안녕하세요 보스턴 임박사입니다.

Clovis Oncology의 Co-Founder였던 Andrew Allen은 NEJM 2014년 논문에서 CTLA-4 Immuno-Oncology에 대한 반응성이 Neoepitope에 좌우된다는 것을 읽고 Neoantigen에 대한 Cancer Vaccine을 개발하기 위해서 Gritstone Oncology를 설립하고 $102 Million Series A를 받습니다.

Gritstone was co-founded by Andrew Allen, who will act as president and chief executive officer. Allen co-founded Boulder, Colo.-based Clovis Oncology . Patrick Mahaffy, chief executive officer of Clovis, will act as Gritstone’s chairman.

Allen founded the company after reading a 2014 paper in the New England Journal of Medicine that discussed why some patients don’t seem to respond to immune checkpoint inhibitors. But cancer cells are constantly mutating, creating so-called neoantigens.

Gritstone’s other co-founders are Tim Chan and Naiyer Rizvi, both physicians at Memorial Sloan-Kettering Cancer Center. Additional co-founders include Jean-Charles Soria of the Institut Gustave Roussy in Paris, Graham Lord of King’s College London, and Mark Cobbold of Massachusetts General Hospital.

Series A를 한 지 2년후에 $93 Million Series B를 받았습니다.

Cancer upstart Gritstone gains major $93M series B. – Fierce Biotech 9/7/2017

The company is slated to enter the clinic in the middle of next year with a focus on non-small cell lung cancer and gastric cancer, and will use much of its new cash toward building a “personalized immunotherapy manufacturing facility.”

This 43,000-square-foot industrialized manufacturing facility in Pleasanton, California, will, according to the company, “form the nucleus of Gritstone’s manufacturing program for personalized cancer therapeutics.”

“Since the formation of the company two years ago, Gritstone has made significant progress leveraging extensive human tumor molecular analysis and machine learning to develop and optimize the proprietary Gritstone EDGE tumor antigen identification platform. We have matched our breakthrough accuracy in tumor neoantigen identification with an antigen delivery system that builds on human immunity insights from infectious disease experts, culminating in an extremely potent neoantigen delivery platform expected to drive best-in-class cytotoxic T cell responses.”

The company has raised nearly $200 million over the last two years and has an experienced executive team, with Allen working alongside its CTO Roman Yelensky, Ph.D., former VP of Foundation Medicine, and a machine-learning team, as well as ex-Pfizer cancer immunotherapy chief Karin Jooss, Ph.D., as its CSO and Genentech vet Raphaël Rousseau, M.D., Ph.D., who became its CMO in May.

아직 전임상 단계에 있던 Personalized neoantigen therapy를 임상으로 진입시키기 위한 delivery system으로 Arbutus의 LNP를 사용하기로 계약을 하게 됩니다.

Gritstone taps Arbutus’ LNP tech for RNA-based therapies. – Biopharmadive 10/19/2017

One solution has been to enclose a therapeutic in a lipid nanoparticle to protect nucleic acid strands from degradation. Arbutus’ delivery platform does exactly that, and was convincingly validated by the Phase 3 success of Alnylam Therapeutics Inc.‘s patisiran, which incorporates Arbutus’ technology.

“The recent phase III validation of Arbutus’ LNP platform makes them the natural partner for Gritstone as we drive our proprietary two-component immunotherapy program into the clinic in mid-2018,” Allen noted.

Gritstone’s pipeline is currently preclinical. But as the biotech looks to move into the clinic, securing a capable delivery platform is crucial for conducting human trials. The deal with Arbutus should help Gritstone optimize its immunotherapy and manufacture product candidates.

그리고 1년후에는 BMS Opdivo와 Yervoy를 Gritstone의 personalized neoantigen therapy와 combination하는 계약을 합니다.

The duo will first evaluate GRANITE-001 in tandem with Opdivo in patients with common solid tumors, such as metastatic non-small cell lung cancer and gastroesophageal, bladder and colorectal cancers, the companies said in a statement. The two-part phase 1 dose escalation trial will also test GRANITE-001 with systemic Opdivo and localized injection of Yervoy.

GRANITE-001, Gritstone’s lead asset, is given in two parts—first a priming adenoviral vector, followed by monthly boosters of an RNA vector, each containing the same 20 patient-specific TSNAs.

