안녕하세요 보스턴 임박사입니다.

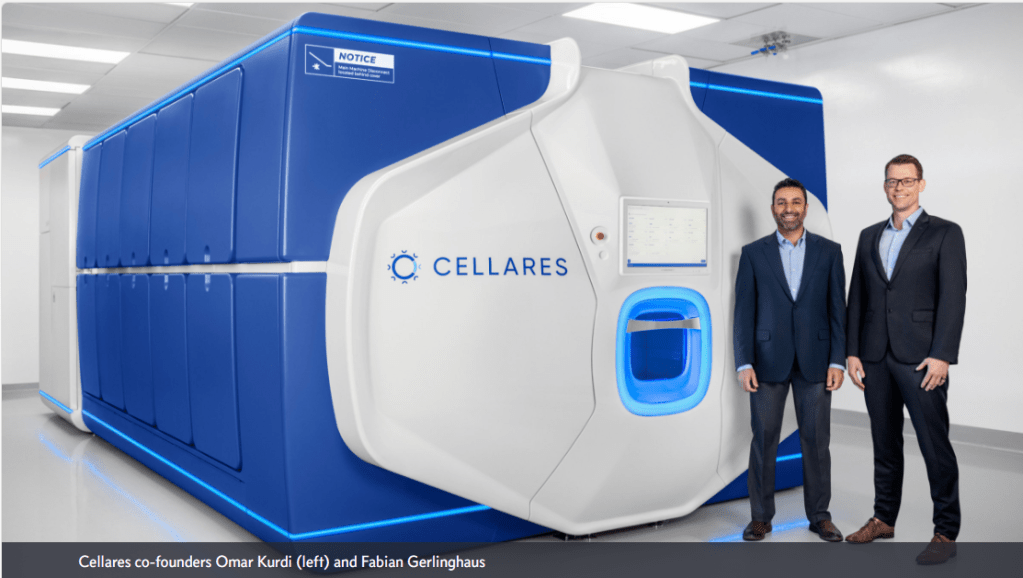

Cell Therapy의 상업용 생산공정 이슈는 이미 익히 알고 있듯이 대량 생산이 어려운 구조입니다. 이 문제를 자동화를 통해서 해결하고자 하는 회사인 Cellares는 ex-Synthego Team에 의해 2019년에 설립이 되었습니다. 현재까지 $355 Million의 펀딩을 받아서 South San Francisco와 뉴저지에 공장을 설립함과 동시에 유럽과 일본에도 공장 설립을 준비하고 있습니다. 이런 중에 Bristol Myers Squibb은 $380 Million upfront & milestone으로 CAR-T therapy의 전속 생산 계약을 맺었습니다. Cellares는 Cell Shuttle이라는 Automated Enclosed GMP factory와 Automated QC를 할 수 있어서 기존 공정에 비해 90%의 원가 절감과 10배를 상회하는 생산 능력을 가질 것으로 예상되어 Cell Therapy Market Share를 크게 늘려 나갈 수 있을 것이로 기대됩니다.

Cellares – Evolving the Pharmaceutical Manufacturing Industry – Press Release 10/29/2020

Justin Butler, Partner at Eclipse Ventures and Cellares Board member shares a personal perspective in this blog post, originally posted on October 29th, 2020.

Living with Stage IV cancer is a dual reality – one reality is counting your days left on this planet with extreme precision, the other is hoping for a miracle that you are “the one” that defies the odds. I lived this duality with my wife as she battled her own terminal cancer. Once the doctors told us that there was nothing that could save her, the chasm between these two realities widened.

As we bounced back and forth during those days, I frantically searched for any experimental clinical trials that could have an impact, and came across a class of drugs known as cell therapies. Reading more about this new technology revealed a world where a patient’s own cells could be genetically modified to recognize and fight their own cancer. And it was working. Patients who were previously on their deathbed after their cancer evaded traditional treatments were transitioning to full remission after receiving a single dose of cell therapy. They were all becoming “the one,” and the gap between their two realities was shrinking.

