안녕하세요 보스턴 임박사입니다.

Harrison Ford가 주연한 영화 “Extraordinary Measures”는 John F. Crowley의 이야기를 바탕으로 한 실화입니다.

“Extraordinary Measure“라는 영화는 John Crowley와 가족들의 삶을 담은 책 “The Cure: How a Father Raised $100 Million–and Bucked the Medical Establishment–in a Quest to Save His Children.“을 바탕으로 하고 있습니다. 이 책은 풀리처 상을 수상한 Greeta Anand가 썼습니다.

세자녀 중 두 아이가 태어난지 얼마 지나지 않아 Pompe Disease라는 근무력증 희귀질환을 앓고 있는 것을 알게된 아빠 John F. Crowley는 아이들의 치료를 위해 백방으로 수소문을 한 끝에 William Canfield 박사를 찾게 되고 그와 창업을 제안하며 Novazyme Pharmaceuticals를 설립합니다.

그의 삶에 대한 이야기는 Global Genes Blog에도 자세히 담겨 있습니다. 지금부터 John Crowley가 2살이 되기 전에 죽을 것이라는 두 자녀를 20대 성인이 될때까지 살 수 있도록 하기까지 어떠한 삶을 살았는지 나누고자 합니다.

John Crowley: Rare Dad, Advocate, Researcher, Entrepreneur – Global Genes Blog 4/24/2022

John Crowley’s life is literally a Hollywood movie. His journey to save his children’s life was turned into the movie “Extraordinary Measures” starring Brendan Fraser and Harrison Ford, and his family has been featured in a number of magazine and newspaper articles, and in two books. John changed his career path to help find a cure for the disease that could end his children’s life, and to help others diagnosed with rare diseases, and along the way, has inspired many others with his leadership skills.

In March 1998, when John’s daughter Megan was 15 months old, she and her newborn brother, Patrick, were both diagnosed with Pompe disease. John and his wife Aileen were told their two younger children would not live past their second birthday.

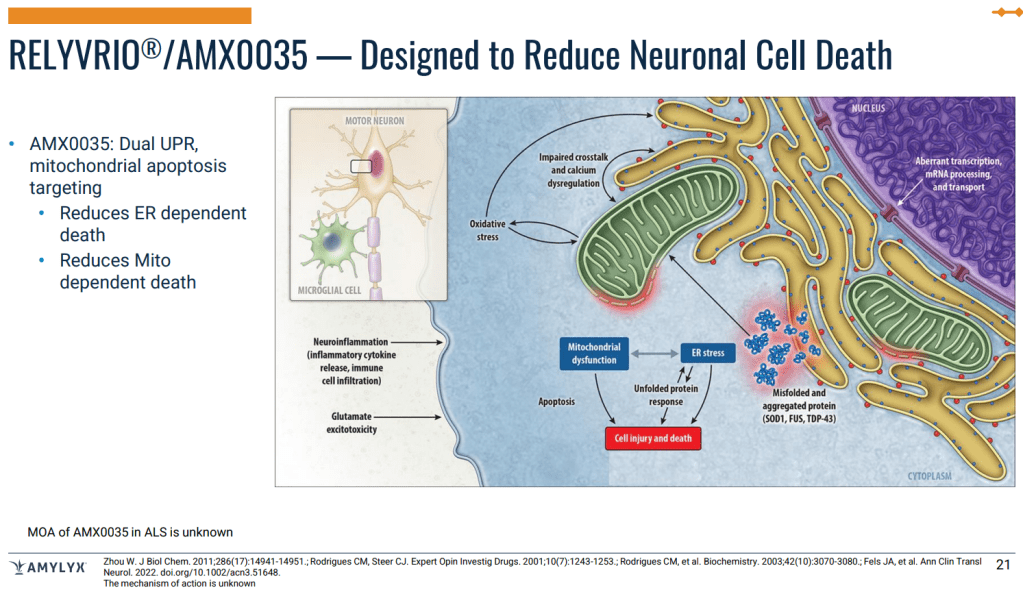

Pompe disease is a neuromuscular disorder caused by a genetic mutation that prevents GAA (acid alpha-glucosidase) production. The result is a toxic buildup of glycogen which in turn causes a number of symptoms, including muscle weakness and swelling of vital organs, and ultimately, respiratory issues and heart failure. Symptoms can be managed with infusions of Lumizyme, which breaks down the glycogen, but it does not treat the cause of the buildup.

When John learned about the prognosis for his children, he felt he had to do more than just sit and watch their health decline. He was well educated, with a bachelor’s degree in foreign service from Georgetown University, a law degree from Notre Dame, and a Harvard MBA. His left his career in management consulting to take a position with a pharmaceutical company in 1998. In 2000, John co-found Novazyme Pharmaceuticals, a startup biotech, with glycobiologist, William Canfield, MD, PhD. Cash advances on credit cards and home equity line of credit on the Crowley’s home helped fund the start up. The gamble would be worth it in the long run.

Novazyme was bought by Genzyme within a couple of years. Genzyme has successfully received FDA approvals for treatments for rare diseases, and eventually created Myozyme, which was a life-saving medicine for Pompe disease. It was not an easy process for Megan and Patrick though. The Genzyme team thought they would have better success with infants to test the drug, and the Crowley children were already toddlers at this point. Even when Genzyme agreed to test the drug on older children, the Crowley’s children did not quality. Finally, Genzyme saw an opportunity to create a clinical trial just for Megan and Patrick, because while both children have an identical genetic mutation, Patrick is affected more than Megan. This “sibling test” gave Genzyme the opportunity to study why the treatment was more effective for some children than others. First, John had to resign from the company in order to avoid any conflicts for Megan and Patrick to be eligible for a clinical trial.

“We hadn’t seen her [Megan] smile in two years. After the first couple of months, we started to notice that she was smiling again.” John shared, “That was the first sign to me that there was some hope.”

