안녕하세요 보스턴 임박사입니다.

Harvard University의 David R. Liu 교수는 Biotech 분야의 발전에 지금까지 수많은 업적을 남겼습니다. 중요한 업적을 든다면 아래와 같습니다. 이 분야는 모두 신약개발에 너무나 큰 공로를 갖고 있는 연구업적들이기 때문에 시간이 문제일 뿐 Liu 교수가 노벨상을 받는 날이 언젠가 올 것으로 생각합니다.

- DNA-Encoded Library

- Base Editing

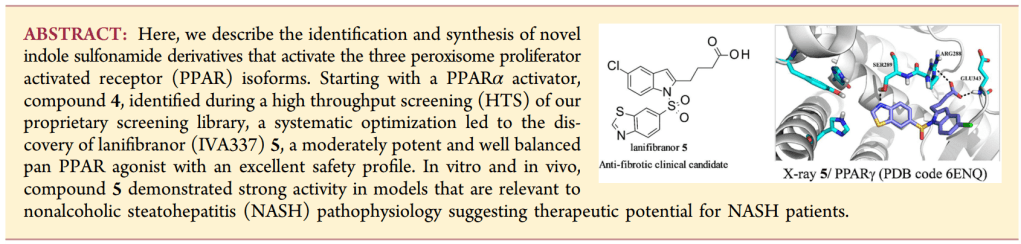

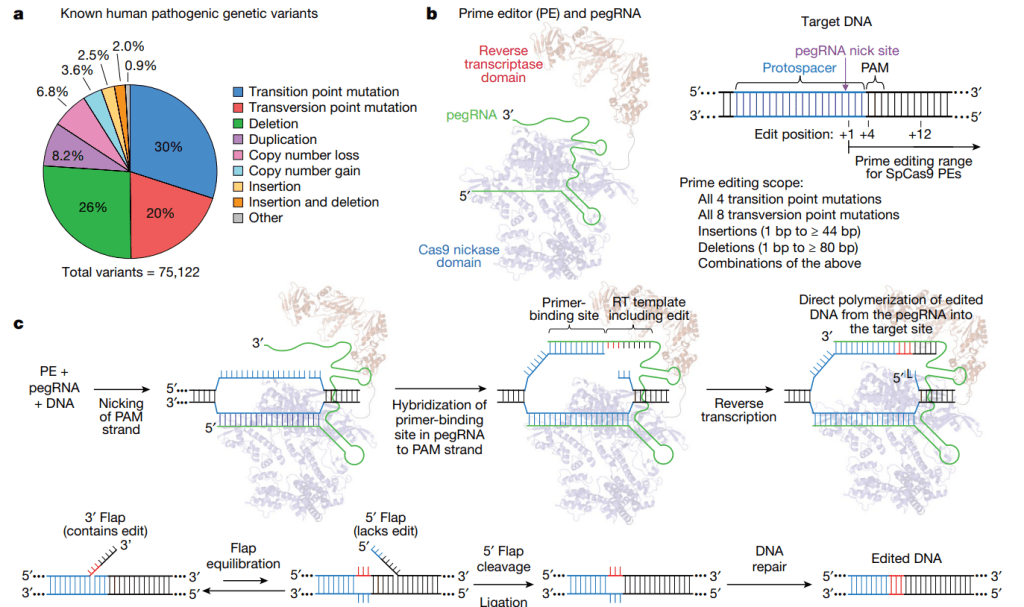

- Prime Editing

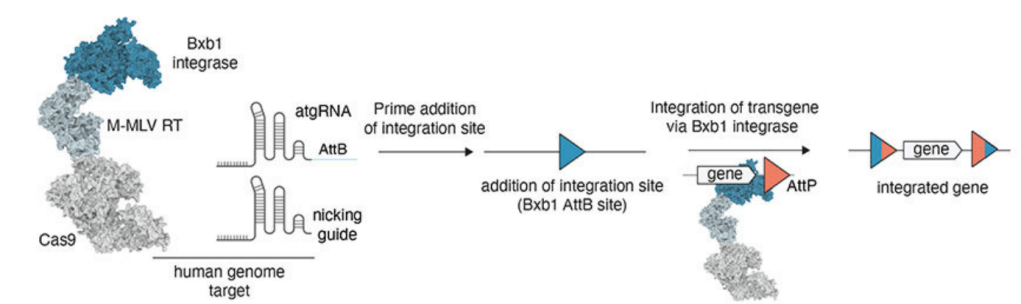

Prime Medicine은 Prime Editing을 세계 최초로 보고한 2019년 Nature 논문 결과를 바탕으로 만들어진 회사입니다.

