Boston Dr. Lim is here. I have covered Gritstone Bio a while ago.

BIOTECH (110) Gritstone Bio: self-amplifying RNA in chimpanzee adenovirus vector

Gritstone Bio has unique technology platform consisting of chimpanzee adenovirus vector (chAd) and self-amplifying messenger RNA (samRNA) to develop vaccines and personalized cancer vaccine.

Gritstone bio is the latest drug developer to be tapped for the Biomedical Advanced Research and Development Authority’s (BARDA’s) Project NextGen, with the biotech in line for more than $400 million to conduct a 10,000-person phase 2 study of its COVID-19 vaccine.

BARDA has contracted the company to conduct a U.S.-based randomized phase 2b trial assessing Gritstone’s self-amplifying mRNA (samRNA) vaccine candidate against an approved vaccine. Preparations for the study, which will be fully funded by the government, are already underway, and the trial is due to kick off in the first quarter of 2024, the biotech said in the Sept. 27 release.

Gritstone’s candidate, which the company has dubbed the CORAL program, is designed to drive both B-cell and T-cell immunity against the virus that causes COVID-19 by using a combination of samRNA and immunogens containing both spike and additional viral targets.

“First-generation COVID-19 vaccines provided great utility during the height of the pandemic but are limited in breadth and durability of clinical protection,” CEO Andrew Allen, M.D., Ph.D., said. “CORAL was designed to address these limitations by inducing durable neutralizing antibody and T cell-based immunity against current and future SARS-CoV-2 variants.”

The contract, worth up to $433 million, is part of the U.S. Department of Health and Human Services’ Project NextGen, which is focused on accelerating the development of new vaccines and therapeutics that can provide broader and stronger protection against COVID-19.

Recent months have seen a flurry of NextGen contracts go out, including $326 million pledged to Regeneron to push ahead with its next-generation monoclonal antibody against COVID-19.

Gritstone is best known for its work in cancer vaccines, with its lead program, dubbed GRANITE, in phase 2/3 trials for metastatic, microsatellite-stable colorectal cancer.

Evercore analyst Jonathan Miller said the BARDA announcement “does give some validation for Gritstone’s approach, and is certainly a nice signal of continued government support for COVID research.”

However, the GRANITE trial, which is expected to read out in the first quarter of 2024, is “by far the most important event” for the company from investors’ point of view, Miller added in a Sept 27 note.

Since then, this Californian company has been going through tough rides with a series of setbacks.

After Gritstone bio nabbed $433 million in federal funds to test its next-generation COVID-19 vaccine candidate, the planned phase 2b trial will get a late start thanks to a manufacturing-related delay. On the flip side, the company believes the delay should add to the trial’s regulatory value.

The study was originally slated to kick off during this year’s first quarter, but it will now launch during the fall in order to “allow use of fully GMP-grade raw materials,” the company disclosed in a press release. GMP is the acronym for good manufacturing practice, which are a group of regulations that govern drug production standards.

“The change likely increases the regulatory value of this large study, is expected to improve study interpretability, and may enable us to contemporaneously address the latest seasonal variant,” Gritstone co-founder and CEO Andrew Allen, M.D., Ph.D., said in the release.

The move was made after “recent communication” with the FDA and input from the Biomedical Advanced Research and Development Authority (BARDA), Allen added.

BARDA contracted the 10,000-participant study in September as a part of its Project NextGen, which looks to speed up the development of new vaccines and therapies that can provide broader and stronger protection against COVID. Regeneron, among others, was also tapped for the project with a $326 million investment.

Gritstone’s candidate, called CORAL, differs from traditional mRNA vaccines because of its self-amplifying technology.

The approach was designed to address the limitations of traditional first-generation mRNA COVID vaccines by “inducing durable neutralizing antibody and T cell-based immunity against current and future SARS-CoV-2 variants,” Allen said in a prior release. With its upcoming study, Gritstone will test its candidate against an approved COVID vaccine.

Elsewhere, Gritstone bio is best known for its cancer vaccines. Its lead program, dubbed GRANITE, is in phase 2/3 testing for metastatic, microsatellite-stable colorectal cancer, with a readout expected soon.

Gritstone lays off 40% of team after delayed launch of COVID vax trial – Fierce Biotech 2/29/2024

Gritstone Bio is laying off 40% of employees after delaying the start of a phase 2 trial testing its COVID-19 vaccine, which in turn pushed back the receipt of federal funds.