Within the first few months of treatment, Megan and Patrick gained muscle strength, and their enlarged hearts returned to the normal size. As the study theorized, Megan did respond better to the treatment than Patrick, but both showed signs of improvement. That life-saving drug, Myozyme, was redeveloped into Lumizyme, and now, more than 3,000 people diagnosed with Pompe worldwide receive the treatments.

John went on to found Amicus Therapeutics, a biotech company that develops treatments for those diagnosed with rare diseases, including new treatments for those with Pompe disease. He has been a passionate advocate for providing universal access to treatments for those with rare diseases, as well as championing needs for those with disabilities.

“In our view, nobody in the world should ever be denied our medicine,” John said. “So we have to figure out creative ways to get it to everybody.”

John was introduced to Global Genes by founder Nicole Boice in 2009 when she was in the planning stages for the non-profit. John and some other contributors helped Nicole to envision the final product as an umbrella organization in the rare disease community. John became a founding board member in 2010 when Global Genes was founded. John told Nicole, “I love your passion, and I love the vision here. There’s an unbelievable opportunity to fill a huge void.”

As a researcher, John is still seeking new and better treatments through his work with Amicus, as a board member for Global Genes, and a former board member for the Make-A-Wish Foundation. As a father, John knows that his children are all adults now, and their medical decisions are their own to make. The Crowley’s oldest child, John Jr., was diagnosed with dyslexia, ADHD and Asperger’s syndrome as a child, so the Crowley family has had to navigate many diagnostic and treatment journeys throughout their kids’ childhoods.

“I think I did my job,” John said. “As a dad, I did what I had to do. I don’t think that makes me a hero.”

In addition to all of his work in the world of rare diseases and being a crusader for those living with disabilities, John has also become known as an authority in leadership, and has spoken to numerous groups about his experiences as a leader in challenging situations. Among his many speaking engagements, John spoke at the 2020 commencement at his alma mater, Notre Dame, at the Rothman Institute of Entrepreneurship at Fairleigh Dickinson University, and at the University of Georgia’s Terry College of Business for the Mason Public Leadership Seminar.

Pulitzer Prize-winning reporter, Geeta Anand, captured the Crowley’s odyssey from diagnosis to finding a treatment, first in a Washington Post article, then, in a book The Cure: How a Father Raised $100 Million–and Bucked the Medical Establishment–in a Quest to Save His Children. The book was the inspiration for the movie, Extraordinary Measures, starring Harrison Ford, Brendan Fraser and Keri Russell.

Imagine what the world would be like if John had not taken the extraordinary measures for his children to save their lives, and in turn affect the lives of thousands of others with Pompe disease, and all of the other lives of those diagnosed with rare diseases and living with disabilities that he has affected.

John Crowley는 Novazyme을 설립할 때 자신의 집을 담보로 자금을 마련하여 Preclinical 연구펀딩을 합니다. 그리고 그 데이타를 바탕으로 $8 Million의 Series A를 함으로써 임상에 진입합니다.

Novazyme completes private stock placement – The Journal Record 9/20/2000

Novazyme Pharmaceuticals has completed an $8 million private placement of Series A preferred stock, the Oklahoma City company said Tuesday.

The placement was co-led by: Catalyst Health & Technology Partners (Boston); HealthCare Ventures (Princeton); and Perseus-Soros Biopharmaceutical Fund (New York). Novazyme will use the funds to accelerate the clinical development of its lead lysosomal storage disease programs.

Novazyme has developed a series of proprietary technologies that have been shown in pre-clinical studies to greatly enhance uptake of replacement enzymes for lysosomal storage diseases. Virtually all of these diseases share a common biologic pathway for uptake through mannose-6 phosphate receptors. Novazyme’s core technology targets enzymes to these receptors. It is applicable to enzyme therapies for all of the lysosomal diseases that share the mannose-6 phosphate pathway. Enhanced enzyme uptake is widely viewed as the key to the next generation of drugs to treat these rare diseases. With more efficient uptake of replacement enzymes, patients may benefit by greater response to these therapies and by reduced side effects, such as antibody responses.

“Novazyme represents a unique opportunity to invest in a company that combines a powerful core platform technology with its own internal drug development programs,” said Dennis J. Purcell, managing director at Perseus-Soros. “The untapped market potential for lysosomal storage diseases is greater than $5 billion. Novazyme is well-positioned to move its technologies rapidly forward into the human clinic on multiple diseases and to take a leadership position in this therapeutic field.”

Series A 펀딩을 한지 딱 1년 후 9/11 테러가 난지 보름정도 지난 어수선한 상황에서 Genzyme이 Novazyme을 $206 Million에 인수하여 John Crowley는 Genzyme에서 Pompe Disease Program VP로 일하며 두명의 자녀들이 임상시험을 받게 하기 위해 애쓰다가 Conflict of interest 문제로 회사를 그만두게 됩니다.

Genzyme acquires city-based Novazyme – The Oklahoman 9/28/2001

Home-grown biotech company Novazyme officially has become part of international pharmaceutical company Genzyme General, company officials said Thursday.

The approximately $206 million acquisition was completed Wednesday with Oklahoma City-based Novazyme Pharmaceutical’s private group of stockholders getting about $19 million less than expected.

In August, a month before the Sept. 11 terrorist attacks that precipitated plunging stock prices, the companies announced the arrangement that was supposed to be worth about $225 million.

That figure was based on Genzyme’s initial payment of about 2.6 million shares of its stock to Novazyme’s shareholders. The stock closed at $56.90 that day. On Wednesday, when the deal was completed, the stock was more than $11 lower at $45.65.

The value of the deal is based on Genzyme General’s stock prices over the closing day and the previous three days. The value, including warrants, acquisition costs and stock purchase rights, combined with two upcoming payments totaling $87.5 million, is expected to be between $204 million and $209 million.

The lowered value was not surprising because Genzyme is among the many companies that have watched frightened investors dump their stock since Sept. 11.

Tulsa financial analyst Fred Russell said the declining value is not a great concern and the deal continues to be favorable.

