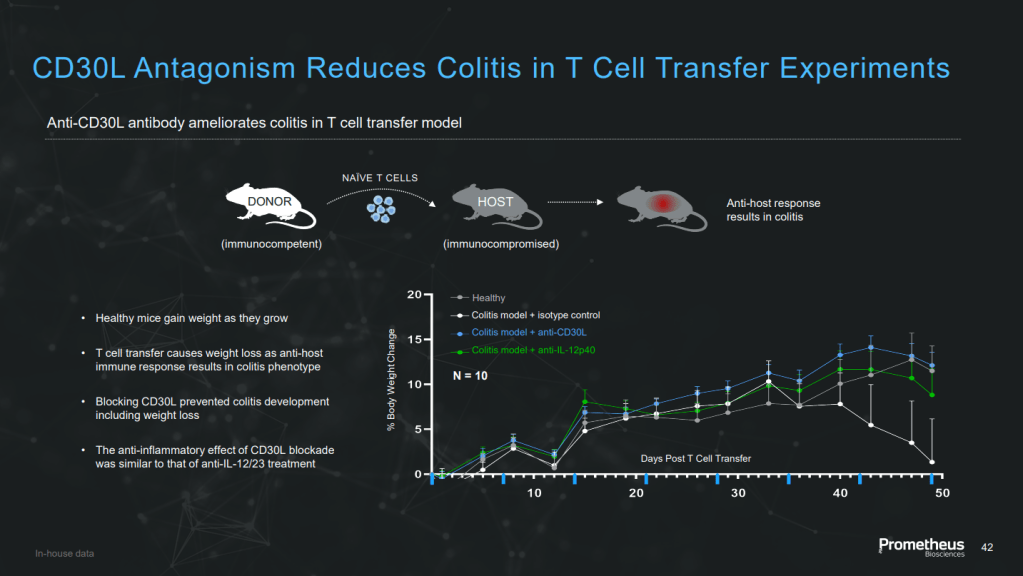

(Picture: John Valliant, McMaster University, Founder & CEO of Fusion Pharmaceuticals)

안녕하세요 보스턴 임박사입니다.

요즈음 Targeted Radiotherapeutics가 정말 굉장합니다. 현재 $7 Billion 시장규모인데 2032년이면 $39 Billion까지 커진다고 합니다. 이렇다보니 빅파마들이 Radiotherapeutics 회사들을 인수하는 일이 많이 있습니다. 종전에 Novartis의 Pluvicto와 Point Biopharma 등에 대해 나눈 적이 있습니다.

BIOTECH (104) Novartis: Pluvicto (177Lu-PSMA-617) – the First Precision Radiopharmaceuticals

BIOTECH (106) Point Biopharma: Precision Radioligand Therapy (RLT)

이들 회사들은 177Lu라는 beta-emitter를 사용하는데요 Fusion Pharmaceuticals는 225Ac라는 alpha-emitter를 사용하는 회사로 가장 앞서가는 회사라고 할 수 있습니다.

캐나다에 있는 McMaster 대학의 화학과 교수인 John Valliant가 2014년에 창업한 회사입니다. 2015년에 PCT 에 출원한 특허에 의하면 Linker Library 에 대한 특허입니다.

Hamilton-based biopharmaceutical precision oncology firm Fusion Pharmaceuticals has entered an agreement that will see it acquired by pharmaceutical giant AstraZeneca for up to $2.4 billion USD.

Fusion Pharmaceuticals was founded out of McMaster University in 2014 with the goal to cure cancer by developing targeted alpha therapeutics, a method that employs radioactive substances that undergo radioactive decay to treat diseased tissue at close proximity.

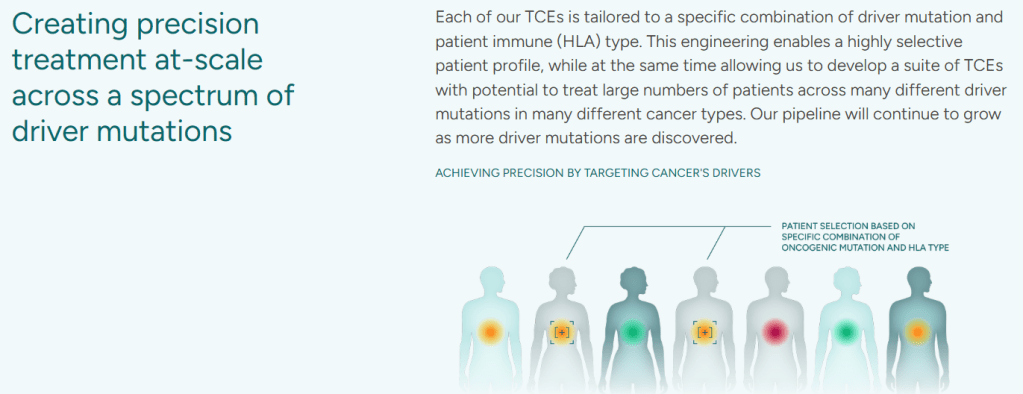

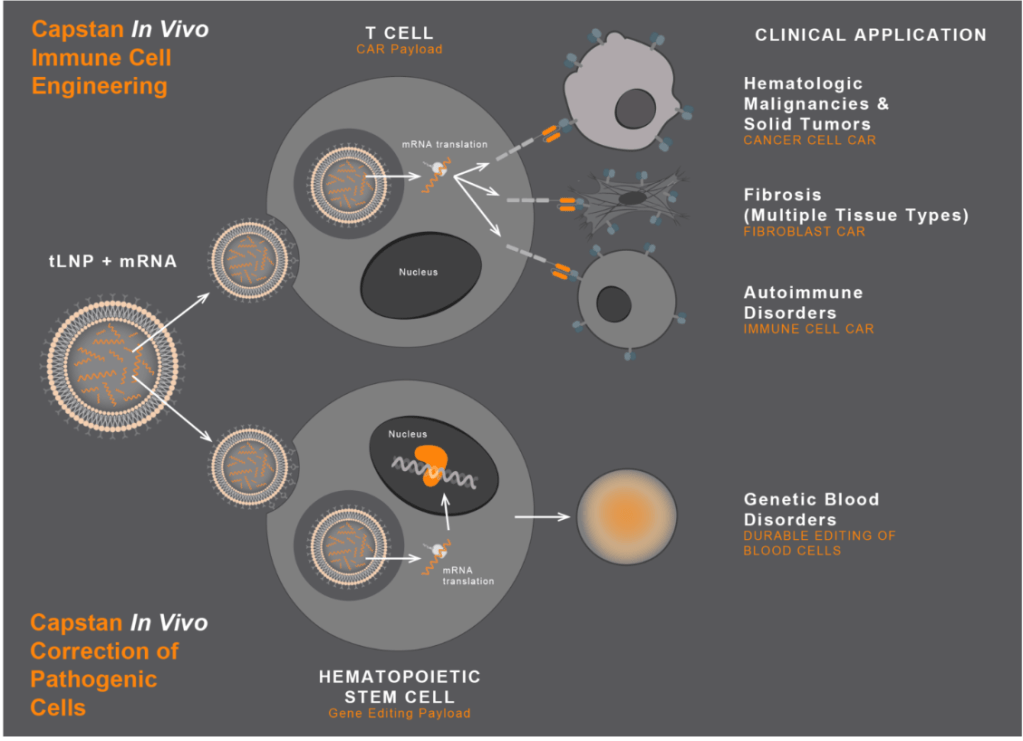

Fusion has been doing just that, developing radioconjugates (RCs), which combine the precise targeting of antibodies, small molecules, or peptides with medical radioisotopes that aim to deliver radiation directly to cancer cells. Fusion, which has been working with AstraZeneca on developing certain RCs, says the treatment provides a more precise mechanism to kill cancer cells compared to traditional radiation therapy.