Unfortunately, these treatments were not yet at a stage in which they were able to help my wife, but I could not stop thinking about their impact, and more importantly, the challenges they faced in treating as many patients as possible. As my research progressed, I discovered that cell therapies are creating a fundamental shift in biopharmaceutical manufacturing. Historically, drugs are made in small batches during preclinical production, and then in large batches for full-scale commercial manufacturing to meet the volume and cost requirements of the market. Cell therapies, however, are not able to take advantage of these economies of scale, as every patient product is a single batch. In other words, for each patient, the entire manufacturing process needs to be executed – multiple steps, multiple technologies, and zero room for error.

It became quickly apparent that there was a disconnect in the industry between the science and the commercial production capabilities. Manufacturing in the pharmaceutical industry is a $100B annual business but has not seen this kind of fundamental change since the advent of modern biotechnology in the 1980s. The industry needs to evolve its supply chain and manufacturing practices to adopt automation, modularity, and scalability – and we at Eclipse were going to find a way to make it happen. We started our search in late 2017 for a team that had a vision aligned with ours to bring modern manufacturing hardware and software capabilities to the cell therapy and broader pharmaceutical industries.

It wasn’t until the spring of 2019 at a Cooley Healthcare Conference that I met Fabian Gerlinghaus. Over lunch, Fabian shared his vision for a new cell therapy manufacturing company. His plan to build a fully automated, enclosed, and modular system hit the fundamental metrics that would be required to be successful in the market.

Over the following weeks, our team at Eclipse Ventures got to know Fabian and his co-founders, Omar and Alex. We quickly realized they were the right team to execute on the mission. In August 2019, we led an $18M Series A alongside our partners 8VC and EcoR1 Capital. Shortly thereafter, Dr. Carl June, a pioneer in the cell therapy field, recognized for his groundbreaking work in the development and commercialization of T-cell therapies, enthusiastically joined their advisory board.

Today, we’re proud to announce that The Fred Hutchinson Cancer Research Center, a world leader in translating new therapies from the lab to the clinic, is the first organization to join Cellares’ Early Access Partnership Program. This partnership will accelerate access to the Cellares technology in a clinical context and bring more of these drugs to market faster, and at a lower cost.

There is still a long way to go in the battle against cancer, but we’re looking forward to working closely with our partners in driving this industrial evolution — and, reducing the gap between the two realities.

Cell therapy manufacturing is currently a manual, multi-step process that takes weeks. Startup Cellares, which is developing a system that automates the process and makes manufacturing scalable, will use the Series B financing to accelerate its work.

Talk to enough biotech industry folks and the phrase “the product is the process” is bound to come up. It refers to cell therapies, which are made by engineering human cells. In short, the medicine is an extension of the process that produced it. Today, that process is time consuming, mostly manual, and very expensive.

Cellares aims to do for cell therapy production what the assembly line did for automobile manufacturing. The startup is developing an enclosed system that makes the production process automated and scalable. Cellares already has prototypes of the system, called Cell Shuttle, in place with life science industry partners that are testing it. On Wednesday, the South San Francisco-based company announced an $82 million Series B round of funding to ramp up development of its technology.

Cell therapies present a whole set of challenges that just don’t exist for other types of medicines. Small molecule drugs are made in manufacturing plants that can scale pill production to the tens of thousands. That’s harder to do for biologic drugs, and it’s impossible for making a cell therapy that starts by harvesting a patient’s immune cells from a vein.

For the type of immunotherapy called CAR T, harvested T cells are transported to a lab where they are engineered to recognize a patient’s cancer. Those cells are multiplied in a lab at a different location, then sent back to the clinical site, where they are infused into the patient. Each step of the process is largely manual, and humans can make mistakes, Cellares co-founder and CEO Fabian Gerlinghaus said in an interview late last year. The length of this process, which the industry calls “vein-to-vein time,” can take several weeks.