“The difference between $225 million and $206 million, given the perspective of the last 60 days, is no decimation. We have two strong companies getting together and that should be good for everyone,” Russell said. “There’s nothing that has shown the fortunes of the two companies have changed.”

Genzyme expects the acquisition to enhance its position in the development of enzyme replacement treatment for lysosomal storage disorders. Novazyme founder and chief scientist Dr. William Canfield developed breakthrough technology to treat the disorders that include Pompe disease, a rare genetic disease that frequently kills children before they reach school age. Novazyme was approaching human clinical studies when Genzyme contacted Canfield and President and Chief Executive John Crowley about selling their company.

Genzyme’s plans call for the work to continue in Oklahoma City. Crowley said he expects the 70 local employees to increase to 100 within a year. After Genzyme completes the human trials and gets Federal Drug Administration approval to market the first two products in the United States, Novazyme shareholders stand to receive two additional payments totaling $87.5 million. Crowley hopes FDA approval will come in 2003.

“We are eager to start working closely with the Novazyme team to develop the best possible products for patients,” Jan van Heek, executive vice president of Genzyme Corp., said in a statement. “Novazyme’s technology platform, drug development team and first-class group of scientists will complement and significantly expand our product development capabilities.”

Canfield will continue to lead the scientific team at the Novazyme lab at 800 Research Parkway. Crowley will work as a senior vice president of Genzyme’s therapeutics unit, assuming overall responsibility for the Pompe disease programs. He also will continue as president of Novazyme, now a wholly owned subsidiary of the No. 3 ranked pharmaceutical company, Genzyme.

The acquisition should lower Genzyme’s earnings per share by 3 cents for 2001. Genzyme expects earnings of about $1.12 to $1.17 per share for the year, compared with previous estimates of $1.15 to $1.20 per share because of the issuance of the new shares for the acquisition.

Genzyme General stock closed up 2 percent Thursday at $46.60.

이러한 John Crowley의 노력에 힘입어 Novazyme을 설립한지 6년만인 2006년 Myozyme이 FDA 승인을 받을 수 있게 되었습니다. Myozyme이 승인되어 Pompe Disease를 치료할 수 있게 되었지만 이 약물은 Enzyme Replacement Therapy의 정상적인 Enzyme folding이 오래 지속되지 못하는 문제로 인해 질병 치료에 한계를 드러냅니다. 따라서 John Crowley는 이 문제를 해결하기 위해 두번째 회사인 Amicus Therapeutics를 창업하게 됩니다.

Genzyme Corp. announced today that the Food and Drug Administration has granted marketing approval for Myozyme(R) (alglucosidase alfa) in the United States. Myozyme has been approved for the treatment of patients with Pompe disease, a debilitating, progressive and often fatal disorder affecting fewer than 10,000 people worldwide. The product is the first treatment ever approved for Pompe disease and the first for an inherited muscle disorder.

“This is a special day for people across the Pompe community and at Genzyme, who have worked together for many years and overcome enormous challenges so that patients with this devastating disease now have a chance,” said Henri A. Termeer, chairman and chief executive officer of Genzyme Corp.

The Myozyme label includes the following indication: “Myozyme (alglucosidase alfa) is indicated for use in patients with Pompe disease (GAA deficiency). Myozyme has been shown to improve ventilator-free survival in patients with infantile-onset Pompe disease as compared to an untreated historical control, whereas use of Myozyme in patients with other forms of Pompe disease has not been adequately studied to assure safety and efficacy.”

The product label also includes a boxed warning with information on the potential risk of hypersensitivity reactions associated with Myozyme. The boxed warning states that “Life-threatening anaphylactic reactions, including anaphylactic shock, have been observed in patients during Myozyme infusion. Because of the potential for severe infusion reactions, appropriate medical support measures should be available when Myozyme is administered.” Of the 280 patients who received Myozyme in clinical studies or through expanded access, eight patients (3 percent) experienced severe or significant hypersensitivity reactions. Full prescribing information for the product is available on Genzyme’s Web site: http://www.genzyme.com/components/highlights/mz_pi.pdf

Pompe disease manifests as a broad spectrum of clinical symptoms. All patients typically experience progressive muscle weakness and breathing difficulty, but the rate of disease progression can vary widely depending on the age of onset and the extent of organ involvement. When symptoms appear within a few months of birth, babies frequently display a markedly enlarged heart and die within the first year of life. When symptoms appear during childhood, adolescence or adulthood, patients may experience steadily progressive debilitation and premature mortality due to respiratory failure. They often require mechanical ventilation to assist with breathing and wheelchairs to assist with mobility.

Genzyme recently completed enrollment in its clinical trial involving patients with late-onset Pompe disease. Ninety patients have been enrolled in this international, placebo-controlled study. Currently, more than 280 patients in 30 countries are receiving Myozyme through clinical trials, expanded access programs, or pre-approval regulatory mechanisms.

Myozyme has received orphan drug designation in the United States, which provides seven years of market exclusivity. The orphan drug law is designed to encourage the development of treatments for rare disorders such as Pompe disease, for which no therapies have existed previously. Genzyme expects to launch Myozyme in the United States within two weeks. Late last month, Myozyme was approved in the European Union.

Because early diagnosis, intervention and treatment are critical in Pompe disease and other lysosomal storage disorders, Genzyme has for the past seven years supported several outside research collaborations to develop new diagnostic technology. This research has led to the recent introduction of an enzyme assay utilizing blood samples that makes it possible to diagnose Pompe patients more rapidly and with a less-invasive procedure. Genzyme will offer this test now through its Genzyme Genetics unit, and the test will also be available through several other clinical laboratories in the United States and elsewhere in the world.

“The journey from development to approval of a therapy for Pompe disease has been a long and winding road, but we are now at a milestone and are thrilled with the outcome,” said Randall H. House, chairman of the International Pompe Association and president of the Acid Maltase Deficiency Association (AMDA), a Pompe patient association in the United States. “Enzyme replacement therapy with Myozyme gives Pompe patients hope.” The AMDA, formed in 1995, has assisted in funding Pompe disease research and promotes public awareness of Pompe disease.