Fusion CEO John Valliant said in a statement that the acquisition will bring together Fusion’s expertise in RCs, including its research, development, manufacturing, and supply chain, with AstraZeneca’s work in small molecules and biologics engineering to develop new RCs.

“Expanding on our existing collaboration with AstraZeneca where we have advanced [a] targeted [RC] into Phase I clinical trials gives us a unique opportunity to accelerate the development of next-generation [RC] with the aim of transforming patient outcomes,” Valliant said.

AstraZeneca said the acquisition will strengthen its presence in Canada.

Following the acquisition, which is expected to close in the second quarter of 2024, Fusion will become a wholly owned subsidiary of AstraZeneca and continue its operations in Canada and the United States (US).

The transaction’s upfront value is approximately $2 billion USD and will see Fusion’s shareholders receive $21.00 per share, a 97 percent premium on its March 18 closing price of $10.64. However, it has the potential to be valued as high as $2.4 billion upon filing a new drug application with the US Food and Drug Administration by 2029, according to The Globe and Mail. The bonus will be paid out as $3.00 per share in a cash payable, non-transferable contingent value right.

Following Fusion’s spinout from McMaster, the company raised a $25-million USD Series A round in 2017 led by its founding venture investor, Johnson & Johnson Innovation. The company later picked up investors like OrbiMed in its $105 million USD Series B round in 2019 and the Canada Pension Plan Investment Board (CPPIB) in a $26-million raise ten months later.

Fusion debuted on the NASDAQ in June 2020 at a share price of $17.00, but has fallen as low as $2.31 per share in the past year. Following the announcement of the deal, its stock price sits at $21.15 as of 2:00 pm EST Wednesday.

As part of the transaction, AstraZeneca said it will acquire the cash, cash equivalents and short-term investments on Fusion’s balance sheet, which totalled $234 million as of December 31, 2023.

AstraZeneca’s $2.4 billion acquisition of Fusion Pharmaceuticals is the third billion-plus dollar Big Pharma radiopharmaceuticals purchase announced in the last six months; Lilly completed its $1.4 billion acquisition of POINT Biopharma last December, and BMS completed its $4.1 billion acquisition of RayzeBio in February.

As I wrote in January, the field of radiopharmaceuticals is having a moment, due to new product science and isotope sources, improvements on the supply chain and manufacturing side, as well as growing clinical evidence (and growing sales figures for marketed drugs, such as Novartis’s Pluvicto) for a widening number of indications.

That growth has led to a radiopharmaceuticals expertise and capacity crunch, however, which can make outsourcing a challenge, as ARTBIO’s Conrad Wüller, director, strategy and operations, explained in a recent panel discussion.

It’s a problem that was cited by John Valliant, founder and CEO at Fusion Pharma, when I spoke with him in late January. People with the right science backgrounds, and the required nuclear safety qualifications, are in “tremendously short supply,” a fact exacerbated by current and predicted growth in the radiopharmaceutical sector. In 2022, the radiopharmaceuticals market (which includes both radiodiagnostics/imaging and radiotherapeutics/drugs) was worth over $7 billion, a 15% increase over 2021, according to MEDraysintell Nuclear Medicine Report & Directory Edition 2023. By 2032, the market is expected to reach $39 billion, according to the MEDraysintell forecast.

When I asked Valliant in January whether he was receiving (and answering) calls from Big Pharma about a potential acquisition, given the amount of deal activity in the space, he deftly deflected, noting that his “vision for the company has never changed; we have a platform, we have manufacturing [capable of producing 100,000 doses a year], and we want to be vertically integrated. We want to take multiple products all the way through to approval in different indications.”

He did, however, reference Fusion’s partnership with AstraZeneca, which began in 2020. “They are leaders in the antibody-drug conjugate space, so they’re really good at putting the actinium on, using our linker technology. And we co-own the drugs that come out of that,” he said. “For me, that’s the best of both companies coming together.”

What’s Unique About Fusion Pharma

The emergence of targeted alpha therapies (TAT) is a key driver in the radiotherapeutics development space, and it served as the impetus for founding Fusion Pharma. As a chemistry professor at McMaster University in the early aughts, Valliant was conducting research focused on connecting medically useful isotopes to molecules, when “the potential of the field became clear,” he says. “There wasn’t the ability to move it out of academic labs and into industry … to have the manufacturing, the quality, and the ability to attract the investment needed to do big picture drug development and full-scale manufacturing.”

In 2008, Valliant founded and launched the Centre of Excellence for Commercialization and Research — now called the Centre for Probe Development and Commercialization — which specializes in radiopharmaceutical R&D and manufacturing. He ran that organization for over a decade, and realized that “to be commercially viable, you want to have an isotope with a long half-life, so that you can centrally manufacture products and ship them to the [patient delivery] sites.”

That insight led Valliant to focus on actinium-225, an alpha particle-emitting isotope with a 10-day half-life, which causes double-strand DNA breaks, a potent cancer cell killer. “The majority of currently approved [radio]therapies are based on beta particle emitters,” said Valliant. Beta particles cause single-strand DNA damage, but to really kill a tumor, “you need multiple single-strand breaks, which requires a lot of beta to cause the damage.” An Alpha particle is much larger in size by comparison, and it “destroys everything in its path,” says Valliant. “But it only travels a distance of one to three cells.” To kill cancer cells, it takes a lot less alpha than beta, or “one thousand times less radiation injected into a patient to cause that massive trauma to cancer cells.” In comparing the same delivery molecule, which directs the radioactive payload to the cancer cell, alpha particles drastically outperformed beta particles in terms of potency against solid tumors, said Valliant. “So we decided to create a company around that.”

