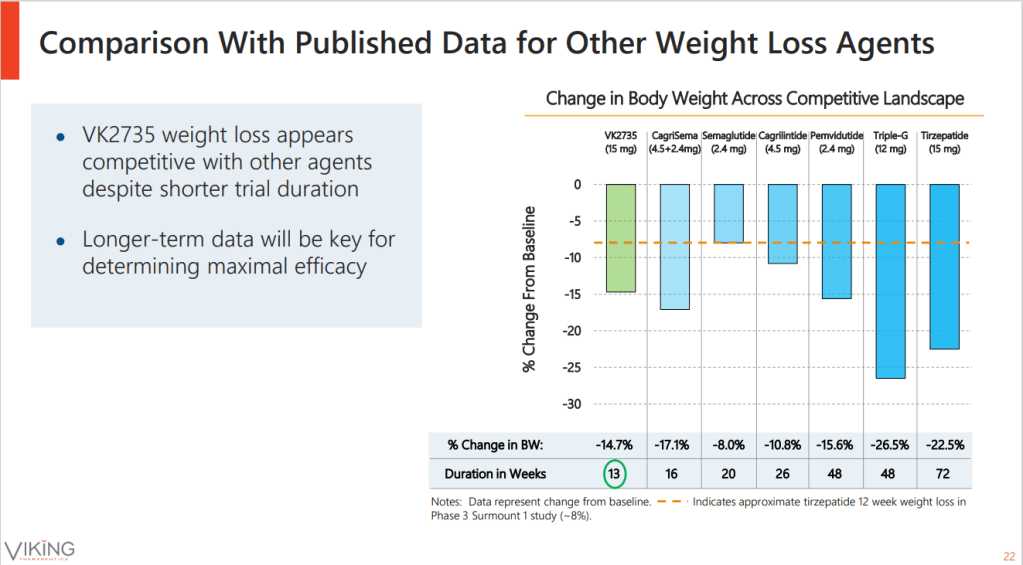

IPO 한 지 근 10년이 지나 Dual GLP-1/GIP Peptide Agonist인 VK2735의 임상2상 결과가 나왔는데 경쟁 약물인 Eli Lilly의 Tirzepatide와 거의 같고 Novo Nordisk의 Semaglutide보다는 나은 체중감소를 보였습니다.

Viking’s GLP-1 spurs steep weight loss, sending shares up 80% – Fierce Biotech 2/27/2024

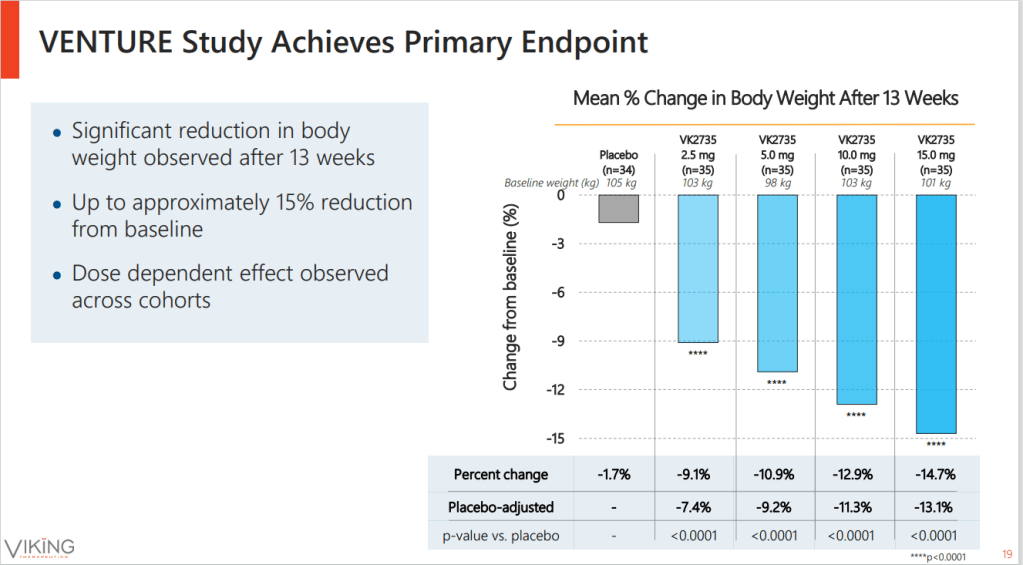

Pass the mead, because Viking Therapeutics has plenty to celebrate after its dual agonist of GLP-1 and GIP was linked to weight loss of up to 14.7% after 13 weeks of treatment, sending the biotech’s stock soaring.

Dose-dependent reductions in the weight of recipients of VK2735, which ranged from 9.1% to 14.7%, were all significantly larger than the 1.7% dip tracked in participants on placebo. While that was enough for the phase 2 study to meet its primary endpoint and clear the 8% bar Viking set as an internal hurdle, the comparison to other molecules is equally important in the increasingly competitive obesity space.

VK2735 looks good compared to the incumbents, with usual caveats about cross-trial comparisons. After 13 weeks, people in Novo Nordisk’s semaglutide phase 3 trial were yet to lose 10% of their body weight. Eli Lilly’s tirzepatide triggered faster, deeper weight loss than semaglutide, but VK2735 looks competitive against that molecule, too. That could catch the eye of pharma dealmakers—and Viking is open to talks.

“Our plan is to proceed aggressively with further clinical development. We’re always open … to [business development] discussions,” Viking CEO Brian Lian, Ph.D., said on a call with investors to discuss the data. “Right now we’re really focused on next steps with the program for us and remain with the ‘open door’ policy for discussing opportunities.”

