Roderick Wong, MD – Managing Partner, Chief Investment Officer at RTW Investments

안녕하세요 보스턴 임박사입니다.

유전자 치료제 분야는 제가 오랜 세월동안 추이를 지켜보며 관심을 가지고 바이오텍 기업들의 흥망성쇠를 관찰하며 저 자신 또한 몸담고 있는 분야입니다. 저는 유전자 치료제와 세포 치료제가 어떻게 해야 환자들과 가족들 그리고 의료인들에게 도움을 줄 수 있게 되는지 그 전과정에 대해 찾아보고 공부하고 있습니다.

오늘 소개할 Rocket Pharmaceuticals는 벤처캐피탈리스트로 부터 시작된 유전자 치료제 회사로 소개하려고 하는데, 잘 아시다시피 바이오텍의 원조인 Genentech도 KPMC에서 해고된 벤처캐피탈리스트 Robert A. Swanson으로 부터 시작되었습니다.

Rocket Pharmaceuticals는 2015년에 RTW Investment의 VC인 Roderick Wong과 당시 Novartis에 있던 Gaurav Shah의 2시간동안의 대화로 시작된 회사입니다. 이 회사에 대한 스토리는 RTW Investment Website와 BioPharmaDive에 비교적 상세히 소개되어 있습니다.

Rocket Pharmaceuticals Inc – RTW Investments

“Forming and building Rocket

Rocket was born out of more than a year-long study in gene therapy. In late 2015, Rocket was formed around a single academic license from a European academic institution. RTW hired a world-class management team, including CEO Dr. Gaurav Shah, COO Kinnari Patel, and CMO Dr. Jonathan Schwartz, and continued to identify additional targets and licensed four more academic programs.

Supporting Rocket through the lifecycle

RTW completed two private financings, syndicating both the Series A and Series B rounds, and took Rocket public through a reverse merger in January 2018. We believe opportunities exist to license additional gene therapy academic assets into the Rocket pipeline in the future. In addition to our board representation in the company, Rocket’s generous pipeline diversification of now five clinical programs creates an attractive risk reward opportunity, giving us comfort in owning an outsized position in the company.”

How Rocket Pharma quietly became one of gene therapy’s high flyers – BioPharmaDive 03/11/2021

Rocket의 시작은 Roderick Wong이 Spain에 있는 Jose Carlos Segovia 교수의 연구에 관심을 가지면서 시작합니다. (Generation of a High Number of Healthy Erythroid Cells from Gene-Edited Pyruvate Kinase Deficiency Patient-Specific Induced Pluripotent Stem Cells. Stem Cell Rep 2015, 5, 1053-1066. Jose C Segovia et al.)

Jose Segovia 교수의 강연이 Youtube에 있는데요 좀 길지만 링크를 걸어 두겠습니다.

2022년에 학회에서 발표한 자료도 있어서 링크합니다.

RTW는 2015년과 2017년에 Rocket Pharmaceuticals의 Series A와 Series B를 주도한 이후에 Inotek과의 Reverse Merger를 주도했습니다.

“Rocket Pharmaceuticals has landed a Nasdaq listing through a reverse merger. Shareholders in Rocket will own 81% of the combined company, leaving the Inotek stockholders who stuck around after back-to-back glaucoma failures with 19%.”

“New York, NY-based Rocket will combine that money with the $25 million it raised from a group of investors including RTW Investments, Cormorant Asset Management and Tavistock Group earlier this year and kick off a multi-front clinical development program. Rocket plans to move into human testing in 2018 and have as many as four trials on the go before the end of the year.”

Rocket Pharmaceuticals가 다양한 프로그램의 유전자 치료제를 BLA까지 임상연구를 잘 수행했지만 최근에 FDA 승인을 받는데 어려움을 겪고 있습니다.

FDA Rejects Rocket’s Gene Therapy, Cites Need for Additional CMC Info – Biospace 06/28/2024

“Rocket Pharmaceuticals’ gene therapy Kresladi has been hit with an FDA Complete Response Letter requesting additional chemistry, manufacturing and controls information to complete its review.”

Rocket crashes as gene therapy patient dies, FDA imposes hold – Fierce Biotech 05/27/2025

“The FDA imposed the clinical hold Friday, before the patient died, to enable evaluation of the causes of the adverse event. Rocket has identified the addition of a C3 inhibitor to the pretreatment regimen as a potential cause of the capillary leak syndrome. The biotech added the immunomodulatory agent to the regimen to counter complement activation by the AAV and prevent thrombotic microangiopathy (TMA). Rocket saw complement activation and TMA, a potentially life-threatening blood vessel condition, in patients who received the original pretreatment regimen.”

“The biotech didn’t see TMA in the two patients who received the C3 inhibitor but both participants had capillary leak syndrome. The first patient died.”

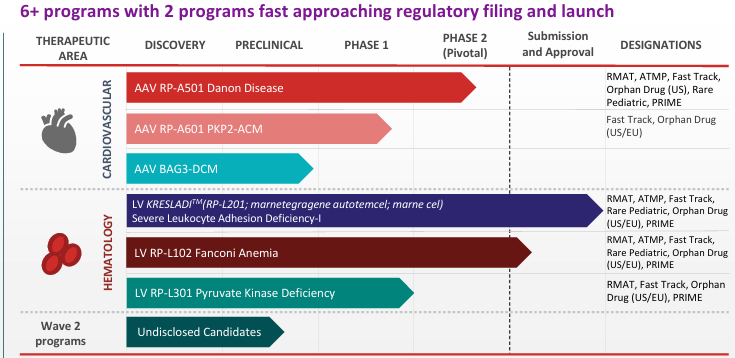

Rocket Pharmaceuticals의 최근 회사 Presentation을 링크합니다. 현재 $318 Million의 현금을 보유하고 있고 2026년 4분기까지 임상시험을 수행할 수 있습니다.

현재 Rocket은 회사의 성장에 있어서 중요한 시점에 있습니다. AAV와 Lentiviral vector를 기반으로 한 전달체 기술이 어려움을 났게 하는 이유인 것 같지만 회사 임직원들이 잘 준비해서 꼭 성공하기를 바랍니다.