Valerie Cwik, medical director for the Muscular Dystrophy Association, said: “Myozyme is the first treatment for any of the muscle diseases included among the 40 neuromuscular disorders covered by the Muscular Dystrophy Association. This is a great day for people with Pompe disease, and a hopeful moment for the thousands of other people who are affected by the diseases in the MDA program, because it shows that support and research can lead to treatments.” The MDA helped support patients who took part in clinical trials of Myozyme and also sponsored early research in Pompe disease.

Genzyme began working to develop a treatment for Pompe disease in 1998. In 2003, the company initiated a pivotal clinical study of Myozyme that demonstrated the product’s safety and efficacy. In the study, 83 percent of patients treated with Myozyme were both alive and free of invasive ventilator support at 18 months of age. In a natural history study, 2 percent of similar infantile-onset patients were alive at 18 months of age. The pivotal trial enrolled 18 patients with infantile-onset Pompe disease, who began receiving therapy at approximately six months of age. The most common serious adverse events observed in clinical studies of Myozyme, whether or not they were related to the drug, were pneumonia, respiratory failure, respiratory distress, catheter-related infection, respiratory syncytial virus infection, gastroenteritis and fever. Many of these can be complications of Pompe disease.

“We are very proud that we have been able to bring to market four therapies for ultra-orphan diseases where no treatments existed previously,” said Mr. Termeer. “This underscores our fundamental commitment to patients and confirms the productivity of our research efforts. We continue to invest in potential new approaches to treating these diseases.”

Myozyme is the fourth enzyme replacement therapy developed by Genzyme for a rare genetic disease. Genzyme has developed Cerezyme(R) (imiglucerase for injection) for Type 1 Gaucher disease; Fabrazyme(R) (agalsidase beta) for Fabry disease; and, in collaboration with BioMarin Pharmaceutical Inc., Aldurazyme(R) (laronidase) for MPS I. These treatments are currently available to patients throughout the world.

Genzyme currently manufactures Myozyme in the United States. In the future, the company expects to also produce Myozyme at its new protein manufacturing facility in Geel, Belgium, and its new fill/finish facility in Waterford, Ireland, to ensure that it is able to meet the anticipated demand for the product throughout the world.

About Pompe Disease

Pompe disease, also known as Acid Maltase Deficiency or Glycogen Storage Disease Type II, is one of more than 40 genetic diseases called lysosomal storage disorders, which are caused by a deficiency or malfunction of specific enzymes found in cell lysosomes. People born with Pompe disease have an inherited deficiency of an enzyme known as acid alpha-glucosidase (GAA). Enzymes, which are protein molecules within cells, trigger biochemical reactions in the body. In a healthy person with normal GAA activity, this particular enzyme would assist in the breakdown of glycogen, a complex sugar molecule stored within a compartment of the cell known as the lysosome. But in Pompe disease, the GAA activity may be dramatically reduced, dysfunctional, or non-existent, resulting in an excessive accumulation of glycogen in the lysosome.

Eventually, the lysosome may become so clogged with glycogen that normal cellular function is disrupted and muscle function is impaired. Although there is glycogen storage in the cells of multiple tissues, heart and skeletal muscles are usually the most seriously affected.

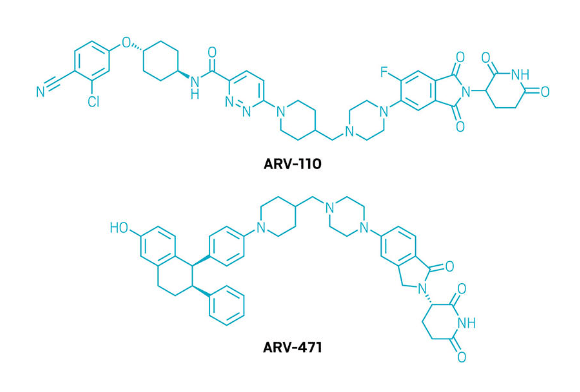

Amicus Therapeutics는 Myozyme에서 경험한 Enzyme folding 문제를 해결하기 위해 초기부터 Chaperone 작용제인 경구용 화학요법제를 개발하기로 합니다. 그리고 2004년에 $31 Million Series B를 합니다. Amicus는 Pompe Disease 뿐만 아니라 같은 문제를 가진 Fabry나 Gaucher 와 같은 병을 함께 치료하는 더 큰 과제를 수행하기 위해 노력했고 Series B를 받은 당시 가장 먼저 진행하던 약물은 Fabry 치료제인 AT1001로서 전임상을 진행 중에 있었습니다.

AMICUS THERAPEUTICS RAISES $31 MILLION IN SERIES B FINANCING – Press Release 5/12/2004

Amicus Therapeutics, Inc., an emerging drug development company focused on the development of a novel therapeutic approach to the treatment of human genetic disorders, with an initial focus on lysosomal storage diseases, today announced the completion of a $31 million Series B private equity financing. The Series B Round was led by Canaan Partners, L.P., with participation from other new investors, Frazier Healthcare Ventures, L.P., New Enterprise Associates, L.P., Prospect Venture Partners, L.P., and Radius Venture Partners, L.P. The company’s founding investor, CHL Medical Partners, also participated in the round.

“Collectively, these investors have an excellent track record in helping to build significant and successful companies, and they bring considerable experience and knowledge to the table in addition to financial resources,” said Norman Hardman, Ph.D., Chief Executive Officer of Amicus Therapeutics, Inc. “With their commitment and support, Amicus is firmly on its way to realizing its vision of becoming the premier company developing treatments for human genetic diseases with small-molecule drugs. During the fundraising we were able to stay focused on ensuring that the pre-clinical development of AT1001, our lead product candidate for treatment of Fabry disease, remained on track. The progress we made has clearly impressed our investors, all of whom are extremely excited about this new product opportunity. With this round of financing secured, our top priorities will be the further advancement of AT1001 –which we plan to have in the clinic by the third quarter of this year — and the development of our R&D program for Gaucher Disease.”