2020년에 창업한 Prime Medicine은 2021년 7월에 $315 Million Series A & Series B를 하면서 알려지게 됩니다.

After a year in the shadows, Prime Medicine is breaking cover with $315 million to develop a new kind of gene editing. It was developed by David Liu, Ph.D., and Andrew Anzalone, M.D., Ph.D., at the Broad Institute.

Here’s how it works: “We make a prime editor that has a protein part and what’s called a guide RNA part,” Gottesdiener said. The editor carries a template for a genetic sequence that will replace the targeted mutation. Once the prime editor gets into a cell, it scans the cell’s DNA for the disease-causing sequence that needs to be edited.

The team is about 50 strong today, and Prime hopes to grow to more than 100 employees by the end of the year. And it won’t be forging its path alone. Prime has a partnership with Beam Therapeutics, the base-editing biotech also founded by David Liu. Under the deal, Prime licensed out the rights for Beam to use prime editing in certain areas such as sickle cell disease. In return, Beam gave Prime certain rights to technology, intellectual property and so on.

3개월 후 IPO를 하였습니다. 전광석화같은 Nasdaq 상장이었죠.

Gross proceeds for Prime could reach $201.25 million—just over the $200 million estimate offered earlier this month by Renaissance Capital, which tracks the IPO market. Prime is among the year’s three largest initial public offerings for a biotech company, following vision care drug/device developer Bausch + Lomb ($630 million gross proceeds) and vaccine developer HilleVax (also $200 million).

Prime projected using approximately $65 million of net proceeds for Investigational New Drug (IND)-enabling studies and potential initiation of clinical studies for some of its current therapeutic programs; and another approximately $65 million for continued advancement of its Prime Editing platform and discovery-stage research for other potential programs.

The company also projected using approximately $50 million in net proceeds to develop its early-stage manufacturing processes and build out a dedicated facility for its medicinal chemistry, process development, and analytical chemistry groups. The facility would include a non-GMP piloting lab for making guide RNA, mRNA, and synthesizing lipids.

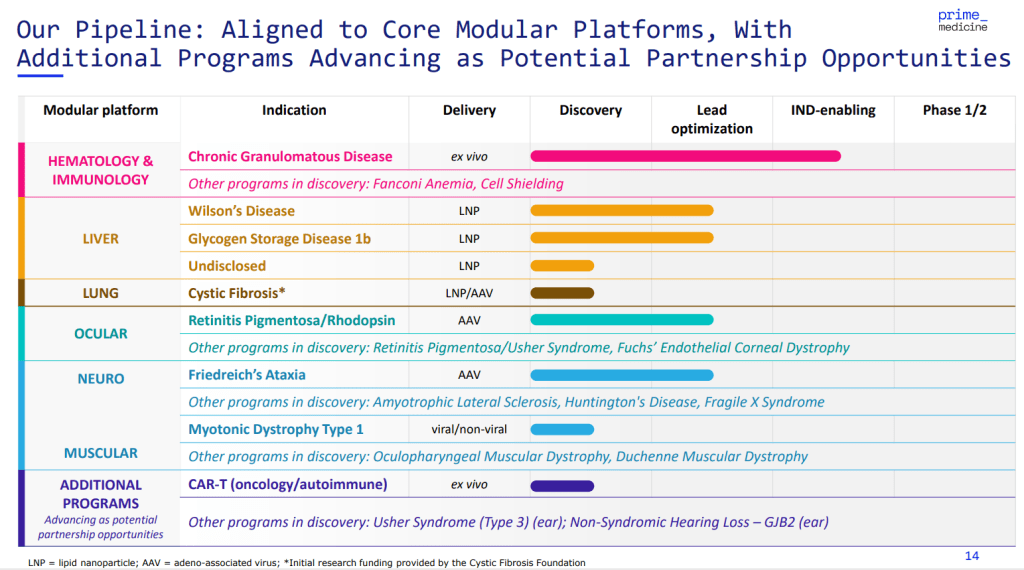

Prime Medicine은 창업 후 4년이 지난 지금까지 아직 임상시험에 진입한 프로그램이 없습니다. 금년 상반기에 PM359의 임상진입을 기대하고 있고 FDA와의 pre-IND meeting 결과도 좋았다고 합니다.