그리고 bluebird bio가 Gritstone Oncology의 EDGE와 TSNA를 bluebird bio의 TCR-directed cell therapy에 사용할 수 있도록 하는 $30 Million 상당의 계약을 합니다.

bluebird bio, Gritstone Oncology Partner on TCR Cancer Cell Therapies. GEN Edge 8/23/2018

bluebird bio will use Gritstone Oncology’s artificial intelligence (AI) platform to research, develop, and commercialize T-cell receptor (TCR) directed cell therapies for cancer, under a collaboration that could generate more than $30 million for Gritstone, the companies said today.

Gritstone will use its EDGE™ (Epitope Discovery in cancer GEnomes) tumor-specific neoantigen (TSNA) identification platform to enable patient selection for clinical development of the cancer cell therapies. EDGE uses machine learning to enable users to analyze specific tumor types to identify tumor-specific targets—and natural TCRs directed to those targets—for use in bluebird bio’s established cell therapy platforms, the companies said.

Gritstone Oncology has agreed to provide bluebird with ten tumor-specific targets across several tumor types and, in some cases, TCRs directed to those targets to bluebird bio. In return, bluebird has agreed to pay Gritstone $20 million upfront, and make a $10 million Series C preferred equity investment in Gristone. Bluebird also agreed to pay Gritstone unspecified “significant” payments tied to achieving development, regulatory, and commercial milestones on any therapies; as well as tiered royalties on certain approved therapies.

그리고 곧바로 $100 Million Nasdaq IPO를 하고 이후 두번의 증자를 했습니다.

Emeryville, Calif.-based Gritstone Oncology hits the ground running today on the Nasdaq Exchange after raising $100 million in an initial public offering. Gritstone, which will sell under the ticker symbol GRTS, sold 6.6 million shares of common stock at $15 per share, the company announced Thursday.

Gritstone Oncology prices $74.8M common stock offering. – S&P Global 4/25/2019

The company’s lead product candidate is GRANITE-001, which is in a phase 1/2 study to treat certain solid tumors.

Gritstone Raises $125M in Private Financings. – Precision Medicine Online 12/28/2020

Gritstone Bio Raises $55M in PIPE Financing. – Precision Medicine Online 9/17/2021

Gritstone Bio said on Thursday it raised $55 million in a private investment in public equity financing from the sale of 5 million shares of its common stock at $11 per share. The PIPE financing was led by Frazier Life Sciences Public Fund, with additional participation from Redmile Group and Gilead Sciences. Cowen served as the sole placement agent for the PIPE financing, which is expected to close Sept. 17.

Emeryville, California-based Gritstone has several candidates in oncology and infectious disease. Its cancer portfolio includes immunotherapies being studied in microsatellite stable colorectal cancer, gastroesophageal cancer, and KRAS-mutated non-small cell lung cancer. The company is also developing a second-generation vaccine against SARS-CoV-2 and an HIV therapeutic vaccine.

Gritstone bio Announces Private Placement of $45.0 Million. – Press Release 10/25/2022

Gritstone bio, Inc. (Nasdaq: GRTS), a clinical-stage biotechnology company that aims to develop the world’s most potent vaccines, today announced that it has executed a securities purchase agreement to sell, through a private investment in public equity (PIPE) financing, 6,637,165 shares of its common stock at a price of $2.26 per share of common stock and 13,274,923 pre-funded warrants to purchase up to 13,274,923 shares of common stock at a price of $2.2599 per pre-funded warrant for aggregate gross proceeds of approximately $45.0 million, before deducting placement agent fees and offering expenses. Each pre-funded warrant will have an exercise price of $0.0001 per share, will be exercisable immediately, and will be exercisable until exercised in full.

Gritstone bio is the latest drug developer to be tapped for the Biomedical Advanced Research and Development Authority’s (BARDA’s) Project NextGen, with the biotech in line for more than $400 million to conduct a 10,000-person phase 2 study of its COVID-19 vaccine.

BARDA has contracted the company to conduct a U.S.-based randomized phase 2b trial assessing Gritstone’s self-amplifying mRNA (samRNA) vaccine candidate against an approved vaccine. Preparations for the study, which will be fully funded by the government, are already underway, and the trial is due to kick off in the first quarter of 2024, the biotech said in the Sept. 27 release.