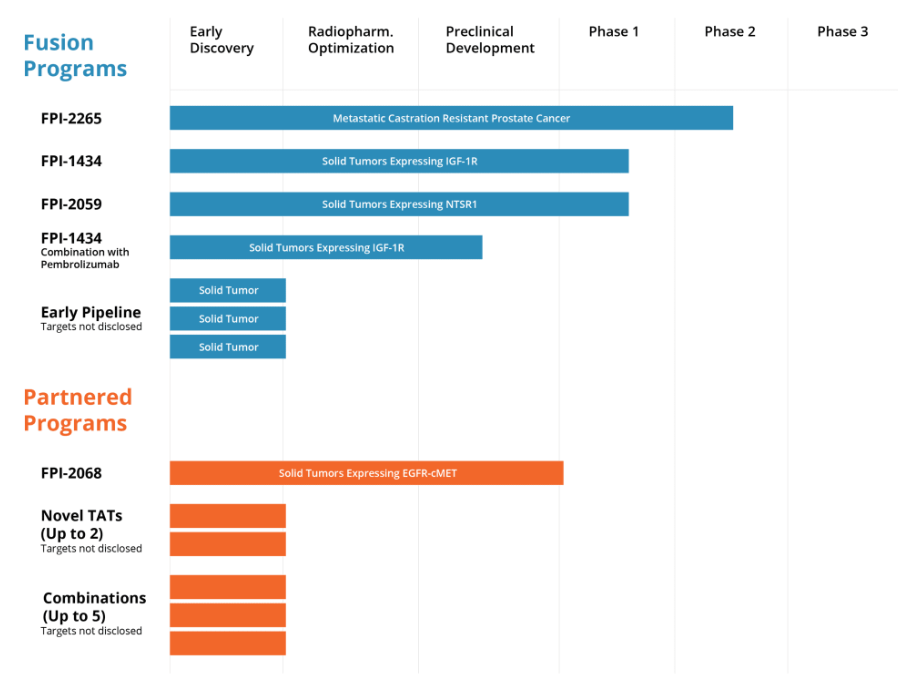

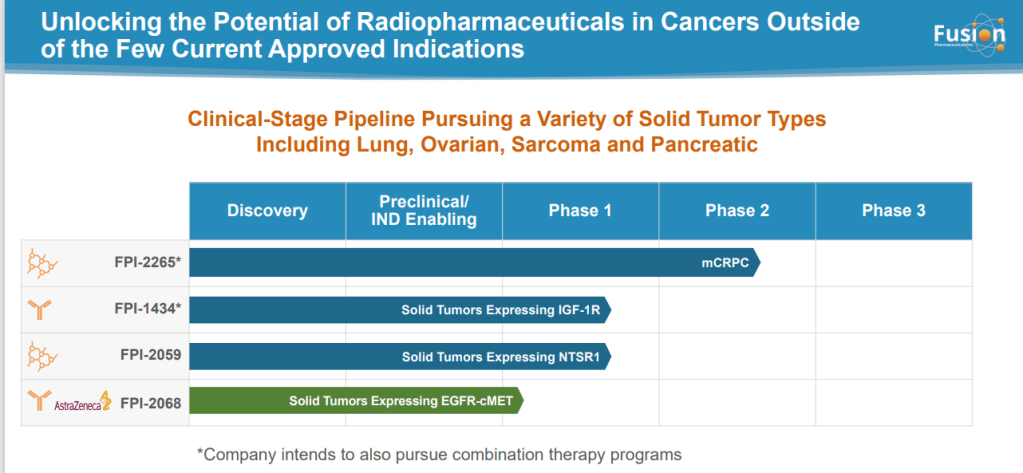

Most radiopharmaceutical companies developing new therapies are shifting toward alpha emitters from beta, noted Valliant. Rayzebio, for example, is currently in Phase 3 clinical trials with a drug that also uses actinium-225 and is targeting gastroenteropancreatic neuroendocrine tumors. Fusion’s lead candidate (FPI-2265), which is moving into a Phase 2/3 registration trial, targets the same indication as Novartis’s Pluvicto: prostate-specific membrane antigen (PSMA)-positive metastatic castration-resistant prostate cancer. However, Fusion is pursuing an indication for patients that fail on Pluvicto. “There are a significant number of patients who need another therapy [after Pluvicto], and we think that will be our first approval,” he says. “The nice part about that is, it will likely be [administered at] the same site, in the same position, and using the same process, making it super easy for a patient to get that therapy once it’s approved.”

Other Fusion pipeline products will explore different cancer types, an expansion on the prostate and neuroendocrine cancer indications that previously defined the field. “There is no reason why this technology shouldn’t have comparable impacts on breast cancer, colorectal cancer, pancreatic cancer … you’re putting a bomb inside a cell,” says Valliant. “We have three additional clinical programs taking this technology to other cancers. For me, it’s a huge whitespace, and we’re just scratching the surface of this field.”

Fusion Pharmaceuticals, a newly formed biopharmaceutical company developing targeted alpha-particle radiotherapeutics for treating cancer, today announced the closing of a $25 million Series A financing led by founding venture investor, Johnson & Johnson Innovation – JJDC, Inc., with investments by HealthCap, TPG Biotech, Genesys Capital and FACIT (Fight Against Cancer Innovation Trust). Targeted alpha-particle emitting radiotherapeutics combine the precision of molecular targeting agents, such as antibodies with the potency of alpha-particle emitting radioisotopes to specifically attack and eradicate cancer cells.

The syndicate is strengthened by HealthCap’s specialized expertise in pioneering a new wave of successful radiotherapeutic companies, such as Algeta and Nordic Nanovector.

Fusion Pharmaceuticals is a spinout from the Centre for Probe Development and Commercialization (CPDC), an organization that Dr. John Valliant, Ph.D., founded in 2008 and is a Centre of Excellence for Commercialization and Research (CECR) located at McMaster University in Hamilton, Ontario, Canada. The CPDC, which was created with the support of multiple stakeholders, including the Networks of Centres of Excellence (NCE) and the Ontario Institute for Cancer Research (OICR), has rapidly become a world leader in the development, translation and manufacturing of radiopharmaceuticals.

In addition to Dr. Valliant, founder and chief executive officer, the company’s board of directors consists of Asish Xavier, Ph.D. (Johnson & Johnson Innovation – JJDC, Inc.), Robert Sutherland, Ph.D., Centre for Probe Development and Commercialization (CPDC), Eran Nadav, Ph.D. (TPG Biotech), Johan Christenson, M.D. (HealthCap) and Damian Lamb (Genesys), who will assume the role of chairman of the board.

“Targeted delivery of medical isotopes that emit alpha particles can be used to kill tumor cells with remarkable precision and unprecedented potency, and it has the added potential of having complementary effects with treatments which activate the immune system,” said Dr. John Valliant, CEO. “Fusion is focused on combining our expertise in radiopharmaceutical development and production with the appropriate targeting molecules to create a new generation of therapeutics that can address the need for better cancer treatments. Fusion is proud to join a wave of new Canadian biotech companies that are being launched with innovative technologies emerging from research institutions like McMaster University.”

Fusion Pharmaceuticals will use the financing proceeds to advance its lead program, FPX-01, into human clinical trials. FPX-01 is an antibody-targeted radiotherapy, which seeks out a specific biomarker of resistance that is present on nearly all types of treatment refractory cancers. The technology is designed to selectively deliver actinium-225 to tumor cells so that in conjunction with internalization, the alpha particles emitted will eradicate diseased tissue. In parallel, Fusion Pharmaceuticals gained access to a centyrin-based targeting molecule in preclinical development that has the potential to deliver isotopes to several cancer types and access to the centyrin protein targeting platform in two licensing agreements with Janssen Biotech, Inc. in transactions facilitated by Johnson & Johnson Innovation.