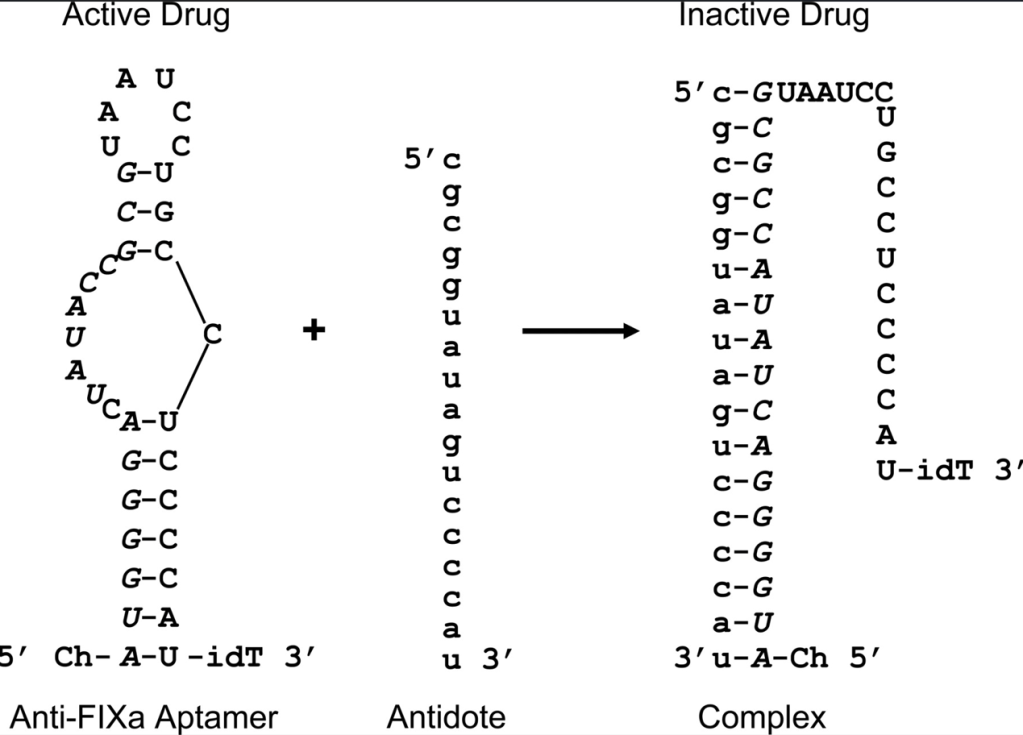

두가지 Legal battle이 예상되는데 PASTE platform의 Tome Biosciences와의 IP infringement issue가 있습니다. Tome Biosciences에 대해서는 블로그를 쓴 바가 있습니다.

BIOTECH (97) Tome Biosciences: Programmable Genomic Integration (PGI) Platform

Prime Medicine이 Clinical-Stage로 되면 IP infringement issue가 표면화될 것으로 예상합니다. 또하나 Legal issue였던 Myeloid Therapeutics와의 공동연구계약 종료와 관련한 소송은 최근에 중재가 된 것으로 알려졌습니다.

Prime Medicine, Inc. (Nasdaq: PRME) (“Prime Medicine”) and Myeloid Therapeutics, Inc. (“Myeloid”), today announced resolution of all of their outstanding disputes, signaling an end to the pending arbitrations and a positive outcome for both parties.