With the close of the financing, Stephen Bloch, M.D., of Canaan Partners, James Topper, M.D., Ph.D., of Frazier Healthcare Ventures, Mike Raab of New Enterprise Associates, and Alex Barkas, Ph.D., of Prospect Venture Partners, have joined the board. They join existing board members, Norman Hardman , Ph.D., and Gregory Weinhoff, M.D., of CHL Medical Partners.

“Successfully concluding this phase of our corporate development brings us a significant step closer to providing potentially effective and convenient oral therapies to those who suffer from Fabry disease, Gaucher disease, and a range of other genetic disorders,” concluded Dr. Hardman.

1년만에 Fabry 치료제 Amigal *migalastat hydrochloride)는 임상2상까지 진행시킬 수 있었고 임상시험 진행과 다른 파이프라인 개발을 위해 $55 Million Series C Funding을 합니다. Gaucher 치료제인 AT2101도 전임상 단계에 이미 진입한 상태였습니다.

AMICUS THERAPEUTICS RAISES $55 MILLION SERIES C FINANCING – Press Release 9/8/2005

Amicus Therapeutics, a biopharmaceutical company developing small molecule, orally-active pharmacological chaperones for the treatment of human genetic diseases, today announced the closing of a $55 million Series C financing. The company intends to use the proceeds to advance its drug pipeline based on the company’s unique technology that has the potential to transform the treatment of human genetic diseases. Amicus’ lead compound Amigal (migalastat hydrochloride) is in a Phase ll clinical program for Fabry disease. All of Amicus’ current investors participated in the Series C round, which was led by new investor Quaker BioVentures.

“Amicus has truly exciting technology that has breakthrough potential for the treatment of devastating genetic diseases,” said Sherrill Neff, managing partner of Quaker BioVentures. “We welcomed the opportunity to join Amicus’ current investors and lead this financing as the company continues to advance. Amicus will soon have two promising compounds in clinical trials based on its pharmacological chaperone technology, and with this new financing the company is well positioned to continue to ramp up its multiple drug development activities.“

Quaker BioVentures led the Series C financing, joined by existing investors Canaan Partners, CHL Medical Partners, Frazier Healthcare Ventures, New Enterprise Associates, Prospect Venture Partners and Radius Ventures. Other new investors include Palo Alto Investors and the Garden State Life Sciences Venture Fund, which is funded by the New Jersey Economic Development Authority (NJEDA) and managed by Quaker BioVentures. Mr. Neff of Quaker BioVentures is joining the Amicus Board of Directors.

“As an early and now repeat investor in Amicus, we are most pleased and impressed with the company’s achievement of several significant milestones in just the past nine months. The momentum at Amicus is simply remarkable and reflects the breadth and depth of its core technology as well as the commitment and passion of its now 35 employees,” said Michael Raab, a partner at New Enterprise Associates and an Amicus board member.

“At Amicus, we are building momentum in human genetic diseases,” said John F. Crowley, chairman and chief executive officer of Amicus. “We look forward to applying these new financial resources to advance our lead compound, Amigal, and to accelerate the growing momentum of our preclinical programs. We are optimistic that our passion and commitment to this field will rapidly translate into effective therapies for the many individuals who live with these life threatening disorders.”

Separately, Amicus today announced positive results from its Phase l clinical studies of Amigal and the start of patient enrollment in its Phase ll clinical program for the treatment of Fabry disease. In addition to meeting all of its safety endpoints, the Phase l studies demonstrated proof of concept for Amicus’ pharmacological chaperone technology, showing that Amigal has the ability to increase target enzyme activity levels, even in healthy individuals.

Amicus’ second product candidate, AT2101, a treatment for Gaucher disease, is in late stage preclinical development with clinical trials expected to commence in the first half of 2006. The company also is advancing its pipeline of earlier stage pharmacological chaperone compounds for a variety of human genetic disorders.

Amicus recently moved into a new 40,000 square foot, state-of-the-art business and science headquarters facility in Cranbury, NJ.

“Amicus represents another success story for the thriving New Jersey biotechnology sector and we are very pleased the Garden State Life Sciences Venture Fund is participating in this financing,” said Caren Franzini, chief executive officer of the NJEDA. “Amicus is a graduate of the EDA’s Commercialization Center for Innovative Technologies in North Brunswick, and we believe the company epitomizes the innovation, entrepreneurial savvy and industry expertise that are making our state such an attractive location for this critically important sector.”

이듬해에 Nasdaq IPO를 하려고 S-1 Filing을 했지만 시장 상황이 좋지 않은 관계로 IPO 를 포기하고 $60 Million Series D를 하게 됩니다. NEA의 주도로 기존 투자자들이 참여한 펀딩 라운드인데 기존 투자자들은 Amicus의 빠른 개발 속도와 실행력에 지원을 아끼지 않았습니다.

AMICUS THERAPEUTICS RAISES $60 MILLION SERIES D FINANCING – Press Release 9/14/2006

Amicus Therapeutics, a biopharmaceutical company developing small molecule, orally-administered pharmacological chaperones for the treatment of a range of human genetic diseases, today announced the closing of a $60 million Series D financing, the Company’s largest to date, led by New Enterprise Associates (NEA). In August, due to market conditions, the Company withdrew its S-1 registration statement with the Securities and Exchange Commission (SEC) relating to a proposed initial public offering.

In this financing round, NEA was joined by current investors Canaan Partners, CHL Medical Partners, Frazier Healthcare Ventures, Palo Alto Investors, Prospect Venture Partners, Quaker BioVentures, and Radius Ventures. In addition, affiliated investment funds of Och-Ziff Capital Management Group participated in this round of financing as a new investor.