Centyrins are protein targeting agents, proprietary to Janssen Biotech, characterized by high selectivity and specificity, combined with tunable pharmaceutical properties and efficient manufacturing. Fusion Pharmaceuticals is building its pipeline through access to the centyrin platform in combination with proprietary labeling technologies, which can be applied to a wide range of targeting molecules.

FUSION PHARMACEUTICALS – A PRODUCT OF A NATIONAL CENTRE OF EXCELLENCE WITH COMPREHENSIVE SECTOR EXPERTISE

Fusion Pharmaceuticals is a spin out from the Centre for Probe Development and Commercialization (CPDC), which is a Centre of Excellence for Commercialization and Research (CECR) located at McMaster University. The CPDC was created to take promising new technologies developed at Universities and use the arising knowledge advantages to realize economic and health benefits for Canadians. The CPDC, which employs over 80 people and has locations and major partnerships in Hamilton, Toronto, Ottawa and Boston, is supported by a range of stakeholders including the Networks of Centres of Excellence, the Ontario Institute for Cancer Research, McMaster University and several industry partners. See www.imagingprobes.ca for additional details.

INNOVATION DRIVEN AND EXPERIENCED MANAGEMENT TEAM

Fusion Pharmaceuticals was founded by Dr. John Valliant, who was also the founder and CEO of CPDC. Under Dr. Valliant’s direction, the CPDC supplied radiopharmaceuticals for over 40 clinical trials, facilitated the creation of three new companies, including building a rapidly expanding manufacturing business. Dr. Valliant, a Canada Research Chair in Medical Isotopes and Molecular Imaging Probes, is a Professor of Chemistry and Chemical Biology at McMaster University. He has won numerous awards including being selected as one of Canada’s top 40 under 40 in 2010.

Fusion’s discovery and development programs are led by the chief scientific officer, Dr. Eric Burak, Ph.D. Eric previously held positions at CPDC, Theracos, Rib-X Pharmaceuticals and Guilford Pharmaceuticals. Eric oversees a world-class team of chemists and biologists who have extensive experience and unique skills in the alpha therapy field.

ALPHA THERAPIES

Certain medical isotopes emit alpha particles, which are highly energetic ions that deposit their energy over very short distances traveling approximately the width of a single cell. When alpha emitting medical isotopes are delivered to cancer cells, they can kill tumor cells through multiple mechanisms including double stranded DNA breaks, which makes repair and hence resistance unlikely. Targeted alpha therapeutics use significantly smaller amounts of material than typical antibody-drug conjugates making it possible to exploit a wider array of drug targets and they do not require complex linkers to release the warhead. One of the additional benefits of Fusion’s alpha therapeutic approach will be creation of a companion diagnostic with each candidate.

ABOUT FUSION PHARMACEUTICALS, INC.

Fusion Pharmaceuticals is a new pharmaceutical company located in Hamilton, Ontario, Canada focused on becoming the leader in the targeted alpha therapy field. Fusion will exploit its unique expertise in linking medical isotopes to targeting molecules to create highly effective therapeutics. In addition to its lead program, FPX-01, Fusion is building a pipeline of products through a protein discovery platform, that allows for the rapid screening of new targeting molecules to promote biomarker localization of alpha emitting medical isotopes. Fusion’s technology development team also has proprietary methods for introducing alpha emitters into targeting molecules.

Fusion Pharmaceuticals, a clinical-stage biopharmaceutical company developing targeted alpha-particle radiotherapeutics for treating cancer, today announced it has completed a second closing of its Series A financing, securing an additional $21 million USD in capital and bringing the total capital raised to $46 million USD. New investors in the second closing include Adams Street Partners, Seroba Life Sciences, and Varian Medical Systems Inc., who join the existing group of international investors, FACIT, Genesys Capital, HealthCap, Johnson & Johnson Innovation – JJDC, Inc., and TPG Biotech.

Fusion Pharmaceuticals also announced that Terry Gould of Adams Street Partners and Alan O’Connell of Seroba Life Sciences have joined the company’s board of directors.

Targeted alpha-particle emitting radiotherapeutics combine the precision of molecular targeting agents, such as antibodies, with the potency of alpha-particle emitting radioisotopes to specifically attack and eradicate cancer cells. Fusion uses its radiochemistry expertise to convert established and novel targeting molecules into potent alpha therapies.

“We are delighted by the significant interest in Fusion Pharmaceuticals, which is driven by the excitement for our pipeline as well as the precision and potency that can be achieved through targeted delivery of medical isotopes that emit alpha particles,” said John Valliant, Ph.D., Fusion’s Chief Executive Officer. “Fusion will use the additional funds to accelerate the clinical development of our lead program FPX-01, expand our pipeline through in-licensing targeting molecules and form new strategic partnerships.”

FPX-01 is an antibody-targeted radiotherapy, which seeks out a specific biomarker of resistance that is present on nearly all types of treatment refractory cancers. The technology is designed to selectively deliver actinium-225 to tumor cells so that in conjunction with internalization, the alpha particles emitted will eradicate diseased tissue.

Fusion Pharmaceuticals is a spinout from the Centre for Probe Development and Commercialization (CPDC), which is a Centre of Excellence for Commercialization and Research (CECR) located at McMaster University in Hamilton, Ontario, Canada. The CPDC, which was created with the support of multiple stakeholders, including the Networks of Centres of Excellence (NCE) and the Ontario Institute for Cancer Research (OICR), has rapidly become a world leader in the development, translation and manufacturing of radiopharmaceuticals.

Fusion Pharmaceuticals is also developing centyrin-based alpha therapies against a series of cancer markers. Centyrins are small proteins that are characterized by high selectivity and specificity, combined with tunable pharmaceutical properties and efficient manufacturing. Fusion obtained the candidates through two licensing agreements with Janssen Biotech, Inc. in transactions facilitated by Johnson & Johnson Innovation.

Two years after Fusion Pharmaceuticals raised a modest $25 million series A, the targeted radiotherapy player has reeled in $105 million in new capital to push a clinical-stage program and build a pipeline of new treatments and combination therapies.

Fusion’s founding venture investor, Johnson & Johnson Innovation, joined OrbiMed and Varian in the financing with Perceptive Advisors, Pivotal bioVenture Partners, Rock Springs Capital and other existing backers also pitching in.