JPM: Prime Medicine Eyes 2024 IND for First Prime Editing Therapy – GEN Edge 1/9/2024

Prime Medicine is on track to file the first IND/CTA application for human trials of a prime editing therapy to the FDA during the first half of this year, with the first clinical data expected as soon as 2025, president and CEO Keith Gottesdiener, MD, told attendees at the 42nd Annual J.P. Morgan Healthcare Conference.

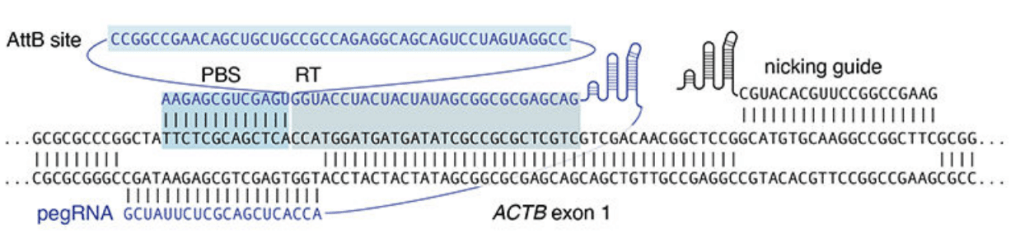

Prime Medicine’s first candidate poised to enter the clinic is PM359, a blood-targeting candidate for chronic granulomatous disease (CGD) now in the IND-enabling phase. PM359 consists of autologous hematopoietic stem cells modified ex vivo using prime editing.

During 2023, Prime Medicine held pre-IND and INTERACT meetings about PM359 and its prime editing platform with the FDA, whose recommendations the company has aligned with regarding preclinical data, toxicology, CMC [chemistry, manufacturing, and controls], off-target edits, and clinical development plans.

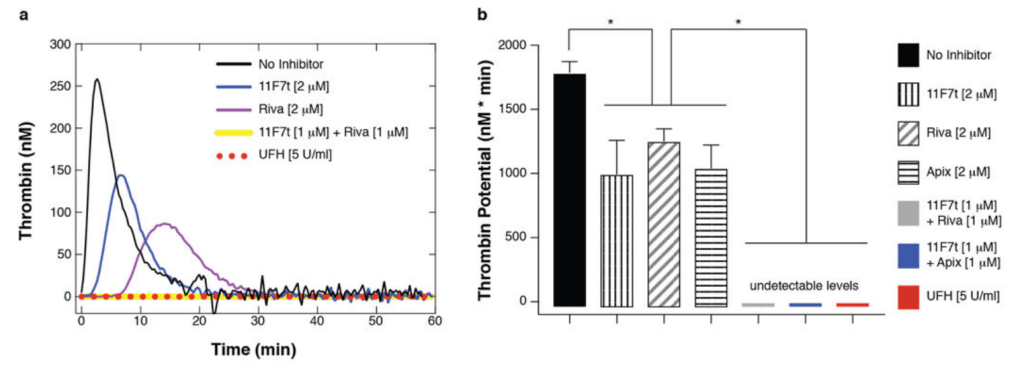

To support its IND/CTA filing, Gottesdiener said, Prime Medicine has generated data showing:

- No off-target editing detected in healthy human donor CD34+ cells, according to a targeted in vitro analysis of 550 potential off-target sites of off-target editing.

- No large deletions or translocations in bone marrow engrafted Prime-Edited LT-HSCs, according to data from an in vivo analysis from mouse bone marrow harvested 16 weeks after engraftment was complete

- Translocation positive control: Cas9 nuclease-edited cells, generated by transfecting HEK293T cells with single guide RNA (sgRNA) targeting NCF1 and Streptococcus pyogenes Cas9 (SpCas9) mRNA

The other three pillars are:

- Liver—Programs to treat Wilson’s disease and glycogen storage disease 1b are in lead optimization phases, while a program with an undisclosed liver indication is in discovery phase. All three apply lipid nanoparticle (LNP) delivery. Other discovery programs are proceeding in Fanconi anemia and cell shielding.

- Ocular—A retinitis pigmentosa/rhodopsin candidate targeting eye tissue and using adeno-associated virus (AAV) vector delivery, is also in lead optimization phase. Other discovery programs are proceeding in retinitis pigmentosa/Usher syndrome, and Fuchs’ endothelial corneal dystrophy.