The layoffs announced after-market on Thursday are the latest consequence of a manufacturing delay that was revealed earlier in February. The phase 2b CORAL trial, originally slated to launch in the first quarter, was pushed to the fall to “allow use of fully GMP-grade raw materials.” But Gritstone now says that delaying the trial resulted in some external funding falling through.

“The lack of near-term funding necessitated this difficult step to fortify our balance sheet and cash position, which unfortunately means an impact to our workforce,” CEO Andrew Allen, M.D., Ph.D., said in a release. The funding referenced is the first tranche of funds from the federal government announced late last year.

The company did not say how much was expected in this first tranche of payments from the Biomedical Advanced Research and Development Authority. But the contract is worth up to $433 million through Project NextGen, which is funding a number of companies’ efforts to create new strategies to fight COVID-19. Gritstone is conducting a 10,000-person U.S.-based phase 2 study for its self-amplifying mRNA (samRNA) vaccine candidate. The study was expected to get off the ground in the first quarter.

Gritstone’s other priorities, including the phase 2 portion of a phase 2/3 study of a personalized cancer vaccine, remain unchanged, according to the release. Data are expected from that program later this quarter, Allen said.

Gritstone bio, Inc. (Nasdaq: GRTS), a clinical-stage biotechnology company working to develop the world’s most potent vaccines, today announced the pricing of an approximately $32.5 million underwritten public offering of its common stock (or pre-funded warrants to purchase common stock in lieu thereof) and accompanying common warrants to purchase common stock (or pre-funded warrants to purchase common stock in lieu thereof), before deducting underwriting discounts and commissions and offering expenses.

The offering consists of (i) 8,333,333 shares of common stock and accompanying common warrants to purchase up to 8,333,333 shares of common stock at a per share exercise price of $1.65 (provided, however, that the purchaser may elect to exercise the common warrants for pre-funded warrants in lieu of shares of common stock at an exercise price of $1.65 minus $0.0001, the exercise price of each pre-funded warrant), at a combined public offering price of $1.50 per share and accompanying common warrant and (ii) to a certain investor in lieu of common stock, pre-funded warrants to purchase up to 13,334,222 shares of common stock at a per share exercise price of $0.0001 and accompanying common warrants to purchase up to 13,334,222 shares of common stock at a per share exercise price of $1.65 (provided, however, that the purchaser may elect to exercise the common warrants for pre-funded warrants in lieu of shares of common stock at an exercise price of $1.65 minus $0.0001, the exercise price of each pre-funded warrant) at a combined public offering price of $1.4999 per pre-funded warrant and accompanying common warrant, which represents the per share combined purchase price for the common stock and accompanying common warrants less the $0.0001 per share exercise price for each such pre-funded warrant. The accompanying common warrants will be immediately exercisable for shares of common stock or pre-funded warrants in lieu thereof, and will expire on the twelve-month anniversary of the date of issuance. All of the shares of common stock, accompanying common warrants and pre-funded warrants are being offered by Gritstone bio. The offering is expected to close on or about April 4, 2024, subject to the satisfaction of customary closing conditions. TD Cowen and Evercore ISI are acting as the joint book-running managers for the offering.

Gritstone bio’s gamble on a novel endpoint has backfired. The cancer vaccine failed to trigger hoped-for changes in circulating tumor DNA (ctDNA), causing the phase 2 trial to miss its primary endpoint and leaving the biotech clinging to immature survival data.

Investigators randomized 104 patients with metastatic microsatellite stable colorectal cancer to take one of two front-line therapies. All patients received induction and maintenance chemotherapy. Around half of the subjects also received Gritstone’s personalized neoantigen cancer vaccine, Bristol Myers Squibb’s Yervoy and Roche’s Tecentriq during the maintenance phase.