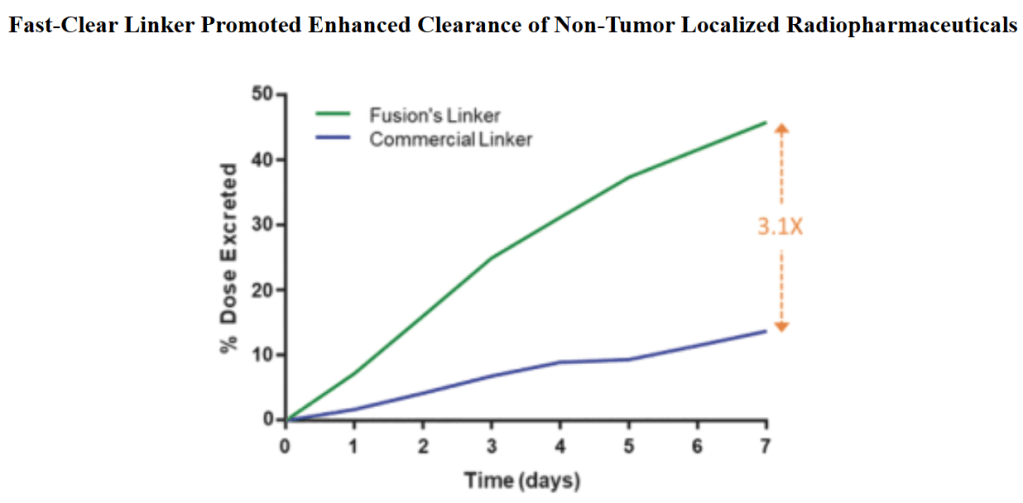

Fusion’s targeted approach combines alpha particle-emitting radiotherapeutics with molecules that deliver them to tumors. Using a molecule such as an antibody to avoid delivering radiation indiscriminately and harming healthy cells is not a new idea. But the company believes that its linker technology—which connects a molecule to a radioactive compound—can clear radiotherapeutics more quickly than commercially available linkers, thereby extending their therapeutic window.

The company’s lead asset, known as FPI-1434, is currently being tested in advanced solid tumors in a 30-patient phase 1 study. It combines an antibody targeting the cancer biomarker IGF-1R and a radioactive isotope of actinium that has shown promise in treating prostate cancer. Though this treatment uses an antibody, the linker technology can be applied to other targeting compounds, such as small molecules.

Fusion has a handful of preclinical programs behind FPI-1434 and plans to build its pipeline through internal discovery, in-licensing targeting molecules and striking up new partnerships, the company said in a statement.

“The investment positions us to implement our clinical and partnering strategies around [225Ac]-FPI-1434, expand our team and fully exploit the unique advantages of our linker technology,” said Fusion CEO John Valliant, Ph.D., in the statement.

Though targeted radiotherapy has been around for decades without stirring up the excitement surrounding other classes of cancer drugs, the field may just be heating up. Novartis at least seems to think so; in the span of one year, the Big Pharma inked two acquisitions totaling $6 billion to get its hands on radiotherapies from Advanced Accelerator Applications and Endocyte that use small molecules to zero in on cancer cells.

Fusion Pharmaceuticals Announces Pricing of Initial Public Offering – PR Newswire 6/25/2020

Fusion Pharmaceuticals Inc. (NASDAQ: FUSN), a clinical-stage oncology company focused on developing next-generation radiopharmaceuticals as precision medicines, today announced the pricing of its initial public offering of 12,500,000 common shares at a public offering price of $17.00 per share. All of the shares are being offered by Fusion. The gross proceeds of the offering, before deducting underwriting discounts and commissions and other offering expenses payable by Fusion, are expected to be $212.5 million. In addition, Fusion has granted the underwriters a 30-day option to purchase up to an additional 1,875,000 common shares at the initial public offering price.

The shares are expected to begin trading on the Nasdaq Global Market on June 26, 2020 under the ticker symbol “FUSN.” The offering is expected to close on June 30, 2020, subject to the satisfaction of customary closing conditions.

Morgan Stanley, Jefferies, and Cowen, are acting as joint book-running managers for the offering. Wedbush PacGrow is acting as lead manager for the offering.

US-Canadian Fusion Pharmaceuticals is collaborating with Anglo-Swedish pharma giant AstraZeneca to develop next-generation radiopharmaceuticals, known as targeted alpha therapies (TATs), to treat cancer.

For this partnership, “Fusion will bring the radioisotope and linker technology, as well as expertise in radiopharmaceutical development, manufacturing and supply chain,” explains the company’s CEO John Valliant. Fusion’s Fast-Clear linker technology allows for isotopes to be delivered to tumour cells and also be rapidly cleared from the body.

Valliant adds: “AstraZeneca will bring…their industry-leading antibody portfolio and oncology expertise.”

AstraZeneca Oncology research and development senior vice-president and head of research and early development Susan Galbraith noted in a release: “With this collaboration, we will seek to identify synergies between our pipelines to unlock the full potential of our medicines, and also to develop novel targeted radiopharmaceuticals.

“We believe that the Fusion team’s expertise in next-generation radiopharmaceuticals complements AstraZeneca’s extensive research and development portfolio.”

According to the terms of the agreement, Fusion and AstraZeneca will jointly discover, develop and have the option to co-commercialise the novel TATs in the US. Fusion will receive an upfront payment from AstraZeneca and will also be eligible for future development milestone and other payments.

TRIUMF, Canada’s particle accelerator centre, today announced it has entered into a collaboration agreement with Fusion Pharmaceuticals Inc. (Nasdaq: FUSN), a clinical-stage oncology company focused on developing next-generation radiopharmaceuticals as precision medicines. Under the agreement, Fusion will provide a financial investment enabling TRIUMF to upgrade its actinium-225 production infrastructure, and in return will receive preferred access to actinium-225, a rare medical isotope that shows great promise in new, cutting-edge cancer therapies.

An alpha-emitting isotope with a short half-life, actinium-225 can be combined with a molecular agent that specifically targets cancer cells, seeking out and destroying the cancer while leaving the surrounding tissue unharmed. The new collaboration will enable TRIUMF to significantly increase its production and delivery of actinium-225.

“Today’s announcement marks an important step in positioning Canada to play a leading role in the development and deployment of next-generation radiotherapies, and in ensuring that researchers and patients around the world have a stable supply of life-saving medical isotopes,” said Dr. Jonathan Bagger, Director of TRIUMF. “Enabled by decades of public investment in TRIUMF’s infrastructure and research programs, this collaboration recognizes the laboratory’s capacity to drive innovation, moving this promising treatment closer to market.”

“Given Fusion’s opportunity to expand our pipeline of actinium-based Targeted Alpha Therapies (TATs), and the importance of isotope production in the supply chain of radiopharmaceuticals, we will continue to proactively address and prioritize actinium supply in our strategic plans,” said Dr. John Valliant, Chief Executive Officer of Fusion. “We are excited to collaborate with TRIUMF, a leader in isotope production, as part of these plans.”

“With its Targeted Alpha Therapy platform technology, Fusion has an opportunity to impact the cancer treatment landscape,” said Kathryn Hayashi, Chief Executive Officer of TRIUMF Innovations. “Through this collaboration agreement, we are partnering with a premier developer of innovative radiotherapies to deepen TRIUMF’s leadership position in isotope production to help save the lives of patients in Canada and around the world”. Read more about the announcement here.

About TRIUMF

TRIUMF is Canada’s particle accelerator centre. The lab is a hub for discovery and innovation, inspired by a half-century of ingenuity in answering some of nature’s most challenging questions. From the hunt for the smallest particles in the universe to the development of new technologies, TRIUMF is pushing frontiers in research, while training the next generation of leaders in science, medicine, and business. Learn more about TRIUMF’s work to produce more actinium-225 here. Discover more at www.triumf.ca and connect on Facebook, Twitter, and Instagram: @TRIUMFLab.