- Neuro and muscular—A candidate for Friedreich’s ataxia also delivered via AAV, also in lead optimization phase; a myotonic dystrophy type 1 program using viral and nonviral delivery is in discovery phase. Other discovery programs are proceeding in amyotrophic lateral sclerosis, Huntington’s disease, Fragile X syndrome, oculopharyngeal muscular dystrophy, and Duchenne muscular dystrophy.

He asserted that Prime Medicine has pursued an aggressive filing strategy for technological advances, and holds broad, enabling, foundational IP for all prime editing technologies—three issued and one allowed patents. “Our position is, for those that truly look like, act like, seem like prime editing, they probably are prime editing, and we’re confident that we have the foundational IP for these technologies,” Gottesdiener said.

Prime Medicine terminated the collaboration in September 2023, prompting Myeloid to file an arbitration claim seeking $17.5 million after Prime failed to pay a milestone payment in that amount. Prime countered that Myeloid breached their agreement, and filed its own arbitration claim in October seeking $43.5 million from Myeloid, according to Prime’s Form 10-Q quarterly report for the third quarter of 2023.

Prime Medicine이 올해 PM359의 IND Filing을 준비하면서 $161 Million 의 유상증자를 성공적으로 했습니다. 지금과 같은 시장상황에서 다행이라고 생각합니다. $6.25/share의 유상증자였는데 현재는 &8.74/share 로 약 40% 정도 주가가 올라온 상황입니다.

The gross proceeds to Prime Medicine from the offering, before deducting underwriting discounts and commissions and offering expenses, were approximately $161.0 million.