Amicus also announced today two key executive management appointments. First, Donald J. Hayden, Jr., Executive Chairman, will serve as Interim President and Chief Executive Officer while John F. Crowley, President and CEO, serves a six-month active duty military obligation with the United States Navy. He is a commissioned officer in the Navy Reserve. Mr. Crowley will return as the CEO on or about March 1st, 2007. Second, Matthew R. Patterson has been promoted from Chief Business Officer to Chief Operating Officer.

“I am delighted that Amicus has been able to secure our largest financing round to date. Our core investors clearly believe in the Company’s pharmacological chaperone technology. We are also extremely pleased to have Och-Ziff Capital Management Group onboard as our newest investor. This additional funding will enable us to continue to advance our pipeline of potential new treatments for the lysosomal storage disorders Fabry, Gaucher, and Pompe and to aggressively develop our earlier stage programs for other genetic diseases. Additionally, I am honored to be asked to serve my country during this active duty obligation and I have the utmost confidence that Don Hayden and the extraordinary senior management team at Amicus will continue to move the company forward while I am away,” said John F. Crowley.

“We are extremely pleased to make this additional investment that will further enable Amicus’ dynamic growth and lay the foundation for a significant and enduring enterprise. The speed and high quality of execution are a testament to the outstanding efforts of this well led and capable team. We wish John Crowley the best of luck during his six-month military service and look forward to his return next spring,” said Michael G. Raab, Partner at NEA and member of Amicus’ Board of Directors.

이듬해에 마침내 $75 Million Nasdaq IPO를 하게 됩니다.

Amicus Therapeutics (Nasdaq: FOLD) announced today the pricing of its initial public offering (IPO) of 5,000,000 shares of its common stock at a public offering price of $15.00 per share. Amicus has granted the underwriters a 30-day option to purchase up to an additional 750,000 shares of common stock to cover over- allotments, if any. All shares in the offering will be sold by the Company and are expected to begin trading today on the NASDAQ Global Market under the trading symbol “FOLD.”

IPO한지 반년이 지난 후 Shire가 $50 Million upfront를 포함한 총 $440 Million규모의 계약을 합니다. Chaperone technology에 대한 관심과 Amicus의 세가지 약물 Phase II Amigal™ for Fabry disease, Phase II Plicera™ for Gaucher disease, 그리고 Phase I AT2220 for Pompe disease 치료제에 투자합니다.

Shire is expanding its pipeline of therapeutics for rare genetic diseases through a licensing deal with Amicus Therapeutics that could be worth up to $440 million. The three Amicus candidates are based on chaperone technology, which will augment Shire’s enzyme-replacement therapies.

Shire will pay $50 million upfront for three compounds in markets outside of the United States: Phase II Amigal™ for Fabry disease, Phase II Plicera™ for Gaucher disease, and Phase I AT2220 for Pompe disease.

Phase II data for Amigal and preliminary Phase II results for Plicera will be available by year end, according to Matt Patterson, COO at Amicus. For AT2220, the firm plans to start a Phase II study early in 2008, he adds.

Based on development achievements through to approval of these compounds, Patterson says that Amicus is eligible to receive $150 million. The company may also get another $240 million in sales milestones. Shire will also make tiered, double-digit royalty payments on net sales.

The companies will jointly pursue a development program toward market approval in the U.S. and Europe and share expenses equally.

The pharmacological chaperone technology, which the firms expect to make available as oral therapies, has been applied to various enzymes that are defective as a result of improper folding. In contrast to the traditional enzyme-replacement approach, pharmacological chaperone technology involves the use of small molecules that selectively bind to and stabilize proteins in cells. This reportedly leads to improved protein folding and trafficking as well as increased activity.

“Amicus’ pharmacological chaperone compounds have the potential to be an excellent addition to our current enzyme-replacement therapy business,” states Shire CEO, Matthew Emmens. Shire’s pipeline includes enzyme-replacement treatments Replagal™ for Fabry disease and GA-GCB in Phase III development for Gaucher disease. “In addition,” continues Emmens, “it provides an opportunity for Shire to enter the market for Pompe disease.”

2010년에는 GSK가 임상3상이 진행 중이던 Fabry 치료제인 Amigal의 상업판권을 위해 upfront $30 Million, 지분투자 $30 Million을 포함한 총 규모 $170 Million의 계약을 합니다.

GlaxoSmithKline (GSK) and Amicus Therapeutics (Amicus) today announced a definitive agreement to develop and commercialise AmigalTM (migalastat HCl), currently in Phase 3 for the treatment of Fabry disease, a rare inherited disorder. Under the terms of the agreement, GSK will receive an exclusive worldwide license to develop, manufacture and commercialise migalastat HCl. Additionally, as part of the agreement, GSK and Amicus also intend to advance clinical studies exploring the co-administration of migalastat HCl with enzyme replacement therapy (ERT) for the treatment of Fabry disease.

Under the terms of the agreement, Amicus will receive an upfront license payment of $30M from GSK and is eligible to receive further payments of approximately $170M upon the successful achievement of development and commercialisation milestones, as well as tiered double-digit royalties on global sales of migalastat HCl. GSK and Amicus will jointly fund development costs in accordance with an agreed upon development plan. Additionally, as part of the collaboration, GSK is purchasing 6.9 million shares of Amicus common stock at a price of $4.56 per share. The total value of this equity investment to Amicus is $31 million and represents a 19.9% ownership position for GSK in the Company. The total cash upfront to Amicus from GSK for the license payment and equity investment is approximately $60 million.

“This strategic collaboration is another significant milestone in delivering our vision for GSK Rare Diseases. Amicus’ scientific and clinical expertise in human genetic diseases is among the best in the industry, and we are pleased to be collaborators and investors in this exceptional company” said Marc Dunoyer, Global Head of GSK Rare Diseases. “Our focus now is to continue to advance Amigal for Fabry disease and it is our hope to deliver a first-in-class, oral medicine to the thousands of people worldwide living with this devastating rare disease.”