Fusion Pharmaceuticals said on Thursday that it has partnered with Merck on a clinical trial evaluating the combination of Fusion’s targeted radiotherapy, FPI-1434, and pembrolizumab (Merck’s Keytruda) for patients with solid tumors expressing insulin-like growth factor 1 receptor (IGF-1R).

The companies will partner on a Phase I/II clinical trial to evaluate the safety, tolerability and pharmacokinetics of FPI-1434 plus the PD-1 inhibitor pembrolizumab. FPI-1434 is a radio-immunoconjugate therapy designed to deliver alpha-emitting isotopes to tumor cells expressing IGF-1R. Fusion describes this as “targeted alpha therapy,” or “TAT,” which combines an alpha particle-emitting isotope with antibodies and other targeted molecules and is designed to deliver the therapeutic payloads to specific tumor cells expressing the target.

According to Fusion, the trial of the combination regimen will begin about six-to-nine months after a recommended Phase II dose is established in a trial investigating FPI-1434 monotherapy. Under the terms of the partnership, Fusion will sponsor the trial and Merck will supply pembrolizumab.

“With our strong preclinical data demonstrating promising activity with FPI-1434 and immuno-oncology agents, we believe we have an opportunity to improve efficacy in tumor indications where Keytruda is approved, and to potentially expand into new tumor indications,” Fusion CEO John Valliant said in a statement. “This collaboration with Merck builds off our research on the mechanism of action of alpha radiation and aligns with our goal to expand the utility of radiopharmaceutical therapies, including advancing into earlier lines of cancer therapy.”

2021년에는 BD를 강화하기 위해서 CBO & President로 Mohit Rawat과 SVP of BD로 Eric S. Hoffman 박사를 영입했습니다. 에릭은 제가 이전 회사에서 Merck와 M&A 딜을 할 때 큰 역할을 했던 사람입니다. 또한번 큰 사고를 쳤군요.

2022년에는 두개의 펩타이드 딜이 있었습니다. 48Hour Discovery와 Pepscan과의 공동연구계약 발표가 있었습니다.

Founded in 2017, 48Hour Discovery Inc. (48HD) is a Canadian biotechnology company focusing on the development of peptide based drugs. 48HD is headquartered in Edmonton, Alberta with satellite sites in San Diego, California and Seoul, South Korea. The 48HD genetically-encoded platform technology and cloud-based discovery management enables rapid identification of pharmaceutical leads in the billion-scale macrocycle therapeutic space. The company has a number of internal discovery projects underway, as well as contracts with five major pharmaceutical companies. For additional information please visit: https://48hourdiscovery.com

Pepscan is an all-in-one partner in peptides, building on 25 years of experience in advancing and applying peptide expertise to facilitate customers in the development and production of peptides. At its end-to-end facility in Lelystad, the Netherlands, Pepscan offers a range of patented technologies, phage display capabilities, a lead-optimization array platform, and production facilities for R&D- to GMP-grade peptides, including libraries and neoantigen vaccines. Among its patents is the CLIPS™ technology, which locks peptides into active conformations.

Pepscan has a proven track record in the field of radiopharmaceuticals and synthesized precursors for radiolabeled peptides suitable for a wider range of applications. Its unique CLIPS™ phage display platform screens libraries with billions of different peptides and enables the discovery of highly constrained de novo peptides with enhanced affinities, selectivities and proteolytic stabilities. Next to the peptides emerging from the discovery platform, Pepscan has successfully produced radiopharmaceutical peptides at GMP grade as developed by customers themselves.

Fusion Pharmaceuticals Inc. (Nasdaq: FUSN), a clinical-stage oncology company focused on developing next-generation radio pharmaceuticals as precision medicines, and Niowave, Inc., a manufacturer of medical radioisotopes from radium and uranium, today announced that the companies have entered into a collaboration and supply agreement for the development, production, and supply of actinium-225. Under the agreement, Fusion will invest up to $5 million in Niowave to further develop their technology to increase current production capacity of actinium-225, and in return Fusion will have guaranteed access to a pre-determined percentage of Niowave’s capacity of the resulting actinium-225, as well as preferred access to any excess supply produced. As part of the agreement, Fusion will also have an option to invest in future production of actinium-225 to scale with Fusion’s needs.

“As excitement for the tumor-killing potential of alpha-emitting radio pharmaceuticals increases, we intend to stay at the forefront of actinium development and supply to support our growing pipeline of targeted alpha therapies,” said Fusion Chief Executive Officer John Valliant, Ph.D. “We continue to prioritize manufacturing and access to actinium as a critical component of Fusion’s platform, and our partnership with Niowave further strengthens and diversifies our supply chain as we advance multiple actinium-based radio pharmaceuticals in the clinic.”

“The Niowave team has worked hard to scale up our actinium-225 production to the millicurie level and this has allowed us to start working with oncology community partners,” said Niowave Chief Executive Officer/Senior Scientist Terry Grimm, Ph.D. “We have been watching Fusion’s progress in the development of their pipeline of targeted alpha therapies and we are very excited to partner with them on this journey.”

Fusion is developing actinium-based TATs leveraging the potency and precision offered by alpha particles. Actinium-225 decay gives off four alpha emissions in relatively rapid succession, maximizing the damage to the DNA of tumor cells, with a 10-day half life that allows for central manufacturing and distribution of products to clinical sites in a ready-to-use form. Fusion currently has existing actinium supply arrangements with TRIUMF and the U.S. Department of Energy (DOE).

Fusion Pharmaceuticals Inc. (Nasdaq: FUSN), and BWXT Medical Ltd., a subsidiary of BWX Technologies, Inc. (NYSE: BWXT), today announced that the companies have entered into a preferred partner agreement for the supply of actinium-225. Under the agreement, BWXT Medical will provide predetermined amounts of Fusion’s actinium supply needs at volume-based pricing.

Actinium-225 is an alpha-emitting isotope used in targeted alpha therapies (TATs) that combine the isotope with specific tumor-seeking targeting vectors to kill cancer cells while minimizing the impact to healthy tissues. There is growing demand for the isotope but a limited number of suppliers who are currently able to produce meaningful quantities of high purity actinium.

Fusion Chief Executive Officer John Valliant, Ph.D., said, “Fusion’s portfolio of clinical-stage targeted alpha therapies is expanding, with three proprietary programs in clinical trials and additional programs advancing under our collaboration with AstraZeneca. Based on emerging clinical data in the literature which show the power of alpha particles over conventional beta emitters, we continue to proactively prioritize access to actinium as a critical component of Fusion’s development plans and we are excited to partner with BWXT Medical. As an established global leader in medical isotope manufacturing and supply with proven ability to produce high purity actinium, BWXT Medical has the necessary infrastructure and shipping logistics capabilities to support both clinical and commercial scale manufacturing and distribution of medical isotopes. This agreement increases our existing actinium supply for both current programs as well as future business development opportunities and partnered programs, diversifies our supply chain, and establishes a relationship to collaborate on longer-term commercial production needs.”

BWXT Medical President and Chief Executive Officer Jonathan Cirtain, Ph. D., said, “Excitement for the potential of targeted alpha therapies to treat cancer is growing, and we have made the necessary investments in infrastructure and intellectual property to help meet the increasing global demand for actinium. BWXT Medical is now producing high-purity non-carrier added actinium-225. Fusion is a leading developer of targeted alpha therapies, and we are pleased to work with them as their clinical programs continue to advance.”