Would-be buyers may need to dig deep to prise VK2735 away from Viking or buy the biotech outright. The company ended yesterday with a market cap of $3.9 billion but saw its stock climb 80% to above $69 in premarket trading.

Investors sent the stock skyward as they digested data from a 176-subject phase 2 trial that paints Viking as a serious force in the red-hot obesity space. Up to 88% of patients on VK2735 experienced weight loss of 10% or more, compared to 4% of people on placebo, and Viking believes further weight loss is possible beyond Week 13.

“There wasn’t really an indication yet of a plateau signal. The two higher doses, the 10 and the 15, one of them appeared to maybe be accelerating a little bit, but it’s hard to know. These are weekly reads, so you get a little bumpiness as the curve evolves,” Lian said.

Asked by an analyst why VK2735 may outperform the competition, Lian pointed to a pharmacokinetic profile that “provides very good exposures” and a half-life that is “quite long.” Lian said those connected factors may help “drive this level of efficacy.”

The next step is to hold a meeting with the FDA, something Lian expects to happen around the middle of the year. “It seems more than likely that a phase 2b will be the next step here but we’ll have a better idea after we speak with the FDA and get some guidance,” the CEO said.

On the safety and tolerability front, the discontinuation rate across all VK2735 doses was slightly lower than in the placebo group, with 13% playing off against 14%, although the rate at the highest dose was 20%.

As with other GLP-1 drugs, many patients experienced nausea, with the rate peaking at 63% at the top dose, but most of the cases were mild and none were severe. One patient went to hospital with symptoms of dizziness. The patient was diagnosed with dehydration and admitted to the hospital, triggering a serious adverse event, but then recovered.

Viking is yet to share data on markers such as liver fat and plasma lipids, but earlier studies suggest the candidate may benefit patients with comorbidities linked to obesity. Lian said the mechanism “seems to be applicable” to metabolic dysfunction-associated steatohepatitis, an indication Viking knows well from its work on VK2809, but, for now, the biotech is going to direct its resources to obesity.

이 결과를 바탕으로 Public Funding을 했는데 목표했던 $550 Million보다 큰 $632 Million에 마감되었습니다. 아마도 빅파마와 협상이 진행되고 있는 것 같습니다. 어떤 결과가 나올지 궁금합니다. 최근 VK2735 Oral의 임상1상도 진행 중입니다.

Viking Therapeutics, Inc. (“Viking”) (Nasdaq: VKTX), a clinical-stage biopharmaceutical company focused on the development of novel therapies for metabolic and endocrine disorders, today announced the closing of its previously announced underwritten public offering of 7,441,650 shares of its common stock at a price to the public of $85.00 per share, which included the exercise in full by the underwriters of their option to purchase up to 970,650 additional shares of common stock. The gross proceeds to Viking from this offering were approximately $632.5 million, before deducting underwriting discounts and commissions and offering expenses.

Morgan Stanley, Leerink Partners, William Blair, Raymond James, Stifel and Truist Securities acted as joint book-running managers for the offering. Oppenheimer & Co. acted as lead manager for the offering. BTIG, H.C. Wainwright & Co., Maxim Group LLC and Laidlaw & Company (U.K.) Ltd. acted as co-managers for the offering.

Viking currently intends to use the net proceeds from the offering for continued development of its VK2809, VK2735 and VK0214 programs and for general research and development, working capital and general corporate purposes.

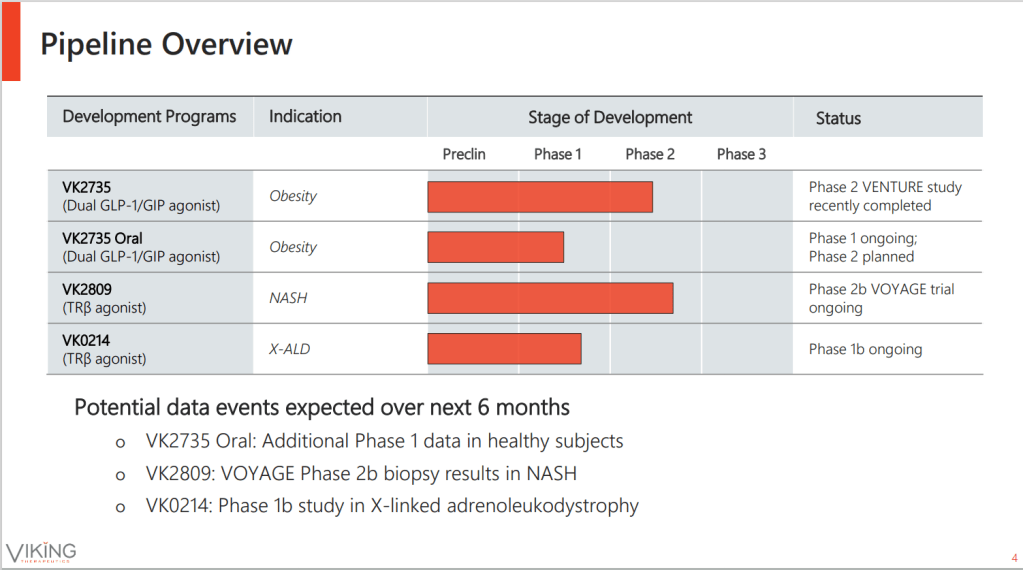

현재 Viking Therapeutics의 파이프라인은 아래와 같이 3가지 입니다. Micro-Cap에서 Unicorn이 되기까지 이 여정이 참 신기하기도 합니다.