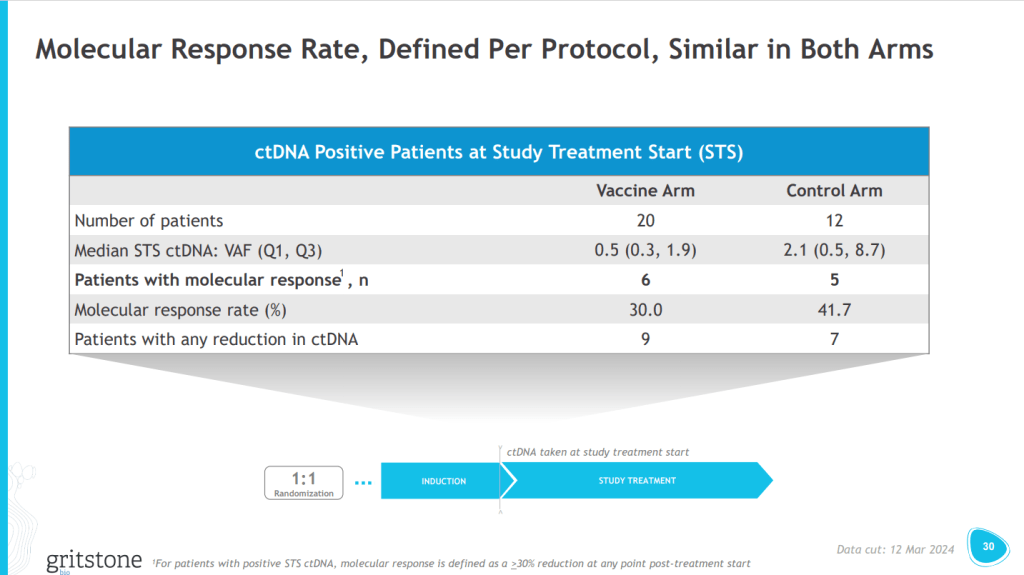

The primary endpoint looked at changes in ctDNA. On that measure, Gritstone’s drug combination was numerically worse than chemotherapy alone, with the molecular responses in the vaccine and control arms coming in at 30% and 41.7%, respectively. Gritstone attributed the result to its misunderstanding of how ctDNA would change after treatment.

“With regard to defining molecular response, we simply got it wrong,” Gritstone CEO Andrew Allen, M.D., Ph.D., said in a statement. “CtDNA levels in both arms decreased on chemotherapy for longer than we anticipated, generating similar short-term molecular response rates across arms and rendering our protocol measure of ctDNA change uninformative.”

While the study missed its primary endpoint, Allen latched on to progression-free survival (PFS) data to contend that the results are “highly encouraging.” The PFS rate was higher in the vaccine group than in the control arm after six months and nine months. However, the lines crossed around the 12-month mark, creating a short period in which PFS probability was higher in the control arm.

The hazard ratio favored the vaccine regimen, clocking in at 0.82 in the overall population, but the wide confidence intervals make it impossible to draw firm conclusions. Gritstone reported a hazard ratio of 0.52 in a subgroup of high-risk patients. PFS data are more mature in the subgroup, leading Allen to call the result “a striking signal,” but, again, the confidence intervals are wide enough that the vaccine may be less effective than the control. Allen had discussed what would be a good PFS result at an event in March.

“The separation [of the curves], of course, is likely and important, but the lifting of the tail is what we really care about,” Allen said at the time. The CEO cited Bayer’s Stivarga as an example of a drug that “shifted PFS by about two months [and is] not widely used because survival is basically no different.”

Gritstone picked ctDNA, rather than the widely used and accepted PFS, as its primary endpoint because of concerns about “pseudo progression.” The term describes people whose tumors appear to grow after treatment but then shrink. That happens when T cells enter tumors and proliferate. Initially, this causes lesions to grow, but they then collapse as the immune cells wipe out the tumor.

Evidence of pseudo progression made Gritstone “a little bit leery” about PFS, Allen said, and led it to make ctDNA the primary endpoint. The hope was that ctDNA would provide a clear signal that the therapy is working and make the case for pushing ahead to an overall survival (OS) readout that will provide the truest test of efficacy.

Instead, the study missed the ctDNA endpoint, leaving Gritstone looking to immature PFS results that, at best, show trends favoring the vaccine to make the case for its therapy. The biotech expects to have mature PFS data in the third quarter of 2024, with OS data set to follow in the first half of next year.

The timing of the readouts is important, because Gritstone’s cash is running low. The biotech ended last year with $79.2 million, a sum it told investors would fund operations into the third quarter of 2024. Gritstone proposed a public offering in the immediate aftermath of the phase 2 data Monday and later priced a $32.5 million sale at $1.65 a share.

Gritstone’s share price has bounced between a low of $1.14 and high of $3.33 over the past year. The stock fell almost 33% in the wake of the updates Monday, falling to $1.58 in after-hours trading.

The following corporate presentation is about GRANITE phase 2 results.

In one day, the valuation of Gritstone Bio cut by almost half.