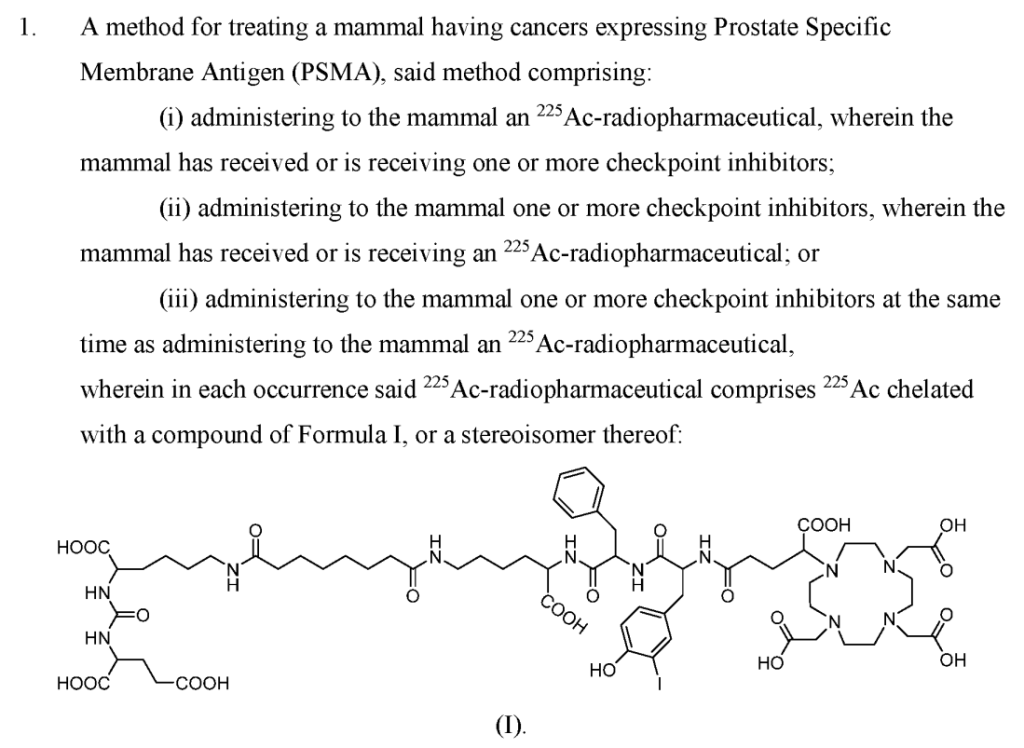

Fusion Pharmaceuticals Inc. (Nasdaq: FUSN) (“Fusion”), a clinical-stage oncology company focused on developing next-generation targeted alpha therapies (“TATs”) as precision medicines, today announced the acquisition from RadioMedix, Inc. (“RadioMedix“) of the investigational new drug application (“IND”) for an ongoing Phase 2 clinical trial (the “TATCIST” trial) evaluating 225Ac-PSMA I&T, a small molecule targeting prostate specific membrane antigen (“PSMA”) expressed on prostate cancers. Following the closing, the alpha-emitting radiopharmaceutical being evaluated in the TATCIST trial will be known as FPI-2265.

“We are pleased to announce this acquisition, which adds an ongoing Phase 2 program for a validated cancer target to our pipeline of innovative TATs,” commented Fusion Chief Executive Officer John Valliant, Ph.D. “From our inception, Fusion has recognized the potential opportunity for actinium-based therapies to address unmet needs in cancer given the power and potency of alpha radiation. We believe that with Fusion’s TAT development expertise, and early investments that provide us with our actinium supply advantage, we are uniquely positioned to be first-to-market with an actinium-based PSMA agent.”

“A growing body of clinical data demonstrates the power of targeted alpha therapies in prostate cancer, including for patients who progress on or after lutetium-based PSMA therapies,” said Oliver Sartor, M.D, Laborde Professor for Cancer Research and Medical Director at Tulane Cancer Center. “With more than 250 patients treated with actinium-based radiopharmaceuticals targeting PSMA in investigator sponsored studies, this class of therapy has both the efficacy data and safety profile that supports continued development. I believe 225Ac-PSMA I&T will have the potential to target a growing patient population with significant unmet need. In addition, it has the potential to move into earlier lines of therapy as monotherapy as well as in combination with other agents.”

The TATCIST trial is designed to evaluate patients with metastatic castration-resistant prostate cancer (“mCRPC”) with progressive disease, including patients who are naïve to PSMA targeted radiopharmaceuticals and those who have been pre-treated with 177Lu-based PSMA radiopharmaceuticals such as PLUVICTO™. The trial is expected to evaluate approximately 100 patients with four treatment cycles per patient occurring every eight weeks. Patients are initially dosed at 100 kBq/kg with dose de-escalation possible based on biochemical response. Efficacy will be assessed using change in PSA levels and radiographic response.

Fusion plans to expand the Phase 2 program to additional sites and expects to report data on 20 to 30 patients in the first quarter of 2024.

“Having treated mCRPC patients for many years, I initiated the TATCIST trial to address the unmet needs for the many patients who are not adequately addressed with currently available therapies,” said Ebrahim Delpassand, M.D., Chairman and CEO of RadioMedix and Medical Director of Excel Diagnostics & Nuclear Oncology Center. “Given Fusion’s radiopharmaceutical development capabilities, leadership in Actinium supply and established infrastructure, we look forward to this preeminent partnership to advance FPI-2265 through the Phase 2 program for the benefit of our patients.”

Dr. Valliant continued, “With one Phase 2 program, three ongoing Phase 1 programs, and an IND submission through our collaboration with AstraZeneca expected in the first quarter of 2023, Fusion continues to extend its leadership in targeted alpha therapy development. Following the encouraging data we reported from the cold antibody sub-study of the FPI-1434 trial in June, we continue to dose escalate and we look forward to reporting the preliminary Phase 1 data in the second quarter of this year. The FPI-1434 data will be the first in what we expect will be multiple clinical updates generated from our pipeline over the next 24 months.”

Private Placement Financing

In connection with the closing of the acquisition of the TATCIST trial and related assets, Fusion has agreed to sell an aggregate of approximately 17.6 million common shares to certain accredited institutional investors in a private placement in public equity financing (the “Offering”). The Offering is expected to result in gross proceeds to Fusion of approximately $60.0 million, before deducting placement agent fees and other offering expenses payable by Fusion.

Pursuant to the terms of the securities purchase agreement, at the closing of the Offering, Fusion will issue approximately 17.6 million of its common shares at a price of $3.40 per share, equal to the closing price of Fusion’s common shares, as reported by Nasdaq on February 10, 2023. The closing of the Offering is subject to customary closing conditions and is expected to occur on or about February 16, 2023.

Morgan Stanley and Jefferies served as co-placement agents for the Offering. New and existing investors in the Offering include Avidity Partners, Federated Hermes Kaufmann Funds, a fund affiliated with Deerfield Management Company, L.P., Invus, Perceptive Advisors, and Woodline Master Fund LP.