John F. Crowley, Chairman and Chief Executive Officer of Amicus Therapeutics said, “The completion of this agreement with GSK is a transformational event for Amicus. It provides a strong validation of the potential for Amigal to become an important new treatment option for people living with Fabry disease and for our pharmacological chaperone technology broadly. GSK has extremely impressive global clinical, regulatory and commercial expertise and a strong commitment to the development of treatments for rare diseases. We look forward to working in close partnership with them.” Crowley continued, “With this key strategic alliance with GSK and the added financial strength it provides, Amicus is now uniquely positioned to build shareholder value through our expertise in rare disease drug development.”

2013년에는 Biogen이 Parkinson 치료를 위한 표적인 lysosomal enzyme glucocerobrosidase (GCase) enzyme 공동개발 협약을 맺습니다. 금액은 공개하지 않았으나 모든 연구비와 활동비를 Reimbursement 하는 계약이었습니다.

Biogen Idec, Amicus Launch Parkinson’s Collaboration – GEN Edge 9/10/2013

Amicus Therapeutics said today it will partner with Biogen Idec to discover small molecules that fight Parkinson’s disease by targeting the lysosomal enzyme glucocerobrosidase (GCase) enzyme, with the biotech giant overseeing their further development and commercialization. The value of the multiyear collaboration was not disclosed.

Biogen Idec agreed to fund all discovery, development, and commercialization activities, as well as reimburse Amicus for all full-time employees working on the project. Amicus is also eligible to receive from Biogen Idec payments based on undisclosed development and regulatory milestones, as well as what it termed “modest” royalties on global net sales.

Amicus는 NDA rolling submission 중이던 epidermolysis bullosa라는 피부 희귀질환치료제 Zorblisa (SD-101)를 개발하는 Scioderm을 $229 Million 주식교환 및 $618 Million milestone payment, 그리고 PRV voucher 를 인수하는 계약을 함으로써 새로운 파이프라인을 얻습니다. 이 계약은 지난 2년간 Scioderm의 이사회 멤버로 약의 개발과정을 지켜본 John Crowley의 결정이었습니다.

Amicus bags PhIII rare disease drug in $847M Scioderm buyout – Fierce Biotech 8/30/2015

Amicus Therapeutics has stepped in to snap up the late-stage rare disease biotech Scioderm, beefing up its orphan drug pipeline in exchange for $229 million in stock and cash along with a promise of up to $618 million more for meeting a slate of milestones.

The buyout leaves Amicus ($FOLD) with its lead drug Galafold under regulatory review, a new drug that could be filed in the near term and a third program entering the clinic–with CEO John Crowley prepping for more deals as the company builds out a global commercial team.

Amicus completes this buyout a little more than a month after Scioderm started a rolling submission of its NDA for Zorblisa (SD-101), an experimental drug for epidermolysis bullosa, a condition that leaves children’s skin papery thin and fragile, subject to tearing and blistering. Most patients–and there are some 30,000 to 40,000 in the world’s major drug markets–die before the age of 30.

Data from the late-stage study is due in the first half of next year, with Amicus looking for a regulatory green light on a drug Crowley believes could be a blockbuster. The market for Zorblisa, says the CEO, is worth “a billion dollars-plus.” Adds Crowley: “We want to be one of the leading biotech companies focused on rare diseases.”

Not that the deal is without risk. TheStreet notes that Zorblisa failed its Phase IIb study, with a small subgroup of patients in the top dose achieving statistical significance compared to a placebo. That top dose is being taken into the Phase III with the blessing of regulators.

There’s an added bonus involved in this deal. If Zorblisa is approved, the owners could qualify for a priority review voucher–an asset that’s been worth hundreds of millions of dollars in recent deals. Amicus will pay Scioderm’s investors either $100 million or half the sales price for the voucher, whichever is less.

Crowley has had a front row seat on Scioderm’s progress as a board member of the company for the last two years.

Little Durham, NC-based Scioderm was unique among the virtual crowd back in 2013, when the FDA handed out one of its first breakthrough therapeutic designations to the biotech. The company raised a $20 million B round late last year and was named a Fierce 15 company back in 2013, when it was still in early development. At the time of the buyout, its staff had grown to 9 and CEO Robert Ryan will now join Amicus in a senior executive position.

Amicus has been focused primarily on Galafold (migalastat), a treatment for Fabry disease. The biotech experienced a severe setback a few years ago when the drug failed a comparison study with a placebo. The failure spurred GlaxoSmithKline ($GSK) to drop out of its partnership, but Amicus came back with a new plan to use a different biomarker on symptoms of the disease. That strategy paid off with successful Phase III studies of the drug, comparing well with Sanofi’s ($SNY) Fabrazyme and Shire’s ($SHPG) Replagal in two measures of kidney function. And that should help make the case for switching patients from a regularly infused drug that costs more than $200,000 a year to an oral therapy.

European regulators have granted an accelerated review of the treatment while an NDA at the FDA is slated for delivery before the end of this year. Amicus has hired 20 people for its European commercial operation, says the CEO. As new products are added, he forecasts, that should grow into a global operation with hundreds of staffers pursuing sales of $500 million to more than a billion dollars on each of three products. As this deal cost $125 million in cash, he says Amicus’s business development team is well positioned to hunt down more tech and product deals, with an early focus on some early-stage deals this time around.

Amicus is hunting new deals in a hot market. Rare disease therapies can earn well into 6 figures, making it an attractive market for a host of companies. Other companies like Alexion ($ALXN) and BioMarin ($BMRN) have done extremely well with investors looking to share the profits. Crowley has a personal connection to the genetic diseases he focuses on. In 1998, two of his children were diagnosed with Pompe disease.

