안녕하세요 보스턴 임박사입니다.

Mirati Therapeutics의 KRAS G12C Inhibitor인 Adagrasib에 대해 오래전에 글을 남긴 적이 있는데요.

BIOTECH (6) – Mirati Therapeutics

글을 올린 해 연말에 FDA의 Accelerated Approval을 받았습니다. 약물 브랜드명은 Krazati입니다. 귀에 쏙쏙 박히는 이름입니다.

Once considered an undruggable target, KRAS now has two FDA-approved therapies vying for a blockbuster cancer market.

Mirati Therapeutics’ Krazati, also known as adagrasib, will take on Amgen’s first-to-market Lumakras thanks to an FDA accelerated approval in previously treated KRAS G12C-mutated non-small cell lung cancer (NSCLC).

Krazati marks Mirati’s first commercial product, and the biotech will focus on efficacy in its marketing pitch, CEO David Meek told Fierce Pharma in an interview ahead of the approval. J.P. Morgan analyst Eric Joseph, Ph.D., has in late November put Krazati’s risk-weighted peak sales estimate across multiple indications at $1.7 billion but then lowered the number to $1.3 billion a few days ago, as blockbuster hopes for the drug have dwindled since a Keytruda combination readout.

Mirati is charging Krazati at a list price of $19,750 for a 30-day supply, a company spokesperson told Fierce Pharma. Krazati is given in 600-mg capsules twice daily. By comparison, Lumakras costs slightly less with a list price of $17,900 per month

In the phase 2 registrational portion of the KRYSTAL-1 trial, Krazati shrank tumors in 43% of patients when used in patients with previously treated NSCLC bearing KRAS G12C mutations. By comparison, Lumakras, given 960 mg once daily, showed a 36% tumor response rate in its own phase 2 trial. And the number dropped to 28% in a larger phase 3 trial.

Similar to Lumakras’ situation, the FDA has required Mirati to run a postmarketing study to test a lower 400-mg twice daily regimen of Krazati. The FDA’s oncology department has recently put an emphasis on dose optimization under Project Optimus. The agency has criticized drugmakers for pushing for the highest tolerable dose in early clinical testing without carefully examining the benefit-risk balance.

About 25% to 50% of NSCLC cases develop brain metastases during the course of the disease. In another key component of Mirati’s commercial campaign, Krazati has shown a brain tumor response rate of 33% versus 25% for Lumakras in patients with baseline brain metastases in its own study. A label with that brain metastases information would be a “nice-to-have” that can differentiate Krazati from the competition, but the data are not included, J.P. Morgan’s Joseph pointed out in a Tuesday note.

In a pooled analysis of the phase 1/2 KRYSTAL-1 trial, patients on Krazati lived a median 14.1 months. By comparison, Lumakras takers survived a median 12.5 months in its phase 2 trial and 10.6 months in the phase 3 study. Krazati’s own phase 3 confirmatory trial, KRYSTAL-12, which compares Krazati with the chemotherapy docetaxel, is underway.

Cross-trial comparisons come with intrinsic problems such as patient characteristics differences. But Meek stressed that Krazati’s response data are best-in-class so far.

In what Meek calls a “halo” effect, Mirati also hopes doctors will notice the company’s recent early results for Krazati’s combination with Merck’s PD-1 inhibitor Keytruda. The early-stage KRYSTAL-7 trial showed what Barclays analysts called “good safety but modest activity” in newly diagnosed NSCLC. In contrast, Merck’s Keytruda combo reported lackluster efficacy data while raising a serious liver safety concern.

“I think we’re the KRAS leader,” Meek said in the interview. “We will set the direction where this KRAS agent goes.”

But while Mirati’s KRAS-Keytruda combo data looked better than Amgen’s, Krazati’s commercial potential is under question as well. The company’s stock price has been about halved after the KRYSTAL-7 combo study, reflecting investors’ concern that the companies’ planned phase 3 trials might not succeed.

Although Krazati is Mirati’s first commercial launch, it’s not the first for the Mirati people. The company has built a sales force with average 19 years of experience in oncology, and the staffers were hired based on their experience in lung cancer, Meek noted.

Mirati has talked to nearly all of the top payer plans and received positive feedback, Chief Commercial Officer Ben Hickey told investors during the company’s third-quarter earnings call last month. Mirati expects to have broad coverage within the first few months of launch, he said.

Krazati’s launch comes as Lumakras experienced a sequential sales decline in the third quarter to $75 million. Amgen attributed the slowdown to a price adjustment as part of reimbursement deal in Germany.