Upon the closing of the Offering, Fusion anticipates having $248.0 million in cash and cash equivalents, which it believes will be sufficient to fund its planned operating expenses and capital expenditure requirements into the first quarter of 2025.

The offer and sale of the foregoing shares are being made in a transaction not involving a public offering and have not been registered under the Securities Act of 1933, as amended (the “Securities Act”). The shares being issued in the private placement may not be offered or sold in the United States or Canada absent registration or pursuant to an exemption from the registration requirements of the Securities Act and applicable state securities laws or pursuant to an exemption from the prospectus requirements of Canadian securities laws, as applicable. Fusion has agreed to file a registration statement with the Securities and Exchange Commission covering the resale of the shares acquired by the investors in the private placement.

This press release does not constitute an offer to sell or the solicitation of an offer to buy the securities, nor shall there be any sale of the securities in any state in which such offer or sale would be unlawful prior to the registration or qualification under the securities laws of such state. Any offering of the shares under the resale registration statement will only be by means of a prospectus.

Fusion Conference Call Information

Fusion will host a live conference call and webcast today beginning at 4:45 p.m. ET to discuss the acquisition. To access the live call, please dial 1-877-870-4263 (U.S.), 1-855-669-9657 (Canada) or 1-412-317-0790 (international) and reference Fusion Pharmaceuticals. A webcast of the conference call will be available under “Events and Presentations” in the Investors & Media section of Fusion’s website at https://ir.fusionpharma.com/overview. The archived webcast will be available on Fusion’s website shortly after the conclusion and will be available for 90 days following the event.

About RadioMedix

RadioMedix, Inc. is a clinical-stage biotechnology company, focused on innovative radiopharmaceuticals for diagnosis, monitoring, and Targeted Alpha Therapy (“TAT”) of cancer. The company has also established facilities including a drug discovery center for the early probe development, a pre-clinical core facility for in vitro and in vivo evaluation of radiopharmaceuticals, and 27,500 SQF cGMP manufacturing and analytical suite for Phase I-III clinical trials, and the large-scale post-approval commercial manufacturing, also known as the Spica Center. To learn more, visit www.radiomedix.com

Fusion Pharmaceuticals Inc. (Nasdaq: FUSN), a clinical-stage oncology company focused on developing next-generation radiopharmaceuticals as precision medicines, today announced that it has entered into an exclusive worldwide license agreement with Heidelberg University and Euratom represented by the European Commission, Joint Research Centre (together, the “Licensors”). The license agreement grants Fusion exclusive worldwide rights to utilize, develop, manufacture and commercialize compounds covered by the patent, which includes 225Ac-PSMA I&T (“FPI-2265”) for the treatment of prostate specific membrane antigen (PSMA)-expressing cancers. In addition, Fusion and the Licensors have signed an agreement to settle the parties’ dispute related to an inter partes review (“IPR”) of a U.S. patent owned by the Licensors which was instituted in August 2023 by the United States Patent and Trademark Board.

Fusion President and Chief Business Officer Mohit Rawat said, “We are pleased to enter into this exclusive license agreement with Heidelberg University and Euratom for their existing patent as we progress FPI-2265, the most advanced actinium-based PSMA targeted radiotherapy currently in development. With Fusion’s expertise in the development and manufacturing of alpha-emitting radiopharmaceuticals, an operational radiopharmaceutical manufacturing facility, and our advantageous actinium supply, we are well positioned to execute this program. We look forward to providing updates as we reach anticipated upcoming milestones in 2024, including data from the TATCIST study in April and the initiation of our Phase 2/3 registrational study in the second quarter.”

As announced in January 2024, Fusion and the U.S. Food and Drug Administration reached alignment on Fusion’s Phase 2/3 protocol for FPI-2265 in patients with mCRPC who have progressed following treatment with lutetium-based radiopharmaceuticals. The updated development plan includes a Phase 2 dose optimization lead-in, expected to complete enrollment by the end of 2024, and a Phase 3 registrational trial expected to begin in 2025.

Under the terms of the license agreement, Fusion will pay the Licensors an aggregate upfront fee of €1.0 million, in addition to certain regulatory milestones upon potential approval and low single-digit royalties on future net sales of applicable products.

AstraZeneca melds with Fusion in $2B radiopharma buyout – Fierce Biotech 3/19/2024

AstraZeneca is adding to the explosion of interest in radiopharmaceuticals, inking a $2 billion buyout to meld Fusion Pharmaceuticals with its cancer unit.

Fusion’s pipeline is led by a PSMA-directed radiotherapy, FPI-2265, that is in phase 2 development as a treatment for metastatic castration-resistant prostate cancer (mCRPC). FPI-2265 delivers actinium-225, an alpha radiopharmaceutical that emits more energy than beta therapies such as Novartis’ Pluvicto. By getting the payload to cells that express PSMA, Fusion believes it can improve outcomes in mCRPC.

AstraZeneca formed a collaboration with Fusion in 2020, securing the chance to work on targeted alpha therapies and drug combinations. But, with interest in radiopharmaceuticals intensifying, it has opted to buy Fusion outright rather than rely on the partnership for programs.

The takeover is worth $2 billion upfront, a 97% premium to Fusion’s closing price Monday. AstraZeneca could pay Fusion shareholders a further $400 million if the biotech meets a certain regulatory milestone.

Fusion has focused development of FPI-2265 on post-Pluvicto patients. The biotech expects to see a 30% to 50% reduction in PSA, a prostate cancer biomarker, in the phase 2 trial. If everything goes to plan, the drug candidate could become the first actinium-PSMA-targeted radiotherapy approved for post-Pluvicto use in mCRPC.

Novartis, which helped kick-start the radiopharmaceutical boom, has a rival candidate in development as it seeks to build on the leadership position it established with the approval of Pluvicto in 2022. A recent paper in The Lancet Oncology suggested such therapies are effective in mCRPC.

FPI-2265 gives AstraZeneca an early opportunity to generate a return on its investment, but the full value of the acquisition may take longer to realize. Fusion has other molecules in development, some of which AstraZeneca knows well from its collaboration. As importantly, the biotech has invested in the supply of actinium, insulating it from a bottleneck that could throttle the availability of alpha emitters.

Fusion is producing clinical, GMP doses at its own facility and works with a network of service providers. Radioisotopes have short half-lives and are made at relatively few production sites globally. The facilities require specialized capabilities distinct from those needed to produce other drug modalities. All those factors create barriers to entry that could limit competition.

Buying Fusion will allow AstraZeneca to vault some of those barriers. The Anglo-Swedish drugmaker is the latest in a series of Big Pharma companies to identify M&A as the way to participate in the rush to realize the potential of radiopharmaceuticals.

Eli Lilly added alpha and beta assets and supply capabilities by acquiring Point Biopharma Global for $1.4 billion. Bristol Myers Squibb joined the party by offering $4.1 billion for alpha specialist RayzeBio. The recent flurry of activity was preceded by Novartis’ $3.9 billion takeover of Advanced Accelerator Applications in 2017.