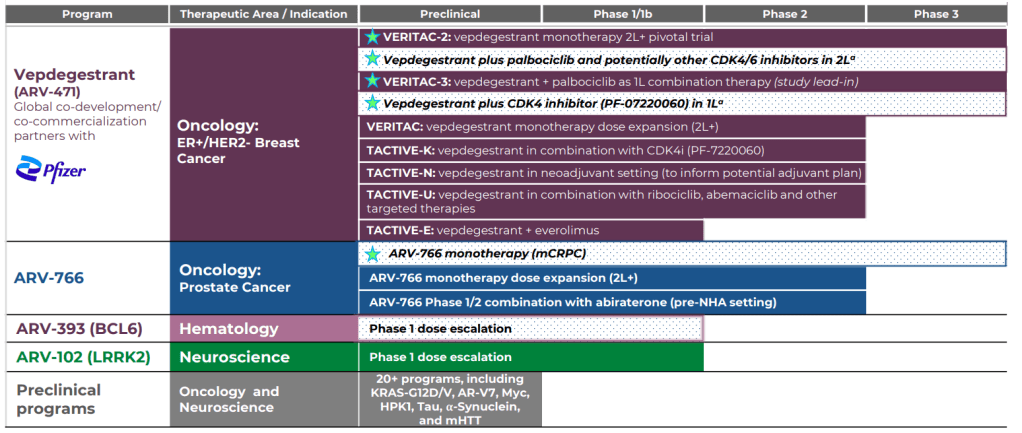

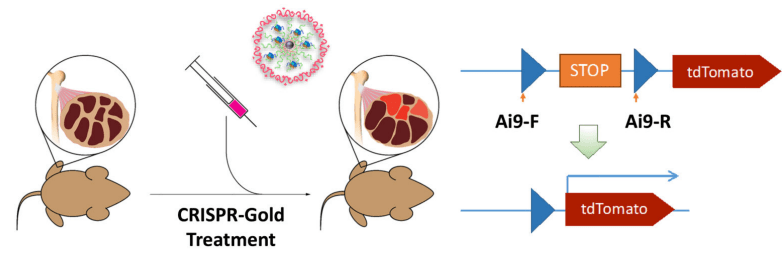

작년 9월 마침내 Pompe 치료제인 “Pombiliti (cipaglucosidase alfa-atga) + Opfolda (miglustat)” 컴비네이션 약물이 FDA승인을 받게 됩니다. 실로 Novazyme을 설립한지 20여년이 걸린 오랜 기간의 노력이었습니다.

Amicus receives FDA approval for Pompe disease therapy – Pharmaceutical Technology 9/29/2023

Amicus Therapeutics has received approval from the US Food and Drug Administration (FDA) for a two-component therapy, Pombiliti (cipaglucosidase alfa-atga) + Opfolda (miglustat) 65mg capsules, to treat Pompe disease. Pombiliti treats adult patients with late-onset Pompe disease (LOPD) weighing 40kg or under who are not able to improve on their present enzyme replacement therapy (ERT). LOPD is a lysosomal disorder caused by a deficiency of the enzyme acid alpha-glucosidase (GAA).

Designed for enhanced uptake into muscle cells, pombiliti is a recombinant human GAA enzyme (rhGAA) naturally expressed with high levels of Mannose 6-Phosphate (bis-M6P). Upon entering the cell, it will be processed into the active and mature form to break down glycogen. The FDA has approved the therapy based on clinical data from the Phase III PROPEL pivotal study. It is the only LOPD trial to assess ERT-experienced participants in a controlled setting. Amicus Therapeutics president and CEO Bradley Campbell stated: “Today’s approval is also a testament to Team Amicus’ extraordinary dedication to patients and our ability to execute on our vision to bring new therapies to the rare disease community.

“Our highly experienced team is ready to launch this medicine in the US and we look forward to rapidly bringing this new treatment regimen to all eligible adults living with late-onset Pompe disease who are not improving on their current ERT.”

Amicus의 역사는 여기서 끝이 아닙니다. Pompe 치료제 승인과 함께 $30 Million 지분투자 및 $400 Million Loan을 받는 계약을 통해 상업적 성공을 위해 노력하고 있습니다.

After Pompe approval, Amicus clinches $430M financing deal with Blackstone – Fierce Pharma 10/2/2023

Hot off an FDA approval for its Pompe disease combo treatment, Amicus Therapeutics has reeled in a major investor. Monday, Amicus unveiled a $430 million financing pact with Blackstone Life Sciences and Blackstone Credit. The deal will see the asset manager furnish Amicus with a $400 million loan that Amicus will use to refinance existing debt, Amicus said in a release. Additionally, Blackstone made a $30 million strategic investment in Amicus’ common stock. The move is designed to help Amicus grow revenues and move toward profitability, the company said.

Late last month, Amicus notched a big win with the FDA approval of Pombility and Opfolda. The green light covers adults living with late-onset Pompe disease who aren’t improving with current enzyme replacement therapy (ERT). Pombiliti is an infused long-term ERT, while Opfolda is an oral stabilizer, which reduces the loss of enzyme activity in the blood during infusion.

The company figures the Pompe disease market could reach $1.8 billion by 2027 and projects peak sales of its combo will reach $1.2 billion. Last week, the company said it was ready to launch “immediately” in the U.S., where it has priced the treatment at $650,000 per year for a patient of medium weight.

Aside from its new Pompe combo, Amicus boasts another commercial product in Fabry disease treatment Galafold, which won its U.S. nod in August of 2018. Amicus’ full-year revenues for 2022 clocked in at $329.2 million, a year-over-year increase of 8%. In March, the company telegraphed a potential pivot to profitability by the second half of 2023.

Pompe 치료제의 FDA 승인에 결정적 임상이었던 PROPEL의 임상결과는 아래의 Presentation에 잘 나타나 있습니다. John Crowley의 노력으로 Pompe 치료제로 고생하는 두자녀를 포함한 세자녀와 아내, 총 다섯식구는 지금도 행복한 가정을 이루고 살고 있습니다. 또한 John Crowley는 신약개발자의 롤모델로서 2024년도 BIO의 대표 (President & CEO)로 선출되는 영예도 얻었습니다. John Crowley의 삶은 신약개발자가 어떤 마음으로 신약을 개발해야 하는지 잘 보여준 살아있는 표본이라고 할 수 있습니다. 그는 현재 Amicus Therapeutics의 Executive Chairman으로 회사를 이끌고 있습니다.