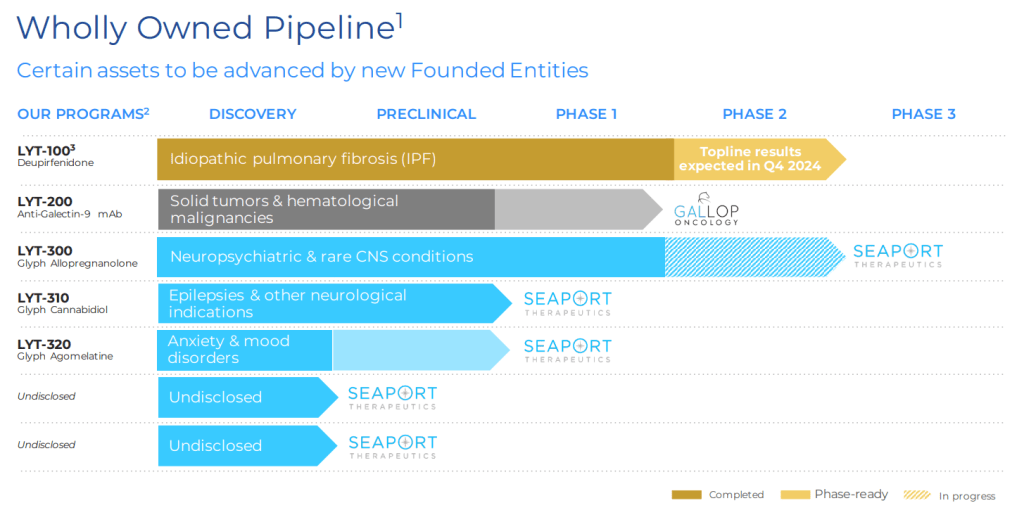

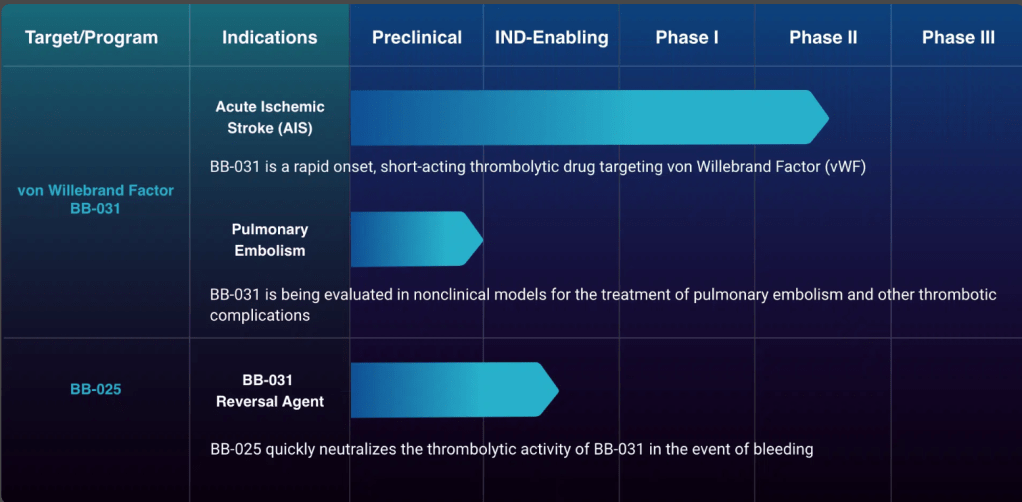

올해 2월에 발표한 Corporate Presentation에 나타난 파이프라인은 아래와 같습니다. ex-Vivo program으로 먼저 Biology Risk를 낮추고 이후에 mRNA-LNP조합으로 간질환 rare disease와 AAV 안과 rare disease 및 Neurology rare disease 프로그램이 Lead optimization 단계에 있습니다.

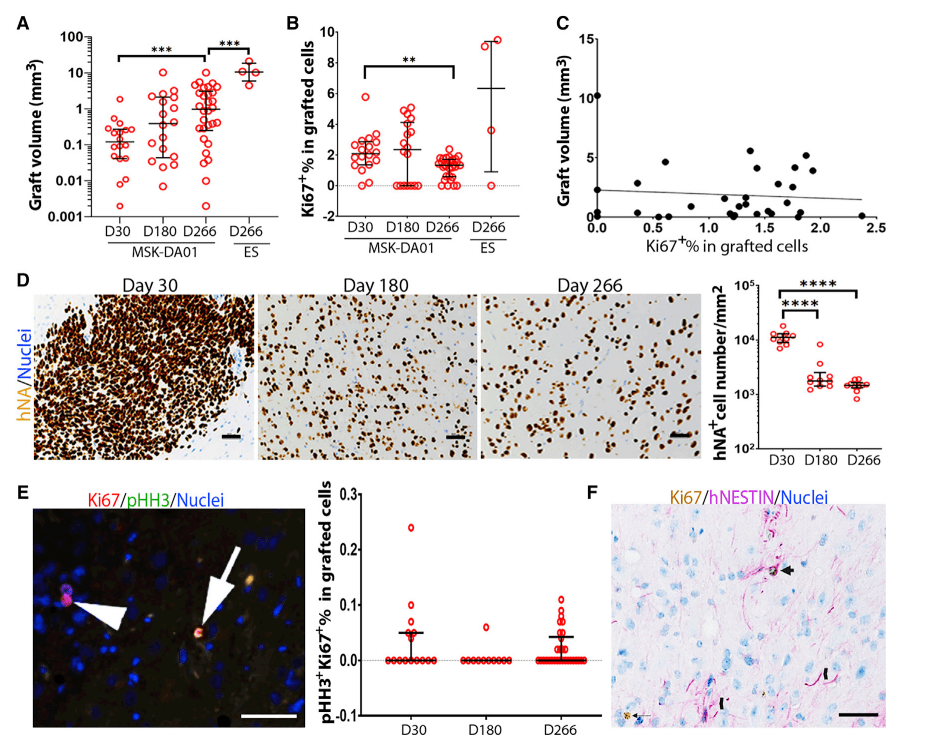

PM359의 Preclinical data를 보면 아래와 같습니다.

- Prime editing을 한 LT-HSC cell은 in vivo에서 완전한 engraftment를 보여주었고

- NCF1 correction이 20% threshold를 훨씬 넘긴 85% 이상을 유지하고 있었고

- Human neutrophill을 보았을 때, ex vivo에서 NADPH oxidase activity가 >80% 교정된 것을 알 수 있었습니다.

이러한 결과는 PM359가 임상에 진입할 수 있슴을 보여주고 있습니다.