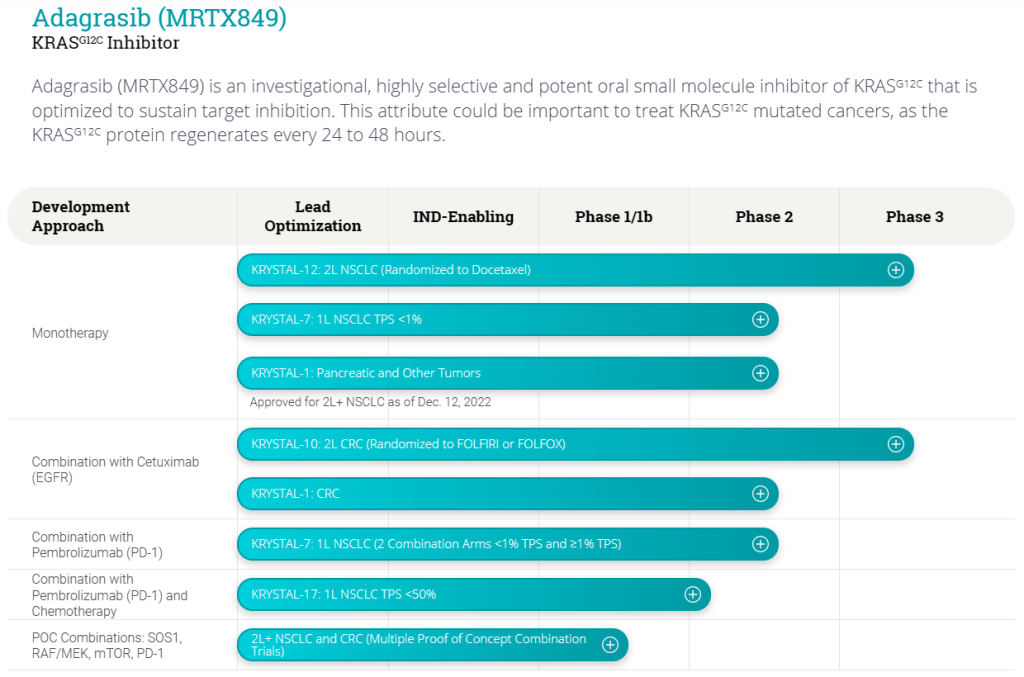

Next up, Mirati plans to launch two phase 3 trials of Krazati—at the 400-mg twice daily dose—in combination with Keytruda in front-line NSCLC this year. The company is discussing a potential accelerated approval pathway for Krazati in third-line colorectal cancer and will have more to share in early 2023, Meek said. The confirmatory KRYSTAL-10 trial for a cocktail of Krazati and Eli Lilly’s Erbitux in second-line colorectal cancer is also expected to read out later next year. In addition, the company has a candidate for KRAS G12D mutations that’s slated to enter clinical testing next year.

With all the pipeline advancement, Mirati has recently reportedly attracted buyout interest from Big Pharma. Mirati has tapped an adviser, and larger pharmas are considering the “merits of a transaction,” Bloomberg reported late November.

“We’re real busy,” Meek said in his interview with Fierce Pharma. “We’re really focused on executing our clinical plans and our launch plans.”

However, any potential acquirer might have pulled out by now, BMO Research analyst Evan David Seigerman said in an investor note after the KRYSTAL-7 combo readout. The phase 3 combo trials Mirati plans to run will take a long time to read out, and existing early-stage data don’t bode well, he said.

Bristol-Myers Squibb to acquire Mirati in up to $5.8 billion deal – Reuters 10/9/2023

Bristol-Myers Squibb (BMY.N), opens new tab on Sunday said it will acquire cancer drugmaker Mirati Therapeutics (MRTX.O), opens new tab for up to $5.8 billion, diversifying its oncology business and adding drugs it hopes can help offset expected lost revenue from patent expirations later this decade.

Bristol will pick up Mirati’s portfolio drugs that target the genetic drivers of specific cancers including its lung cancer drug, Krazati, which was approved in December.

A second compound – MRTX1719 – which could be used in some types of lung cancer was also attractive to the company, Bristol executives said in an interview.

“We think this really helps strategically complement our oncology portfolio but also, from a financial standpoint, it helps out commercially in the back half of the decade,” said Adam Lenkowsky, Bristol’s Chief Commercialization Officer.

The company said that it will buy Mirati for $58 per share in cash, or around $4.8 billion. Mirati has around $1.1 billion in cash on hand, so “we’re paying essentially $3.7 billion enterprise value…we think with that we’ve gotten a very attractive deal,” Lenkowsky said.

Mirati stockholders will also receive one non-tradeable contingent value right for each Mirati share held, potentially worth $12.00 per share in cash, representing an additional $1 billion of value opportunity, the company said

Bristol will finance the transaction with a combination of cash and debt, the company said in a statement.

The U.S. Food and Drug Administration in December approved the drug to treat adults with advanced lung cancer.