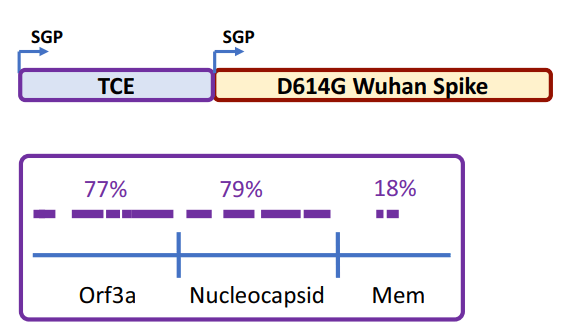

Gritstone’s candidate, which the company has dubbed the CORAL program, is designed to drive both B-cell and T-cell immunity against the virus that causes COVID-19 by using a combination of samRNA and immunogens containing both spike and additional viral targets.

“CORAL was designed to address these limitations by inducing durable neutralizing antibody and T cell-based immunity against current and future SARS-CoV-2 variants.”

Gritstone is best known for its work in cancer vaccines, with its lead program, dubbed GRANITE, in phase 2/3 trials for metastatic, microsatellite-stable colorectal cancer.

그런데 COVID-19 CORAL phase 2b 임상시험을 위한 GMP-grade raw material이 준비가 되지 않으면서 임상이 6개월 가량 뒤로 밀리게 됩니다.

The study was originally slated to kick off during this year’s first quarter, but it will now launch during the fall in order to “allow use of fully GMP-grade raw materials,” the company disclosed in a press release.

그러나, Phase 2b 일정의 연기는 Gritstone Bio 임직원의 40%라는 메이저 정리해고를 낳게 되엇습니다.

Gritstone to lay off 40% of workforce after costly study delay. – Biopharmadive 3/1/2024

Gritstone Bio will lay off about 40% of its workforce after missing out on funding it expected to receive this quarter, the company said Thursday.

Gritstone, a maker of vaccines for cancer and infectious diseases, is developing a COVID-19 shot with the help of the U.S. government. In September, the Biomedical Advanced Research and Development Authority awarded the company a contract worth up to $433 million to run a large mid-stage trial testing its shot against an available vaccine. That contract is part of “Project NextGen,” a federal initiative that began last August to search for new and better COVID-19 drugs.

According to a regulatory filing, Gritstone expected to receive up to $10 million from the contract by the first quarter upon hitting certain goals related to the study’s preparation. The bulk of the cash would come afterwards, once the trial is up and running.

Earlier this month, though, a manufacturing-related delay caused Gritstone to push the trial’s start from the first three months of the year to next fall. At the time, Gritstone said the extra time would improve the trial’s “regulatory value” and “interpretability,” as well as enable it to test the shot against a newer coronavirus variant. But the setback also left Gritstone without the extra cash from BARDA. The company had just over $90 million in the bank at the end of September.

“The lack of near-term funding necessitated this difficult step to fortify our balance sheet and cash position, which unfortunately means an impact to our workforce,” said CEO Andrew Allen, in a Thursday statement announcing the restructuring. The company had 233 full-time employees at the end of 2022, according to its last annual report.

Gritstone noted Thursday its “core programs and anticipated milestones” haven’t changed. In the first quarter, it still expects to report preliminary data from the Phase 2 portion of a study evaluating a vaccine it’s developing for colorectal cancer.

2023년 10월에 발표한 Corporate Presentation은 아래와 같습니다.

이번 40%의 인력 구조조정은 Covid-19뿐만 아니라 Personalized Neoantigen Therapy에도 영향을 주지 않을까 염려가 됩니다. GMP-grade raw materials이 문제였는데요. 이것이 Arbutus의 LNP 에 들어가는 raw material 때문이었는지 아니면 samRNA의 raw materials 문제였는지 알 수 없지만 non-GMP에서 GMP로 갑자기 넘어가는 것은 간단한 문제는 아니라고 생각이 되어서 다소 우려되는 상황이라고 생각이 들고요. 2Q까지 어떻게 진행이 되는지 지켜봐야 할 것 같습니다. 속히 문제가 해결되면 좋겠습니다.