“The problem of how do we manufacture cells at commercial scale really only exists since 2017,” Gerlinghaus said, referring to the year the FDA approved CAR T products from Novartis and Gilead Sciences. “It’s a fairly new problem. Prior to that, cell therapy development was largely in the clinic and the preclinical phase.”

Gerlinghaus described Cell Shuttle as a “factory in a box.” The system is entirely enclosed, serving as its own clean room. It also houses all the instruments, some of them robotic, for processing the cells. Cell Shuttle can process up to 10 therapies at once—that’s 10 therapies for 10 different patients. In preclinical research, that capability can be used to conduct different experiments in parallel, Gerlinghaus said. And that vein-to-vein time? Depending on the cell therapy, Cell Shuttle can cut that time down to one or two days, Gerlinghaus said.

The idea for Cellares came to Gerlinghaus in pre-pandemic times, while he was chief innovation officer at Synthego. At in-person industry conferences (remember those?), he heard about the progress of cell therapies. He also heard about the problems. Cell therapy developers talked about the challenges of manufacturing these therapies at scale.

Gerlinghaus teamed up with two other Synthego veterans, Omar Kurdi and Alex Pesch, to co-found Cellares in 2019. The startup raised an $18 million Series A round of funding led by Eclipse Ventures but kept mostly quiet about its work until late last year, when it started to test its technology with industry players. The Fred Hutchinson Cancer Research Center was announced as the first research partner last October. The center gains early access to Cell Shuttle while Cellares gets insight about how the technology fits into manufacturing workflows. Earlier this year, PACT Pharma of South San Francisco was the first company to enter this partnership program.

Cell Shuttle could make cell therapies more accessible and more affordable for more people. In addition to speeding up the manufacturing process, Cellares claims its technology lowers manufacturing costs by 75%. Gerlinghaus envisions Cell Shuttle being marketed to three segments of the life sciences industry. The first is pharmaceutical companies, large ones as well as startups. Cancer centers and hospitals represent the next target customer group, followed by contract development and manufacturing organizations (CDMOs).

Cellares has competition in the effort to automate cell therapy manufacturing. Ori Biotech is developing an enclosed and automated cell and gene therapy manufacturing system. The London-based startup closed a $30 million Series A financing last October. Lonza is developing technology that performs the manufacturing steps in a disposable cassette loaded into a system it calls Cocoon. The Cocoon technology comes from Octane Biotech, a startup based in Canada and a Lonza partner. In 2018, the CDMO giant paid an undisclosed amount to acquire an 80% ownership stake in Octane. The deal also gave Lonza the right to acquire full ownership of the startup.

The latest Cellares financing was co-led by Decheng Capital and Eclipse Ventures. Also participating in the Series B round were 8VC and Skyviews Life Sciences. 8VC is a returning investor to Cellares while Decheng and Skyviews are new ones.

Forget the industry terms “CDMO” and “CMO” when discussing cell therapy manufacturer Cellares. The South San Francisco-based company has coined its own acronym as the world’s first integrated development and manufacturing organization (IDMO).

Based on the financing Cellares has attracted, investors are convinced the company has plenty to offer along with its differentiating new handle.

Wednesday, Cellares revealed a $255 million series C investment round to complete construction of its commercial-scale cell therapy manufacturing facility in Bridgewater, New Jersey. The fresh funding follows an $82 million series B round in 2021 and brings total backing in the company to $355 million.

Leading the round is Koch Disruptive Technologies, which will enlist its managing director David Mauney to Cellares’ board. Another investor betting on Cellares’ approach is Bristol Myers Squibb—a major cell therapy player with two treatments approved (Abecma and Breyanzi) and three others in its pipeline.