“With multiple targeted oncology assets including Krazati, Mirati is another important step forward in our efforts to grow our diversified oncology portfolio and further strengthen Bristol Myers Squibb’s pipeline for the latter half of the decade and beyond,” said Chris Boerner, Bristol’s incoming CEO and current chief operating officer, in a statement.

The New York-based company has been pressured by declining demand for two of its top drugs, the blood cancer treatment Revlimid and blood thinner Eliquis, which face generic competition.

Bristol is buying Mirati at a time when the shares are considerably cheaper than they were. Mirati’s shares touched a 52-week high of $101.3 apiece on Nov. 28 and are now trading at $60.2.

The transaction is expected to be dilutive to Bristol’s non-GAAP earnings per share by approximately 35 cents per share in the first 12 months after the transaction closes, the statement added.

In April, Bristol said CEO Giovanni Caforio would step down in November and be succeeded by Boerner.

Last year, Bristol acquired drug developer Turning Point Therapeutics for $4.1 billion in cash to help bolster its arsenal of cancer drugs.

Bristol Myers Squibb looks on track to overtake Amgen as the KRAS leader in lung cancer after following up its rival’s FDA setback with a positive confirmatory trial readout.

BMS’ Krazati significantly reduced the risk of tumor progression or death compared with chemotherapy in patients with pretreated KRAS G12C-mutated non-small cell lung cancer (NSCLC), the company said Thursday. The KRAS inhibitor came to the New Jersey pharma as part of its recent acquisition of Mirati Therapeutics.

The assessment was made by a blinded central review committee of the pivotal phase 3 KRYSTAL-12 study, which serves as the confirmatory trial for Krazati’s accelerated approval as a second-line therapy. BMS said it’s finishing a full evaluation of the data and will share results with regulators.

Besides declaring that the trial met its primary endpoint of progression-free survival, the independent data reviewers noted that Krazati was better than chemo at shrinking tumors, which was one of the trial’s secondary endpoints. The improvements on both endpoints were statistically significant and clinically meaningful, according to BMS.

The trial remains ongoing to evaluate whether Krazati can extend patients’ lives. BMS didn’t specify which direction Krazati’s survival outcomes are trending right now. Progression-free survival has typically been an approval-worthy endpoint in second-line NSCLC, unless there’s a negative trend in overall survival.

As for Amgen, the California drugmaker recently applied for full approval of its first-to-market KRAS inhibitor, Lumakras, based on progression-free survival data from the phase 3 CodeBreaK 200 trial. The study would have served its purpose had it been done properly. But the FDA figured its results couldn’t be reliably interpreted, and a group of external advisers agreed.

The agency and its advisory committee experts voiced concerns about disproportionate patient dropout rates between the two trial arms in Lumakras’ CodeBreaK 200 study as well as a bias for investigators to be more likely to call tumor progression early for patients on chemo so that they could cross over to receive Lumakras.

Both problems were chalked up to the enthusiasm around Lumakras as the first FDA-approved KRAS inhibitor.

By comparison, Krazati’s KRYSTAL-12 requires confirmation from a blinded central review to determine tumor progression before crossover.

Despite the compromised trial results, the FDA has let Lumakras stay on the market while Amgen runs another confirmatory trial to be completed no later than February 2028. The recently launched phase 3 CodeBreaK 202 trial is comparing Lumakras against Merck’s Keytruda in their respective combinations with chemotherapy for patients with newly diagnosed, advanced, PD-L1-negative, KRAS G12C-positive nonsquamous NSCLC.

Lumakras’ setback gives Krazati an opportunity to catch up. Before the BMS buyout, Krazati in the third quarter posted $16.4 million in sales, coming in below analysts’ expectations. Lumakras generated $52 million sales during the same period.

BMS’ Krazati also appears to hold more potential in the first-line setting. While Amgen was forced to combine Lumakras with chemo alone, a better liver toxicity profile has allowed BMS to pair Krazati with drugs in the PD-1 inhibitor class. A phase 3 trial is testing the Krazati-Keytruda combo in first-line KRAS G12C-mutated PD-L1-high NSCLC. And the company expects phase 2 results this year to guide its development path in PD-L1-low disease.

Both BMS and Amgen are also gunning for approvals in colorectal cancer, which is a smaller market than NSCLC. Amgen recently reported that Lumakras, at its currently approved 960-mg dose and used in combination with Vectibix, extended the median progression-free survival to 5.6 months versus 2.2 months for standard treatments in patients with chemo-refractory KRAS G12C colorectal cancer. The result came from the phase 3 CodeBreaK 300 trial.

A regulatory submission based on the study was planned in the first half of 2024, Amgen said during its fourth-quarter report. The company recently also launched a phase 3 trial for Lumakras in combination with Vectibix and chemo in first-line colorectal cancer.

For its part, BMS has the phase 3 KRYSTAL-10 study for Krazati and Eli Lilly’s Erbitux in second-line colorectal cancer, with a readout expected this year.