“Cell therapies have tremendous curative potential across a wide range of diseases,” Mauney said in a release. “But right now, manufacturing by conventional CDMOs is expensive, failure-prone, and impossible to scale.

“As the first IDMO, Cellares is empowering cell therapy companies to build viable businesses, remain competitive, and meet the needs of fast-growing patient populations.”

CDMO is the biopharma industry term for a contract development and manufacturing organization, while a CMO describes a contract manufacturing organization. The companies help drug developers throughout the various stages of advancing a drug to market and then help provide commercial supply when needed.

Meanwhile, Cellares’ site in New Jersey covers 118,000 square feet and will be able to produce 40,000 cell therapy batches a year, the company said. This represents a tenfold increase in productivity compared with “conventional CDMO facilities,” according to Cellares.

Compact automation allows for a 90% reduction in both labor and facility size to produce the same number of batches, according to the firm. Cellares has dubbed its platform Cell Shuttle.

The New Jersey site will have the capacity for 50 Cell Shuttle modules. Each is a factory-in-a-box platform that leverages automation to reengineer patient cells and create a finished product ready for infusion.

The company aims for the New Jersey factory to be ready in the second half of 2024.

At its headquarters, Cellares plans to conduct preclinical process development and tech transfer of manual processes into Cell Shuttles for its existing partners. That site will be ready in the first half of next year. Cellares also has a third plant in the works in Europe at a location it has yet to unveil.

Also participating in the investment round are DFJ Growth and Willett Advisors along with prior investors Decheng Capital, Eclipse and 8VC.

Cellares has inked its first international deal with Bristol Myers Squibb, with the cell therapy manufacturer noting it is going through “tremendous tailwinds” from the Biosecure Act with increased interest from many potential clients.

Bristol Myers has reserved clinical and commercial capacity for an undisclosed number of CAR-T therapies at Cellares’ future facilities in the US, EU and Japan, which are slated to open in the next few years. “We’re building out unprecedented amounts of cell therapy capacity,” CEO Fabian Gerlinghaus told Endpoints News in an interview.

The Bristol Myers deal is worth $380 million in upfront and milestone payments. Cellares will tech-transfer the pharma company’s CAR-T therapies into its automated platform, dubbed the Cell Shuttle. It will also get access to Cellares’ recently announced automated quality control platform.

As biopharma companies seek US-based cell manufacturers, they are competing with each other over Cellares’ offerings, Gerlinghaus said. “Whether the Biosecure Act passes or not, the mere fact that Congress is thinking about forbidding American pharma companies from working with WuXi is making a lot of pharma executives very, very nervous,” he said.

The Novo-Catalent deal has also given Cellares an opening, Gerlinghaus added. “There’s obviously always conflicts of interests. You don’t necessarily want your competitor pharma company manufacturing your products,” he said.

It’s crucial to have global capacity as CAR-T therapies need to be made as locally as possible, Gerlinghaus said. “From the pharma perspective, whoever can meet patient demand really grabs market share. So from that perspective, capacity is king,” he said.

Cellares has two US-based facilities set to open this year, with the first located in South San Francisco, CA, and the second in Bridgewater, NJ.

In August, Bristol Myers participated in Cellares’ Series C raise and then expanded its proof-of-concept partnership with the manufacturer in October to assess the abilities of the Cell Shuttle to make its CAR-T therapies.

“Our collaboration with Cellares strengthens our existing internal manufacturing capabilities for CAR-T cell therapies by giving us access to the first end-to-end fully automated cell therapy manufacturing platform, to help ensure we meet the high demand for these differentiated treatments, now and in the future,” Bristol Myers’ cell therapy business president Lynelle Hoch said in a statement.

Cellares has other CAR-T partnerships. In November, Cabaletta Bio announced a proof-of-concept deal for the manufacturer to make its clinical-stage autoimmune therapy. In September, Lyell Immunopharma tapped Cellares to make its clinical-stage CAR-T for solid tumors that express the protein ROR1.